Ah, the sweet serenade of Ethereum‘s price movements-a symphony conducted by whales, ETF inflows, and advocacy-driven funding. The air is thick with whispers of recovery, as if the ghost of bullish pasts has returned to haunt traders’ spreadsheets. Or perhaps it’s just another mirage in the desert of speculative finance.

Ethereum Hovers Near Resistance Like a Nervous Butterfly 🦋

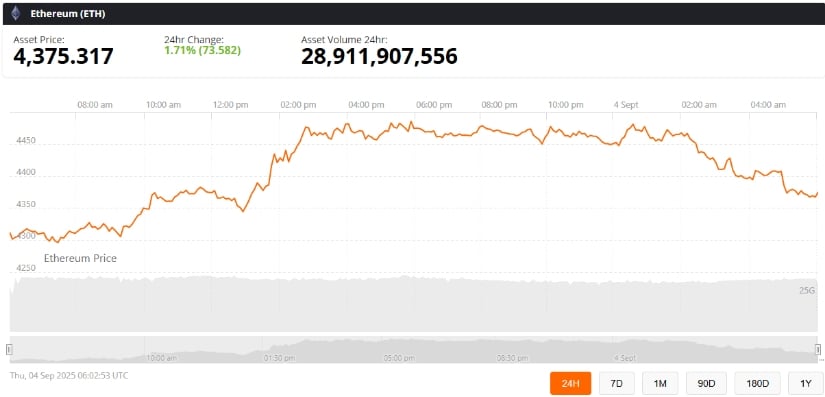

Today, Ethereum flutters near $4,400, consolidating after its recent acrobatics. Analysts, those modern-day soothsayers armed with Fibonacci retracements and trendlines, declare $4,450-$4,500 as the next battlefield. A successful breakout could send ETH soaring toward $6,000-or even $8,000 for the truly optimistic dreamers among us.

Of course, let’s not forget that ETH has dipped 11% from its August high of $4,950. But fear not! Institutional demand, like a benevolent overlord, might swoop in to save the day. Or maybe it won’t. Who knows? Certainly not your average retail investor. 😉

Ethereum Technical Analysis: The Drama at $4,450 🔍

The technical wizards tell us $4,500 is where the magic happens-or doesn’t. This level aligns with the mystical 0.5 Fibonacci retracement at $4,486 and dances tantalizingly close to a long-term descending trendline. Should ETH conquer this barrier, it may embark on an epic journey toward $4,729 and eventually $4,957.

But beware, dear reader! Failure to hold this zone could expose ETH to support levels at $4,381 and $4,237. Volatility reigns supreme, and short-term traders are watching patterns like hawks eyeing unsuspecting rabbits. Or perhaps they’re just refreshing their screens compulsively. Either way, drama ensues.

Ethereum ETF Inflows: Institutions Play Dress-Up 💼

Ah, the allure of ETF inflows-a beacon of institutional interest! Last week, Ethereum ETFs raked in $1.08 billion, with BlackRock’s behemoth leading the charge at $968.2 million. Fidelity’s FETH added $108.4 million, while Grayscale’s Mini Ethereum ETF captured $54.5 million. Quite the little tea party, isn’t it?

Though trading volume dipped slightly, net inflows rose to $13.5 billion-a testament to institutional conviction. Bitcoin who? These players seem smitten with Ethereum, seeking refuge from Bitcoin’s increasingly predictable antics. How poetic.

Whale Moves: From Bitcoin to Ethereum, the Great Rotation 🐳

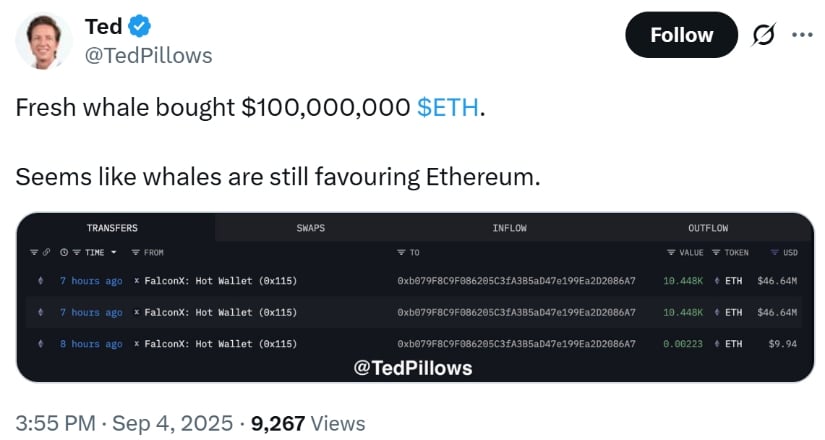

Behold the grand spectacle of whale activity! One particularly ambitious leviathan sold 4,000 BTC for $435 million and promptly purchased nearly 97,000 ETH (worth $433 million) in under 12 hours. Now sitting pretty with over 837,000 ETH ($3.85 billion), this whale seems convinced of Ethereum’s upward trajectory.

Such moves, analysts claim, reflect confidence in Ethereum breaking higher resistance zones. Or maybe the whale simply got bored of Bitcoin. After all, variety is the spice of life-and portfolios.

Etherealize Secures $40M: Advocacy Meets Ambition 🚀

In other news, Etherealize-an advocacy firm championing Ethereum adoption-has secured $40 million in funding led by Electric Capital and Paradigm. Their mission? To make Ethereum more palatable to global finance through institutional-grade tools for tokenization and settlement platforms.

Danny Ryan, co-founder of Etherealize, waxed poetic about Ethereum’s evolution from “experiment” to “open financial network.” Quite the transformation, wouldn’t you agree? Though whether these efforts will succeed remains as uncertain as predicting tomorrow’s weather.

Public Firms Go All-In on Ethereum 💼🔥

Meanwhile, public firms have been busy hoarding Ethereum like squirrels preparing for winter. Strategic ETH Reserve reports over $1.2 billion worth of purchases this week alone. The Ether Machine led the pack with a staggering 150,000 ETH buy valued at $654 million. BitMine Immersion Technologies and others followed suit, adding millions to their coffers.

Nick Forster of Derive mused that institutions now hold nearly 4% of Ethereum’s supply. With potential Fed rate cuts looming, this figure could climb to 6-10% by year-end. Imagine that-corporate giants pulling strings behind the curtain of crypto chaos!

Ethereum Price Prediction: A Tale of Two Targets 🎯

And so we arrive at the pièce de résistance: market forecasts. Nick Forster gives ETH a 44% chance of reaching $6,000 this year, with a 30% probability of hitting that mark as early as October. Meanwhile, @cryptogems555 on X projects a dazzling $8,000 target based on a “pivot line” breakout pattern.

Will Ethereum ascend to these lofty heights? Or will it stumble yet again, leaving hopeful investors clutching empty wallets? Only time will tell-but oh, what a deliciously chaotic ride it promises to be. 😏

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Thanos Comics (September 2025)

- Gold Rate Forecast

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- Resident Evil Requiem cast: Full list of voice actors

- Best Shazam Comics (Updated: September 2025)

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Death Stranding 2: Best Enhancements to Unlock First | APAS Guide

- When is the Royal Variety Performance 2025 on TV? Host, line-up and air date

2025-09-05 00:25