-

Experts believe that ETH might dip to the lower end of the falling wedge, currently around $2,200

Significant buying pressure can be seen around this zone too

As a seasoned researcher with years of experience navigating the volatile cryptocurrency market, I find myself intrigued by the current state of Ethereum (ETH). Despite the promising introduction of an ETH Spot ETF in the U.S and other favorable developments, it’s evident that we haven’t seen new all-time highs yet.

Although positive advancements such as the launch of an Ethereum Spot ETF in the U.S have occurred, Ethereum, the largest altcoin, has not reached new record highs yet.

Indeed, it’s clear that Ethereum (ETH) has dropped by approximately 6.62% over the last seven days. Given this decrease, it’s not surprising that a cryptocurrency analyst is foreseeing this trend might continue. Particularly since ETH appears to be searching for some equilibrium before potentially experiencing a surge.

Falling wedge – Temporary decline, potential for massive upswing

Based on the daily chart analysis by analyst Carl Runefelt, Ethereum (ETH) is presently moving within a contracting trend known as a “falling wedge.” This pattern, typically observed following a phase of decrease, often precedes a substantial increase in price.

In simpler terms, this ‘decline-to-rally’ pattern often occurs when an asset reaches its minimum point within the wedge, also known as its support level. For Ethereum (ETH), this crucial level seems to be approximately $2,200 on the chart. This is a point that the analyst has highlighted because it shows strong signs of buying activity.

According to the analysts’ prediction, if ETH bounces back at its current support point, it might surge by as much as 80.47%. This could propel the digital currency towards a possible price of $4,000, and additional increases seem plausible as well.

He added,

“Once a breakout occurs, there’s a strong possibility #Ethereum could rise back to $4K.”

To verify the strength of the $2,200 support, AMBCrypto conducted an analysis of its own.

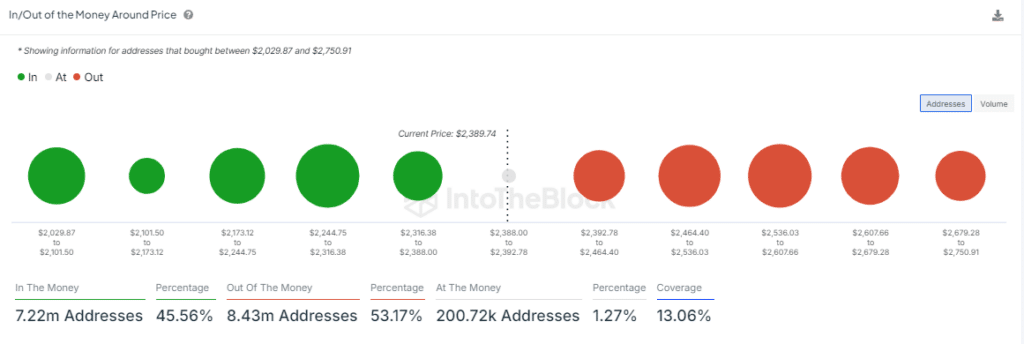

‘In-the-Money’ traders expected to drive the rally

According to AMBCrypto’s analysis using IntoTheBlock’s In and Out of Money Around Price (IOMAP) tool, it was found that the region around $2,200 represents a significant area with strong buying pressure due to the concentration of substantial asset holdings in this price zone.

As per IOMAP data, a key support level is found at approximately $2,218.93. At this point, more than 1.59 million Ethereum is held in profit by various addresses. If the value of Ether falls to this level, it could trigger substantial buying pressure due to these profitable holders.

On the other hand, the IOMAP indicates that ETH may not plummet as far as $2,218.93 before recovering. Instead, there’s a high chance of a recovery around $2,281, where approximately 2.17 million investors collectively own about 1.01 million ETH.

To put it another way, the cumulative liquidation level delta for Hyblock showed a negative value. This means that there were more short positions than long ones, suggesting a predominantly bearish market direction.

Further decline likely for ETH

Taking a step further, AMBCrypto’s analysis suggested that ETH may be approaching a decline.

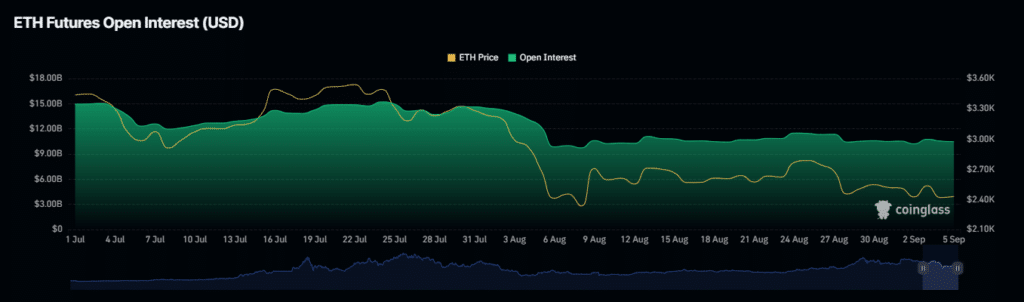

This assertion can be supported by a notable drop in the OI-weighted funding rate — recorded via Coinglass. It fell from 0.0043% on 4 September to 0.0023% at press time.

The OI-weighted funding rate adjusts the funding rate based on the asset’s Open Interest, indicating that retail investors are willing to drive ETH’s price lower.

If this decline continues, a fall to the $2,200 support zone will become increasingly likely.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-09-06 09:11