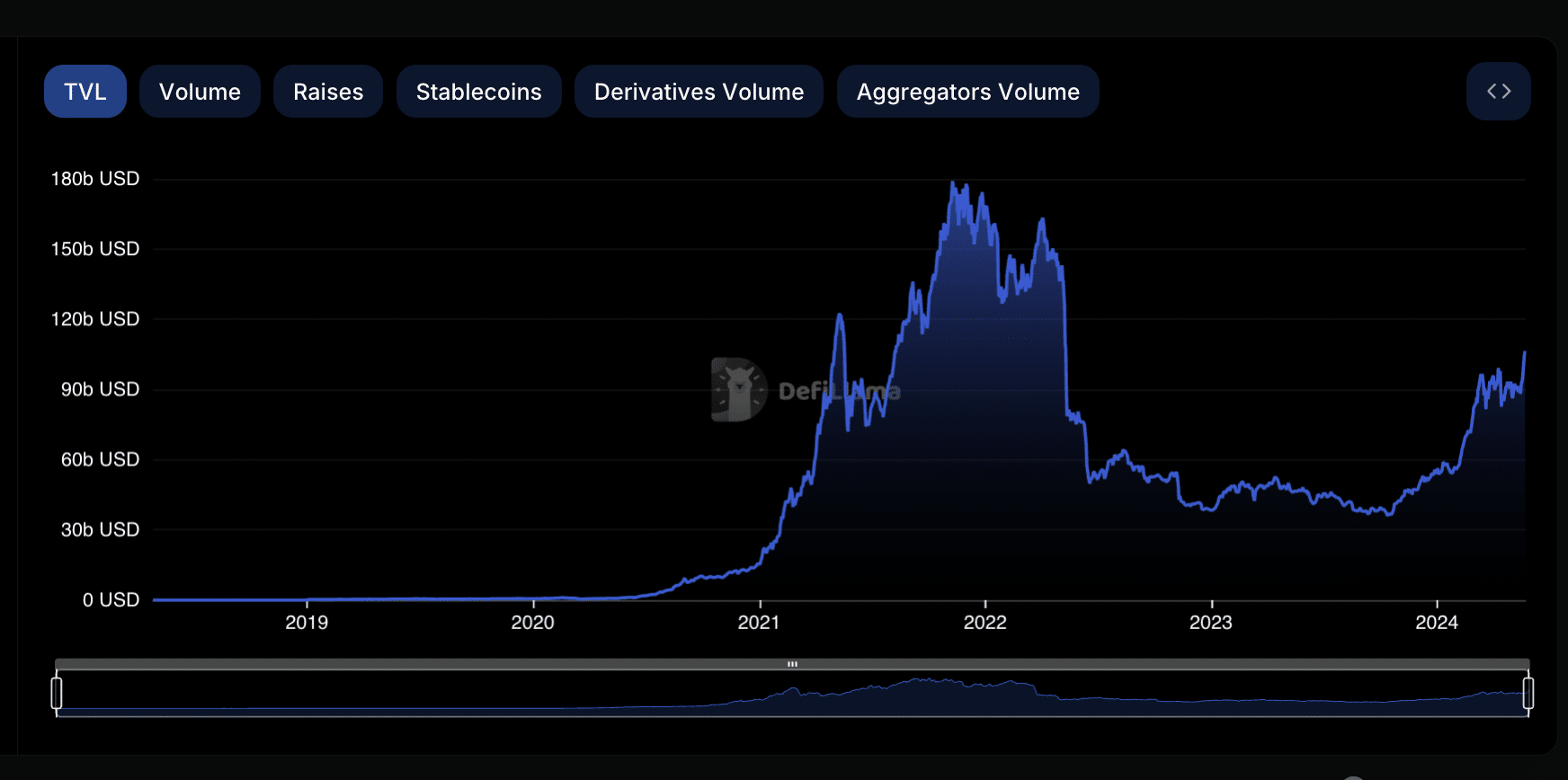

- DeFi TVL has now sat at its highest since May 2022.

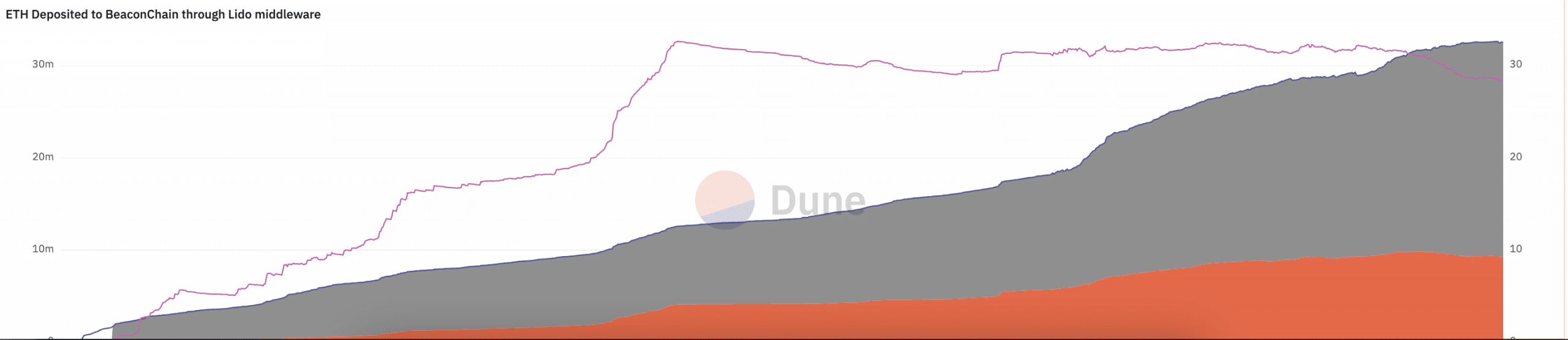

Lido’s share of the ETH staking market is declining.

As a researcher with experience in the DeFi space, I find it intriguing to observe the recent developments in the decentralized finance landscape. The total value locked (TVL) across DeFi protocols has reached its highest point since May 2022, currently sitting at $106.45 billion. This growth is particularly noteworthy when considering that the year-to-date increase amounts to a substantial 96%.

The amount of value secured in Decentralized Finance (DeFi) platforms has reached a two-year peak, as indicated by DefiLlama’s latest figures, due to the broader cryptocurrency market surge.

As a crypto investor, I can tell you that the total value locked in Decentralized Finance (DeFi) projects currently stands at $106.45 billion according to the latest data. Looking back at the year so far, this figure represents a remarkable 96% growth from the beginning of 2023.

Lido sees a decline in market share

The total worth of assets secured in Lido Finance [LDO], the foremost Ethereum [ETH] staking solution and the biggest Decentralized Finance (DeFi) project in terms of Total Value Locked (TVL), has been on a consistent upward trend since May 12th.

Before this stage, the protocol’s total value locked (TVL) had dropped to a two-month low of $27.43 billion. But as cryptocurrency asset values started climbing up in mid-May, Lido’s TVL mirrored this trend and has since increased by 30%.

It’s intriguing to note that Lido currently holds a 28.6% share of the Ethereum staking market on the BeaconChain, according to Dune Analytics. This figure is lower than what it was previously, and last saw such a low percentage back on April 17, 2022.

I’ve noticed a recent downturn in the amount of ETH being staked on various platforms. This trend is part of a larger pattern that has seen a decrease in Ethereum staking over the last few days.

As an analyst, I’ve examined The Block’s data dashboard and discovered that the proportion of Ethereum’s total supply represented by staked ETH reached a Year-to-Date high of 27% on May 13th. However, since then, approximately 4 percentage points have dropped off, resulting in a decreased stake ratio for Ethereum.

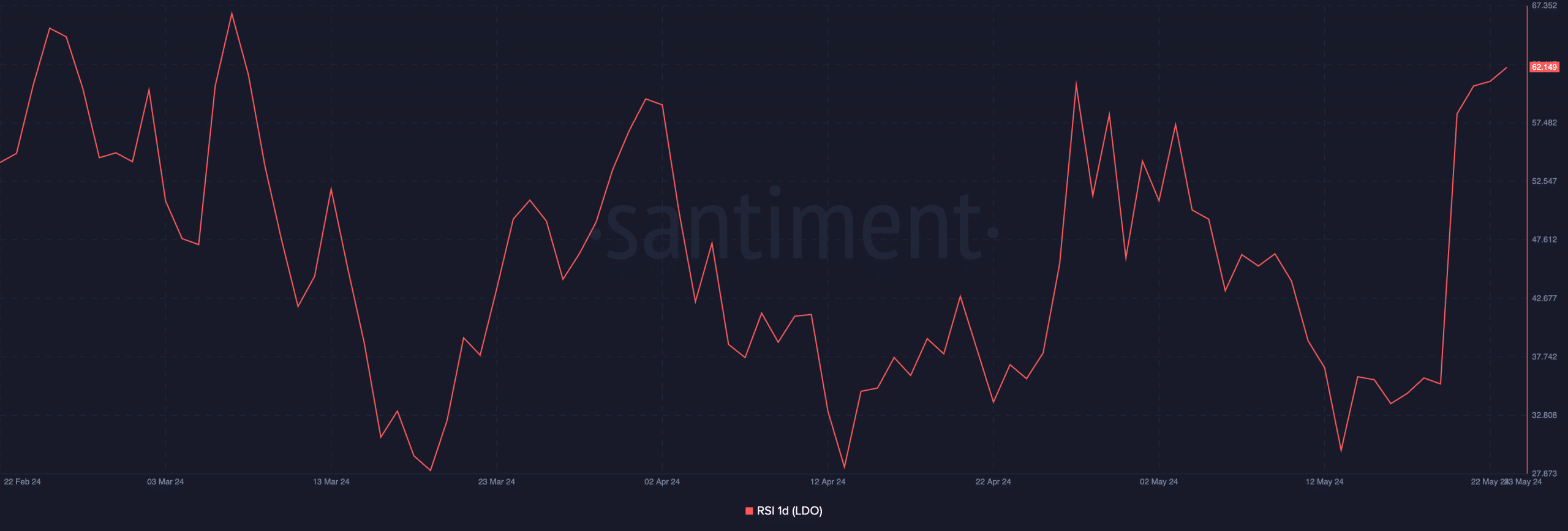

LDO sees surge in demand

As an analyst, I’ve observed that the governance token of the protocol, LDO, was traded at a price of $2.13 at the current moment, based on data from CoinMarketCap. Over the past week, there has been a significant increase in the value of this altcoin, amounting to more than 30%.

The increase in the token’s value can be explained by the heightened demand during that specific timeframe. According to Santiment’s analysis, there has been a surge in the Relative Strength Index (RSI) for LDO since May 19th. At present, LDO’s RSI reading of 62.149 indicates that buying activity has been stronger than selling activity.

Realistic or not, here’s LDO’s market cap in BTC’s terms

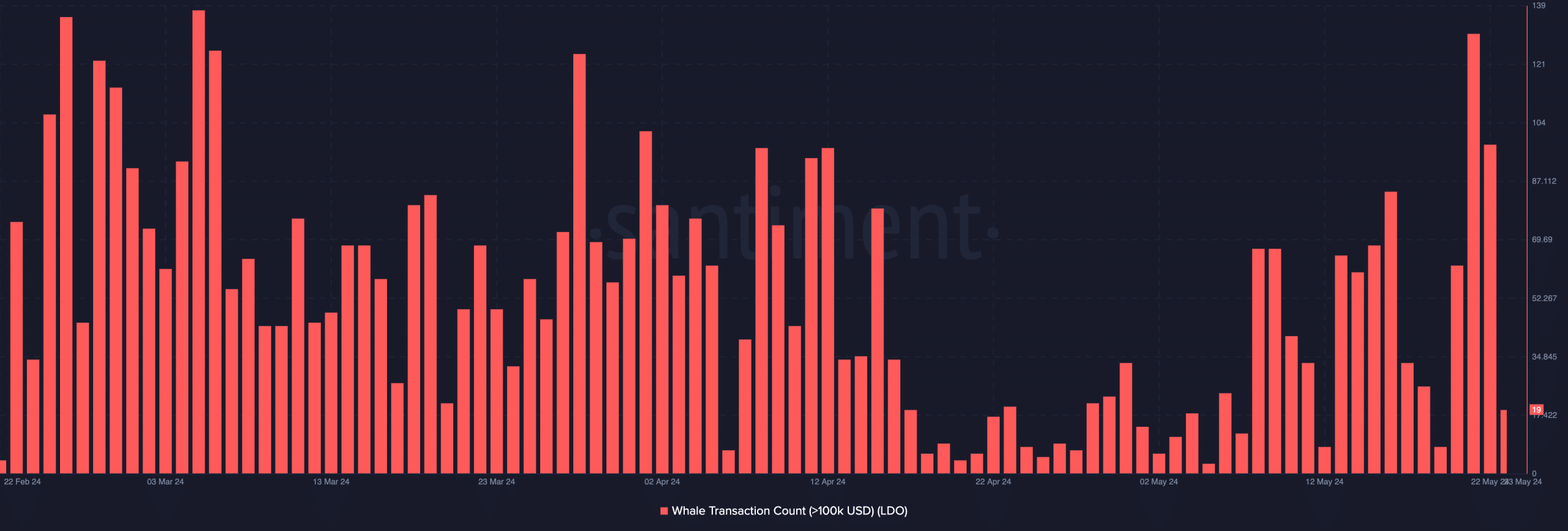

Additionally, there has been a significant increase in LDO whale transactions in recent days. In particular, on May 21st, the number of these transactions, which each involved over $100,000 worth of LDO, reached its peak since March 6th.

On that day, 131 LDO transactions valued above $100,000 were completed.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-05-24 08:07