-

Ethereum showed signs of accumulation from investors in the past three weeks.

The momentum when disbelief turns into FOMO could usher in even more gains for ETH.

Peter Brandt criticized Ethereum [ETH], labeling it a “less valuable cryptocurrency” with “exorbitant” transaction fees. However, some investors remained optimistic about the token’s future potential.

On April 8th, there was a surprising 6.5% rise in prices when this statement was penned. This advance occurred despite a bearish chart prediction signaling a potential drop to $2800. Is the current rally an unexpected disbelief from most market participants, or just a brief pause before another downturn?

The U.S. traders are in disbelief

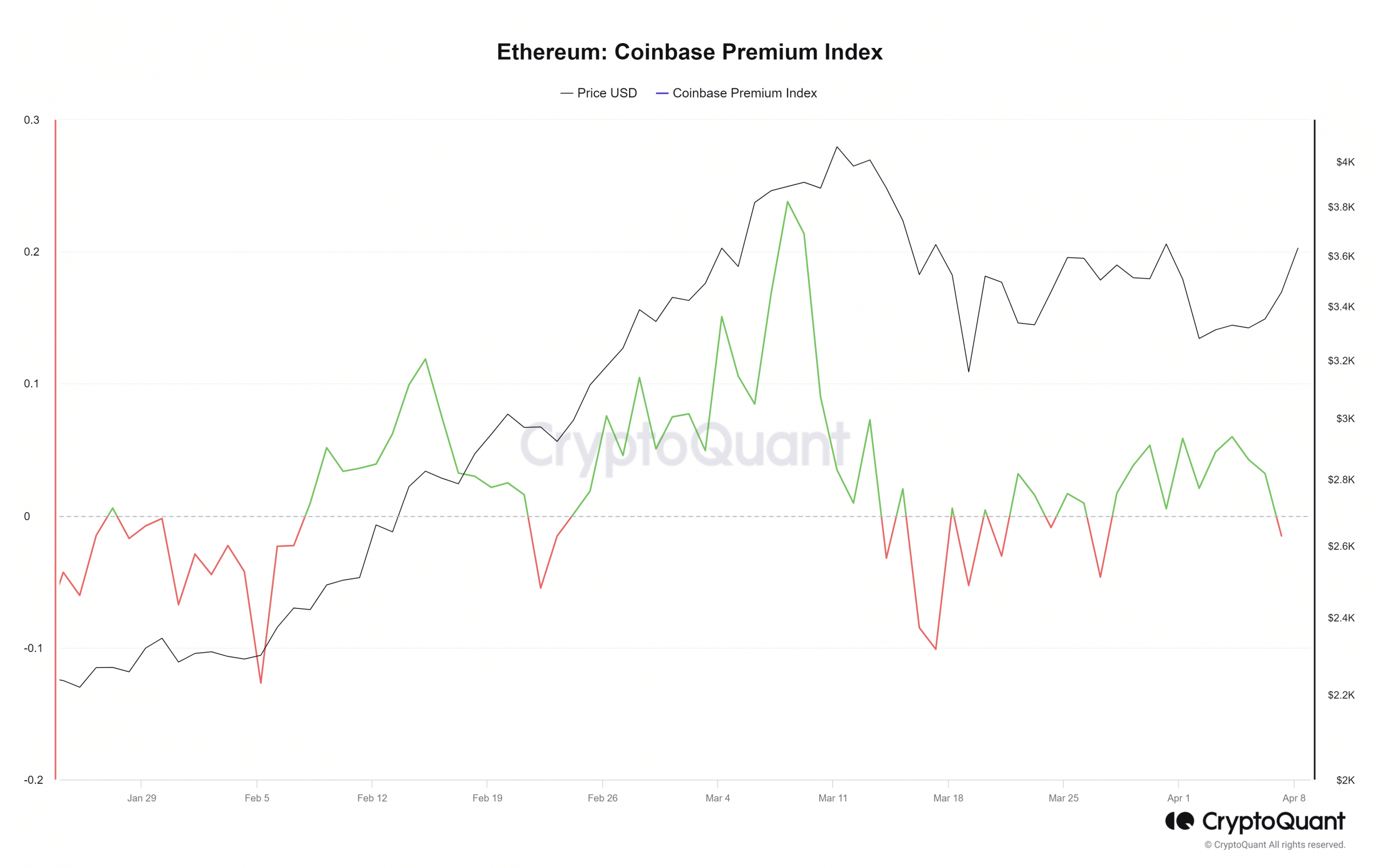

The Coinbase Price Difference Index measures the percentage variances between prices on Binance and Coinbase. Since Binance is not accessible to US residents, using Coinbase as an index reflects the level of interest among US participants.

Between April 2nd and 7th, the Coinbase price difference with the market value of Ethereum (ETH) approached zero. However, during this period, ETH was in the middle of reversing previous losses. Conversely, when there was a significant Ethereum rally toward late February, the Coinbase premium noticeably increased quickly.

ETH to $4k once more?

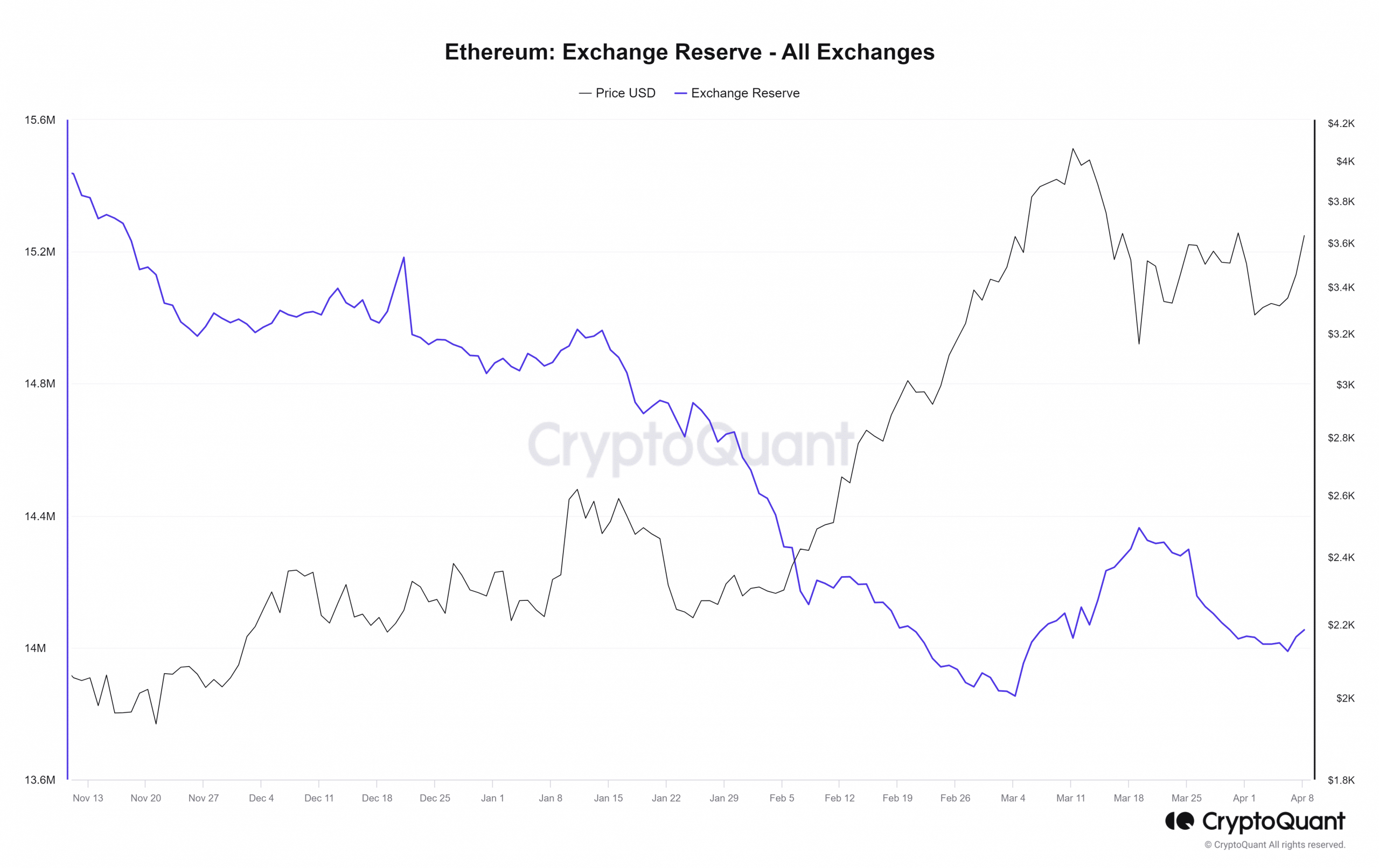

Following the decline to $3056 on March 19th, Ethereum’s exchange reserves started decreasing. This indicated that investors were transferring their tokens away from centralized platforms. The trend suggested that there was accumulation happening and less pressure to sell.

The downtrend continues unabated, with a brief respite on April 7th marking an increase in exchange reserves. This occurrence coincided with the regaining of the $3.4k resistance level, prompting some investors to cash in their gains.

Overall, a continued downtrend in the reserves metric would be excellent news for long-term bulls.

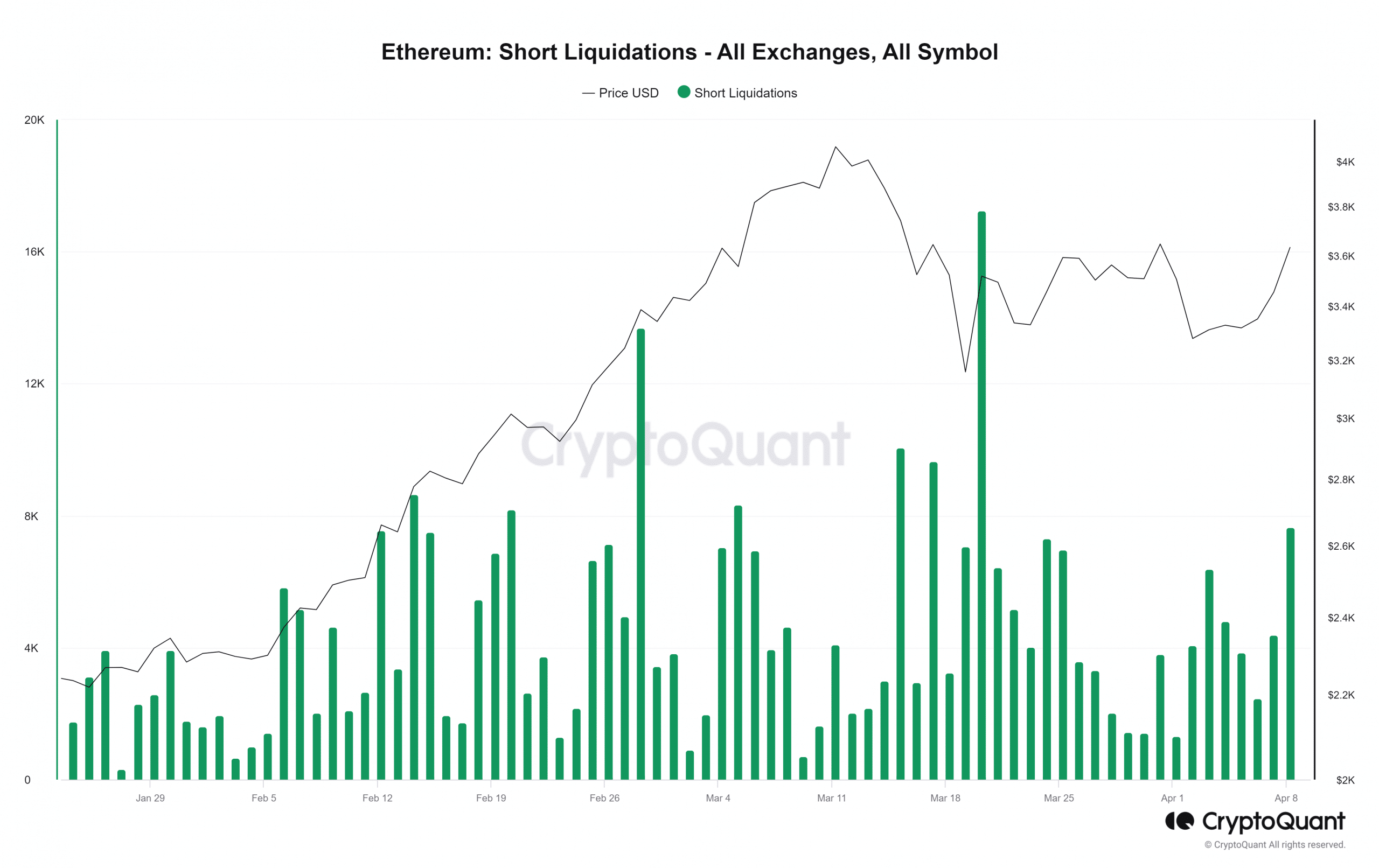

Over the past two days, there were significant Ethereum short positions that were liquidated, according to data from CryptoQuant. The total value of these liquidations came up to around 17,000 ETH when they were executed. After a liquidation is initiated, market buy orders automatically follow, causing the price to increase.

Is your portfolio green? Check the Ethereum Profit Calculator

With the uncertainty brought by the Coinbase Premium Index adding to our doubt, it seemed plausible that Ethereum would overwhelm the bears and keep rising if the trend persisted.

An unyielding surrender from them might lead to even greater advancements. There’s a strong possibility of a short squeeze and Ethereum reaching $4,000 again this week. Disbelief may quickly give way to the fear of missing out (FOMO).

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-04-09 10:15