Markets

What to know:

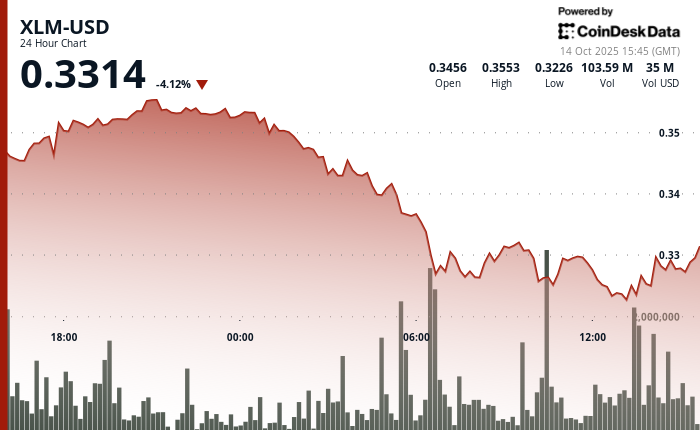

- XLM does a nosedive, down 8% in a 23-hour selloff from Oct. 13-14, breaks the magic $0.34 support, and hits a new low of $0.32 on a crazy 63.1 million token volume. Yeah, things got messy.

- Capitulation selling and wild volatility = “oversold” signs, with a brief “oh wait, let’s buy” from the big guys lifting prices back to $0.33 before trading went on an afternoon break at 14:05.

- Some analysts still think there’s hope, looking at those Elliott Wave patterns and dreaming of a $1.44 XLM by 2025… which seems like a lot of optimism after all that drama.

So here’s what happened: Stellar’s XLM took a dive-down 8% from Oct. 13 to Oct. 14. It slid from $0.36 to $0.33 as trading volume spiked to 63.1 million tokens. That’s more than the 24-hour average of 36.85 million. Not exactly a subtle movement.

Everything went south once XLM broke the critical $0.34 support early on Oct. 14. It triggered a massive selloff, pushing prices down to a fresh local low of $0.32. Ouch.

The selloff screamed “capitulation,” with high-volume selling that looked like panic. But hey, there was a glimmer of hope-XLM bounced back in the final hour of trading, up 0.4% from $0.32 to $0.33, as some big players snatched up tokens on sale. It’s like the stock market version of “I’ll take that for half off!”

And then… trading froze at 14:05. Totally stalled. Market consolidation or just a nap? Who knows? Meanwhile, Bitcoin’s sitting steady at 58% dominance, so clearly no one really knows what’s going on. Some analysts, however, are still positive. They see a potential rally toward $1.44 by the end of 2025. Sure, let’s go with that. Why not?

Technical Signals Flash Market Stress

- XLM breaks the critical $0.34 support during the 04:00 Oct. 14 session with a whopping 48.03 million volume. I mean, that’s not just a slip-up, that’s a full-on crash.

- Capitulation selling kicks in at $0.32 with volume exploding to 63.10 million tokens during the 13:00 Oct. 14 session. Someone call the ambulance.

- Exceptional volatility shows a 2% intraday range-because why not? The market was definitely stressed out, but it looks like a minor panic attack.

- Institutional buyers swoop in between 13:46-13:47 with some absurd volume of 2.67-3.68 million tokens. Guess they saw a good deal.

- And then… nothing. Trading activity stops completely at 14:05, as if the market just ran out of steam. No volume = consolidation phase. Or maybe everyone just went for lunch.

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- How to Build a Waterfall in Enshrouded

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Meet the cast of Mighty Nein: Every Critical Role character explained

- The Legend of Zelda Film Adaptation Gets First Photos Showcasing Link and Zelda in Costume

- Character Introduction — “The Undying Fire” Durin

- World of Warcraft: Midnight Gets March 2, 2026 Release Date in New Trailer, Beta Sign-Ups Now Open

2025-10-14 21:21