Haseeb Qureshi, Dragonfly’s managing partner, thinks Hyperliquid’s USDH stablecoin request for proposal (RFP) process is a joke. Seriously, a joke. But not the funny kind – the kind where you’re laughing out of sheer disbelief.

Allegations of a ‘Backroom Deal’

A crypto exec from Dragonfly has called out Hyperliquid’s USDH stablecoin RFP as a total “farce,” claiming the whole thing was rigged to favor one bidder. Oh, and if you’re wondering who that lucky bidder is… you might want to pull up a chair because the drama is thick. Haseeb Qureshi went on a Twitter rant where he claimed that more than half of the other bidders also thought the validators were only interested in Native Markets. Sounds like a great reality show plot, right?

Qureshi’s accusations came in the middle of Hyperliquid’s search for proposals from companies like Ethena, Paxos, Agora, and Frax to take over USDH’s stablecoin infrastructure. As reported earlier by Bitcoin.com News, these bidders were required to submit pitches that talked about their grand plans for compliance, distribution, and how they’d share all that sweet reserve yield with Hyperliquid’s ecosystem. The lucky winner gets to control and manage USDH’s stablecoin. Who wouldn’t want that power?

But wait, according to Qureshi, despite all these *super impressive* pitches from more established players, none of the validators seemed interested. “There’s a backroom deal already done,” he said. And he wasn’t done there-oh no. He also hinted that Native Markets’ proposal came out *way* too quickly after the RFP was announced, leading him to believe they had advance notice. A little too cozy, don’t you think? 🕵️♂️

“Native Markets’ proposal came out almost immediately after the USDH RFP was announced, implying they had advanced notice,” Qureshi pointed out in a Sept. 9 Twitter post. “Everyone else scrambled over the weekend to put something together. So, this whole USDH RFP was basically custom-made for Native Markets.” Yeah, sounds totally fair.

Conflicts of Interest and a Call for a Fair Process

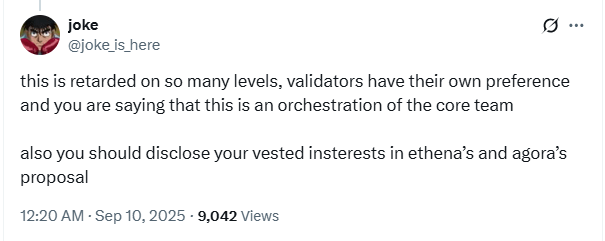

To back up his claims, Qureshi argued-without evidence, mind you-that the community was on his side, and that more prominent entities like Ethena, Paxos, and Agora had superior proposals compared to “brand new startup” Native Markets. But of course, people on social media are like “uhh, dude, you have some *serious* skin in the game here, and this sounds suspiciously like sour grapes.” A fair point, right?

In a classic move of damage control, Qureshi clarified that he wasn’t throwing shade at the Native Markets team directly. Nope, he’s gunning for the validators, accusing them of totally ignoring the delegators and the wider community. Oh, and just to be clear, his firm has investments in multiple bidders-including some of those being “ignored” by validators. But, hey, it’s not about the money, right? It’s about the process. Of course, it is. 🙄

“To be clear, we have stakes (of varying size) in Hype, Ethena, Agora, Sky, and Frax. We’ve been investors for a long time, so we have a very large portfolio,” he said. “It’s not really about the economic impact so much as the process I’m calling out.” Well, thank you for the clarification, Haseeb. We feel so much better now. 🙌

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Dan Da Dan Chapter 226 Release Date & Where to Read

2025-09-11 08:13