In the bleak mid-December, Ethena finds itself at a crossroads, a place where history whispers of rallies yet to come or traps to befallen the unwary. The price, like a tired soldier, huddles near a once-glorious zone that signaled a mighty surge in 2024. Macro sentiment, that relentless critic, keeps the short-term action subdued, as if mocking the dreams of investors. But hold on-amidst the chaos, technical whispers and on-chain signals flicker like a flickering candle in the darkness, drawing cautious eyes to Ethena’s uncertain fate. Ah, the eternal ballet of hope and despair-what a saga! 😅

Ethena’s Price: A Historic Echo or Just Echoes in the Hollow?

Back in September 2024, ENA/USD hovered near a modest $0.20, a humble beginning before it burst forth in a glorious rally, soaring to about $1.20-a 525% ascent, a triumph for the brave and foolish alike. Now, that same demand zone re-emerges like an old friend with bad memories, beckoning once more. Picture it: a chart that resembles the past, teasing perhaps a replication of triumph or merely the ghost of prior glory, as markets respond to the siren call of liquidity and historical demand-those old friends of traders. Watch closely, for within these shadows lies potential-perhaps good news, or just another tease from the gods of volatility. 🔮

It’s as if Ethena’s chart is a haunted house-familiar corridors echoing with past rallies, yet whether history repeats or merely haunts remains uncertain. Wise traders know: past performance doesn’t guarantee the future, but it sure makes the lottery more interesting. Like a gambler at the table, we watch for signs of stabilization, hoping for the next roll of the dice-an upward surge or another false alarm. The market, that fickle mistress, responds to these levels where liquidity once danced; it rewards the patient or punishes the reckless. So, brace yourself; the next move might be a gentle step or a sudden leap-who knows? 🤷♂️

Short-Term Stalemate: The Quiet Before the Storm?

In the theater of prices, a calm looms-sideways, sedate, almost sarcastic. A brief consolidation, some believe, might give the players a breather-buyers and sellers alike weary of the endless jousting. A lull that allows exhaustion to settle in, setting the stage for a potential comeback-aiming back at that nostalgic $1.20. But remember: even the best scripted plays depend on supportive conditions outside the script. Absent macro stability, these technical setups are like a ship Without a compass-destined to drift aimlessly. So, we tiptoe on the edge of the abyss, hopeful but wary. The forecast remains conditional-like a weather report in a thunderstorm. ⛈️

“Dostlar, $ENA çoktan %50 yaptı, tekrar yatayda buralarda yatıp market mecburen götürür. Bu oyunlar, elinizdekileri satıp market maker’ın malını alıp kendisini zengin etmek. 😂”

– Kripto Warrior (@kriptowarrior) December 17, 2025

The scenario, like a soap opera, hinges on broader market stability. Without the supporting cast of big assets, even the most promising setups risk becoming just another failed subplot. The short-term outlook? Conditional-like a reality show with too many plot twists. Stay tuned, for the show is far from over. 📺

On-Chain Optimism: Staking and Trust-Or Just Digital Cheers?

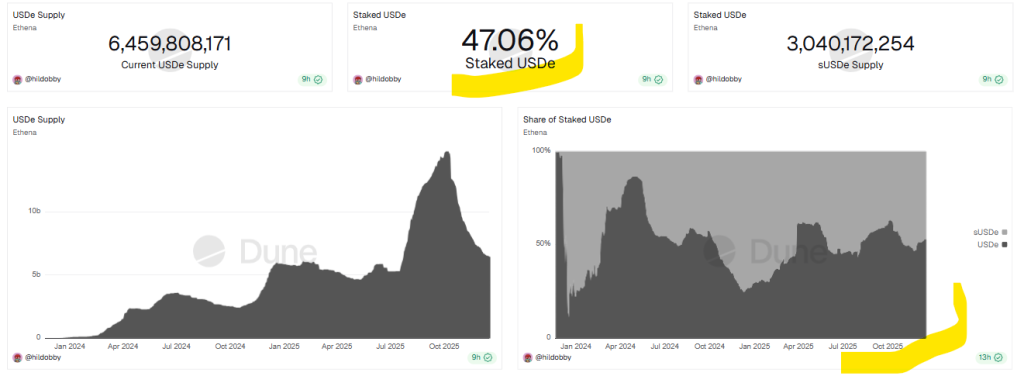

Beyond price swings, on-chain metrics tell a different story-one of cautious optimism. The rising tide of staked USDe (sUSDe) indicates that savvy users are locking in their assets, chasing yields like a dog after a bone. The system’s credibility grows-faith in Ethena’s design is quietly solidifying. Not a guarantee of a rebound overnight, but a reassuring sign amid the storm. Like a lighthouse in fog, these signals offer a glimmer of hope, even if the ship still rocks on high waves. 🌊

In essence, Ethena’s fundamentals show resilience rather than weakness-if only the macro gods would stop fiddling with the global gears. But beware: even the strongest foundation can be shaken by the tremors of macro chaos. Trust in the on-chain signals is wise, but do not forget-macro risks are like uninvited guests who refuse to leave. 🎭

The Macro Beast: A Storm on the Horizon?

And now, the elephant in the room-macro conditions, that ancient beast looming large. The Bank of Japan, that curious institution, holds the key to global liquidity-the Yen carry trade, that trickster’s tool, might soon be under threat with a rate hike on December 19. Historically, these hikes have triggered Bitcoin’s nosedives of 20-30%. A similar scenario could turn Ethena into a forlorn ship in a storm-no matter how shiny its deck. The price forecast? Delicate-hovering between hope and despair, depending on macro whims. The micro may dance, but the macro roars. If liquidity dries up, support collapses, fundamentals be damned. So, hold your breath-this rollercoaster isn’t over yet. 🎢

For now, Ethena balances on the razor’s edge-between promising signs and macro risks. Stability and consolidation may open the door to upward adventures. But a sudden plunge in global risk sentiment? That could turn dreams into nightmares. Stay alert, dear traders-fortune favors the cautious. ⚠️

Read More

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Ultimate Spider-Man: Incursion #2 Is the Most Basic Crossover Chapter Imaginable

- 10 Best Modern Slasher Movies Ranked

- Keeper Teaser Confirms The Monkey and Longlegs Director Is Going to Freak Us Out Again

2025-12-17 17:27