- Bitcoin’s recent on-chain metrics indicated a potential market top, with a cycle peak similar to previous years.

- Analysts observed increased selling activity, aligning with historical trends.

As an experienced analyst, I find Charles Edwards’ on-chain analysis of Bitcoin’s recent market metrics intriguing and worth considering. The sustained increase in the Long-Term Holder inflation rate and the sharp rise in the Dormancy Z-score, along with other indicators like Spent Volume, suggest that we could be approaching a cycle peak for Bitcoin.

At the moment of reporting, Bitcoin [BTC] was undergoing a price decline, having previously surged past $63,000.

In the previous seven days, the value of the cryptocurrency has decreased by 1.1%. However, it experienced a more substantial decrease of 2.7% just in the last 24 hours, resulting in its current trading price of $60,929.

In the current market fluctuations, Charles Edwards, the head of Capriole Investments, has signaled that certain on-chain indicators point towards a possible decrease in Bitcoin’s market power.

Bitcoin’s turning point?

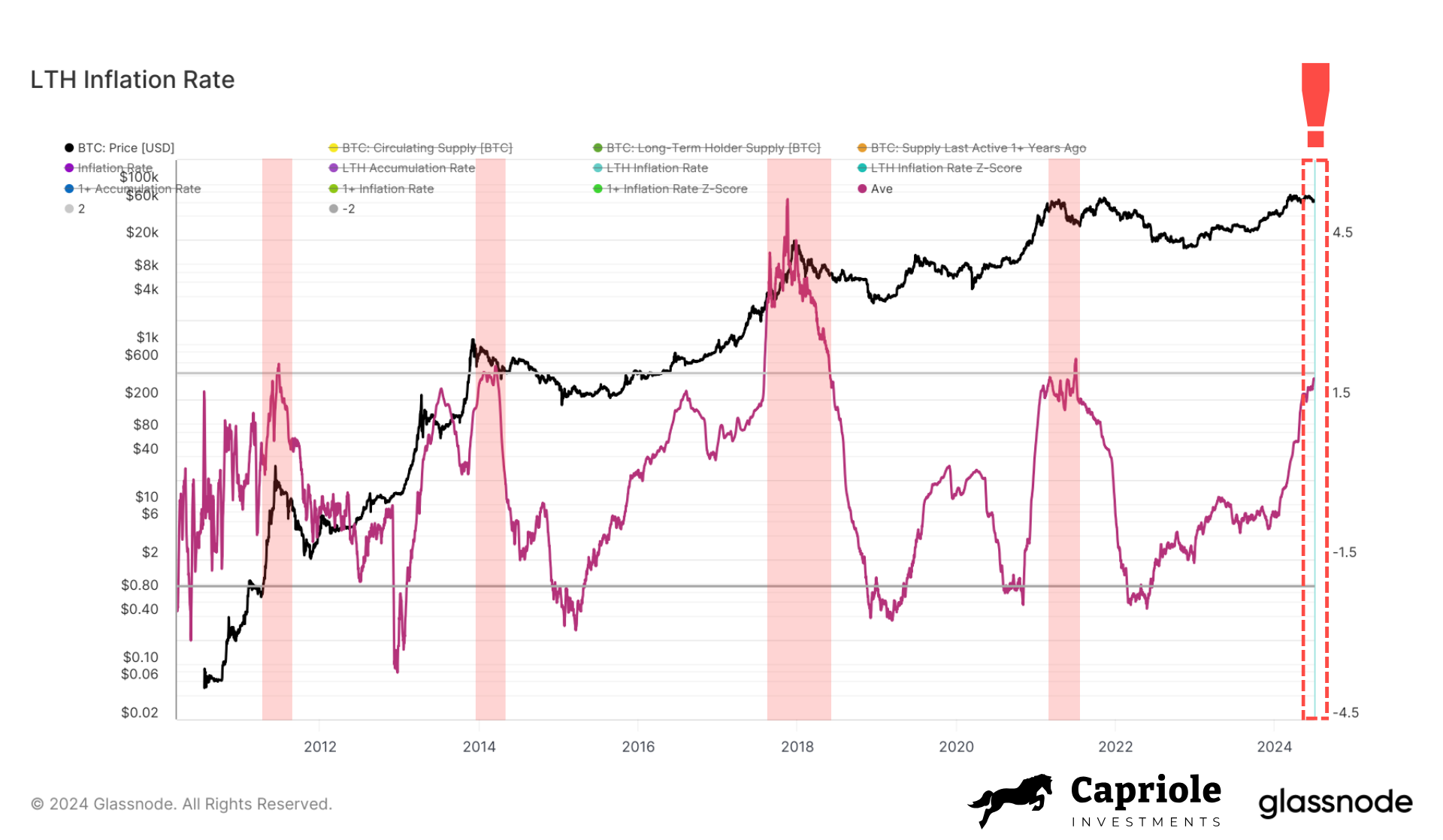

As a market analyst, I’ve noticed Charles Edwards highlighting several on-chain signals suggesting potential market saturation. One noteworthy indicator is the trend in Bitcoin’s Long-Term Holder (LTH) inflation rate, which is closely observed by Glassnode.

Over the last two years, the yearly pace at which long-term Bitcoin holders have been disposing of their coins in comparison to freshly mined ones (represented by the LTH inflation rate) has noticeably risen.

At present, it approaches a significant historical threshold typically linked to market peaks. According to Edwards, an inflation rate for the Long-Term Trend (LTT) markets getting close to the 2.0% nominal inflation rate usually indicates the end of a cycle.

At press time, the king coin was dangerously close at 1.9.

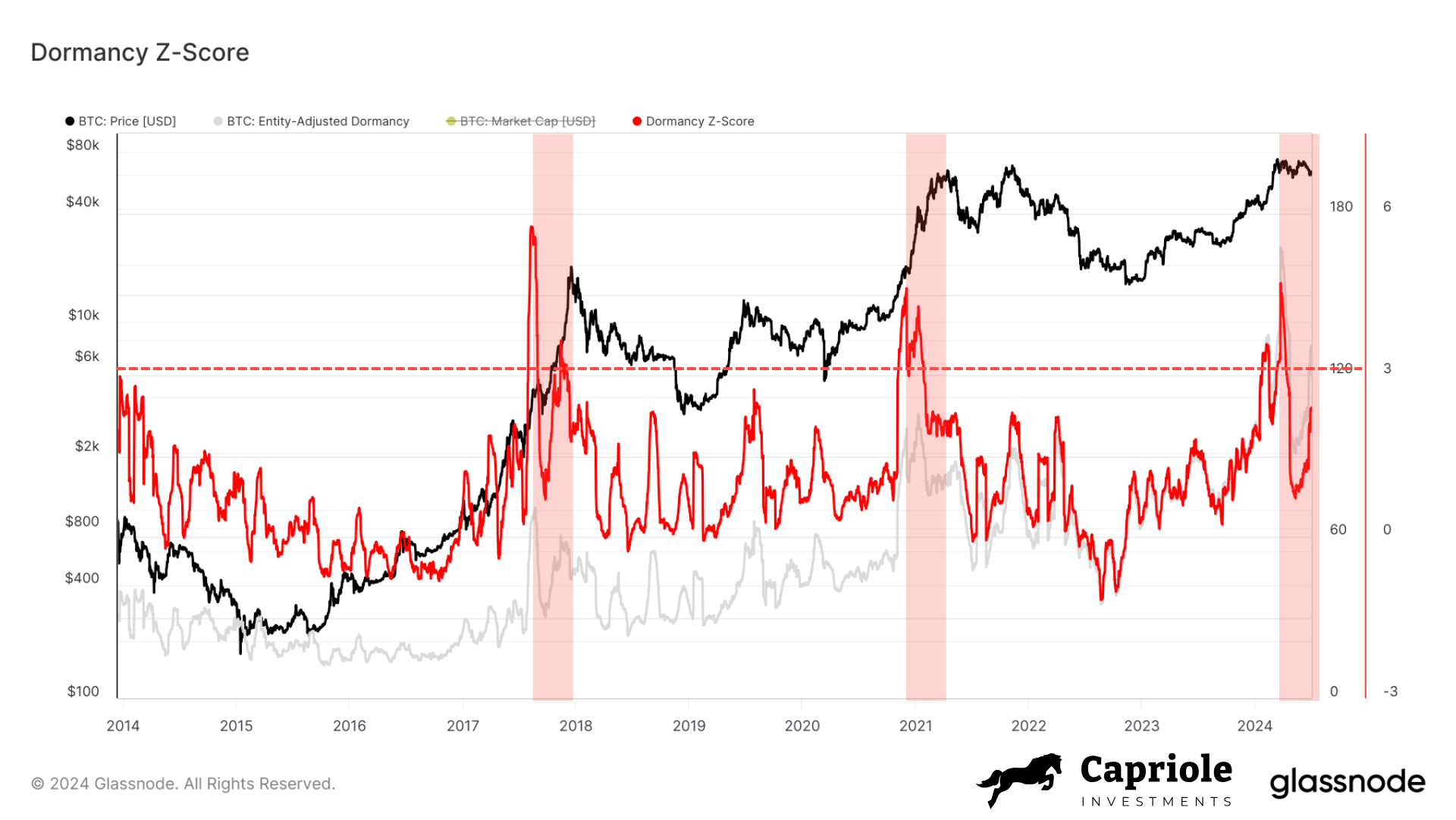

One significant measurement brought up by Edwards is referred to as the Dormancy Flow. This metric assesses the significance of old coins in relation to their age and the total transaction activity.

New findings reveal a significant increase in the Dormancy Z-score, most notably in April 2024. This surge may be indicative of an upcoming market peak, as it suggests a higher than usual number of older Bitcoin coins are being activated for transaction purposes.

Edwards elaborated,

Three months have passed since metric peaks often signal cycle tops. Notably, prices have decreased since then, and the current Dormancy Z-Score peak bears a striking resemblance to those seen in 2017 and 2021.

At present, the Dormancy Flow Z-score indicated that Bitcoin’s price could be reaching a peak during this market cycle. This was due to the coin’s price seeming expensive compared to the transaction volume of older Bitcoins. Such a disparity might be a warning sign for a broader market correction.

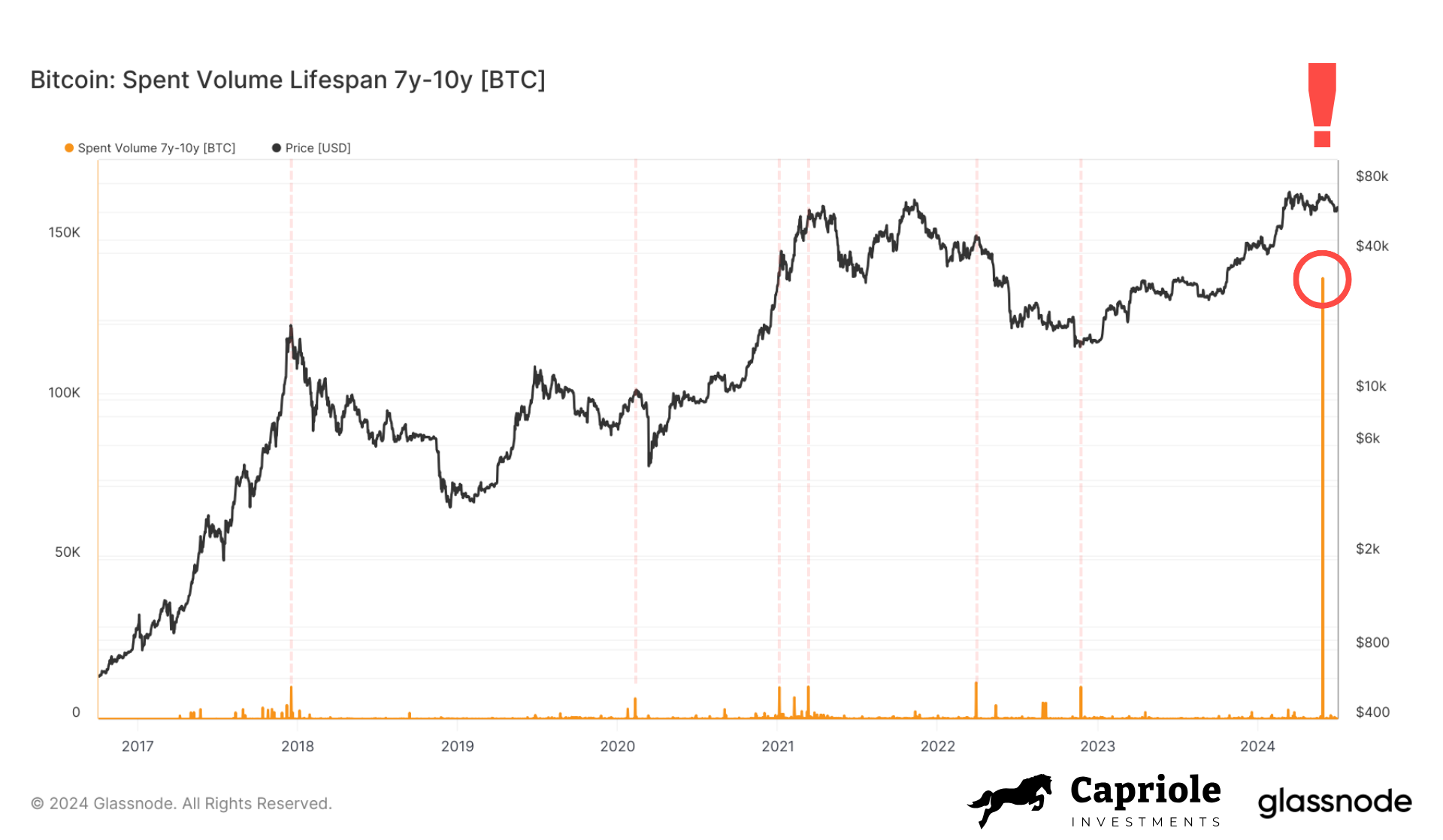

The surge in spending activity for Bitcoins that are between 7 and 10 years old tends to indicate the peak of a Bitcoin price cycle, as market risks heighten.

In 2024, Edwards observed a remarkable surge in Bitcoin’s Spent Volume, characterizing the large-scale transfer of Bitcoin on the blockchain as extraordinary.

Approximately $9 billion in Bitcoins from accounts that have been inactive for over a decade have been moved. A significant portion of this activity can be linked to the resolution processes of the defunct Mt. Gox cryptocurrency exchange.

Cycle top in: Are traders aware?

As a cautious crypto investor, I believe it’s important to consider different viewpoints when assessing Bitcoin’s price, even if Charles Edwards has pointed out some potential weaknesses.

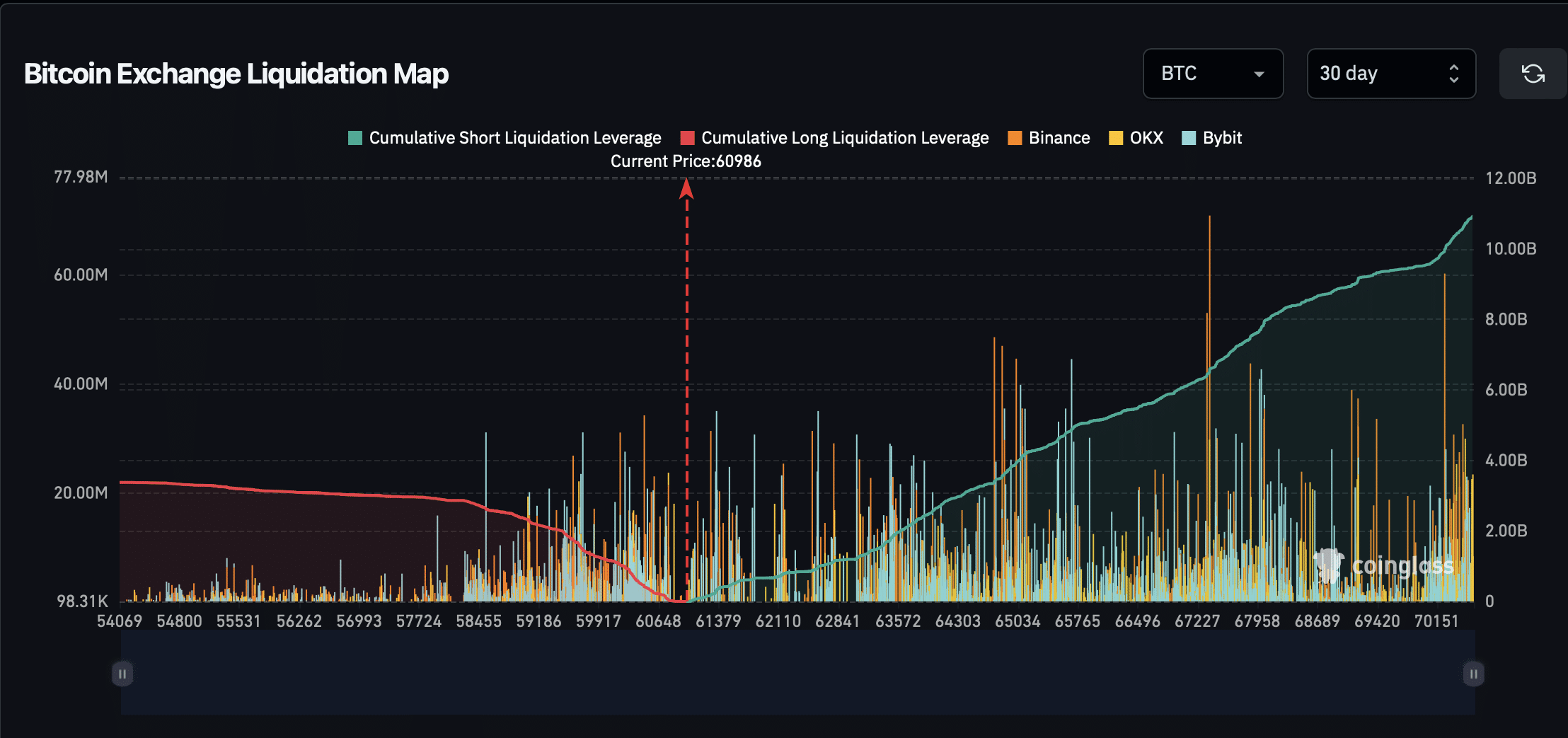

Examining the short and extended term liquidation data for Bitcoin on Coinglass, it was found that most liquidations during the previous month were long positions. This implies that numerous traders expected an increase in Bitcoin’s price.

It remains to be seen whether holding long positions in Bitcoin will ultimately yield profits for traders or if the cryptocurrency’s price will keep dropping, as Edwards anticipates. The outcome will depend on the passage of time.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In regard to the price trend, a recent analysis by AMBCrypto suggests an encouraging change in mining activity.

Bitcoin’s price might be reinforced by the recent significant growth in miners’ stockpiles.

Read More

- AUCTION/USD

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Solo Leveling Season 3: What You NEED to Know!

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- XRP/CAD

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-07-03 23:04