- Ethereum lags behind Bitcoin in terms of demand from institutional investors

- Ethereum maintains strong lead against Bitcoin in one key area though

As a seasoned analyst with years of experience in the crypto market, I have witnessed the ebb and flow of various digital assets. The comparison between Ethereum and Bitcoin is always an intriguing one, given their unique characteristics and roles within the ecosystem.

As a crypto enthusiast, I’ve noticed a surge of interest in Ethereum ETFs, yet the buzz hasn’t matched the frenzy we witnessed with Bitcoin. This trend seems consistent with the evident political backing Bitcoin has been receiving.

Is it possible that one potential downside for Ethereum, when compared to Bitcoin, is its lower liquidity? A recent study by QCP indicates that Ethereum might struggle to gain traction in large-scale financial markets, as investor interest remains heavily skewed towards Bitcoin at this time.

As an analyst, I find myself intrigued by the prospect of comparing the performance of Bitcoin and Ethereum, two digital assets that are accessible through Spot ETFs. Such a comparison could offer a more distinct view of their respective performance dynamics.

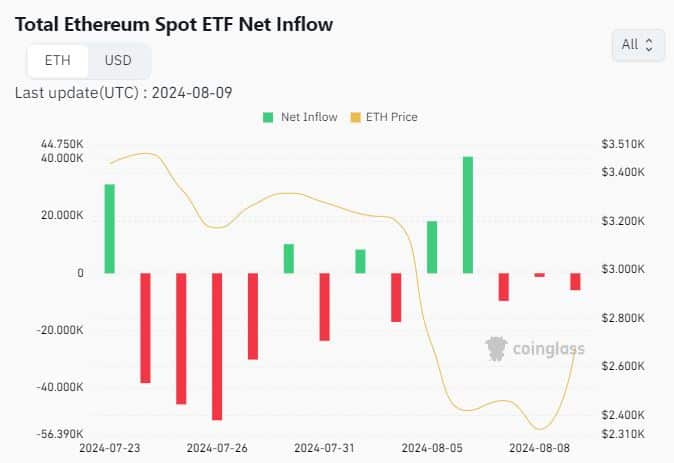

In the past two weeks, the average daily inflow or outflow of Bitcoin through Bitcoin Exchange-Traded Funds (ETFs) was approximately 300,000 Bitcoins, as reported by Coinglass. On the other hand, there was a total net outflow of roughly 114,350 Ethereum from Ethereum spot ETFs during the same period.

The data disclosed stronger demand for Bitcoin, compared to ETH in the spot ETF segment.

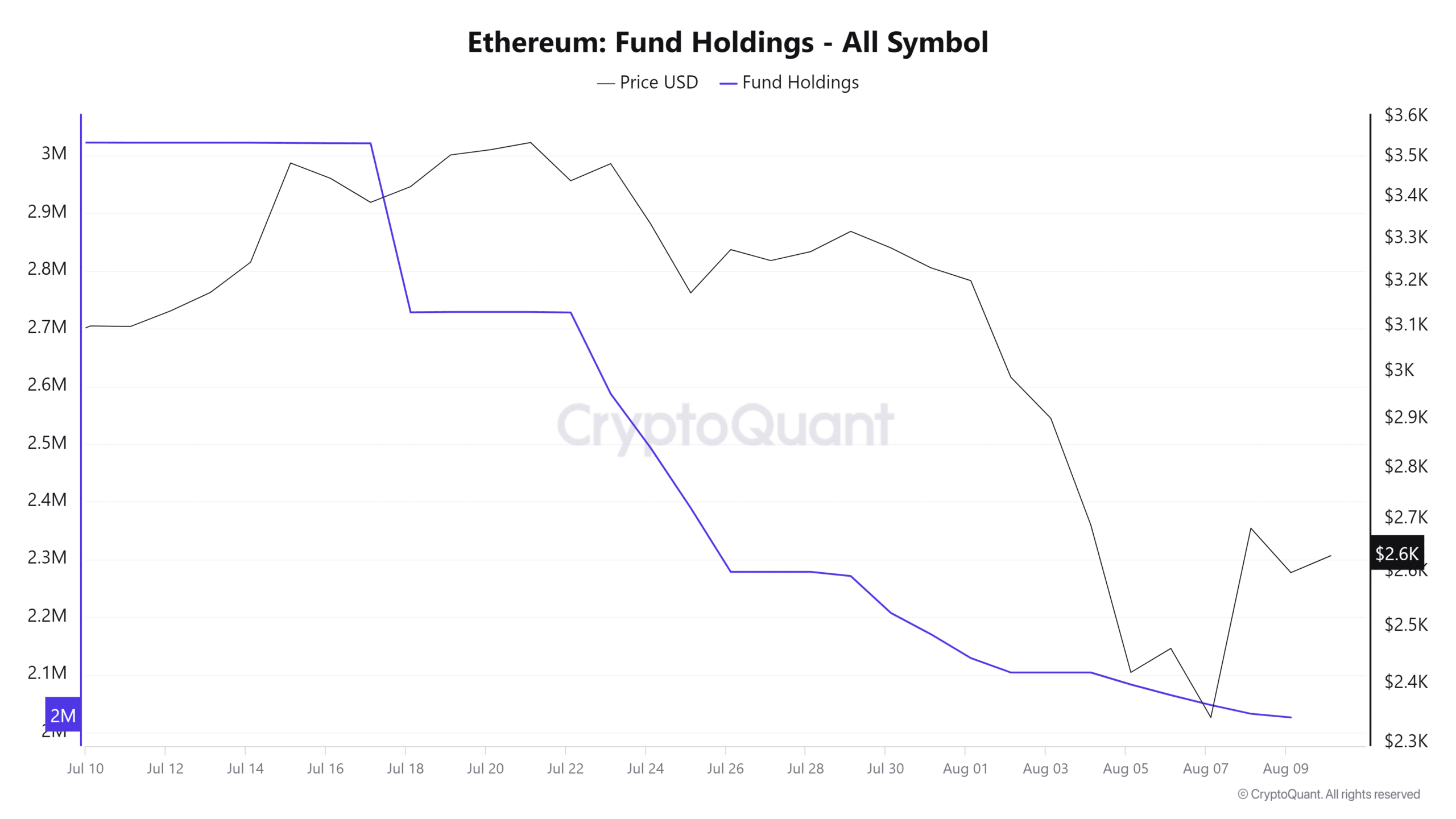

Our assessment also revealed the same for fund holdings. According to CryptoQuant, ETH fund holdings amounted to 2,026,328.5 ETH, worth $5.32 billion at ETH’s press time price.

It’s important to mention that even though the market was recovering, the holdings of the ETH fund were continuing to decrease when this was written.

In the current context, Bitcoin funds held approximately 280,951.35 Bitcoins, equating to a value of around $17.07 billion. Notably, this is more than three times the value of Ethereum. Interestingly, despite a decrease in Bitcoin fund holdings over the past four weeks, it still surpasses the value of ETH.

A fair comparison?

It was found through the previously mentioned information that Bitcoin is generally favored over Ethereum in the stock markets.

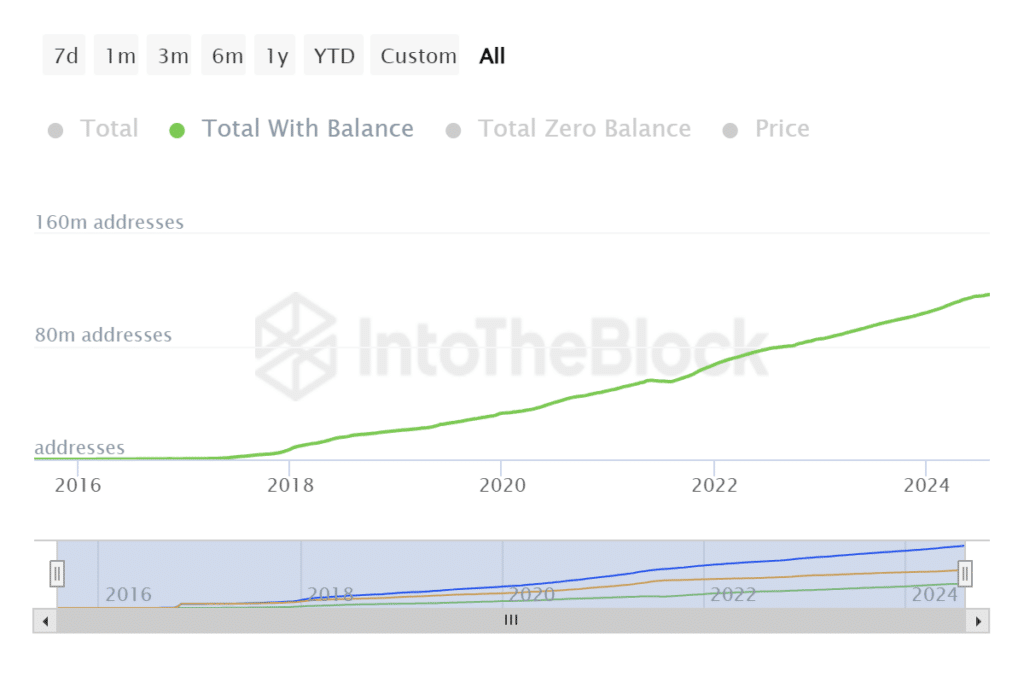

It’s possible that this disparity is due to the fact that investments lean towards Bitcoin over Ethereum. Yet, Ethereum excels in certain critical aspects as well. For instance, it boasts a significantly larger number of addresses with balances, totaling approximately 116.97 million.

Compared to Bitcoin, Ethereum has more than twice as many unique addresses holding a balance, with around 109 million Ethereum addresses compared to Bitcoin’s approximately 52.67 million.

Emphasizing one of Ethereum’s key advantages, its growing ecosystem, has been a significant factor contributing to recent Spot ETF approvals – one of the most notable reasons for this approval.

It’s undeniable that Bitcoin initially outpaced Ethereum, giving it a significant edge. Nevertheless, Ethereum holds an opportunity that institutional investors are increasingly recognizing. Furthermore, Ethereum-based ETFs are relatively new, having been introduced just a few weeks ago, while Bitcoin ETFs have been in existence for several months already.

For the remainder of 2024, we can expect a more defined outlook on Ethereum’s performance within the broader financial market. However, it’s worth noting that Ethereum currently faces some challenges when competing with Bitcoin for institutional investment liquidity.

It may explain the differences between BTC and ETH’s price action too.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP/CAD

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-08-11 02:15