- ETH was up by nearly 7% in the last seven days.

Whales have increased their accumulation over the past week.

Last week saw a surge in Ethereum‘s [ETH] value, pushing it well above the $3,500 threshold. This uptrend appears promising, with major investors reportedly accumulating larger stashes of ETH, which could potentially lead to further price gains.

Whale activity is rising

Based on information from CoinMarketCap, ETH investors experienced gains of approximately 7% in value over the past week. Currently, Ether is being bought and sold for around $3,520.80, and its total market worth surpasses $422 billion.

Interestingly, while the token’s price increased, whale activity around the token also increased.

A recent tweet from Lookonchain indicated that large investors, or “whales,” have been purchasing Ethereum (ETH). Specifically, one whale transferred 22,251 ETH, equivalent to approximately $80.06 million, off of cryptocurrency exchanges.

A different whale withdrew 3,092 Ethereum tokens, equivalent to around $11.12 million, from Binance. This action signaled confidence in Ethereum and an expectation that its price would continue to increase, potentially pushing Ethereum towards the $4,000 mark.

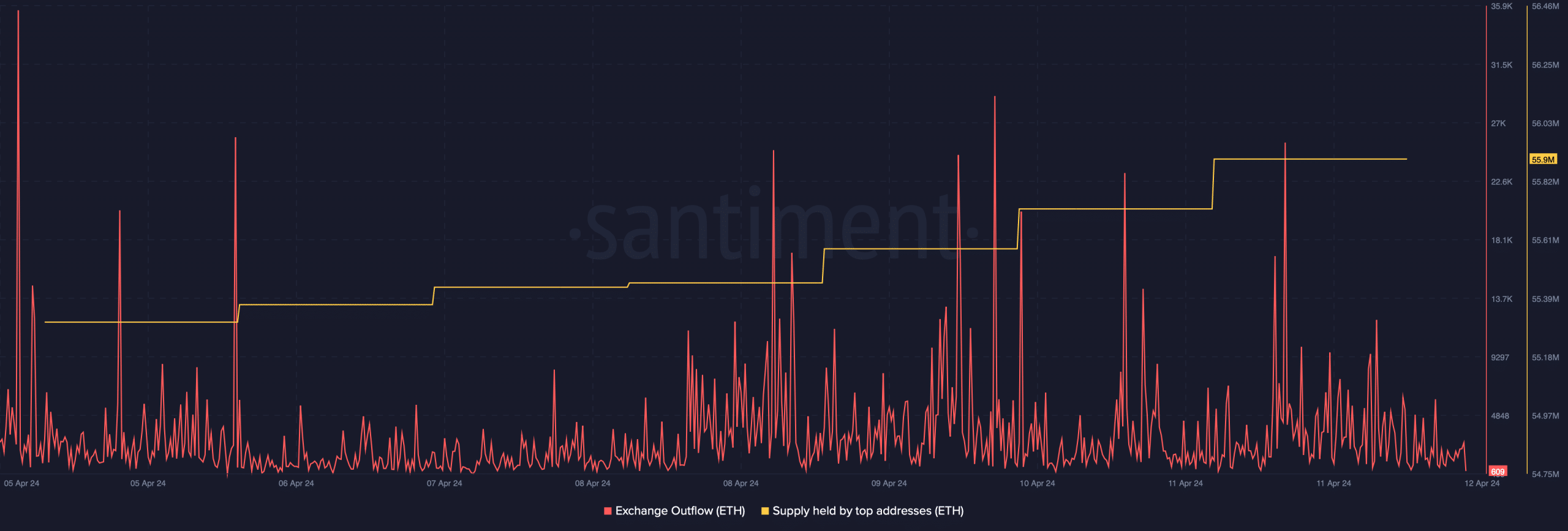

To find out if there was significant demand from whales to buy Ethereum (ETH), AMBCrypto examined the information provided by Santiment. We discovered that the quantity of ETH owned by large holders had gone up over the past week. Moreover, there was a noticeable surge in ETH being taken off exchanges, suggesting an uptick in buying activity.

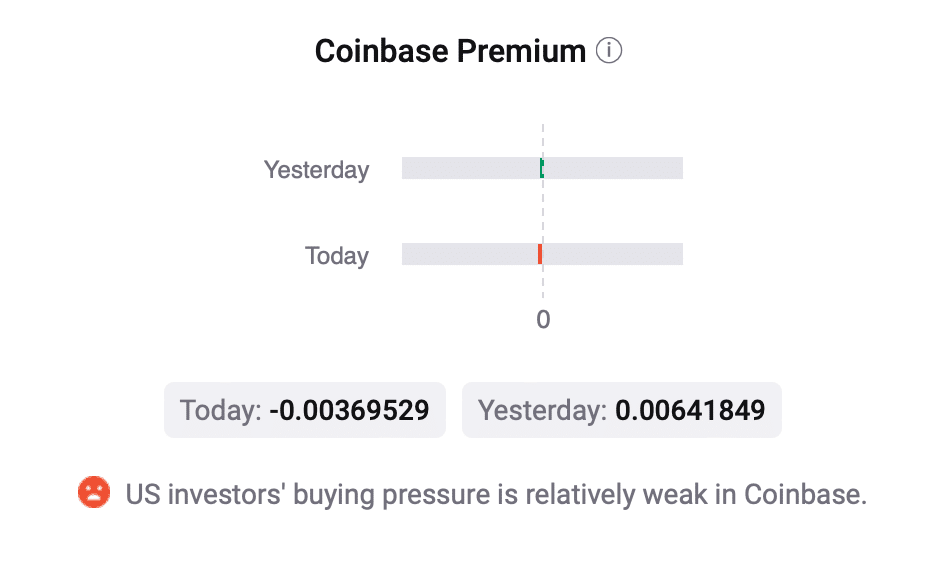

An examination of CryptoQuant’s figures aligned with our own findings. The Ethereum reserves on exchanges were decreasing. Yet, it was noteworthy that the Ethereum Coinbase Premium indicator switched to negative. This suggested a prevalent selling attitude among US investors.

Ethereum’s next target: $4k?

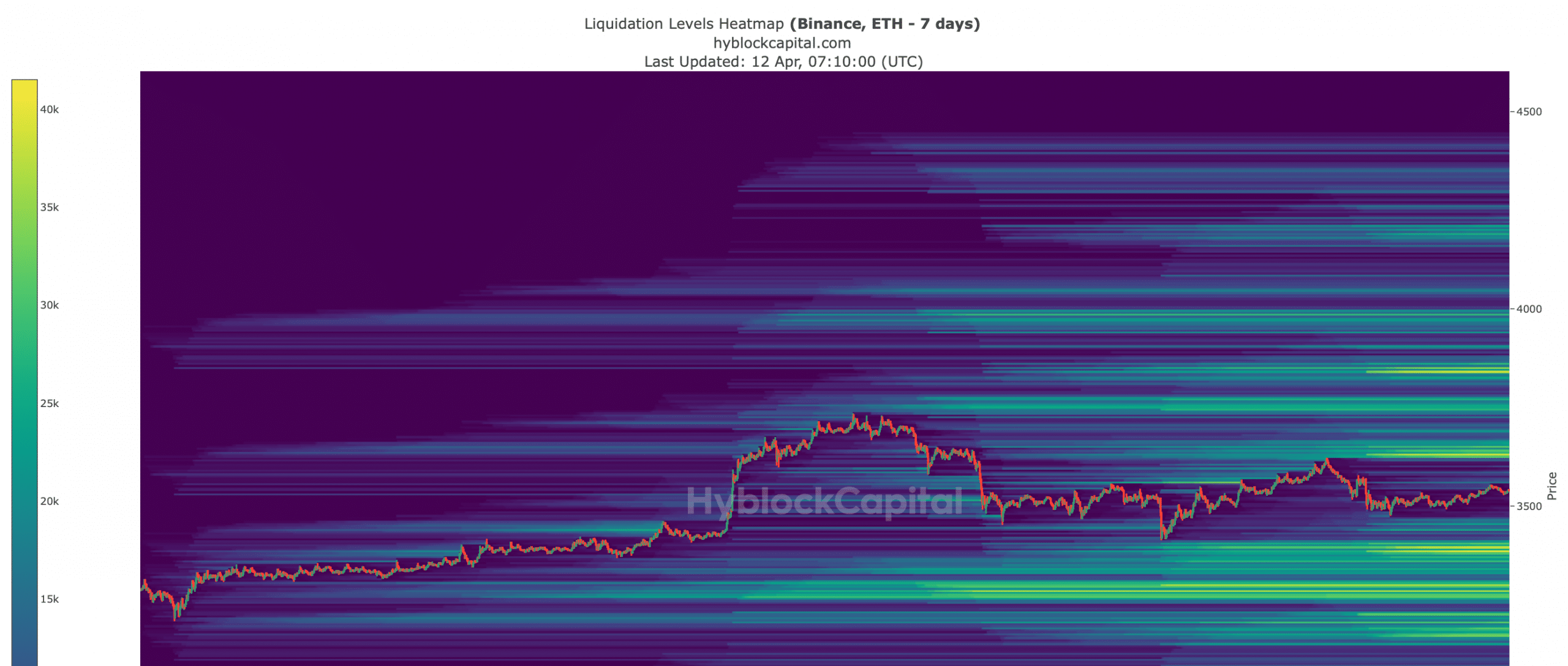

After examining Hyblock Capital’s information, AMBCrypto considered the potential heights Ethereum could attain if significant Ethereum hoarding by whales led to a market upturn.

Before reaching the $4,000 mark, Ethereum needs to surmount some significant resistance points. Should a bull market ensue, it’s crucial for Ethereum to climb above $3,650 and $3,800 before hitting $4,000. This is because the number of Ethereum liquidations will escalate at these levels.

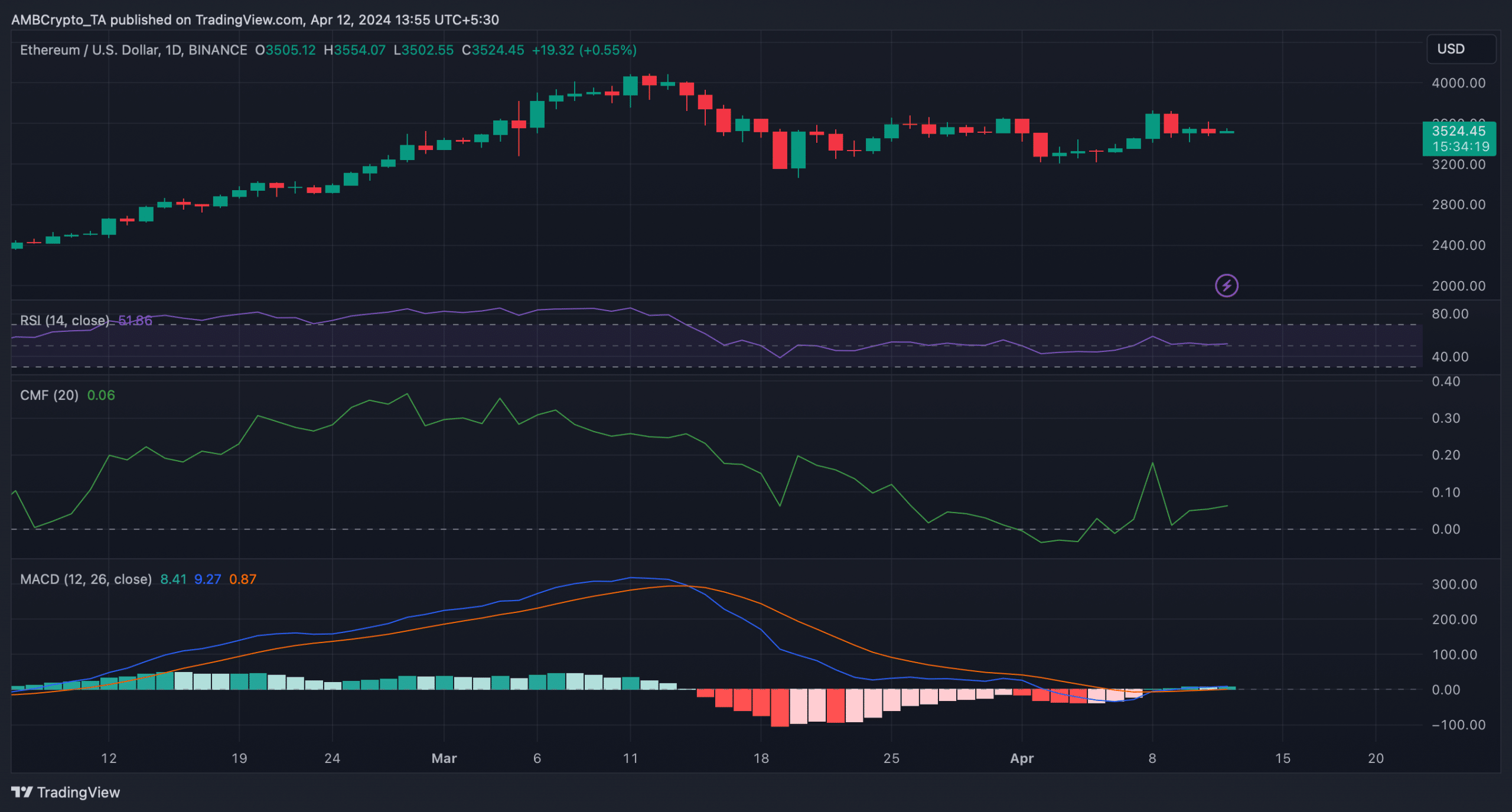

We examined Ethereum’s daily chart to assess the probability of a bull market starting. According to our analysis, Ethereum’s Relative Strength Index (RSI) has remained stable for several consecutive days.

Read Ethereum’s [ETH] Price Prediction 2024-25

The MACD indicated that bulls and bears were closely battling for control, while the Chaikin Money Flow showed a significant surge, suggesting bullish momentum.

Based on the CMF’s information, it appears that Ethereum (ETH) may experience a bullish trend in the near future.

Read More

- SQR PREDICTION. SQR cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- CLOUD PREDICTION. CLOUD cryptocurrency

- TON PREDICTION. TON cryptocurrency

- HI PREDICTION. HI cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- EVA PREDICTION. EVA cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

2024-04-13 03:03