- Bitcoin’s post-halving hours saw a 2.31% dip, but ETF inflows surged and boosted investor confidence

- Potential expansion of crypto-ETFs beyond Bitcoin and Ethereum could drive mainstream adoption

The Bitcoin halving event brought some unexpected developments! Despite all the anticipation surrounding Bitcoin’s (BTC) halving, BTC experienced a setback, decreasing by 2.31% within a day. This occurrence came despite notable changes in the Bitcoin ETF market. After a five-day series of outflows, an unexpected surge of positive net inflows emerged just before the halving day.

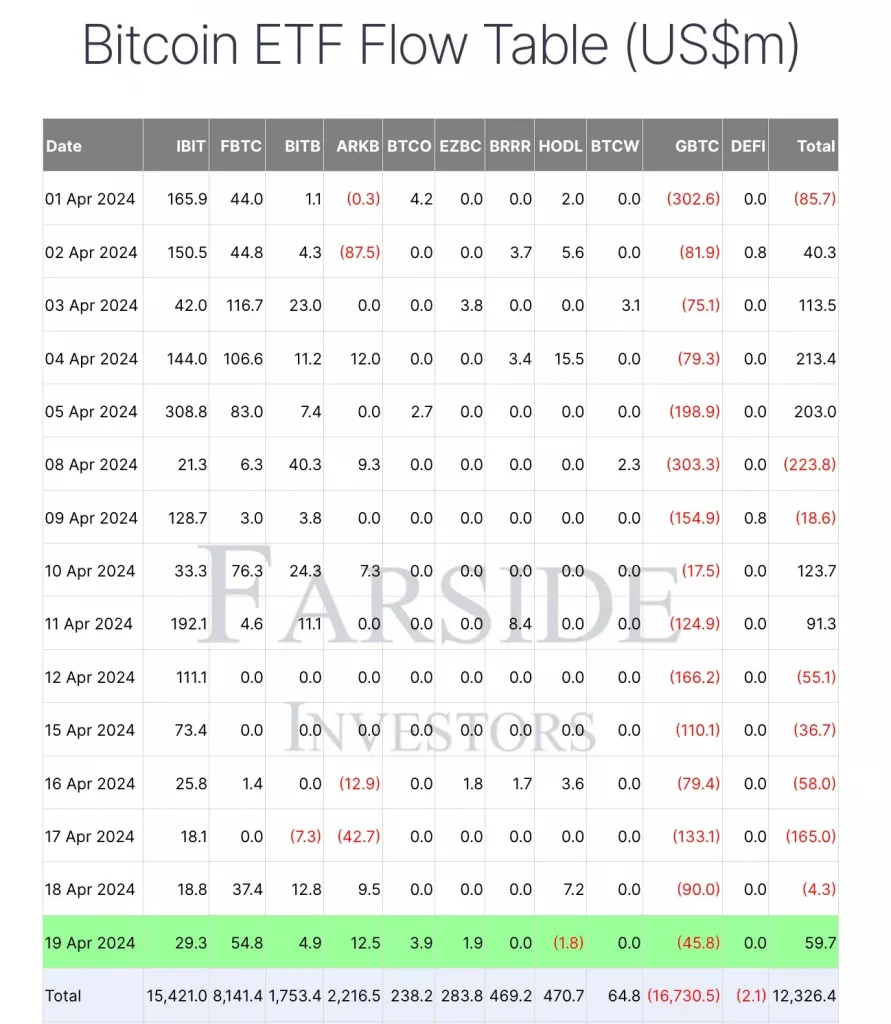

Based on Farside Investors’ figures, approximately half of the 10 ETFs experienced inflows amounting to $59.7 million collectively.

Investor confidence in Bitcoin’s pre-halving and post-halving periods has noticeably increased within the ETF (Exchange Traded Fund) market.

Expansion of ETFs leading to crypto-mainstream adoption

In a recent interview, Sergey Nazarov, the Co-founder of Chainlink, shared his thoughts on the possibility of growth in the crypto Exchange-Traded Fund (ETF) sector beyond Bitcoin and Ethereum [ETH].

“I believe we’ll see more ETFs focusing on coins other than Bitcoin and Ethereum in the near future. Consequently, I expect the trend of creating these ETFs to persist and expand significantly throughout this year.”

The remarks he made brought out the possibility that ETFs could boost the use of digital currencies among a wider audience and further promote the incorporation of Web3 tech in everyday life.

In a different conversation, Anthony Scaramucci, the founder of SkyBridge Capital, likewise shared his thoughts on this topic.

“Bitcoin is on an adoption curve.”

He added,

“This inflation hedge or store of value that some commentators are talking about won’t be apparent to you until a platform reaches over a billion users. Consequently, it will currently be much more unpredictable and risky compared to what those experts suggest.”

All eyes on Spot Ethereum ETFs

Following Hong Kong’s decision to allow Bitcoin and Ethereum ETFs, progress is being made towards wider acceptance. However, the potential success of these new ETFs, in comparison to those based in the US which have amassed around $60 billion in assets since their introduction, remains uncertain.

Echoing similar sentiments, senior Bloomberg ETF analyst Eric Balchunas recently commented,

“The addition of Bitcoin ETFs in other countries is certainly positive, but it pales in comparison to the vast influence and size of the US market.”

All this leads us to a question – Will the SEC reject the spot Ethereum ETF applications?

When asked about the mentioned query, Jupiter Zheng, the Head of Research at Hashkey Capital, answered.

If the ETF application is rejected, the market reaction may not be overly bearish since the ETF’s impact hasn’t been fully factored in yet. Additionally, there are Bitcoin ETFs available that can provide traditional investors with access to this asset class.

What dictates entry into the crypto-market though? Well, according to Nazarov, adoption does.

The executive believes that in order to encourage wider acceptance of cryptocurrencies, the industry needs to prioritize making them easier to use, more capable of handling large volumes of transactions, better connected to various systems, and more private. These enhancements would not only draw in new users, but also propel the industry forward by challenging current limitations.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-04-21 03:04