-

ETH’s fall has caused holders to rethink their belief in the coin’s potential.

The MVRV ratio showed that altcoin was undervalued.

Based on AMBCrypto’s findings, it appears that investors holding Ethereum [ETH] over a prolonged period share similar concerns regarding its future prospects.

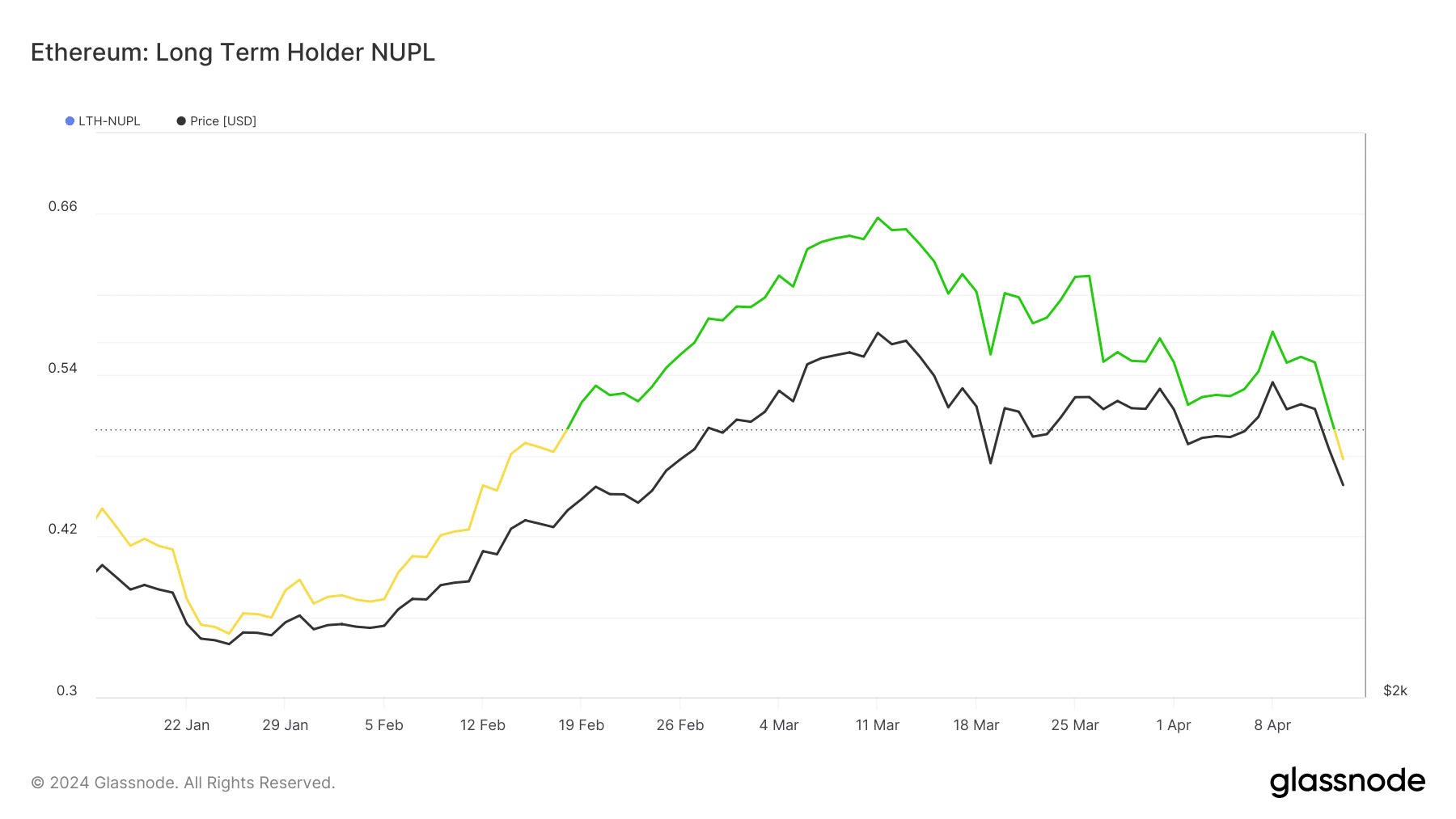

After analyzing the Long-Term Holders Net Unrealized Profit/Loss (LTH-NUPL), we discovered some important information based on the investing patterns of individuals holding Bitcoin for over 155 days.

Holders are not calm

If the metric shows red, it indicates fear among investors that the cryptocurrency could experience a significant decline. On the other hand, when the color is blue, it reflects excitement or intense desire from investors.

As of when this press release was published, the LTH-NUPL had shifted from being in the green to the yellow zone. Green represents the belief that the price may still rise, while yellow signifies growing apprehension and uncertainty among holders of altcoins like Ethereum.

An shift in public opinion might be connected to Ethereum’s price fluctuations. On the 12th of April, for instance, the cryptocurrency took a nosedive and dipped below $3,200. Just as some investors believed that the downturn had come to an end, another price drop occurred.

In this occasion, the unrest in the Middle East caused ETH to reach a peak of $2,850. Yet, according to current information, the price has bounced back and is now above $3,000 once more.

Instead of asking “But will the price be higher than this in the short term?”, you could ask “What is the likelihood that the price will rise above this level in the near future, according to AMBCrypto’s analysis?” or “AMBCrypto considered the possibility of a price increase. What does their examination of the Seller Exhaustion Constant suggest?”

Selling pressure may take ETH to another level

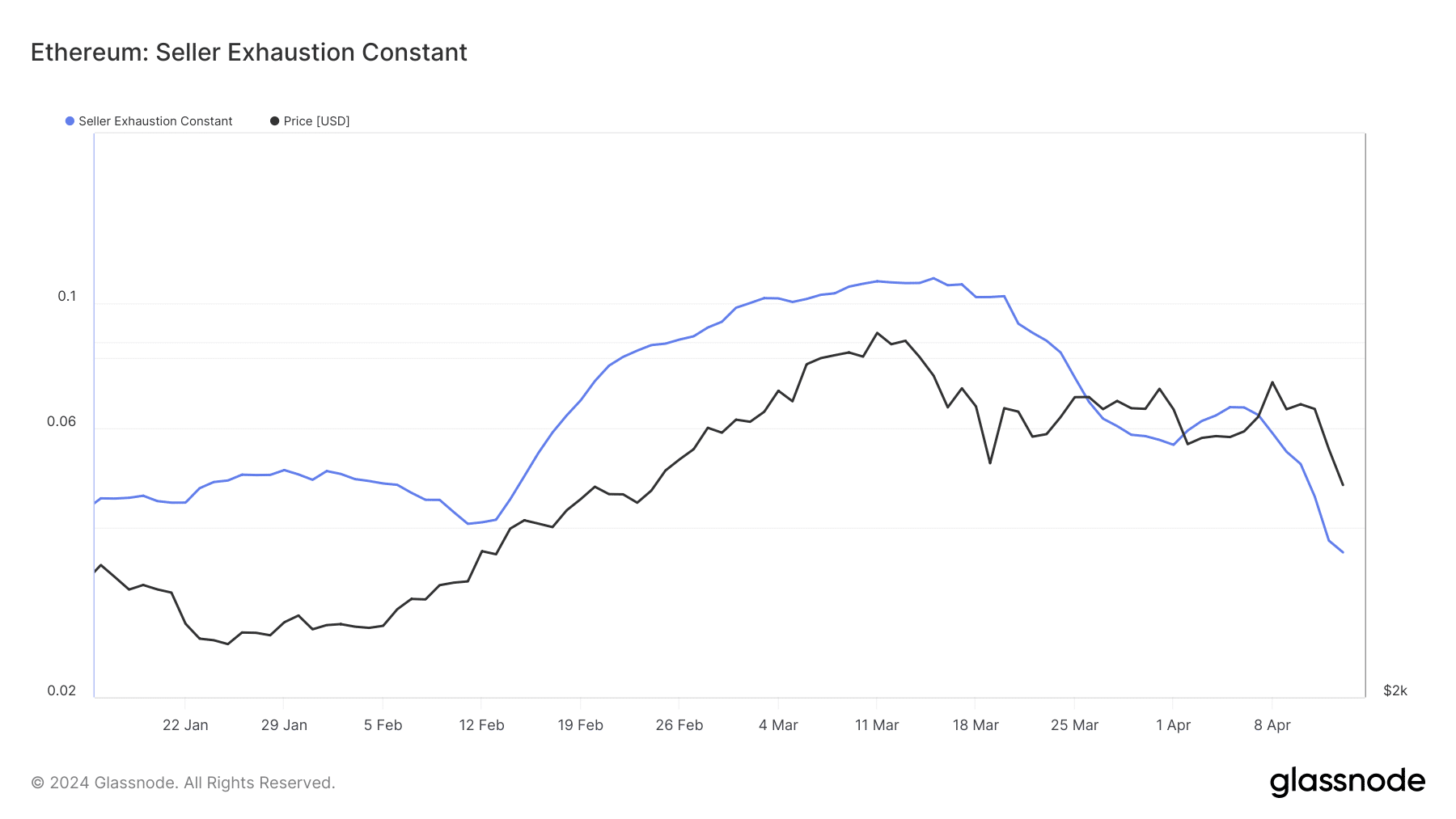

If the Seller Exhaustion Constant is rising, it means that sellers are losing energy and may soon run out of supply to sell. This situation could potentially lead to an increase in the price of Ethereum (ETH).

Yet, according to Glassnode’s data, the metric dipped to 0.036, implying that bears were still present and potentially causing further downward pressure on Ethereum’s price if the trend continues.

In this situation, Ethereum owners may shift from hopefulness to expressing concerns. The value of the cryptocurrency might decrease as a result, potentially leading to a drop down to $2,800 once more.

In other words, if the metric experiences a significant increase, it could lead to improved circumstances for ETH. As a result, Ethereum might attempt to reach prices between $3,200 and $3,500 again in a relatively brief time frame.

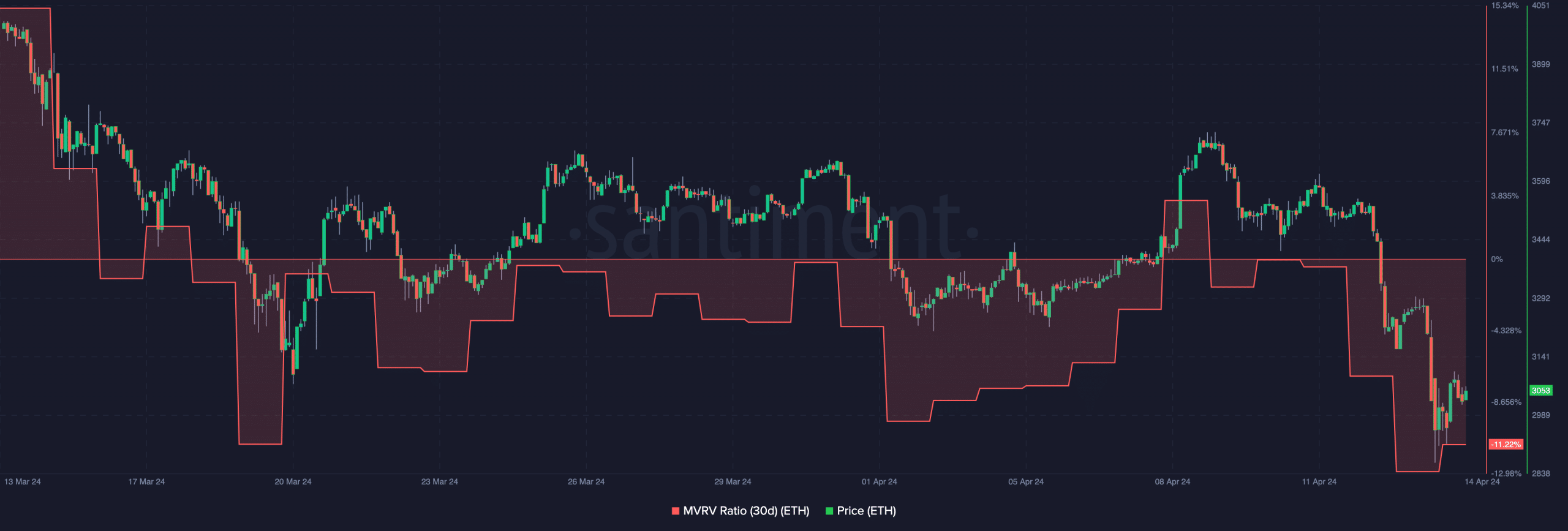

An additional indicator, the Market Value to Realized Value (MVRV) ratio, signaled that ETH might experience a price rebound. Currently, this ratio stood at -11.22% over the past thirty days.

The reading indicated that many ETH investors who bought lately suffered losses. Nevertheless, the MVRV ratio can help determine if an asset is underpriced, fairly priced, or overpriced.

On the 20th of March, when the metric showed a negative value similar to what it is now, Ethereum’s price was only $3,100. This implies that according to this metric, Ethereum may have been underpriced at that time.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Approximately a week afterwards, the cryptocurrency’s value bounced back to reach $3,669. Such occurrences have taken place on other occasions as well.

In other words, the outlook for Ethereum’s long-term growth remains optimistic, and investors may eventually feel confident enough to fully commit to their holdings.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-04-15 11:03