Markets

What to know:

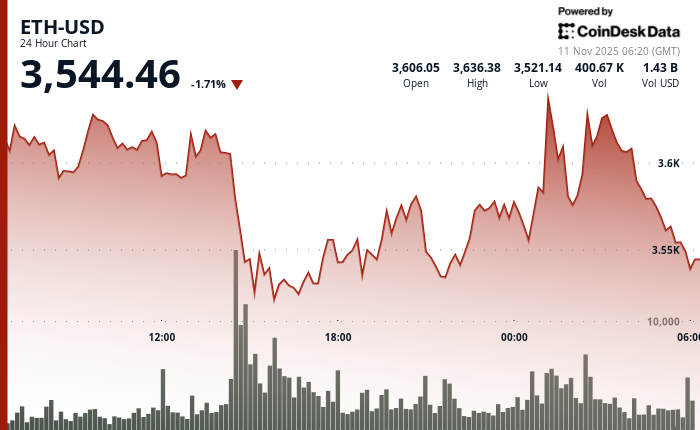

- ETH took a nosedive from $3,629 to $3,576, with trading volume surging 138% above average. A most dramatic exit, if you’ll pardon the pun. 🎭

- The critical support at $3,590, which had been the market’s steadfast ally, failed to hold-how disappointing! 🙃

- Price wobbled near $3,565 after testing $3,532 lows, suggesting further weakness. A tale as old as time. ⏳

According to CoinDesk Research’s technical analysis data model, Ether took a 1.5% tumble, with bears outmaneuvering the bulls near critical resistance. A most unflattering performance. 😏

ETH plunged from $3,629 to $3,576 within a $136 trading range as selling volume spiked 138% above normal levels. The breakdown confirms bears now control the near-term direction after weeks of consolidation. A masterclass in chaos. 🧠

The selloff accelerated after ETH rejected the $3,646 resistance level during early morning trading. Exceptional volume of 338,852 contracts drove the decisive break below $3,590 support. This key level had previously provided reliable demand during recent volatility. ETH touched an intraday low of $3,532 before stabilizing near current levels. A rollercoaster, if you’ll forgive the metaphor. 🎢

Price action now shows lower highs despite multiple recovery attempts. The bearish structure emerged following the failed breakout attempt above $3,646. Volume normalized in final hours, suggesting the new $3,565-$3,589 trading range reflects genuine institutional selling rather than temporary liquidity gaps. A game of cat and mouse, with the cat clearly in charge. 🐈

Technical Breakdown vs Institutional Accumulation: What Traders Should Watch

Technical factors dominated Tuesday’s session as momentum indicators flashed warning signals across multiple timeframes. The $3,646 rejection triggered cascading stops that overwhelmed recent institutional buying interest. Republic Technologies’ $100 million ETH allocation and BitMine’s 3.5 million token holdings provided insufficient support against the technical breakdown. A case of “out of the frying pan, into the fire.” 🔥

The $3,590 support failure marks a critical shift in market structure for ETH bulls. This level had served as a reliable demand zone during recent price swings. With momentum deteriorating and volume patterns confirming distribution, traders now eye further downside testing before any sustainable recovery emerges. A bleak outlook, if you ask me. 😢

Key Technical Levels Signal Caution for ETH

Support/Resistance: Primary support sits at $3,510-$3,530 cluster, with broken $3,590 level now acting as resistance. A fortress turned foe. 🏰

Volume Analysis: Breakdown volume of 338,852 exceeded 24-hour average by 138%, confirming institutional selling participation. A veritable flood of selling. 🌧️

Chart Patterns: Lower high formation at $3,646 followed by support breakdown establishes bearish continuation setup. A predictable drama. 🎭

Targets & Risk/Reward: Immediate downside target sits at $3,510 support, with further weakness toward $3,480-$3,500 zone likely. A descent into the abyss. 🕳️

CoinDesk Index 5 (CD5) Market Analysis – 10 November 03:00 UTC to 11 November 02:00 UTC

CD5 edged higher from $1,840 to $1,843 during volatile 24-hour trading that featured extreme price swings and distribution patterns across major crypto assets, with the index touching $1,869 highs before sellers emerged near resistance levels and drove prices back toward session averages. A brief flirtation with glory. 🌟

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Ashes of Creation Rogue Guide for Beginners

- What KPop Demon Hunters’ Charms Mean, Explained By Creators

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- Demon Slayer: Infinity Castle Announces Its Strangest Theatrical Event Yet

2025-11-11 10:04