-

Both longs and shorts experienced a turbulent time after ETH’s price went up and down

Realized Profits increased, indicating that the value may fall below $3,400

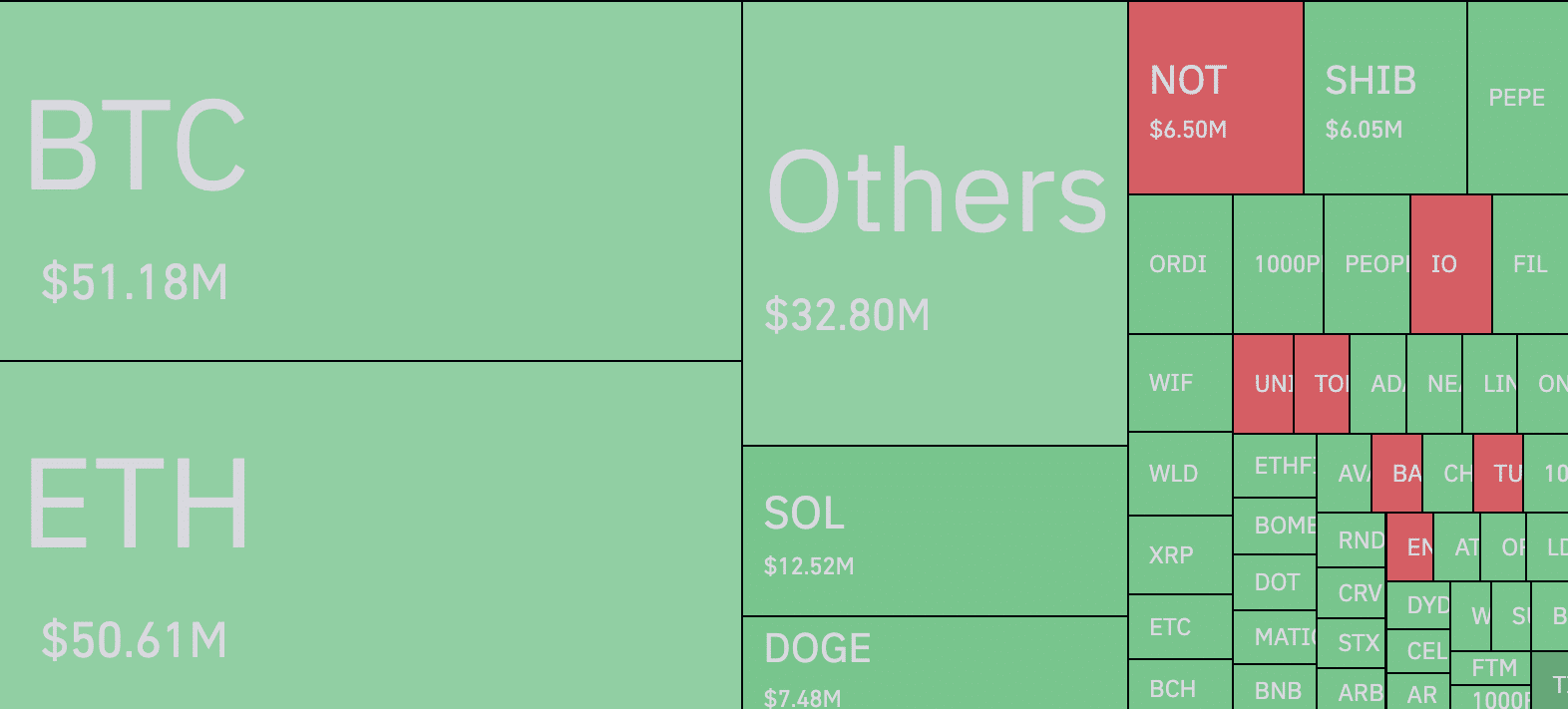

As a researcher with experience in the crypto market, I’ve witnessed firsthand how turbulent it can be for both long and short traders when prices go up and down drastically. The recent volatility in Ethereum [ETH] is a prime example of this. With liquidations totaling $215 million, ETH contracts accounted for approximately $50.61 million. These forced closures occur when a trader doesn’t have enough margin balance to keep their position open, leading to further losses.

The volatile market resulted in market liquidations reaching a total of $215 million. Among these, Ethereum [ETH] contracts represented approximately $50.61 million based on Coinglass’s data.

When a trader’s margin account falls short of the required amount to maintain an open position, a liquidation takes place. This compulsory closing of a trade is essential to prevent additional losses.

Stormy season for the market

The significant liquidations for Ethereum might be attributed to its fluctuating price. At one point on June 14th, the cryptocurrency’s value dipped down to $3,368. However, it subsequently rebounded and reached a peak of $3,512 later in the day. Currently, Ethereum is trading above $3,500.

As a crypto investor, I’ve experienced firsthand how unpredictable the market can be with its extreme price fluctuations. Long positions are for those who believe in the potential growth of an asset and aim to profit from its price increase. Conversely, short positions are taken by investors betting on a price decrease, hoping to make profits when they buy back the asset at a lower price. Regardless of our chosen position, we’ve all felt the impact of these market swings.

Traders appeared to anticipate a decrease in Ethereum’s price based on the data from Deribit, the derivatives exchange. The Put/Call ratio before last Friday’s options expiry stood at 0.37.

With a ratio under 0.50, pessimism had prevailed among expectations. Yet, the degree of volatility experienced appeared to take participants by surprise.

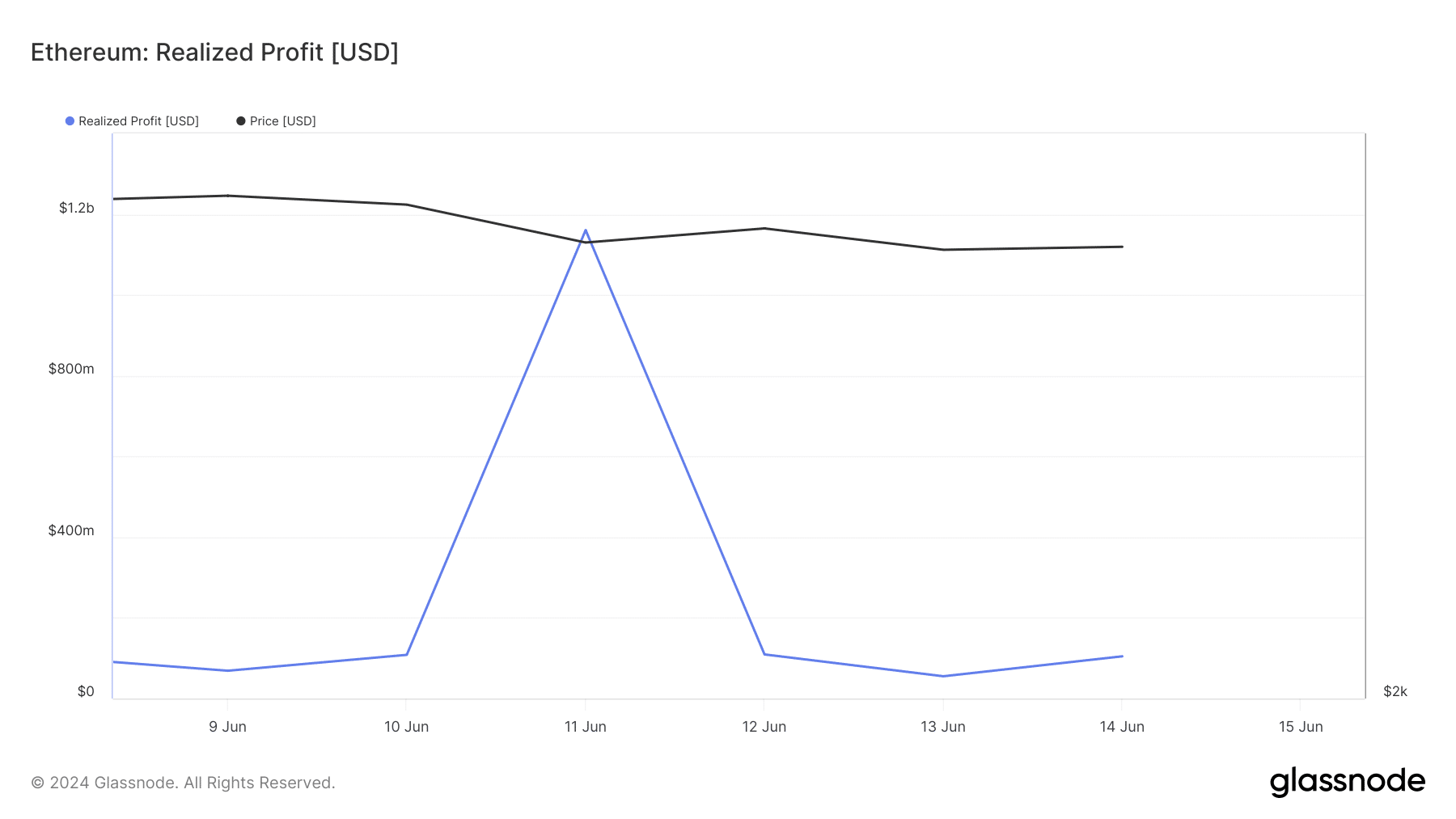

When considering the cost in the context of AMBCrypto’s analysis, they also factored in the Total Realized Profit. This term represents the aggregate value of all coins that have been transferred with a previous price lower than their current market value at the time of transaction.

ETH plans to swing between $3,400 and $3,600

On the 12th of June, ETH‘s Realized Profit stood at $55.18 million. By the 14th of June, this figure had climbed up to $104.58 million. An uptick in this indicator suggests that holders have been realizing their profits. This trend could potentially result in a price decrease on the charts.

As a researcher studying market trends, I’ve observed that when a metric like Realized Profit for Ethereum reaches a stable point, selling pressure tends to decrease in the cryptocurrency market as a whole. Based on this observation, I believe it is plausible that altcoins will trade within the range of $3,400 and $3,600 over the upcoming days.

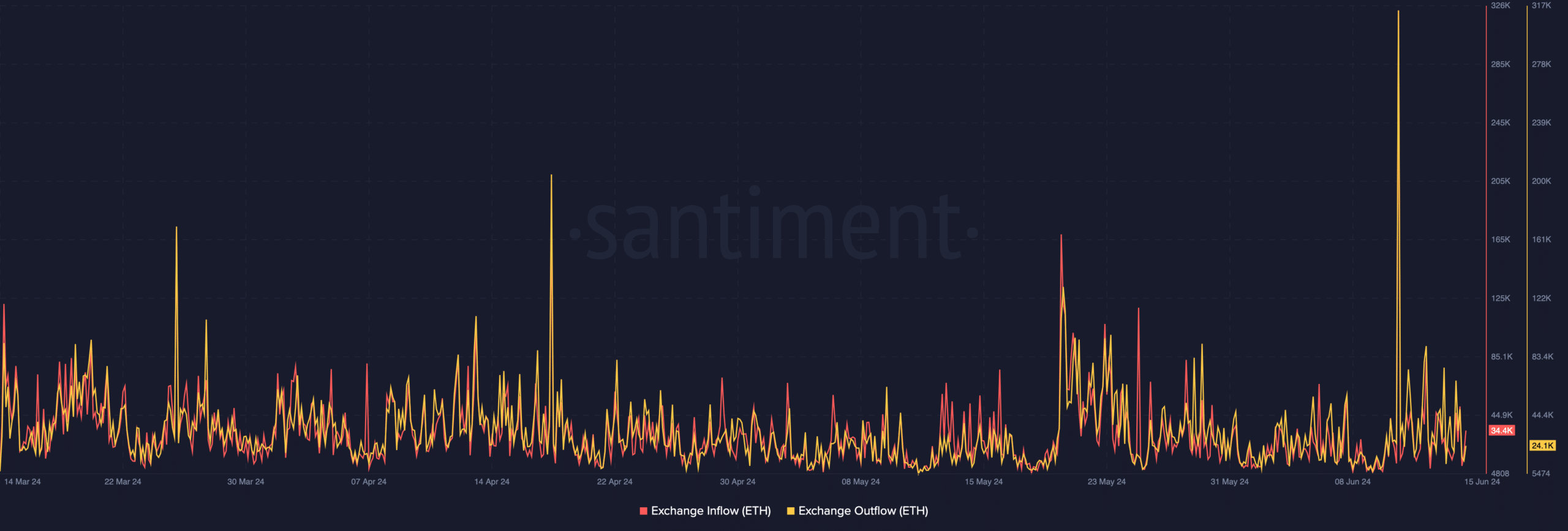

AMBCrypto examined the trends in exchange deposits and withdrawals to predict Ethereum’s potential direction. Incoming transactions to exchanges represent the amount of coins transferred into these platforms.

As an analyst, I would interpret an increase in this metric as a sign that coin holders are intending to dispose of their assets. Typically, such action results in a downward trend for the cryptocurrency’s price. Conversely, exchange outflows represent the number of coins leaving exchanges, which can be indicative of various reasons, including transfers between wallets or withdrawals to cold storage.

As a crypto investor, I’ve noticed an intriguing discrepancy between Ethereum (ETH) inflows and outflows at present. Specifically, ETH exchange inflows amounted to $34,400, while the altcoin had outflows of $24,100. This difference suggests that more Ethereum was being put up for sale on exchanges than was being withdrawn to cold wallets for long-term storage.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Should the current trend persist, there’s a possibility that the value of Ethereum may dip below $3,400, reminiscent of its price on June 14th. Conversely, if selling pressure lessens, Ethereum could continue to stabilize and hold its ground on the charts.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- EPCOT Ceiling Collapses Over Soarin’ Queue After Recent Sewage Leak

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- Daredevil: Born Again’s Shocking Release Schedule Revealed!

- Heartstopper Season 4 Renewal Uncertain, But Creator Remains Optimistic

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Gene Hackman and Wife Betsy Arakawa’s Shocking Causes of Death Revealed

- The White Lotus Season 3: Shocking Twists and a Fourth Season Confirmed!

- BNB PREDICTION. BNB cryptocurrency

- Teyana Taylor & Aaron Pierre: The Romance Confirmed at Oscars!

2024-06-15 23:03