$4.58B Crypto Tokens Unlocked in March 2026: WBT, CONX, APT Lead!

Releasing these tokens could cause some price fluctuations in the market, especially in the short term. Here’s a look at what you should keep an eye on.

Releasing these tokens could cause some price fluctuations in the market, especially in the short term. Here’s a look at what you should keep an eye on.

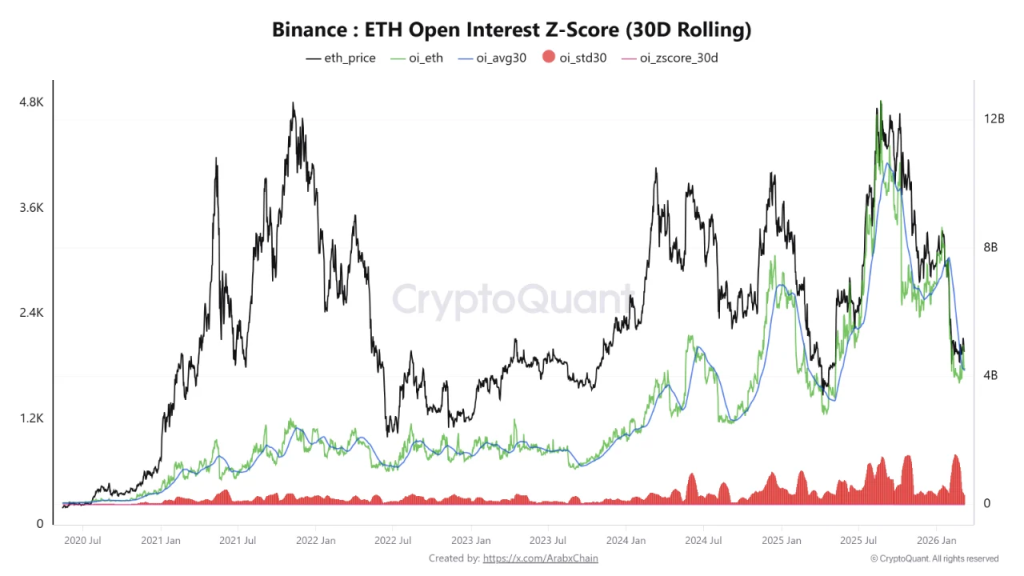

Specifically, leverage appears to be taking a nap. Freshly brewed data from Binance’s Ethereum derivatives activity reveals that the 30-day average open interest has slinked down to its lowest level since May 2025. This isn’t just some random number thrown into the void; it’s a polite hint that traders have been steadily reducing exposure after months of wild gyrations. And when leverage takes a break, markets tend to stop behaving like a caffeinated squirrel.

Per CoinGlass, the overall XRP exchange netflow is now pegged at -153%, which is like saying you’re 153% worse at math than a toddler with a calculator. This figure translates to an actual outflow of over $738 million-enough to buy a small island, if that island happens to be in a volatile market.

As if that weren’t enough, the network’s activity-or rather, its profound lack thereof-has done little to instill hope. The number of active addresses on the XRP network has slumped to a level not seen in over a week, and that, dear reader, is a clear sign that XRP’s followers are growing weary. At the heart of this malaise, it appears, is a growing sense of apathy, as if the once-vibrant community of XRP enthusiasts has suddenly found more exciting things to do-like watching paint dry or perhaps, counting the number of grains of sand in a desert.

The news spread like wildfire across X, yet the excitement must be tempered. After all, excitement is often a luxury reserved for those who do not understand the futility of counting beans while the barn burns.

Apparently, Bitcoin is having a rebound moment after a sell-off that felt like a Black Friday sale gone wrong. On paper, it’s up 2.7% today, which is like getting a participation trophy-nice, but not exactly a gold medal. Meanwhile, the Middle East is still having its own version of a reality TV show, and the global economy is as stable as a Jenga tower after a few too many margaritas. So, naturally, Bitcoin’s like, “Hold my beer.”

The protocol saw a rather impressive 31% revenue growth month-over-month in February, pulling in $13.4 million. Year-over-year? Oh, just a 38% rise, with a solid $145 million to show for its efforts. That’s some serious revenue growth. If only the price of the token felt like participating in that party…

So far, three brave souls-including the ever-pompous United States-have raised their hands in support, as if saying, “Yes, let us toss a few barrels into the wild market and see what happens!” American officials, with the confidence only they could muster, predict that a joint release of 300-400 million barrels might just coax the markets back into polite society. Currently, the G7 hoards a modest 1.2 billion barrels of black gold, tucked away like a vintage wine collection.

On a recent X post-a place where pronouncements are both proclamations and confessions-Samson Mow, that tireless herald of crypto, proclaims BTC to be none other than “exponential gold.” Such a declaration could either be a prophecy or a polite form of madness. One wonders whether he sleeps or merely tosses and turns with visions of million-dollar coins.

XRP tried to rally above $1.3740 but failed so spectacularly it’s now the laughingstock of the crypto zoo. Down it tumbled, below $1.3650 and $1.3550, into a bearish wonderland where dreams go to die.