-

Ethereum could reach $3,600 and $4,000 if market sentiment remains unchanged.

Despite the massive ETH deposits to Binance, Ether remains bullish.

As a seasoned researcher with extensive experience in analyzing cryptocurrency market trends, I have closely followed Ethereum’s [ETH] recent price movements and whale transactions. The latest news of a significant ETH deposit to Binance by a whale has sparked curiosity and concern among investors and traders alike.

In the midst of the optimistic mood among investors, a large Ethereum (ETH) deal carried out by a significant investor has sparked considerable interest within the cryptocurrency circle.

30th July Update: As a crypto investor closely monitoring the market, I came across a recent announcement from Lookonchain on their platform. They’ve reported the movement of a significant 25,800 ETH, valued at approximately $87 million, by a whale to Binance. Keeping an eye on such large transactions can provide insights into potential market trends.

Whale moves 25,800 ETH to Binance

Based on information provided in the article on X, it’s been reported that a whale made a purchase of 26,721 Ether (ETH) from Binance at an average cost of approximately $3,457 per token between May 31st and July 25th of this year.

Recently, a large Ethereum investor, referred to as a “whale,” added approximately 26,660 Ether to their holdings. The average cost for these transactions was around $3,376 between the 17th and 29th of July.

1. This action has sparked worry among financial investors and market players. However, the rationale behind such a large transfer still seems obscure.

In case substantial funds are transferred to exchanges, it’s likely that the price could drop or otherwise influence the market.

Based on the data including Total-Value Locked (TVL) and Open Interest (OI), it appears that this significant Ethereum deposit may not have a substantial influence on the Ethereum price.

Based on data from Defillama and CoinGlass, the total value locked (TVL) in Ethereum contracts has increased by 3%, while open interest (OI) has grown by 6.2% within the past 24 hours.

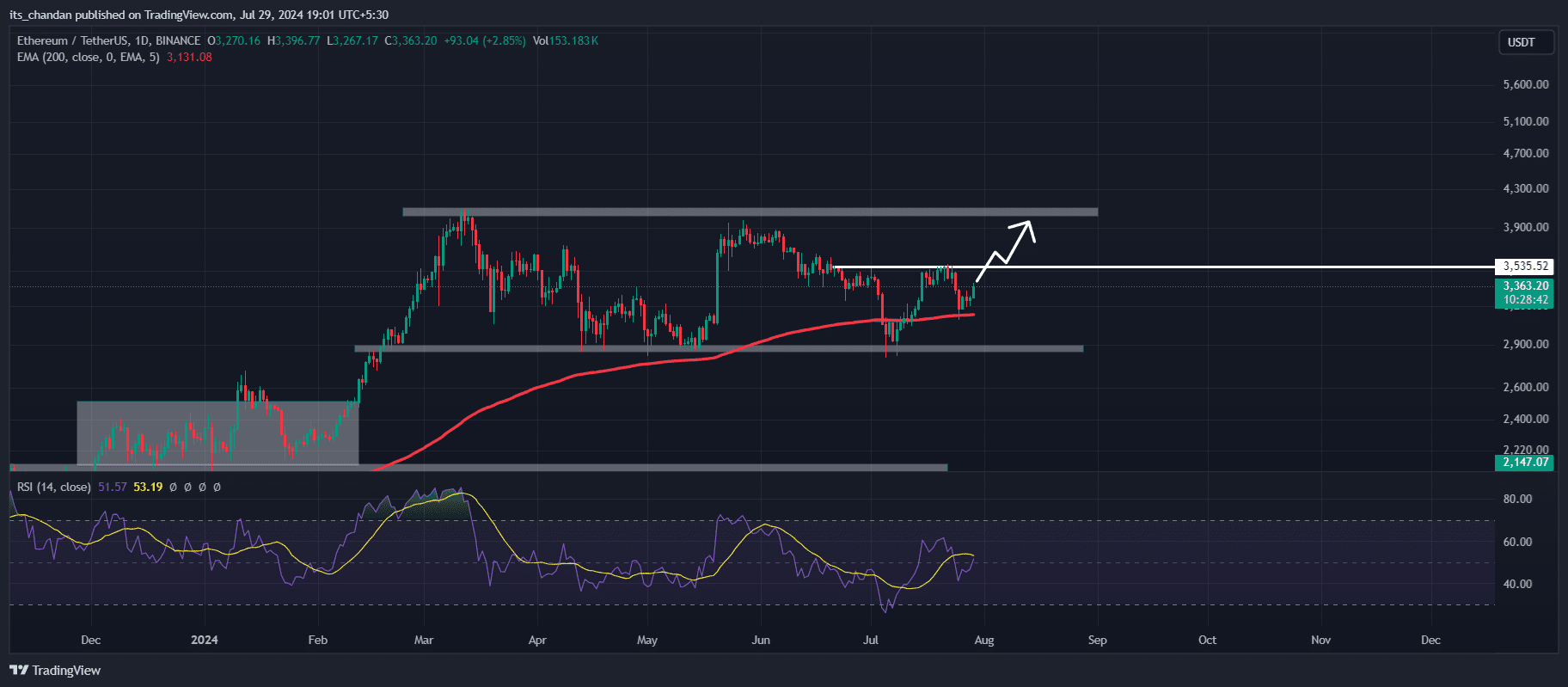

Ether technical analysis and key levels

As a crypto investor, I’ve noticed an encouraging trend with Ethereum (ETH). Based on my technical analysis, ETH seems to be gaining momentum as it surpasses the 200 Exponential Moving Average (EMA) on both the 4-hour and daily charts. This bullish movement suggests potential for further growth in the near future.

Furthermore, the Relative Strength Index (RSI) signals a bullish trend for Ethereum since its RSI value stays within the oversold zone.

Based on my examination of Ethereum’s (ETH) price trend through the lens of technical analysis and chart patterns, it appears likely that ETH may surge to hit the prices of $3,600 and potentially even $4,000 if the prevailing market mood stays consistent.

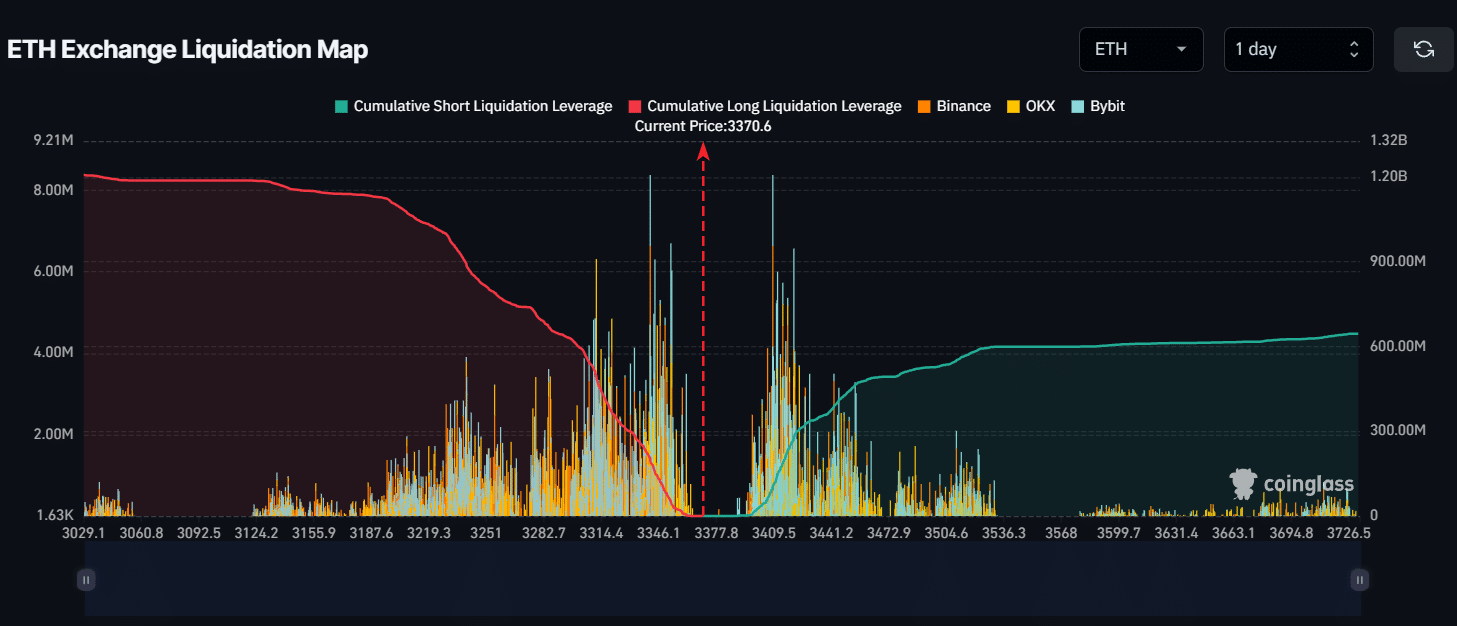

ETH’s major liquidation level

1. Based on CoinGlass data, significant sell-off points are set at $3,340 (lower) and $3,410 (higher). A drop in market sentiment to the $3,340 level would result in a liquidation of approximately $188 million in long positions.

Should the Ethereum (ETH) price surge to the $3,400 mark, it’s estimated that approximately $87 million worth of bearish bets will be wiped out. This information from CoinGlass indicates that at present, bulls hold a more dominant position in the market compared to bears.

Read Ethereum (ETH) Price Prediction 2024-25

At present, Ethereum is hovering around the $3,380 mark in current market transactions, representing a significant increase of approximately 3.5% within the past 24 hours.

During this timeframe, there’s been a 20% drop in trading activity, which might indicate reduced investment or trading involvement from market participants.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-07-30 13:12