- Ethereum whales added to their balances as the price extended its consolidation phase

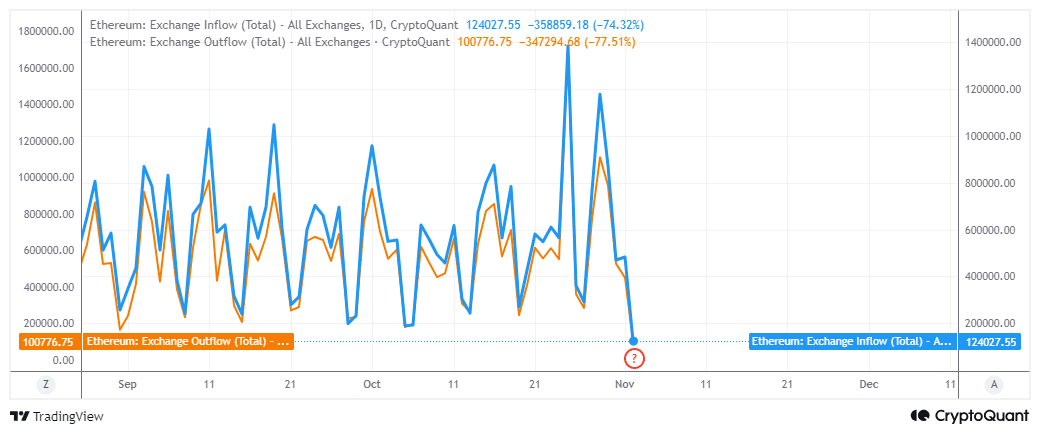

- Directional uncertainty prevailed as ETH inflows outweighed its outflows

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear cycles. The current state of Ethereum [ETH] has caught my attention, especially given the recent trends in whale activity and the fractal pattern that Crow pointed out on Twitter.

It’s possible that Ethereum (ETH) might soon experience a significant price surge based on its current chart trends. Notably, it appears to be accumulating strength, as recent observations indicate that large investors, often referred to as “whales,” have been increasing their holdings.

Additionally, analyst Crow drew attention to a captivating Ethereum fractal pattern on platform X, which points to an amassing area that has persisted since August – analogous to the 2023 pattern.

Indeed, by the end of its consolidation period from mid-August to mid-October in 2023, the fractal showed a positive or bullish result.

After a powerful surge forward (bullish breakout), there’s a possibility that the past may be mirrored again. It’s an interesting thought to ponder.

Ethereum whales are adding to their balances

A consolidation phase will either conclude with a bullish outcome or a bearish trend.

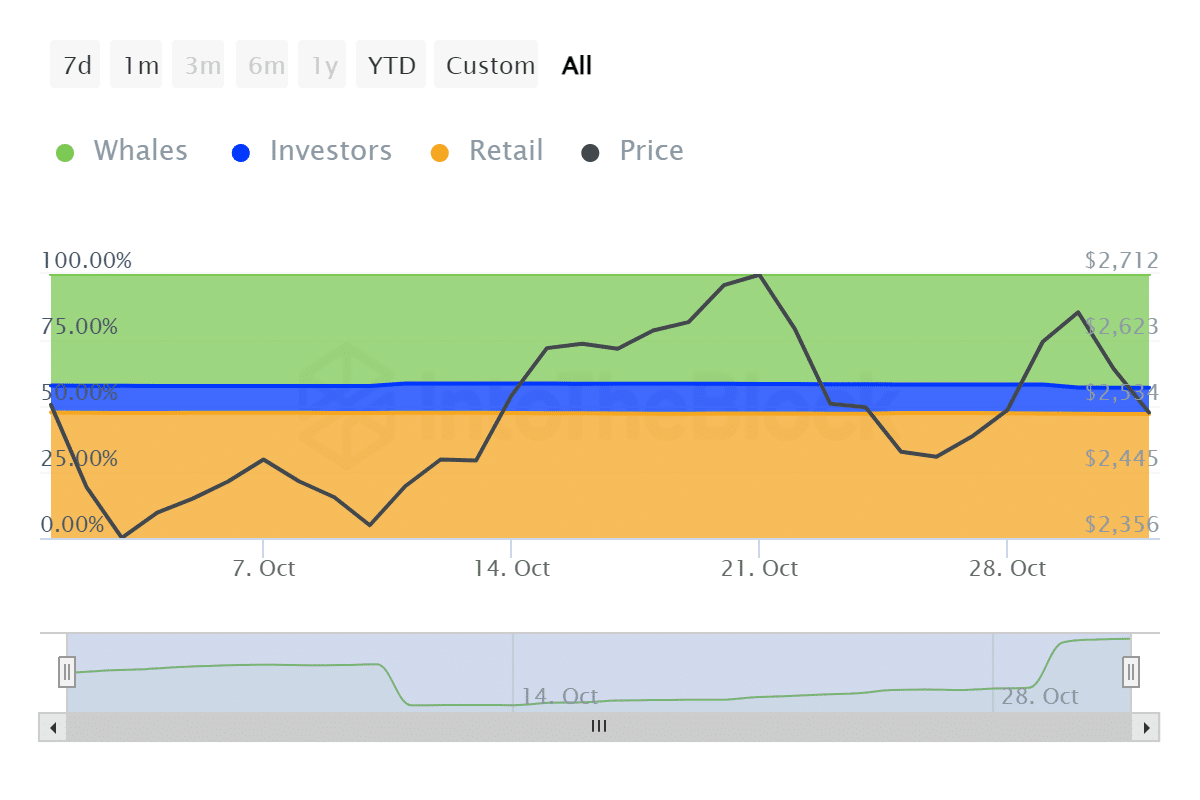

Notice this – The analysis from IntoTheBlock revealed an increase in whale holdings over the past fortnight. By mid-October, whales controlled approximately 56.68 million ETH. However, their holdings rose to 59.2 million ETH on the 1st of November.

As a crypto investor, I noticed during that specific timeframe that both institutional and individual investors experienced some withdrawals. Interestingly, this data suggests that even the ‘whales’ in the market were capitalizing on the reduced prices as well.

Over the past three days, there has been a notable increase in Ethereum being taken off exchanges rather than put onto them. Specifically, on November 2nd, 124,057 ETH were withdrawn from exchanges, while only 100,776 ETH were deposited. This indicates that there has been more selling pressure than buying pressure on Ethereum recently.

In my exploration, I encountered an unexpected challenge with Ethereum (ETH) at its two-month support level on the charts. Yet, this setback hinted towards a potential shift in trend, suggesting a promising bullish reversal as we move into the upcoming week.

Currently, ETH is priced at approximately $2,502. Notably, it’s been having a hard time establishing a clear trend.

Although the retest might hint at some positive sentiments, there were also indications suggesting a potential drop in price. A significant signal was the RSI falling beneath the 50% mark. Additionally, the increasing hoarding by whales could imply insufficient demand to trigger an upward trend.

Furthermore, Ethereum (ETH) is encountering intense rivalry from Solana (SOL) and Suisei (SUI), which has been gradually eroding its leading position.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Additionally, doubt has come back into play within the market, which could lessen optimism and weaken Ethereum’s upward momentum.

To put it simply, the fact that whales are amassing Ethereum suggests that it remains appealing at its current value. Yet, there seems to be a sense of ambiguity or doubt that may be preventing Ethereum from fully realizing its potential.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-03 08:07