This text discusses the differences between Bitcoin Exchange-Traded Funds (ETFs) and Bitcoin Exchange-Traded Products (ETPs), as well as Ethereum ETFs and ETPs. It highlights the regulatory framework, flexibility, accessibility, and investment processes for each. The text also touches on the future of crypto ETFs and ETPs and provides an FAQ section to answer common questions.

Investing in cryptocurrencies can be an exciting and anxiety-inducing realm. On one hand, the possibility of substantial profits is hard to ignore. However, on the other hand, the intricacies involved in dealing with crypto exchanges and safeguarding digital assets can be overwhelming.

As a crypto investor, I’ve come across Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) as attractive options in the market. It’s essential to grasp the distinctions between these financial instruments and their main benefits for effective investment strategies.

In this comprehensive analysis, we’ll explore the intricacies of investing in ETFs (Exchange-Traded Funds) versus ETPs (Exchange-Traded Products) within the cryptocurrency market. Gain a deep understanding to confidently make wise financial choices.

Key Takeaways

- ETFs and ETPs offer convenient ways to invest in cryptocurrencies without directly buying or storing them.

- ETFs are a specific type of ETP that tracks an underlying basket of assets, while ETPs encompass a broader range of financial instruments.

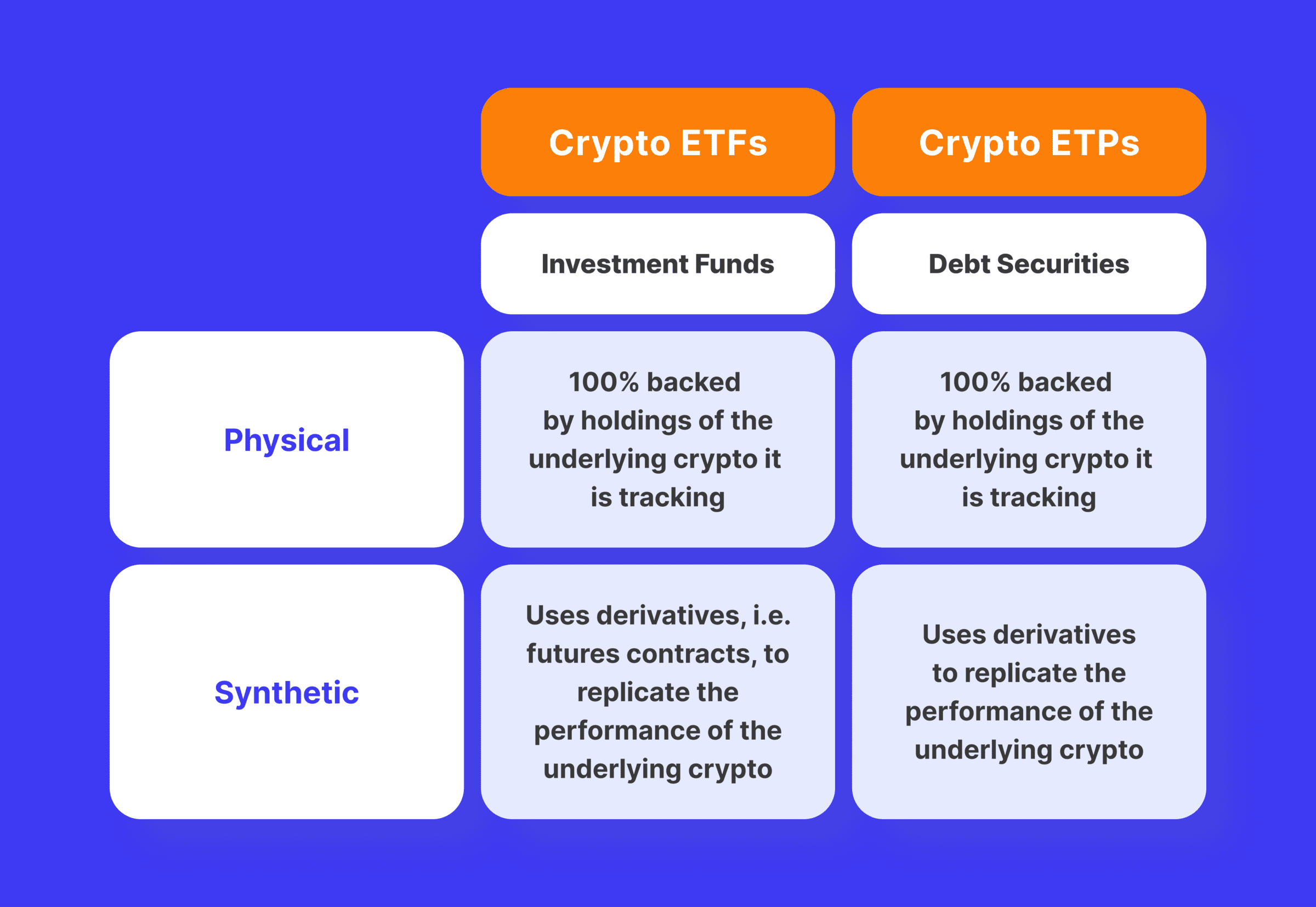

- Crypto ETFs invest directly in cryptocurrencies, while some ETPs use derivative contracts like futures to track crypto prices.

- Both ETFs and ETPs offer advantages, such as diversification, liquidity, and potentially lower fees, compared to directly buying crypto.

Understanding ETFs vs. ETPs in Crypto

Before discussing the advantages and differences between these assets, let’s define both of them.

What is a Crypto ETF?

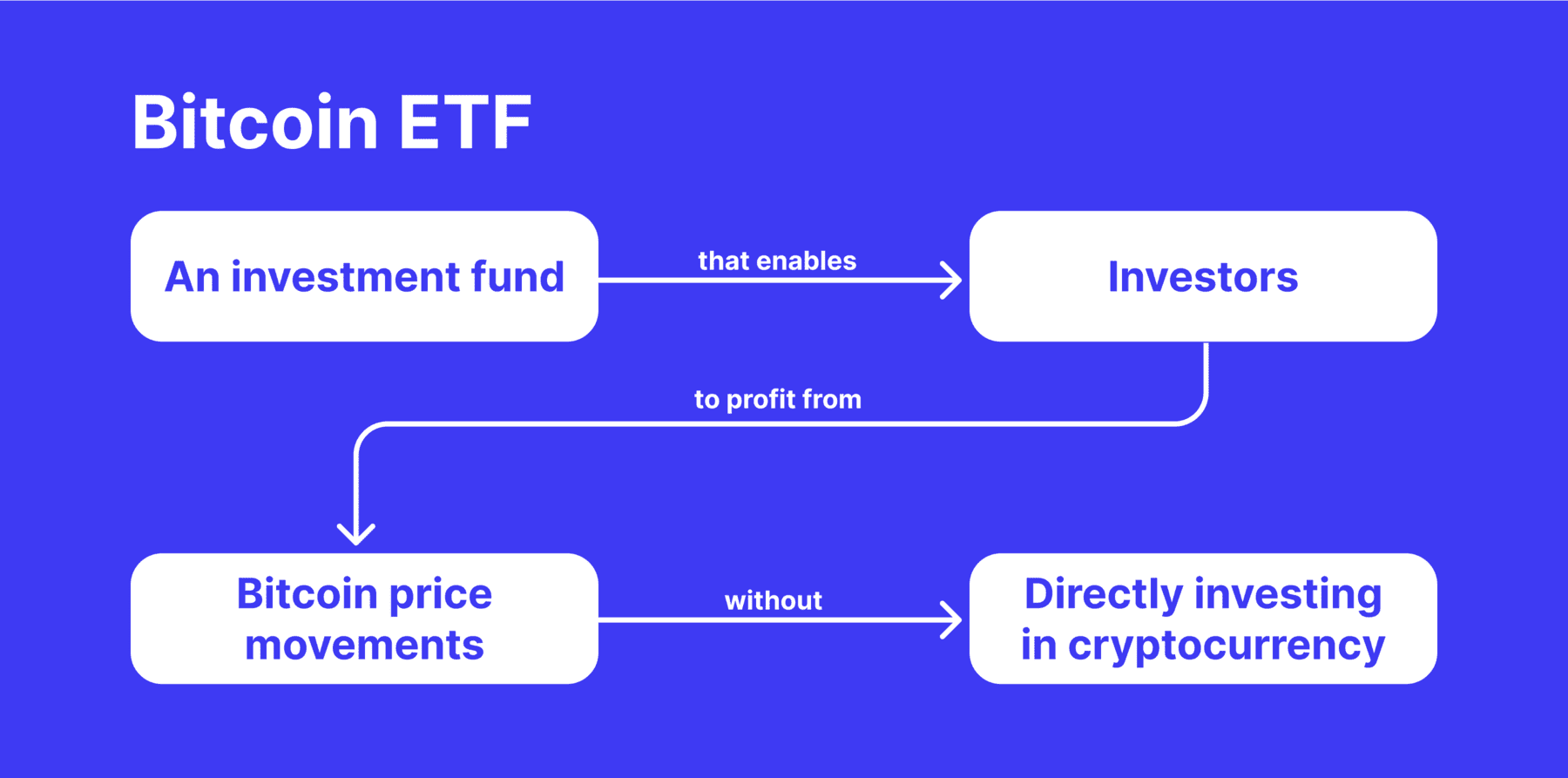

An Exchange-Traded Fund (ETF) focused on cryptocurrencies functions similarly to a traditional stock, being traded on exchanges. It comprises assets like Bitcoin, Ethereum, or other digital currencies, intending to mirror their market performance. By purchasing shares of this ETF, investors gain access to the price fluctuations of these cryptocurrencies without the need for managing individual wallets and handling private keys.

What is a Crypto ETP?

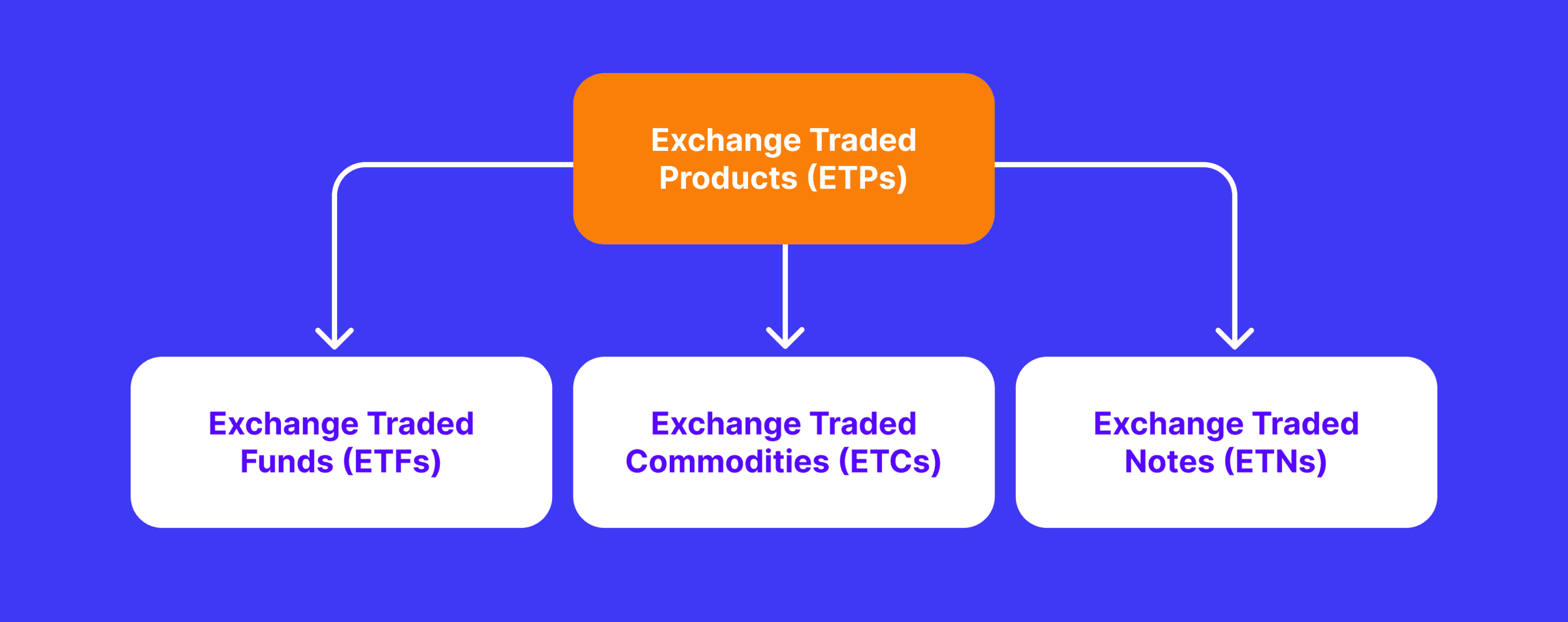

As a financial analyst, I would describe crypto Exchange-Traded Products (ETPs) as a diverse class of investment tools encompassing Exchange-Traded Funds (ETFs), Exchange-Traded Notes (ETNs), and Exchange-Traded Commodities (ETCs). The primary objective of these instruments is to grant investors access to the price movements of an underlying asset, be it a cryptocurrency. By issuing tradable securities on exchanges, Crypto ETPs enable investors to gain exposure without directly owning the underlying asset. These products can mirror the performance of individual digital currencies or a collection of them.

Key Differences Between Crypto ETFs and ETPs

When it comes to investing in cryptocurrencies, both Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) provide hassle-free access. However, it’s essential to be aware of their fundamental differences:

Structure

Exchange-traded funds (ETFs) represent a particular class of investment vehicles that mirror the performance of a collection of assets, which may consist of a sole cryptocurrency, a grouping of cryptos, or even a blend of cryptos along with conventional assets.

In contrast to ETFS, ETPs (Exchange-Traded Products) cover a more extensive selection of financial tools. These include Exchange-Traded Commodities (ETCs), which represent actual commodities like gold, and Exchange-Traded Notes (ETNs), which are essentially debt securities issued by financial institutions.

Underlying Asset

Instead of investing in crypto Exchange-Traded Funds (ETFs) indirectly through stocks or other instruments, they actually own and store the digital currency assets themselves. For instance, a Bitcoin ETF would physically possess Bitcoin or enter into agreements for future delivery of the cryptocurrency.

In contrast, certain Crypto Exchange-Traded Products (ETPs), particularly those specialized in Bitcoin, employ derivative contracts such as futures to follow the value of the cryptocurrency without physically possessing it. The investment offerings encompassing crypto ETPs may comprise cryptocurrencies themselves, futures, or even debt securities issued by crypto-related companies. This expansive classification enables a wider range of investment tactics but potentially brings forth extra risks.

Regulation

As a crypto investor, I’d put it this way: In the United States, Exchange-Traded Funds (ETFs) are governed by the Investment Company Act of 1940, ensuring increased security and clarity for investors. This regulation mandates that ETFs must possess the actual assets or their equivalent value.

In contrast to traditional ETFs, Exchange-Traded Products (ETPs) come with more flexible regulatory requirements. Among them are ETNs (Exchange-Traded Notes) and ETCs (Exchange-Traded Commodities), which may feature distinct structures and risk characteristics.

Investment Strategy

ETFs (Exchange-Traded Funds) are designed to mimic the overall performance of a particular market index or a collection of assets. An example of this is a Bitcoin ETF, which is intended to track the value movement of Bitcoin.

As a researcher exploring Exchange-Traded Products (ETPs), I can adopt different approaches to managing my investments. For instance, I may opt to monitor the prices of individual assets within an ETP, keeping a close eye on their movements in the market. Alternatively, I could focus on baskets of assets that align with my investment goals, allowing me to diversify risk and potentially capture broader market trends. Furthermore, I might employ leverage or inverse strategies to amplify gains or hedge against potential losses, respectively, based on my market outlook and risk tolerance.

Tax Efficiency

As a researcher studying exchange-traded funds (ETFs), I’ve discovered that one of their major advantages is their tax-efficient structure. This feature enables in-kind redemptions and creations, which can effectively reduce the amount of capital gains distributions for investors. In simpler terms, ETFs allow for the transfer of shares or securities instead of cash, thus minimizing taxable events and resulting in fewer capital gains distributions for investors.

The tax benefits of Equity-Linked Tax-Preferred Products (ETPs) can vary based on their unique structures and the governing laws.

Advantages of Crypto ETFs and ETPs

Whether you choose a crypto ETF or ETP, you benefit from several significant advantages:

- Diversification: Instead of putting all your eggs in one basket by buying a single cryptocurrency, ETFs and ETPs allow you to gain exposure to a broader market segment, potentially mitigating risk.

- Liquidity: Both ETFs and ETPs trade on traditional stock exchanges, offering the same level of liquidity as stocks. You can easily buy and sell your holdings throughout the trading day.

- Regulation: Crypto ETFs and ETPs are regulated financial products, which means they must adhere to strict guidelines and undergo regular audits.

To be more precise, let’s outline the benefits of ETFs and ETPs separately and in detail.

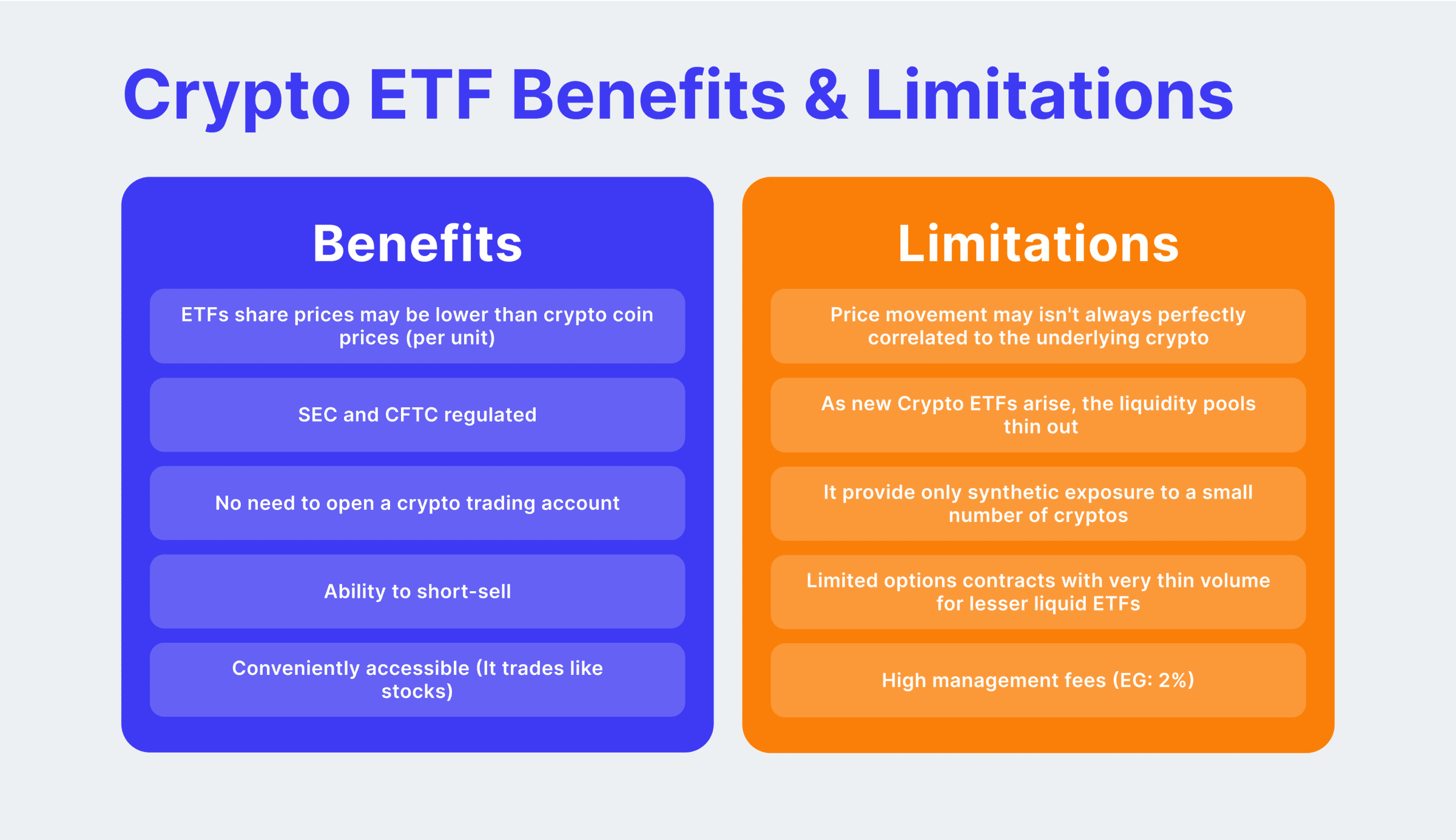

Key Advantages of Crypto ETFs

Regulatory Oversight and Transparency

The SEC and other regulatory bodies play a crucial role in overseeing Crypto Exchange-Traded Funds (ETFs), ensuring they comply with stringent reporting and operational requirements. This regulation boosts investor confidence by increasing transparency and security. For instance, the ongoing debates surrounding crypto ETF approvals underscore the significance of regulatory examination for upholding market trustworthiness.

Ease of Access and Trading

One significant advantage of crypto Exchange-Traded Funds (ETFs) is their accessibility for investors. These funds can be purchased and sold like common stocks via regular brokerage accounts. This convenience streamlines the process for individuals looking to invest in cryptocurrencies. Moreover, ETFs are traded on major stock exchanges, providing high liquidity and a straightforward trading experience.

Diversified Exposure

As a crypto market analyst, I would advise that investing in Crypto Exchange-Traded Funds (ETFs) can offer you exposure to a well-diversified collection of cryptocurrencies or relevant assets. By doing so, you reduce the risk linked with putting all your eggs in one basket, i.e., investing solely in a single cryptocurrency. For instance, some top-performing crypto ETFs include a combination of Bitcoin, Ethereum, and other prominent digital currencies, ensuring a balanced investment strategy.

Lower Expense Ratios vs Other Types of Funds

As a researcher studying investment vehicles, I’ve observed that Exchange-Traded Funds (ETFs) generally come with lower expense ratios compared to actively managed funds. This cost advantage is a significant draw for investors seeking to keep their investment expenses in check. For instance, Bitcoin futures ETFs typically have less expensive fees than mutual funds or hedge funds that offer comparable exposure to the digital asset market.

Key Advantages of Crypto ETPs

Broader Range of Investment Options

Crypto Exchange-Traded Products (ETPs) provide investors with a wider variety of investment opportunities than traditional Exchange-Traded Funds (ETFs). These options extend beyond just cryptocurrencies, encompassing debt securities, futures contracts, and commodities as well. This versatility empowers investors to construct portfolios that align with their unique risk profiles and financial objectives.

Innovative Investment Strategies

Expert: ETPs (Exchange-Traded Products) offer more intricate and creative investment approaches compared to ETFs (Exchange-Traded Funds). For example, inverse ETPs enable investors to gain profits from falling cryptocurrency prices, while leveraged ETPs intensify the gains (as well as the risks) of the underlying assets. Such strategies present attractive chances for experienced investors aiming to benefit from market fluctuations.

Higher Liquidity

Certain crypto Exchange-Traded Products (ETPs), particularly those that follow extensively dealt cryptocurrencies such as Bitcoin and Ethereum, present better liquidity compared to the individual digital currencies. This enhanced liquidity leads to narrower bid-ask spreads and more streamlined price discovery. In turn, investors profit from reduced trading expenses and improved market entry opportunities.

Accessibility for Retail Investors

As an analyst, I would explain it this way: I’ve observed that Exchange-Traded Products (ETPs) are specifically crafted to cater to a larger pool of investors, including individual retail investors. This expansion in accessibility is significant because it enables smaller investors to engage with the cryptocurrency market without having to commit substantial financial resources or deal with the intricacies of crypto exchanges.

Choosing Between Crypto ETFs and ETPs

When deciding between investing in a crypto exchange-traded fund (ETF) or an exchange-traded product (ETP), it’s essential to take into account your unique investment plan and risk appetite. Consider the following aspects for making an informed choice:

For those seeking a direct connection to the price fluctuations of a particular cryptocurrency, consider opting for a crypto Exchange-Traded Fund (ETF) instead, as it physically holds the underlying asset.

As a financial analyst, I would rephrase it as follows: Crypto Exchange-Traded Funds (ETFs) represent a novelty in the investment world, with regulatory frameworks differing based on geographical location. In contrast, Exchange-Traded Products (ETPs), which have been established for some time, typically fall under more established regulatory jurisdictions within the financial industry.

Goal for Investing in Crypto: Do you want a passive investment that mirrors the entire crypto market’s performance, or are you drawn towards actively managed funds with distinctive strategies? Both Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) can accommodate various investing goals.

Fast Fact

In 1990, the first Exchange-Traded Fund (ETF) was introduced in Canada, marking the beginning for the US debut of the SPDR S&P 500 ETF Trust in 1993. These funds offered investors the benefits of a mutual fund’s diversification, while allowing them the convenience and flexibility of trading like stocks. However, it took some time before ETFs gained significant popularity.

Comparing Bitcoin ETPs and ETFs

In the realm of Bitcoin investing, ETFs (Exchange-Traded Funds) and ETPs (Exchange-Traded Products) each present distinct advantages and factors to take into account.

Bitcoin Exchange Traded Funds

- Regulation: Bitcoin ETFs, such as those by prominent financial institutions like BlackRock, are subject to stringent regulatory approval processes.

- Simplicity: Bitcoin ETFs provide a straightforward way to gain exposure to Bitcoin’s price movements without the need to manage digital wallets or private keys.

- Market Impact: The approval of a spot Bitcoin ETF significantly impacts the market by increasing institutional and retail participation, potentially driving up demand and stabilising prices.

Bitcoin ETPs

-

Variety: Bitcoin ETPs can include different types of products, such as ETNs and ETCs, which may have varying degrees of risk and return profiles.

Innovation: Bitcoin ETPs often incorporate innovative features, such as leverage or inverse performance tracking, allowing investors to implement more complex trading strategies.

Accessibility: Bitcoin ETPs might be more accessible in jurisdictions where ETFs have yet to be approved, providing an alternative way for investors to gain exposure to Bitcoin.

Comparing Ethereum ETPs and ETFs

With a sizable market value ranking second among cryptocurrencies, Ethereum has garnered substantial attention from investors.

Ethereum ETFs

- Regulatory Framework: Similar to Bitcoin ETFs, Ethereum ETFs are subject to regulatory approval, ensuring a level of protection and transparency for investors.

- Diversified Holdings: Some Ethereum ETFs might include a mix of Ethereum and related assets, providing a diversified investment option.

Ethereum ETPs

- Flexibility: Ethereum ETPs can offer exposure to Ethereum through various structures, including futures and other derivatives, providing more flexibility in investment strategies.

- Innovation and Risk: Ethereum ETPs may introduce innovative features like leveraged returns or inverse performance, which can appeal to more risk-tolerant investors.

How to Trade ETFs and ETPs

Now, let’s look through the process of trading ETFs and ETPs.

Steps to Trade ETFs

- Open a Brokerage Account: Ensure the brokerage platform offers access to a wide range of ETFs, including crypto ETFs.

- Research: Use resources like the crypto ETF list to identify suitable ETFs based on your investment goals and risk tolerance.

- Place Orders: Buy or sell ETF shares through your brokerage account, just like trading stocks.

- Monitor Performance: Regularly review your ETF investments and adjust your portfolio as needed to align with your investment strategy.

Steps to Trade ETPs

- Understand the Product: Before trading, ensure you fully understand the specific type of ETP, its underlying assets, and its risk profile.

- Choose a Platform: Select a trading platform that offers a range of ETPs, including cryptocurrency ETPs.

- Execute Trades: Place buy or sell orders for ETPs, considering factors such as liquidity and market conditions.

- Risk Management: Protect your investments by employing risk management strategies, such as setting stop-loss orders.

Conclusion: The Future of Crypto ETFs and ETPs

The crypto market is in a state of continuous change, and the regulatory landscape for crypto Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) is expected to adjust accordingly. As the market expands and garners increased recognition, it’s reasonable to assume that we will witness a diverse array of new crypto ETFs and ETPs emerge, providing investors with additional avenues to invest in this intriguing asset class.

To effectively distinguish between Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs), it’s essential to assess their unique features based on your investment objectives and risk appetite. Keep in mind that while the crypto market presents enticing opportunities, it also comes with inherent risks. Conduct comprehensive research before making any investment decisions.

FAQ

1. Is an ETF a private equity fund?

Companies held in private equity Exchange-Traded Funds (ETFs) might be financially intricate due to their reliance on leverage and deal-driven nature. Nonetheless, these ETFs grant investors access to the private equity market, providing potentially lucrative and appealing returns on investment.

2. Has ETH ETF been approved?

As a crypto investor, I’m thrilled to share that on May 23, 2024, the US Securities and Exchange Commission made a significant decision in approving applications from Nasdaq, CBOE, and NYSE to list Ethereum Exchange-Traded Funds (ETFs). These ETFs are linked to the price of ether. If all goes according to plan, these products could hit the markets towards the end of this year, opening up new opportunities for investors like us to gain exposure to ethereum through a more traditional investment vehicle.

3. What is the Bitcoin ETF approval date?

As a seasoned crypto investor looking back over the past decade, I can recall that the initial application for a bitcoin spot Exchange-Traded Fund (ETF) was filed with the US Securities and Exchange Commission (SEC) way before. However, it wasn’t until January 10, 2024, that this long-awaited approval finally came through.

4. Which are the best crypto ETFs?

As a researcher exploring the world of cryptocurrency Exchange-Traded Funds (ETFs), I’ve come across several noteworthy options: iShares Bitcoin Trust (IBIT), Bitwise Bitcoin ETF (BITB), Grayscale Bitcoin Trust ETF (GBTC), VanEck Ethereum Strategy ETF (EFUT), Global X Blockchain ETF (BKCH), Amplify Transformational Data Sharing ETF (BLOK), and ProShares Ultra Bitcoin ETF (BITU). These funds provide various ways for investors to gain exposure to the crypto market.

5. Can I buy an ETF for $1?

In simple terms, you have the freedom to buy and sell stocks or ETFs as frequently as you’d like without any limitations. You can even start investing with just a dollar through fractional shares, without any required minimum investment. Additionally, you have the ability to execute trades continuously throughout the day instead of waiting for the net asset value (NAV) calculation at the end of the trading day.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

2024-06-11 17:51