ETH is trying to climb out of the bear pit, but the market is still stuck under a mountain of macro resistance… which is basically a fancy way of saying “no one believes in this recovery.” 😂

The price is trying to break through a trendline that’s been capping every rally since October. It’s like trying to open a jar of pickles with a spoon… it’s not working. 🍴

Momentum is improving, but buyers need to break $3,500 to prove they’re not just playing the market. Otherwise, every gain is just a temporary victory… until the bears come back for revenge. 🧠💥

Technical Analysis

By Shayan, the human version of a spreadsheet with a PhD in confusion. 📊🎓

The Daily Chart

ETH is respecting the descending trendline, but still way below the 100-day and 200-day moving averages. It’s like a toddler trying to reach the top shelf… close, but not quite. 🧸

The critical region is $3,400-$3,500, where a Fair Value Gap and bearish order block are lurking. It’s like a haunted house for traders. 👻

If ETH breaks above that, it might head to $4k. But let’s not get ahead of ourselves… the bears are just waiting for their turn. 🐻

Support levels are clean. $2,900 has held, and below that, $2.5k and $2.2k are strong demand zones. It’s like a safety net, but only if the bears don’t jump in. 🪂

As long as ETH stays above $2.9k, buyers have a base. But they need a new high to confirm a trend reversal… or just a new reason to panic. 😬

The 4-Hour Chart

The 4-hour chart shows ETH pushing into the descending trendline again after defending $2.9k. It’s like a game of chicken… but with more numbers. 🚗

This range is support, but buyers haven’t shown strength to take back $3.2k. It’s like a superhero without a cape. 🦸♂️

RSI is mid-range, no exhaustion, but no momentum. It’s like a middle-aged man at a gym… not doing much. 💪

A rejection sends ETH back to $2.9k. A breakout above $3.2k would be the first sign of bullishness… or just a temporary reprieve. 🕵️♂️

Without that, ETH stays stuck under trendline compression. The risk of another liquidity grab is still out there… like a surprise party. 🎉

On-Chain Analysis

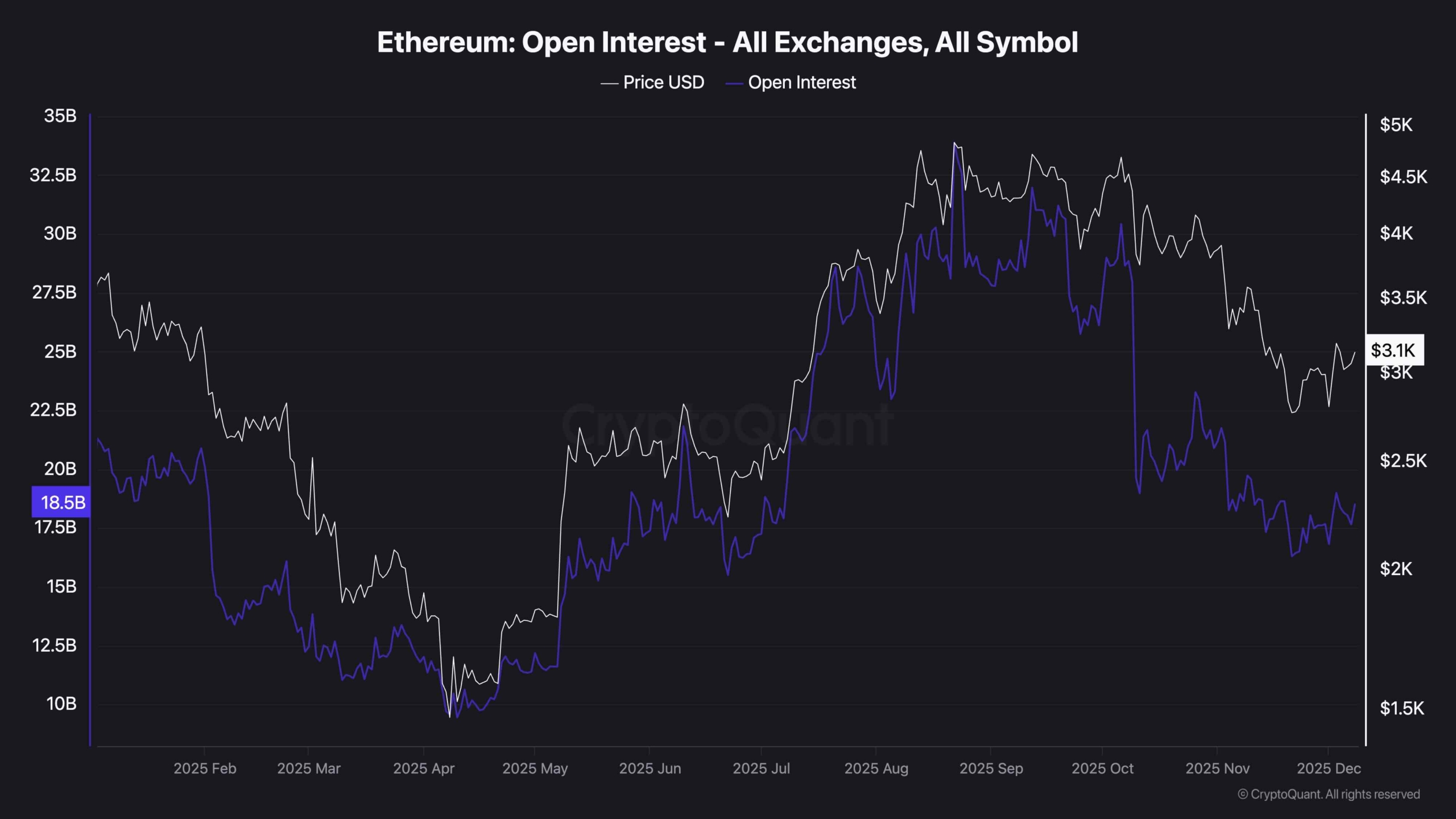

Open Interest

Open Interest is down since September, and price pulled back. It’s like a party where everyone’s leaving early. 🎉

OI hasn’t expanded, signaling no aggressive longs. Traders are cautious, not chasing the move. It’s like a date where no one wants to make the first move. 🤝

Low leverage can lead to healthier rallies. It’s like a diet… slow and steady wins the race. 🥗

Market doesn’t trust the upside. A spike in OI during a breakout would confirm participation… or just a temporary fluke. 🤯

Until then, ETH is in a neutral-to-cautious phase. It’s like a wait-and-see attitude… but with more numbers. 🤔

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Build a Waterfall in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Get the Bloodfeather Set in Enshrouded

- Ratchet & Clank Mobile May Be Okay Actually, First Gameplay Revealed

- How to Build Water Elevators and Fountains in Enshrouded

- Forza Horizon 6’s Tokyo City is One of Playground’s “Most Detailed and Layered Environments” Yet

2025-12-08 17:56