-

ADA could potentially see a relief rally over the next 1-4 days

ADA whales can be seen buying the dip en masse

As an analyst with a background in studying market trends and on-chain data, I believe that Cardano (ADA) could potentially see a relief rally over the next 1-4 days. The recent buying pressure seen in the crypto market, as indicated by the TD Sequential buy signal and the rising On Balance Volume, suggest a potential reversal of the downtrend.

As a researcher studying the cryptocurrency market, I’ve observed that Cardano (ADA) experienced a noteworthy increase of approximately 2% within a 24-hour trading window. This uptick comes after a considerable setback in April, where Cardano suffered significant losses exceeding 23%.

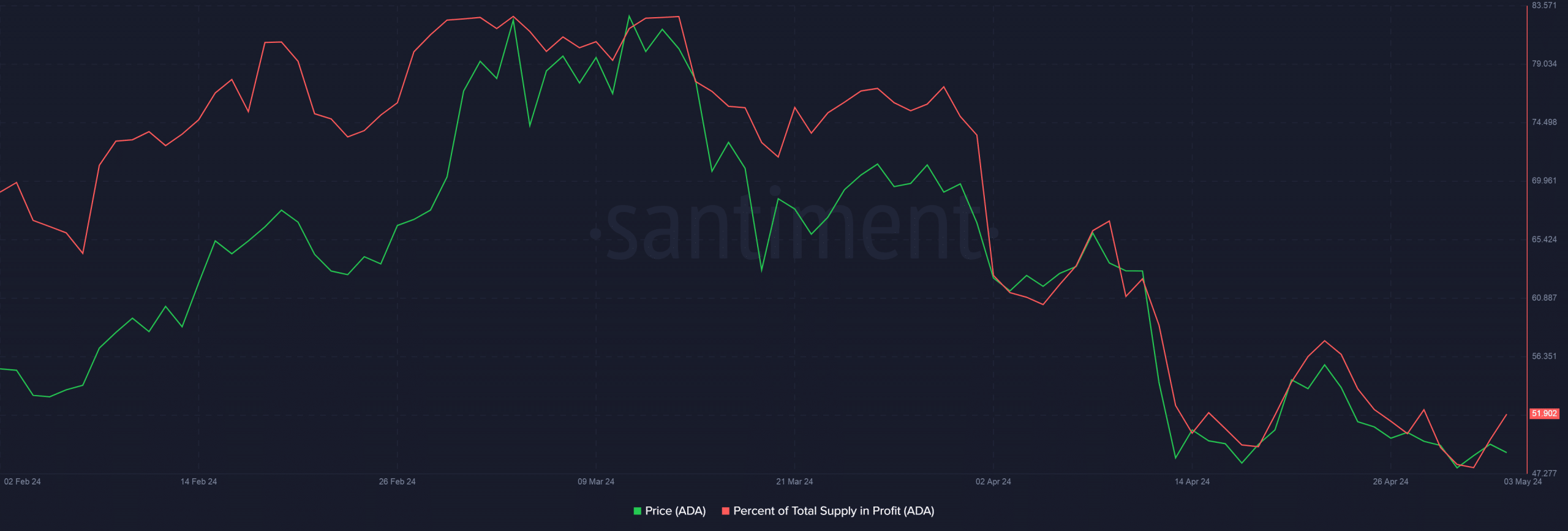

Based on AMBCrypto’s interpretation of Santiment’s findings, I observed that the proportion of ADA‘s entire supply generating a profit for its holders dwindled significantly from approximately 73% at the start of the month to around 51% by its end.

Rebound incoming?

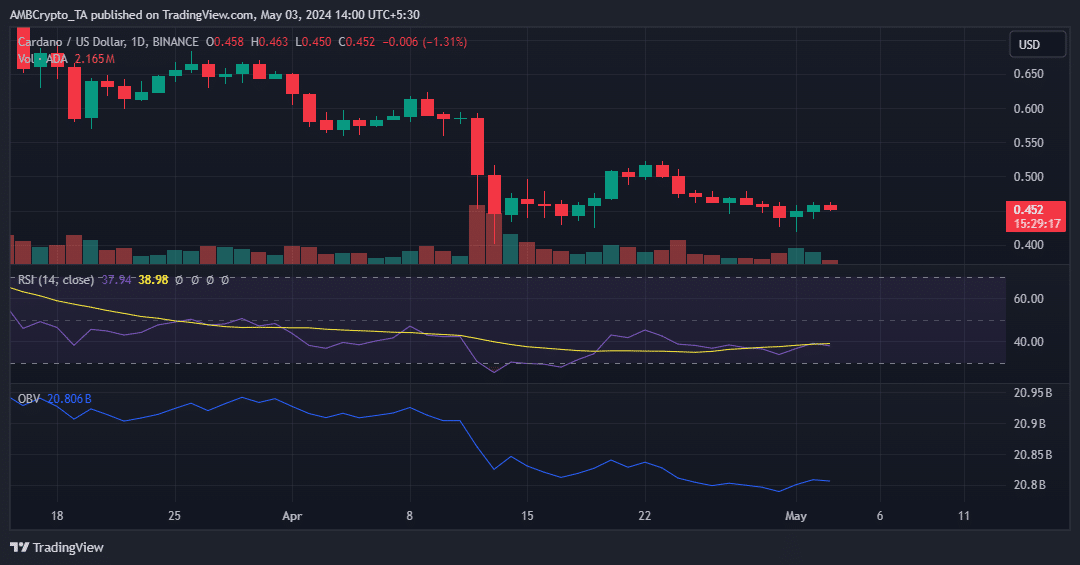

According to well-known on-chain analyst Ali Martinez’s projections, the corrective phase for ADA may be nearing its end. On the cryptocurrency’s daily chart, he identified a buy signal using the TD Sequential indicator, which could result in a short-term relief rally lasting 1-4 days.

To make better sense of the forecast, AMBCrypto examined other key technical indicators of ADA.

As a researcher observing the market trends, I’ve noticed that the Relative Strength Index (RSI) has been on an upward trajectory over the past 2-3 days. This could be indicative of decreasing selling pressure and potentially, a shifting tide in the market. However, it is essential to keep in mind that the overall sentiment remains bearish. For a more convincing sign of a potential rally, the RSI needs to surpass the 40 threshold. A rise above the neutral-50 mark would serve as a stronger indicator of bullish sentiments regaining momentum.

As an analyst, I’ve noticed that On Balance Volume (OBV) has been trending upward since early May, indicating strong buying pressure. At the current moment, this upward trend in OBV aligns with ADA‘s price movement on the charts, increasing optimism for a prolonged price increase.

Read ADA’s Price Prediction 2024-25

Assessing whales’ response

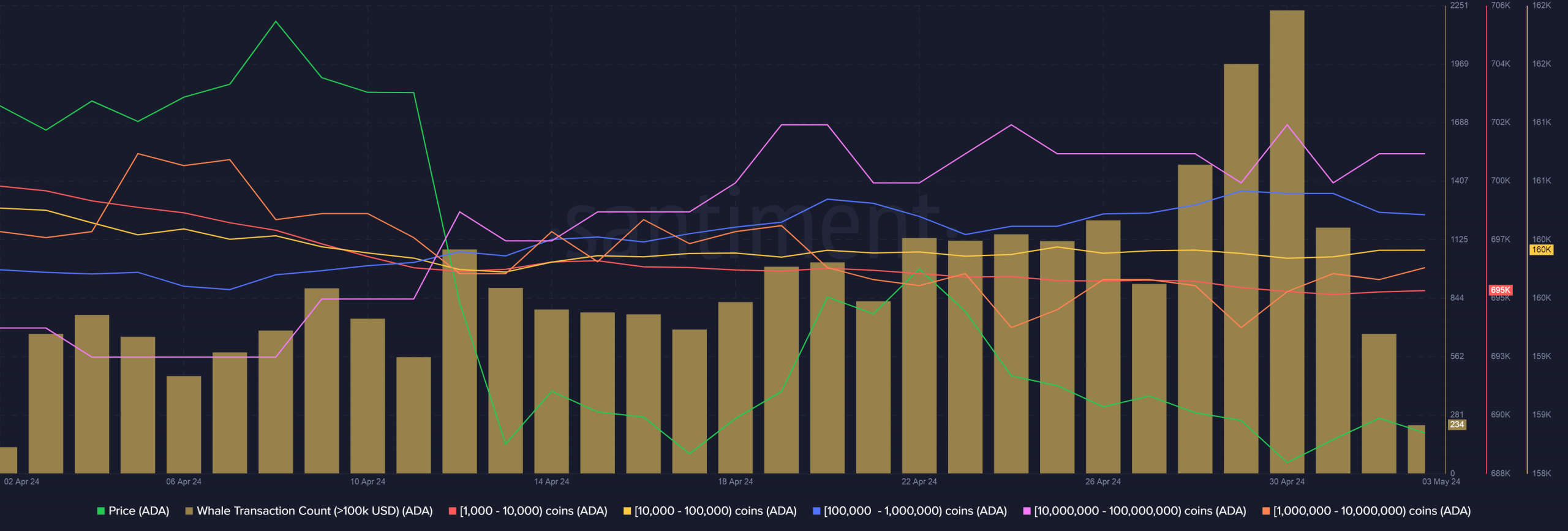

As an analyst, I’ve noticed a significant decline in Cardano’s price that piqued the interest of large-scale investors. Specifically on 30 April, transactions exceeding the value of $100,000 reached their peak levels since November 2023.

Through examination of various groups of whales, some noteworthy findings emerged. The smaller cohort of whales, whose holdings of ADA ranged between 1,000 and 1 million units, experienced a decrease in population size. This could indicate that they have been offloading their holdings.

In contrast, a greater number of larger whale addresses, representing between one million and one hundred million coins, were amassing coins. This indicated a noticeable transfer of substantial capital from smaller whales to the larger ones.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-04 04:07