- The U.S. SEC has approved all the applications for ETH spot ETF filed before it.

This approval has come with a series of anticipated impacts on the broader cryptocurrency market.

As a seasoned crypto investor with years of experience in the market, I’m thrilled to see the U.S. Securities and Exchange Commission (SEC) approve eight applications for Ethereum [ETH] spot ETFs. This approval is a significant milestone that has been long-awaited by the crypto community, and it’s expected to bring substantial capital inflows into the Ethereum ecosystem.

On an unexpected development, the United States Securities and Exchange Commission (SEC) granted approval to eight proposals for Ethereum [ETH] exchange-traded funds (ETFs) on the 23rd of May.

The Securities and Exchange Commission (SEC) gave its approval to 19b-4 forms for the ETF proposals submitted by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Invesco Galaxy, and Franklin Templeton.

Prior to this week, it seemed that the SEC was unwilling to give the green light to Ethereum ETFs based on scant communication with the applicants. Yet, things took a turn for the better earlier in the week as the SEC initiated dialogues and demanded the filing of 19b-4 forms from the issuers.

While this approval is significant, it doesn’t automatically make the ETF based on Ethereum (ETH) available for trading right away. As James Seyffart, Bloomberg ETF expert, pointed out in a post on X (previously Twitter), ETF issuers still need to have their S-1 forms approved before they can launch their products in the market.

On the timeline for this, Seyffart said:

Generally speaking, this procedure can last for several months – around 5 months in certain cases. However, Eric Balchunas and I believe that we might be able to expedite this process to some extent. The approval of Bitcoin ETFs historically took approximately 90 days.

Now that Ethereum ETF has been approved…

Similar to how the approval of a Bitcoin spot ETF is thought to bring about significant investments, the green light for an Ethereum ETF is predicted to result in a large influx of capital.

Based on Citi’s assessment, there was a total investment of $13 billion in Bitcoin spot ETFs from their approval on 4th January until the 20th of May.

The large inflows caused Bitcoin’s price to spike, reaching a record high of $73,750 on March 14th. This indicated that each $1 billion investment resulted in a roughly 6% price hike for the digital coin.

As a crypto investor, I’d interpret this information as follows: Based on the market capitalization, Citi projects that Ethereum (ETH) could attract inflows ranging from $3.8 billion to $4.5 billion. These inflows may have the potential to push ETH prices upward by approximately 23% to 28%.

Based on the latest figures from CoinMarketCap, I find Ethereum being traded at approximately $3,798. Should Ethereum experience a 28% surge in value, its price would then reach around $4,861.

The price remains lower than its previous peak of $4,891, which was reached by the front-runner cryptocurrency almost three years ago.

Certain analysts are of the opinion that the approval of a spot Ethereum Exchange-Traded Fund (ETF) could cause Ethereum’s price to surpass its existing record high.

Ethereum ETF to send ETH to $10,000?

Andrey Stoychev, Nexo’s prime brokerage head, shared his perspective in a Cointelegraph interview: ETF approvals could potentially drive Ethereum’s price up to $10,000 before the year ends.

Stoychev said,

“ETFs based on Ethereum in the USA and comparable products in Asia might serve as a catalyst, propelling the cryptocurrency’s price to reach $10,000 by the end of 2024. This growth could mirror Bitcoin’s market momentum following its ETF approval.”

As a researcher examining the potential impact of an Ethereum-based Spot Exchange Traded Fund (ETF) approval on the Ethereum network, I’m intrigued by the ongoing discussion regarding whether this event would lead to increased staking rewards for Ethereum validators.

Based on the views of Matthew Sigel, the leader of Digital Assets at VanEck, the returns from Ethereum (ETH) staking protocols are expected to rise substantially once ETH shifts from these platforms into Exchange-Traded Funds (ETFs).

If Ethereum stakers transfer their previously staked ETH to new approved Exchange-Traded Funds (ETFs), this action might pose a potential security risk for the larger Ethereum community. The withdrawal of coins from staking may lessen the network’s overall security strength.

As a security analyst, I would explain that the Ethereum network’s security hinges on the coins that are staked by validators. A decrease in staked Ether implies a reduction in the number of validators securing the network, potentially leaving it more susceptible to malicious attacks.

Some people hold a different perspective, contending that an ETH ETF might not generate sufficient returns for investors to motivate them to transfer their coins from staking platforms.

In a recently published report, CCData Research noted:

If you had opted to invest in a 1000 ETH position through an ETF provider starting from January 1, 2023, instead of holding the native Ether and earning staking rewards, your potential gains would have amounted to less than $800,000.

As a researcher studying the cryptocurrency market, I’ve come across Broker, Bernstein’s perspective on how the Biden administration may influence the market in their latest report to clients. They suggest that the administration could adopt a more lenient stance towards cryptocurrencies leading up to the November Presidential Elections.

The regulator’s approval of the ETH spot ETF marks a favorable change in their attitude towards the cryptocurrency industry.

The market in the past 24 hours

As a crypto investor, I’ve seen Ether (ETH) surge in value following the approval news, reaching an impressive peak of $3993. However, the excitement was short-lived as ETH experienced a 5% correction, resulting in its current trading price of $3,798 at this moment.

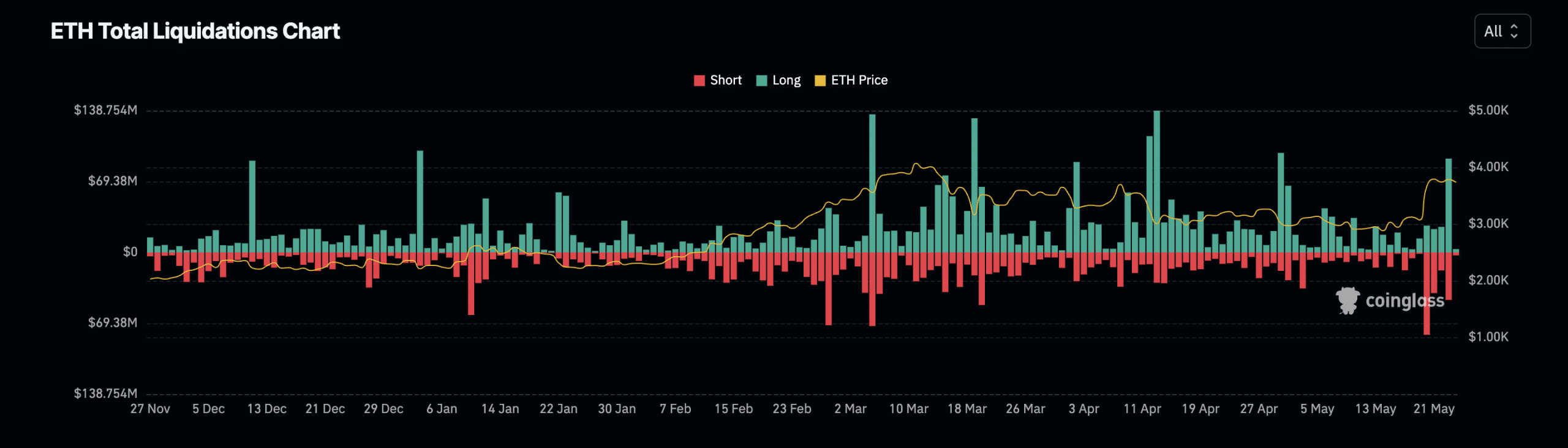

The sudden drop in price caused investors to sell off their long-held Ethereum positions, resulting in a total loss of approximately $92 million, as indicated by data from Coinglass.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-05-24 10:16