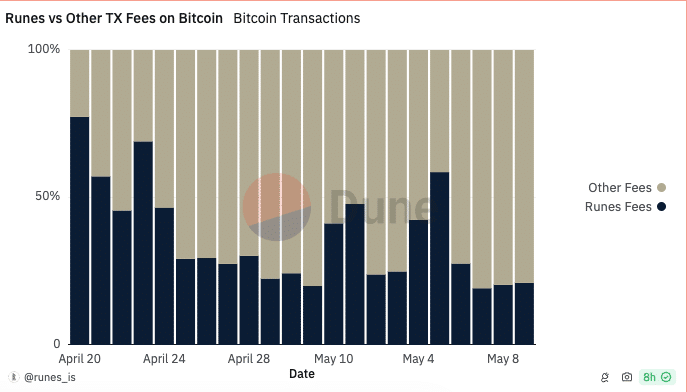

- Fees generated by Runes to Bitcoin have fallen to 21.1% after an earlier dominance of 77.3%.

- Declining activity on the protocol and Ordinals have led miners’ revenue to plunge.

As a crypto investor with experience in Bitcoin and its related ecosystems, I’m concerned about the recent developments surrounding Bitcoin Runes and Ordinals. The sharp decline in fees generated by Runes from an earlier dominance of 77.3% to just 21.1% is worrying, especially considering the initial hype and adoption that followed its launch.

As a researcher studying the latest developments on the Bitcoin blockchain, I’ve noticed that Bitcoin Runes, a newly introduced token standard, has experienced a significant drop in activity within the past month.

As a researcher examining data from Dune Analytics, I’ve observed that the total fees on the network have not yet reached the levels seen during the initial rollout.

Casey Rodarmor, the talented developer behind Bitcoin Ordinals, introduced the Runes protocol with a goal to enhance the process of generating and administering fungible tokens on the blockchain.

According to Rodarmor’s perspective, this advancement could broaden Bitcoin’s reach and draw in new users to the network. Notably, the advent of Runes occurred concurrently with the Bitcoin halving.

Activity fizzles, stops miners’ fanfare

In just a short time, the use of Runes protocol rapidly increased, resulting in more than $135 million in fees being earned during its initial week.

On the 20th of April, fees paid to the Dune protocol accounted for an impressive 77.3% of the total Bitcoin transaction fees. Nevertheless, data from Dune indicated a decrease in network activity.

In the past, other fees on the blockchain held a 22.7% market share. However, this has since changed, as other fees now command a 78.9% share, leaving Runes with a 21.1% share.

Neglecting this downward trend could be detrimental for miners. Initially, the production of new rune units brought substantial profits for miners.

During that time, I came to understand that the evolution of the protocol provided a protective layer as incentives were slashed in half by AMBCrypto’s analysis.

The forecast may no longer be accurate if there isn’t any significant progress on the protocol.

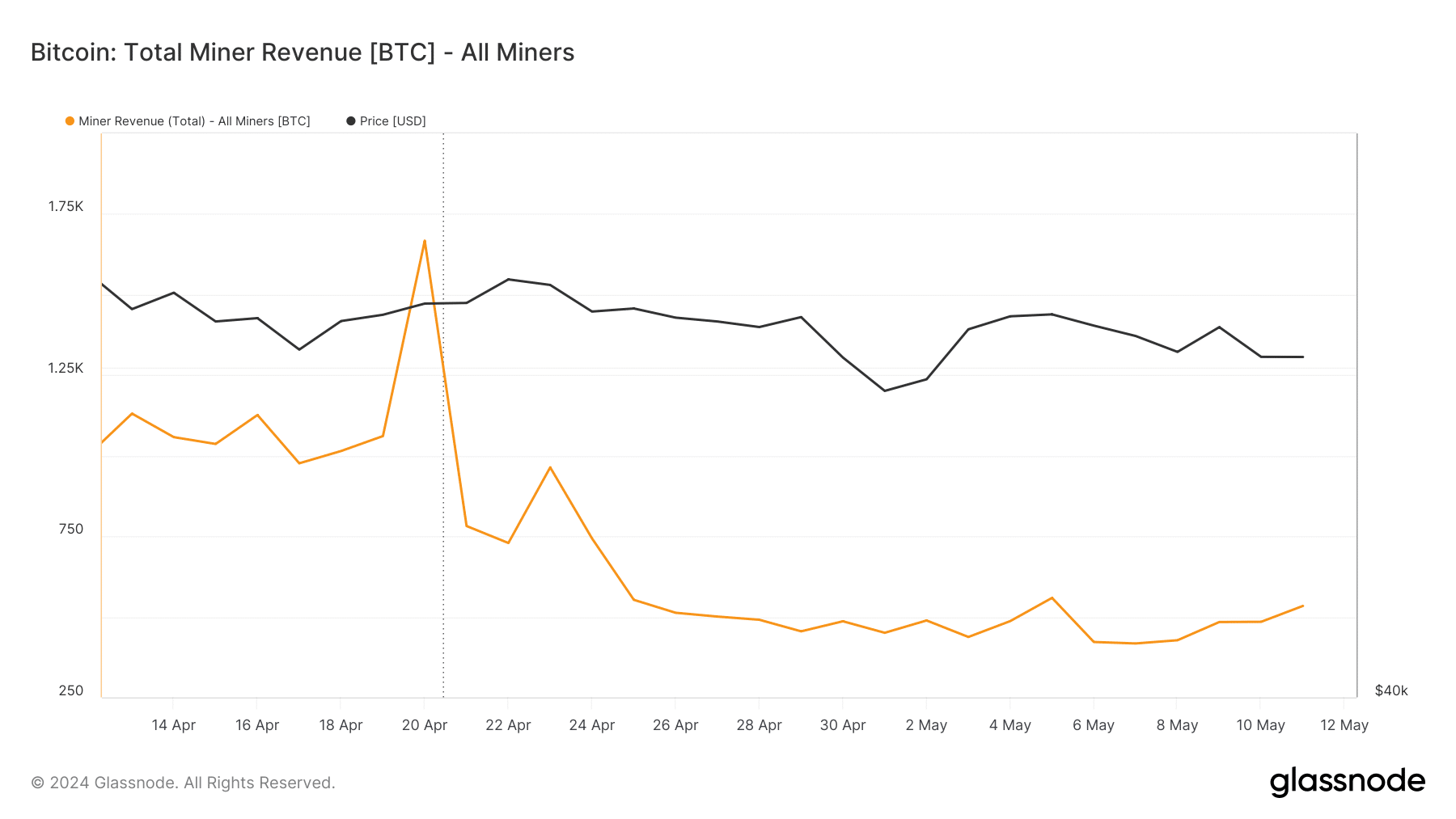

Examining the Glassnode data corroborated this trend. Based on Glassnode’s on-chain information, miner earnings amounted to 533.69 BTC on the 11th of May.

As a researcher, I’ve noticed a substantial decrease in revenue from the 20th of April when the total earnings amounted to 1677.09 BTC. This downturn may be attributed to the dwindling activity observed on the Runes protocol.

Ordinals are not left out

From a more comprehensive perspective, the decrease in Bitcoin network activity was evident as well. Additionally, Runes wasn’t alone in experiencing apathy.

Based on Messari’s analysis, both Bitcoin Ordinals and BRC-20 tokens drew significant attention. To clarify, BRC-20 tokens are a type of digital token developed on Bitcoin through the implementation of the Taproot upgrade.

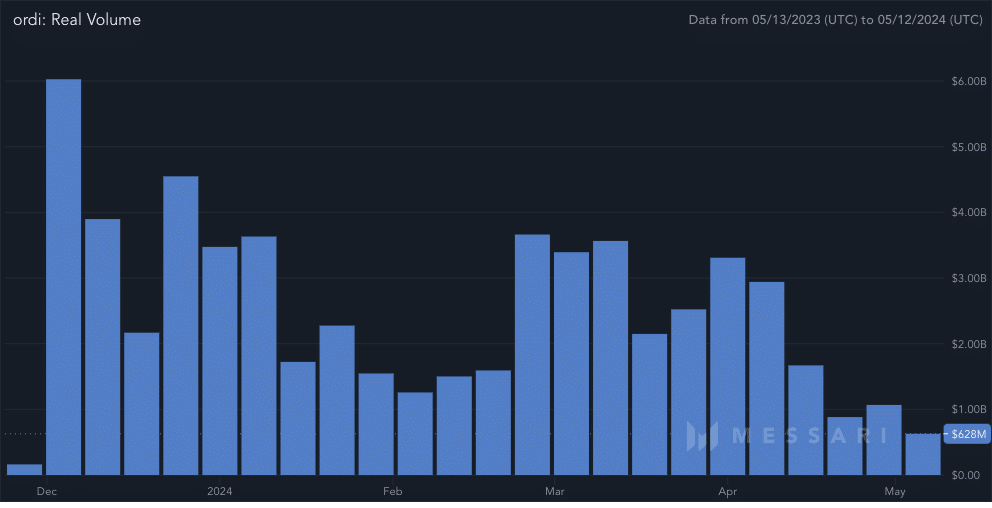

As a crypto investor, I’d express it this way: Currently, the value of ORDI, the largest BRC-20 token in terms of market capitalization, is sitting at $36.37 on the price charts. However, this represents a significant 61.88% drop compared to its all-time high.

Realistic or not, here’s ORDI’s market cap in BTC’s terms

The volume, much like its cost, has been on a downward trend. At present, ORDI’s volume stands at approximately $628 million.

I analyzed the data from December 2023 and found that the metric of interest in the token was a mere $600 million – a significant decrease compared to the previous figure of over $6 billion. This indicates a reduction in demand for the token by approximately 90%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-12 18:15