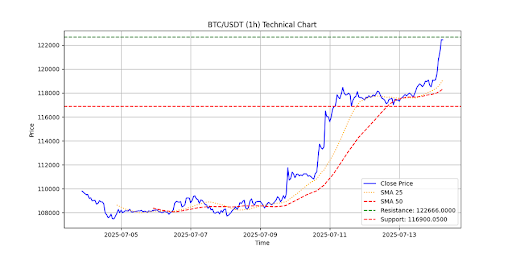

Bitcoin’s Slight Stumble: Miners Take a Breather

But fear not, dear reader, for this slight stumble is likely just a minor blip on the radar. According to the clever folks at CryptoQuant, the Miners’ Position Index has risen above 2.7, which means that miners are transferring more BTC to exchanges than their one-year average 📈. In the past, this has often signaled a short-term correction, as some miners take profit after strong price gains 💸.