The US Dollar Index (DXY) recorded a modest recovery, standing at 98.2 at press time. Following recent losses, the index was up 0.09% over the previous day.

Oh great, the dollar index is up 0.09%… because 0.09% is the new 100%. Meanwhile, some guy on X (who used to work at Goldman Sachs-*obviously* a credible source) claims the dollar’s about to lose its “global reserve currency” crown. Groundbreaking. 🤡

Dollar Reserve Status in Danger: What Comes Next?

Wolf Financial explained that a currency can only hold reserve status if it’s backed by strong military power. The US currently fulfils this role. Why? Because of its nuclear arsenal, submarines, stealth aircraft, and hundreds of military bases around the world.

The US Navy also secures global trade routes, which gives other countries confidence in using the dollar for international settlements. This arrangement has allowed the US to maintain reserve currency status and freely print money.

“But there’s just one problem… the dollar is clearly failing. So what country’s currency can replace the dollar? None,” the post read.

The analyst argued that no single fiat currency, whether the Chinese Yuan, Japanese Yen, or Russian Ruble, possesses the liquidity, trust, or economic backing to replace the USD. As a result, the world may face decades of instability rather than a smooth transition to a new single reserve currency.

In such a scenario, global trade could fragment into regional systems. Therefore, countries could likely be trading more with neighbors and empires rather than globally. The US might rely heavily on Canada and Mexico for trade and could even return to a gold standard since it owns the largest gold reserves.

Meanwhile, other nations may experiment with different systems. Some may adopt gold-backed currencies, others may use Bitcoin (BTC), many may turn to central bank digital currencies (CBDCs), and a few may try out IMF Special Drawing Rights (SDRs).

“How will this look in the long term? The East will trade with the East, and the West will trade with the West. The majority of fiat will die, with countries either using gold-backed currencies or BTC on government-controlled layer 2s,” Wolf Financial said.

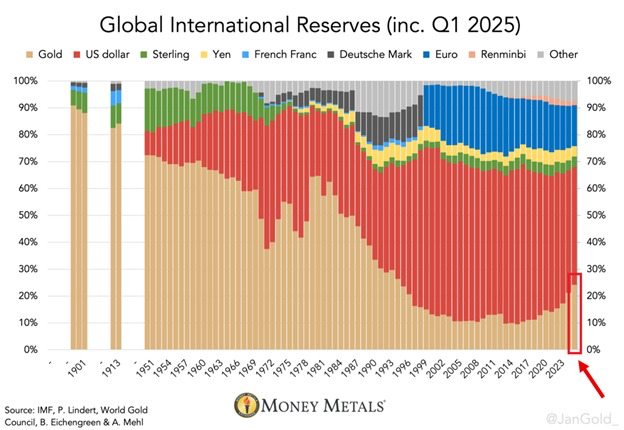

Meanwhile, in reality, the USD has already seen a decline in its dominance in global reserves.

“We conclude with this chart: A sudden surge in Gold as a % of global reserves as the % of USD falls,” The Kobeissi Letter stated.

Hedge fund manager Ray Dalio corroborated this perspective. He recently cautioned that the rising debt brings the US closer to an ‘economic heart attack.’ Amid this, cryptocurrencies could emerge as a potential alternative asset.

“Crypto is now an alternative currency that has its supply limited, so, all things being equal, if the supply of dollar money rises and/or the demand for it falls, that would likely make crypto an attractive alternative currency,” Dalio said.

Thus, as the DXY stabilizes, the financial community watches closely, weighing the dollar’s resilience against the analyst’s provocative vision of its decline. Furthermore, with the dollar index and BTC’s inverse relationship, the latter will likely benefit if the analysts’ predictions come true.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Ashes of Creation Rogue Guide for Beginners

- Maury Povich Details His and Wife Connie Chung’s “Tough” Fertility Jou

- Mila Kunis Reveals One Parenting Rule With Ashton Kutcher

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

2025-09-04 11:51