Crypto’s 2025 Meltdown: Worse Than FTX? 🚨

But lo! What of the FTX-driven apocalypse of 2022, that grand carnival of chaos? Did it not leave the digital asset realm quivering in its boots, a shattered mirage of trust? 🧠

But lo! What of the FTX-driven apocalypse of 2022, that grand carnival of chaos? Did it not leave the digital asset realm quivering in its boots, a shattered mirage of trust? 🧠

It was a dark and stormy night in the Bitcoin world (or at least a metaphorically dim and profit-losing one) as Bitcoin miners faced declining profitability after the 2024 halving event. But wait! As demand for AI compute capacity rocketed into the stratosphere, tech giants started cluing in. They discerned miners’ established power infrastructure as the ultimate key to fast-tracking data center growth.

In a lawsuit that reads like a spy novel gone wrong, 306 plaintiffs-victims and relatives of Hamas’s October 7, 2023, attack on Israel-are pointing fingers at Binance for laundering a cool $1 billion for terror groups. Yes, you read that right. One. Billion. Dollars. Enough to make even Scrooge McDuck blush. 🤑

TON, the prodigal child of the Telegram-affiliated blockchain, has surged 8.33% to $1.60 in the blink of an eye. What sorcery is this? A mix of ecosystem milestones and growing support, they say. But we know better-it’s the universe rewarding audacity. 🎭

In a move that screams “we’re not playing around,” Revolut’s latest round involved a secondary share sale so big it probably needed its own zip code. Investors like Coatue, Greenoaks, and Dragoneer (yes, that’s a real name) led the charge, with heavy hitters like Fidelity and Andreessen Horowitz throwing their hats-and wallets-into the ring. Even NVIDIA’s NVentures got in on the action, because apparently AI and banking go together like avocado and toast. 🥑🍞

According to Peter Schiff (aka Captain Doom), crypto donors might have to rethink their midterm election strategies. Turns out, losing billions can put a damper on your political clout. Who knew? 🤷♂️

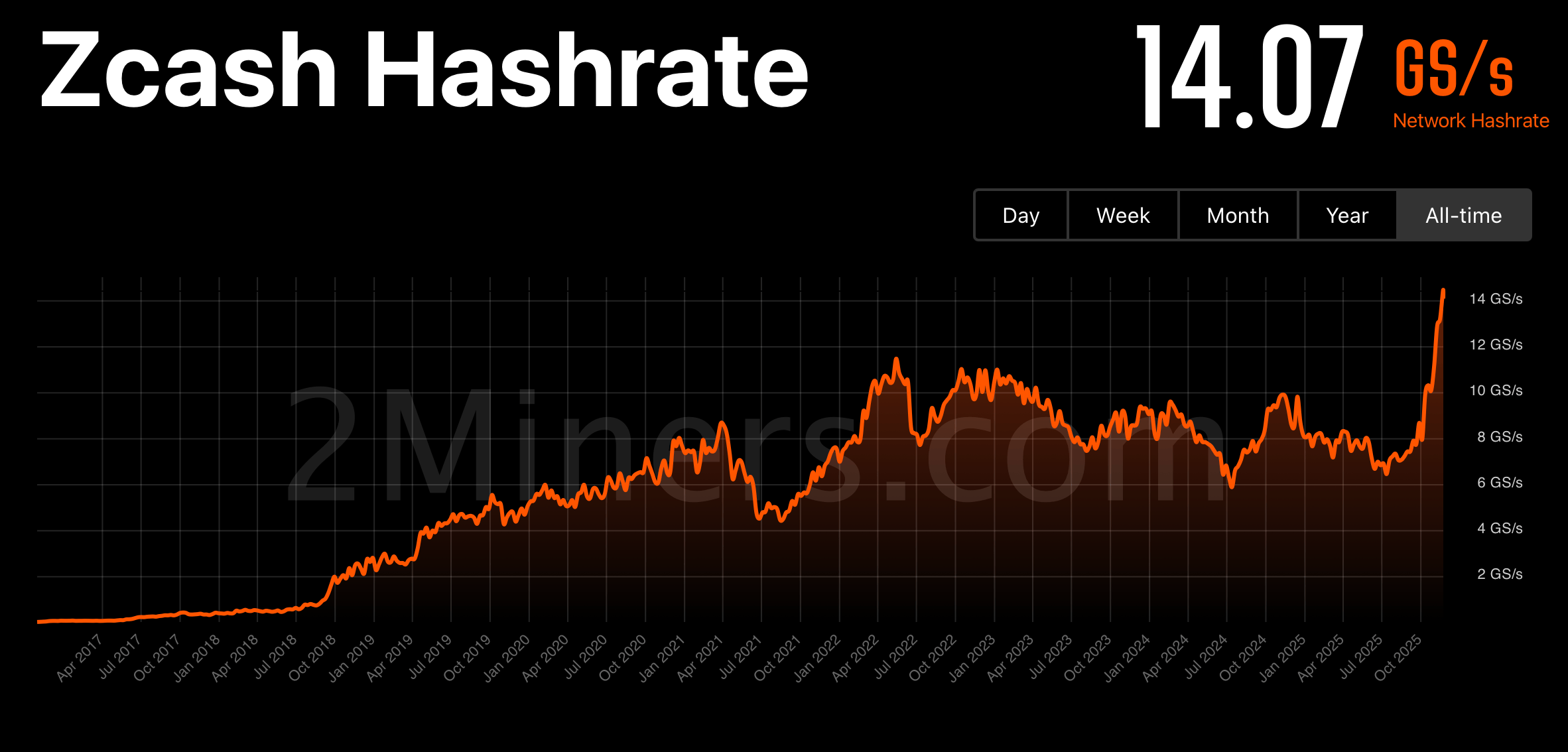

The digital currency Zcash (ZEC), a darling of the discreet and the devious, has been on a tear of late, adding 18.7% against the U.S. dollar today. Despite a 14% dip this week-a mere hiccup in its ascent-its current price of $586 marks a 125% surge over the past 30 days. This meteoric rise has propelled the Zcash network to the zenith of the PoW heap, with its Equihash algorithm outpacing Bitcoin’s SHA256 in terms of profits. A triumph, one might say, for those who prefer their transactions as opaque as a London pea-souper.

Why the pessimism, you ask? Well, two major bearish signals have decided to crash the party simultaneously. Together, they’re like the uninvited guests who eat all the guacamole and leave before the good part. 🥑🚫

Japan, already flirting with Ripple in banks and remittances, now plots a ballet with stablecoins and next-gen payment systems, attempting to seduce cross-border investments into a faster, shinier rhythm.

In the daily timeframe, our dear Bitcoin is riding a downward escalator to the land of lower highs and lower lows. Volume spikes like a barista on a caffeine binge, yet the asset flirts with the $80,537-$85,000 level, teasing a short-term bottom. Resistance at $95,000-$100,000 looms like a grumpy troll under a bridge, daring anyone to cross. Optimism? More like counter-trend daydreaming. 🌉😴