-

ADA fell by 13% in the last 24 hours

Technical indicators pointed to a further price decline in the making

Today, Cardano (ADA) made news for unveiling its development milestones in March. Yet, the attention wasn’t entirely positive as the cryptocurrency experienced a downturn of around 13%, contributing to the overall market decline and causing a dip on the price charts.

Cardano doing well on dev front

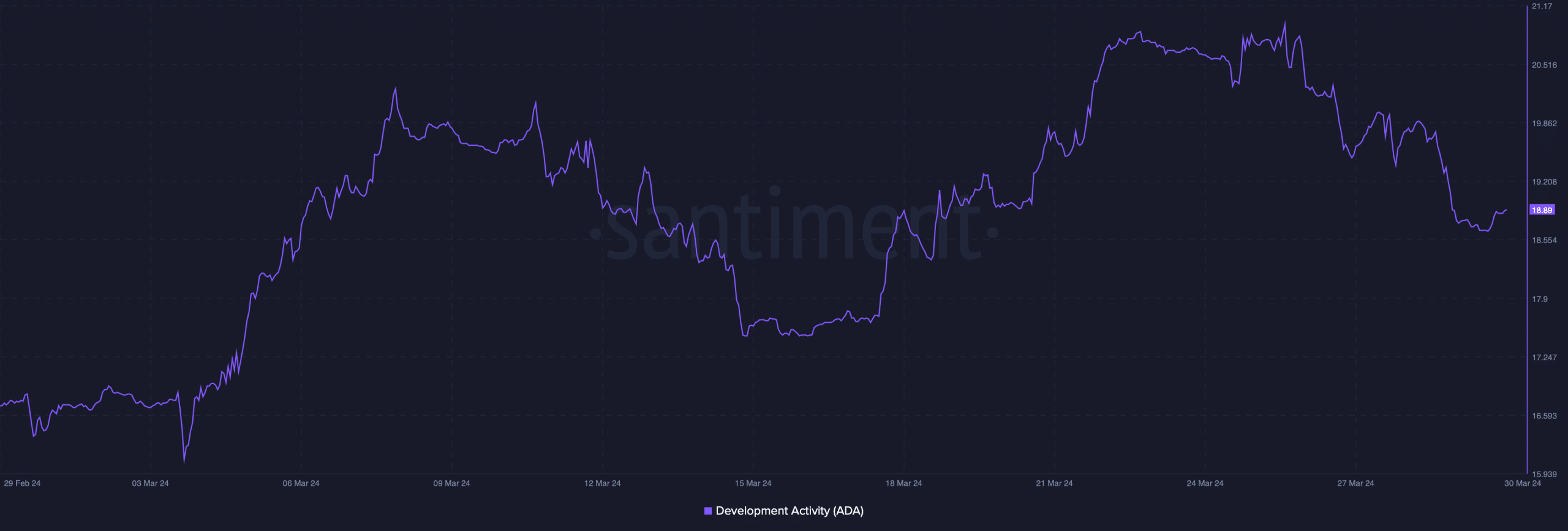

Based on an analysis by AMBCrypto using Santiment’s data, there has been consistent development activity around Cardano, as indicated by the unwavering upward trend on its developer activity chart throughout March.

The team at Input Output, who oversee the development of Cardano, recently shared an update in a forum post about their accomplishments during the last month of the first quarter. Among these achievements was the release of Cardano node version 8.9.0. This new update came with Genesis Lite peer nodes as part of the package and also addressed a bug that was recertified to enhance overall performance.

To enhance scalability, Mithril introduced distribution version 2408.0, featuring stake distribution upgrades and more. Furthermore, there was a notable rise of around 2.3 million transactions on ADA‘s network last month. In March, three new projects emerged on the Cardano blockchain.

Cardano is facing bears’ wrath

At the end of March, Cardano experienced a modest decrease in value, with its price dipping to around $0.64 – a slight decline from the month’s start. Unfortunately for investors, April did not bring any positive price shifts; instead, the token saw a significant drop of approximately 13% within a single day.

Based on information from CoinMarketCap, currently ADA is priced at $0.5071 and has a market value exceeding $18 billion, ranking it as the 10th largest cryptocurrency. However, there’s a high probability that ADA’s price could decrease in April, as various indicators suggest a bearish trend.

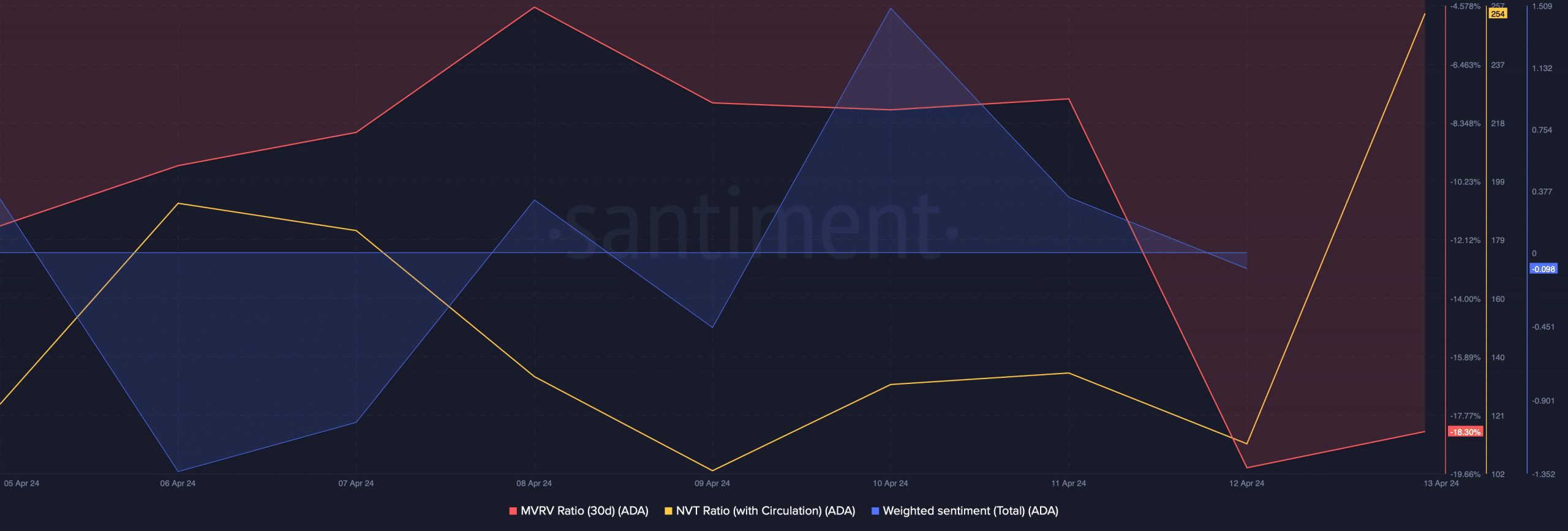

Based on Santiment’s data findings, we discovered that Cardano’s MVRV ratio experienced a significant decrease, with a current value of -18% as of now. Furthermore, the sentiment towards ADA became increasingly negative, as indicated by the decline in its weighted sentiment on April 12. Additionally, the NVT ratio for Cardano surged dramatically. When this ratio rises steeply, it typically means that an asset is overpriced, possibly leading to a potential price decrease in the near future.

Read Cardano’s [ADA] Price Prediction 2024-25

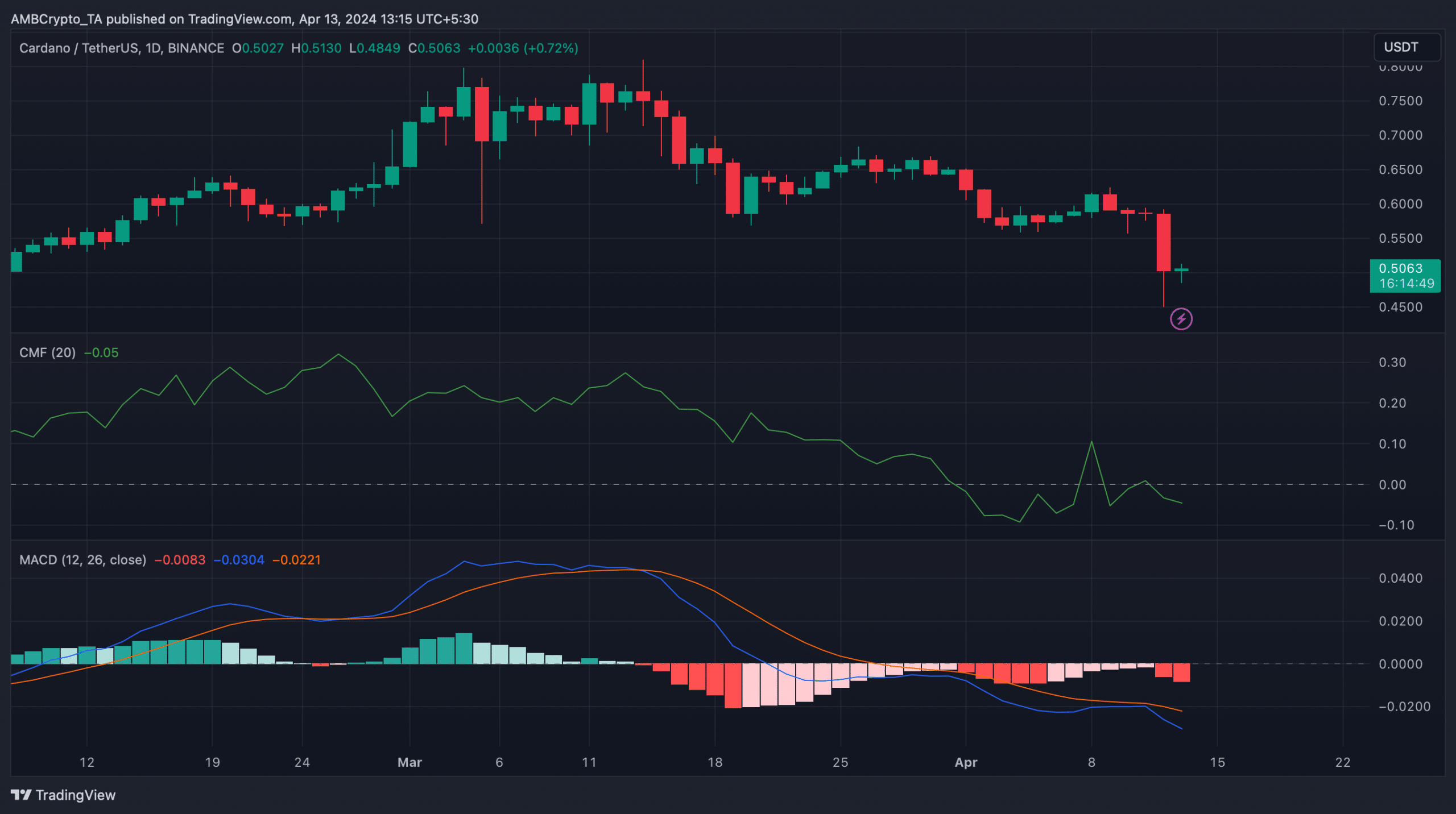

After examining Cardano’s daily price chart, we looked for signs from technical indicators that suggested a possible price drop. The Moving Average Convergence Divergence (MACD) of ADA showed a strong bearish signal in the market.

On the 12th of April, the Chaikin Money Flow (CMF) experienced a significant decline. This, coupled with the other technical indicator’s signals, suggested that sellers had the upper hand and that investors could expect ADA‘s value to decrease in the near future.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION/USD

- Solo Leveling Arise Amamiya Mirei Guide

- `Tokyo Revengers Season 4 Release Date Speculation`

- ETH/USD

- How to Install & Use All New Mods in Schedule 1

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Kayla Nicole Raves About Travis Kelce: What She Thinks of the Chiefs Star!

2024-04-13 21:11