- Dogecoin whales’ activity correlated with price spikes and volatility.

- Recent whale movements could signal a strategic accumulation or a pump attempt.

As a seasoned researcher with a knack for deciphering market trends and patterns, I find the recent Dogecoin [DOGE] whale activity both intriguing and concerning. The collective acquisition of 160 million DOGE by these large holders is undeniably significant, raising questions about their intentions – strategic accumulation or a pump attempt?

Over the past weekend, I observed a significant action taken by Dogecoin [DOGE] whales. These large-scale investors jointly amassed an impressive 160 million DOGE.

As a seasoned cryptocurrency investor with years of experience under my belt, I’ve learned to keep a close eye on significant purchases that could potentially influence the market. The recent acquisition has certainly raised some eyebrows and sparked speculation about its impact on Dogecoin’s price. Given my past experiences with similar events, I can’t help but wonder if this purchase will cause a surge or dip in Dogecoin’s value. Only time will tell, but I’ll be closely monitoring the situation to adjust my investment strategy accordingly.

These acquisitions happening in this manner have sparked speculation: Could these whales be trying to manipulate short-term stock fluctuations, or are they preparing for future profits instead?

Examining the actions of Dogecoin’s major investors might provide useful clues about potential future price movements within the meme coin market.

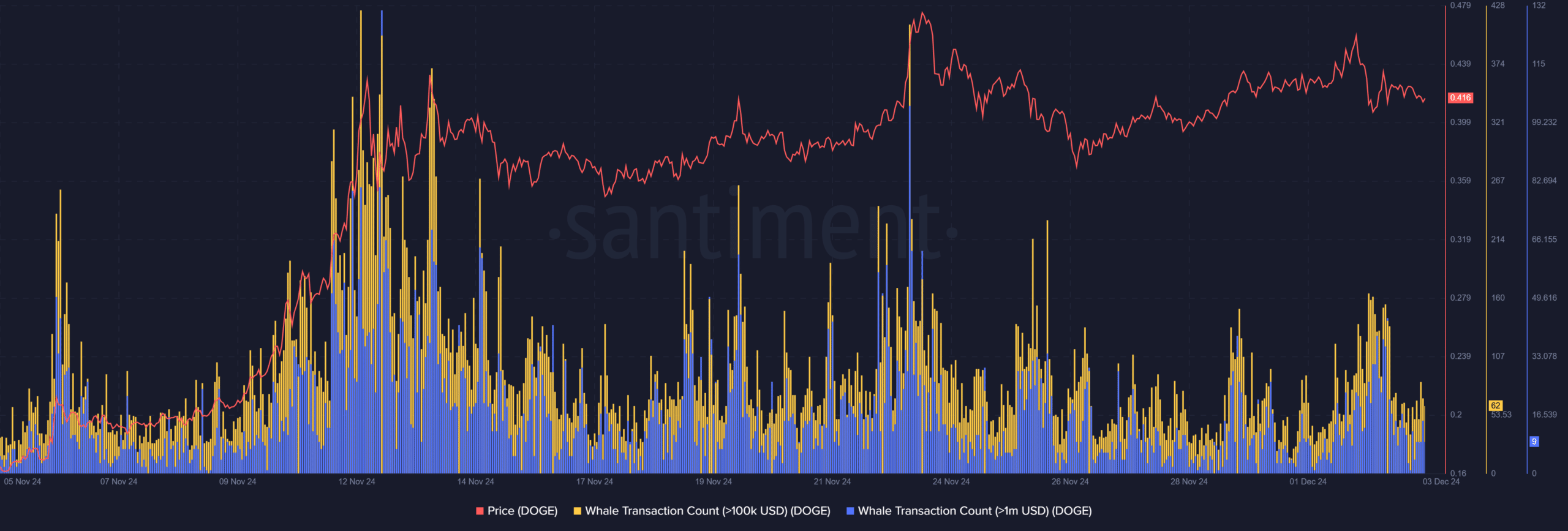

Whale activity: A month in review

Over the last four weeks, we’ve seen a marked increase in large-scale Dogecoin transactions. This surge is demonstrated by the rising count of transactions valued over $100,000 and $1 million.

It appears that a strong connection exists between those significant transactions and market fluctuations, particularly price instability. Interestingly, the surge in ‘whale’ activities during mid-November seemed to align with the rise of Dogecoin from $0.28 to its highest point at $0.44.

As an analyst, I’ve noticed that the behavior of whales significantly impacts Dogecoin’s temporary direction. In other words, the moves made by these large investors can influence where Dogecoin is headed in the short term.

In times of heightened market action, it seems that whales boost market trends, whether they’re rising or falling. Yet, as trading activity decreased around late November, the price of Dogecoin settled around 0.41 USD.

The behavior suggests strategic positioning by whales, potentially ahead of another breakout.

The question is whether this trend suggests a forthcoming surge (rally) or careful stockpiling (accumulation). This ultimately hinges on the overall market trends and investor mood over the next few weeks.

Dogecoin price dynamics

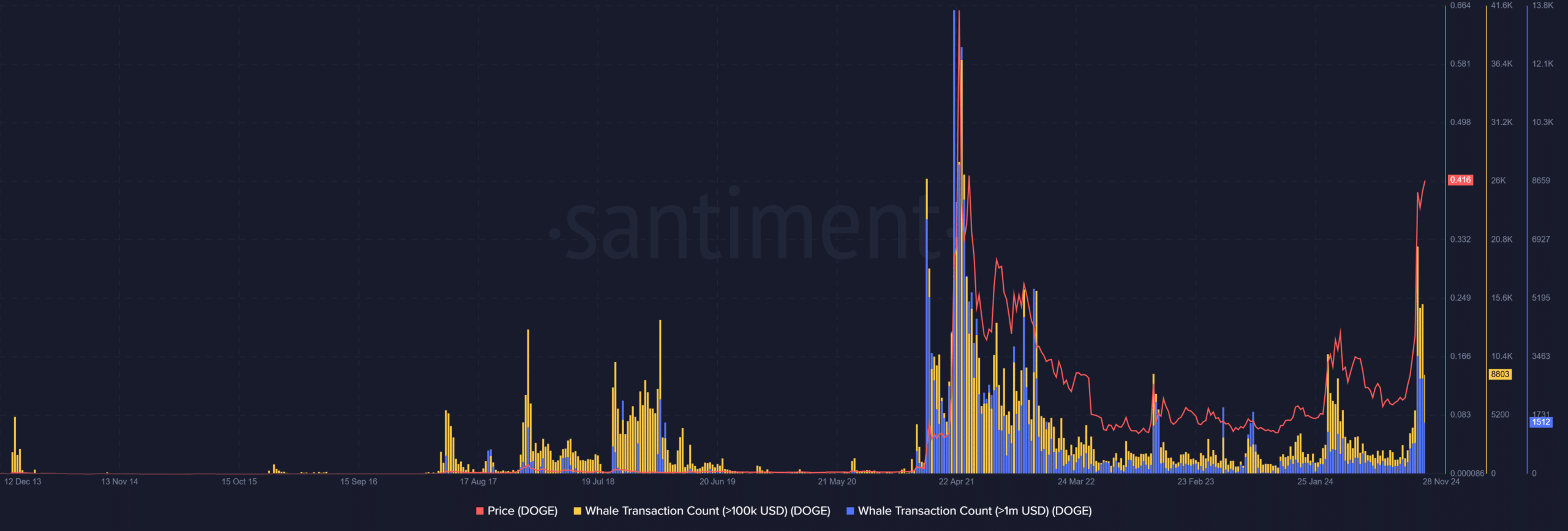

It’s been observed that Dogecoin’s history shows a significant link between large-scale investors (whales) and major price fluctuations. For instance, the record high in 2021, characterized by an increase in transactions worth over $1 million, coincided with Dogecoin reaching a peak of $0.74.

This sharp increase clearly shows that intense buying activity can cause dramatic upward trends, orchestrated by retail investors who are influenced by the actions of larger, experienced investors (whales).

Over the subsequent years, I found an intriguing pattern emerging: extended phases of minimal whale activity seemed to align with prolonged periods of market stagnation. This discovery underscores the significant role that major market participants play in maintaining market dynamism.

The increase in whale activities recently resembles the periods leading up to rallies in 2020 and 2021, hinting at a possible upcoming surge.

Yet, the data also highlights the risks of over-reliance on whales, as abrupt sell-offs have historically triggered cascading corrections.

Could the surge indicate a price pump?

The current occurrence of whale activities is sparking speculation about whether it could be orchestrated as a synchronized price surge.

Historically, major Dogecoin investors have taken advantage of buying large quantities strategically during market hype, which frequently leads to significant price increases.

160 million Dogecoin amassment shows trends similar to those preceding significant surges, yet the lack of sustained buying pressure might hint at temporary intentions.

If it turns out that this is an attempt to inflate prices, the approach would likely involve retail traders pursuing the price surge, propelling DOGE past important resistance points such as $0.45.

Given the general market mood is leaning towards caution, not breaking these levels might put large investors (whales) in potential liquidity trouble, causing them to quickly sell off their holdings abruptly.

Strategic accumulation or fragile optimism?

Instead, the amassment could symbolize a long-term strategy, demonstrating faith in Dogecoin’s robustness within the meme coin market.

This method follows the pattern seen in history, where whales tend to amass during periods of negative sentiment, presumably preparing for an upcoming bull market.

Still, risks remain. Over-reliance on whale-driven rallies leaves the ecosystem vulnerable to price manipulation.

Furthermore, the absence of practical use cases for Dogecoin other than speculative investment creates doubts about its capacity to maintain long-term upward price movements.

Maintaining regular interaction with retailers is crucial; without it, even large-scale investor positions (whales) might not generate sustained growth.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-12-04 08:12