- BNB was rangebound, for now.

A move beneath the range was favored, but a breakdown was not yet confirmed.

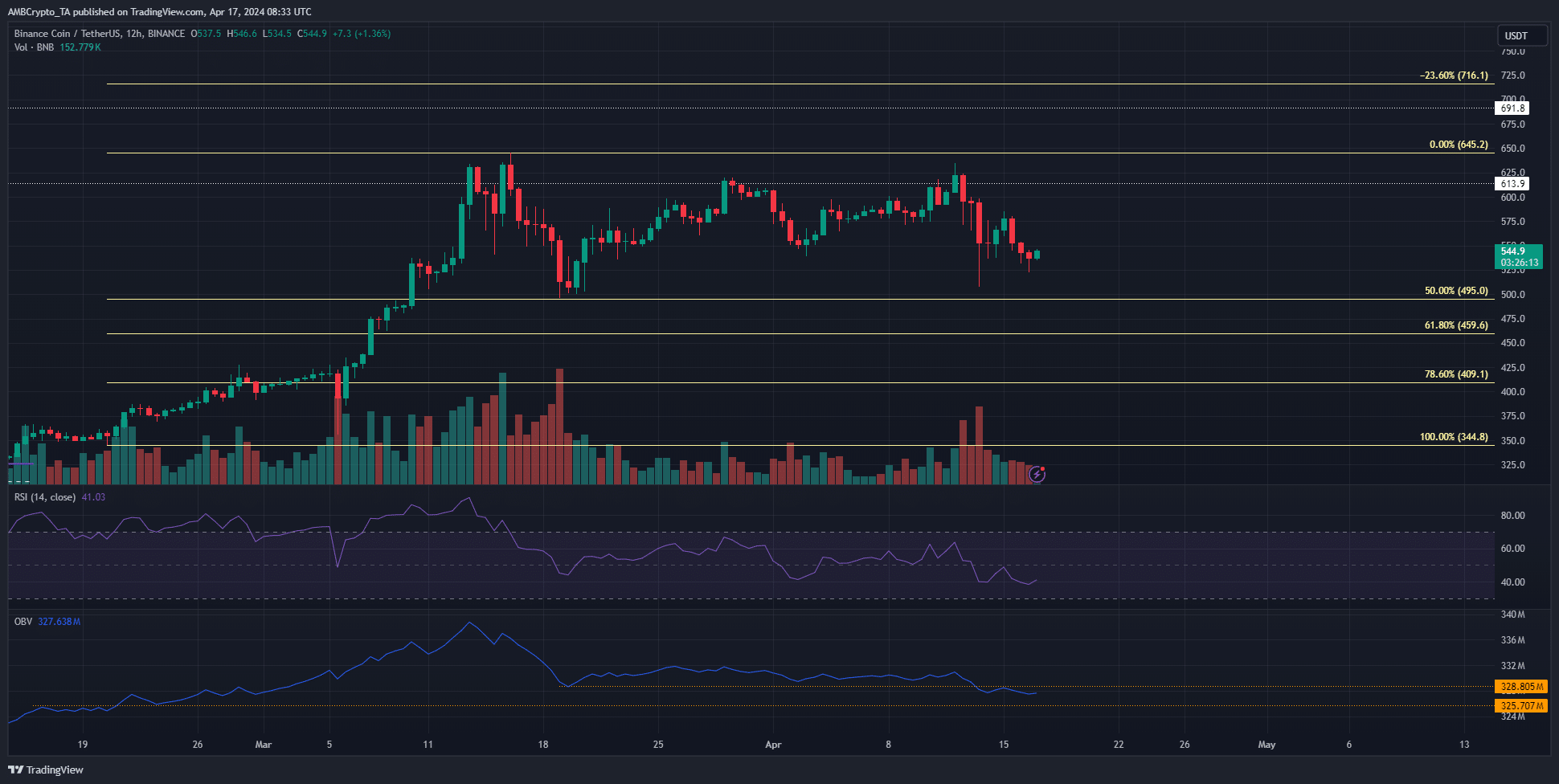

Since March 19th, Binance Coin (BNB) has remained within a set price range. This range spanned from approximately $505 to $630. At the current trend, BNB was poised to test those lower limits again.

In the last seven days, the value of the exchange token hasn’t decreased as significantly as many other large-cap tokens. This was a positive sign for investors, but there were additional factors at play.

The combination of buy walls and range lows

Over the last month, the trading activity has been quite subdued. However, there was a significant increase in trading on the 12th and 13th of April due to heightened selling pressure. This surge resulted in the On-Balance Volume (OBV) dipping below its support level that had held for a month.

This drop provided an extra incentive for the bears, suggesting that sellers could potentially drive prices down below the $505 support level and even under the $495 mark, which represents the 50% Fibonacci retracement level.

The RSI was also below neutral 50 to underline downward momentum.

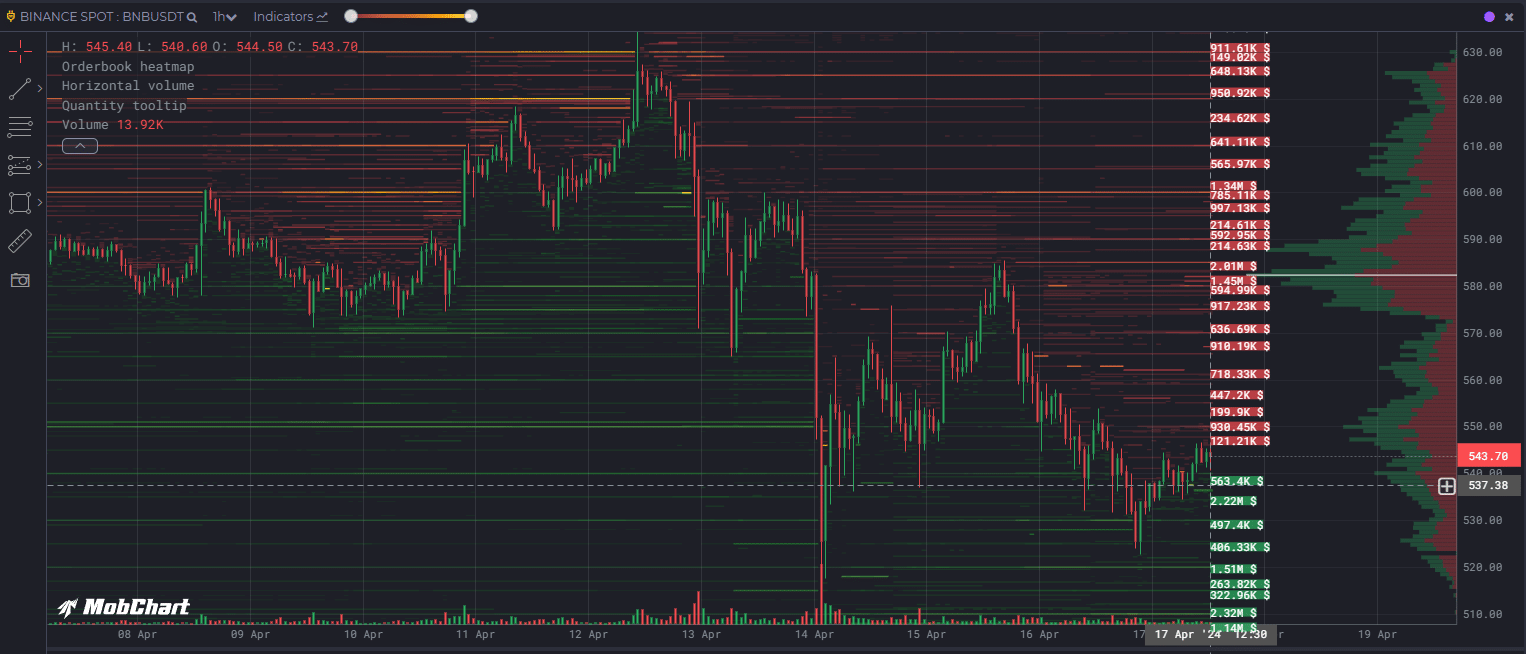

Data from the order book indicated two buy orders with limits set at $510 and $520, valued at $1.51 million and $2.32 million respectively.

In simpler terms, when the price reached the support level at the bottom end of the range and faced downward pressure, it was likely that the buy walls would be challenged soon.

In the northern region, an equal number of buy limits were placed at the $580 and $585 price points, signifying these levels as potential barriers to further price increase.

The presence of short-term demand could undermine BNB bears

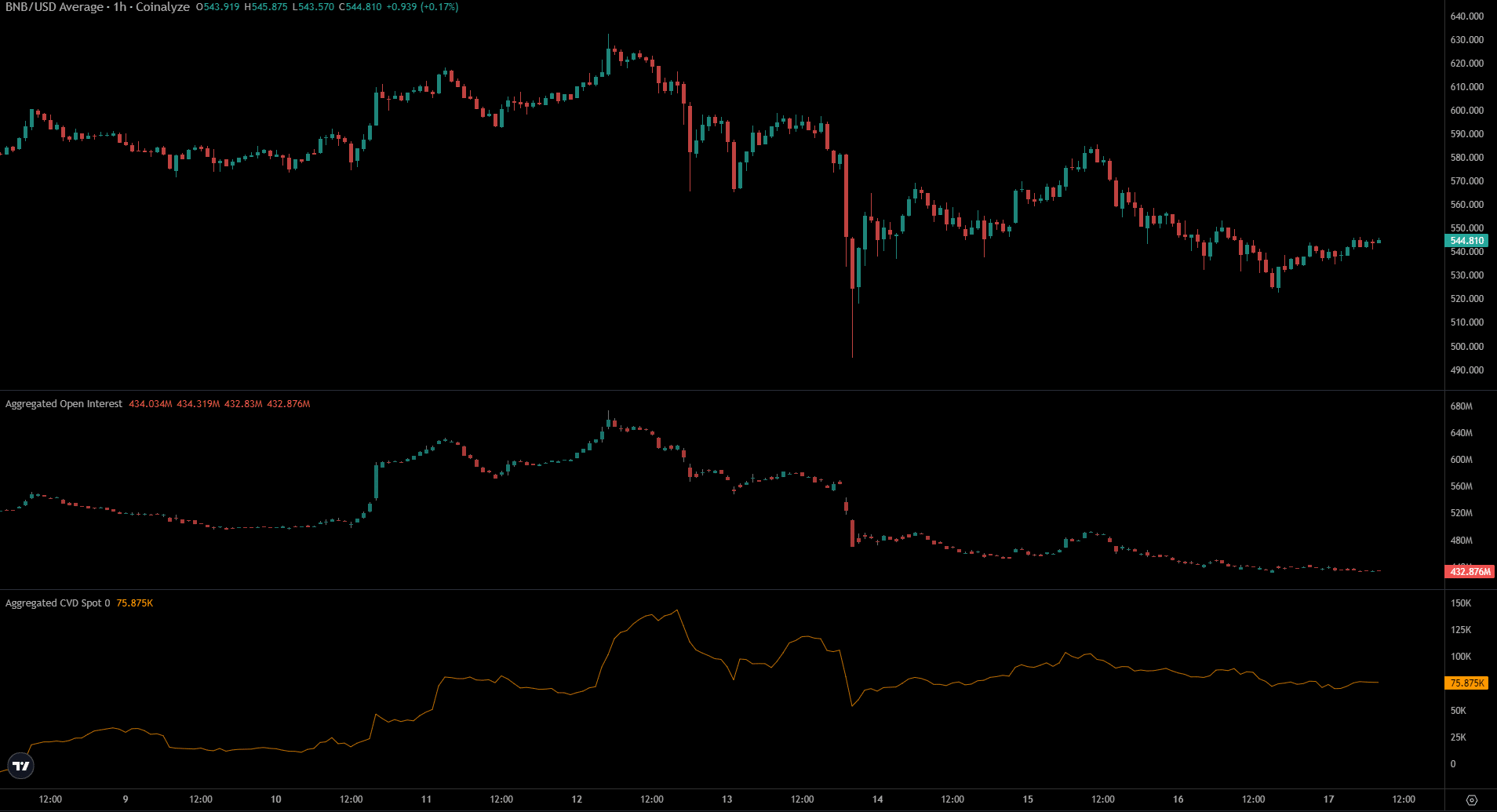

At AMBCrypto, we noticed that the Open Interest chart had remained quiet since the significant price drops on April 13th. This indicated that traders were hesitant to buy and hold BNB, preferring instead to bide their time and wait for market volatility to lessen before making a move.

In other words, the price of spot CVD rose significantly on April 14th, but has since been declining gently. A surge in demand might prevent prices from falling below the $505 support level.

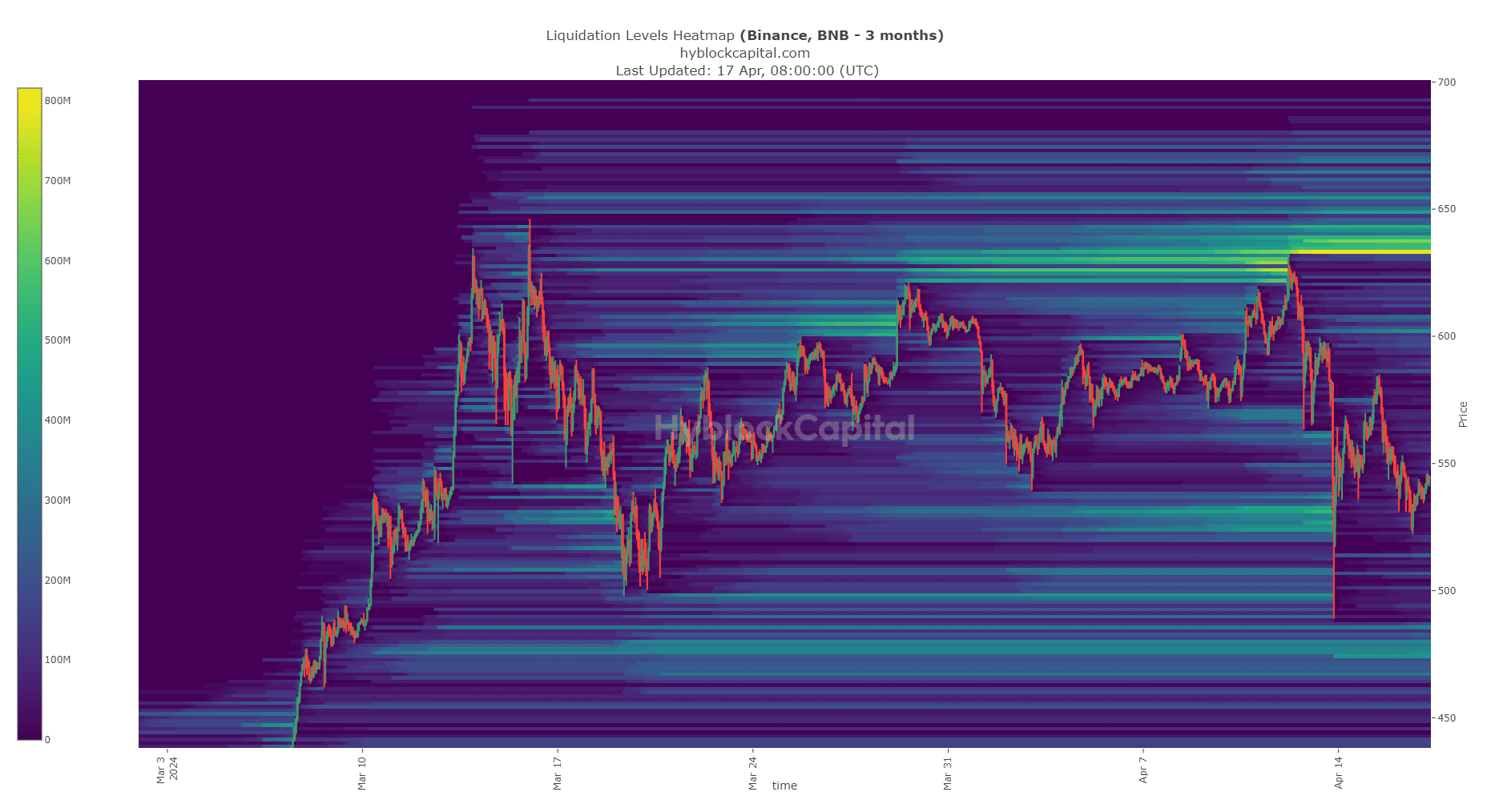

The heatmap indicating liquidation points revealed that $475 was the upcoming focal point. Few liquidation levels were present between $500 and $510, suggesting that $475 represented the next significant attraction for market activity.

In summary, the data pointed towards a potential price range between $460 and $475. Yet, there were still uncertainties, meaning a bullish rally wasn’t entirely out of the question.

Read More

- DOGS PREDICTION. DOGS cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- TON PREDICTION. TON cryptocurrency

- HI PREDICTION. HI cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- CLOUD PREDICTION. CLOUD cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

- EVA PREDICTION. EVA cryptocurrency

2024-04-18 04:07