-

ONDO’s price witnessed a massive correction over the last week caused by whale behavior.

Despite the price volatility, the protocol continued to see growth in terms of TVL.

Recently, Ondo Finance (ONDO) experienced significant growth due to increasing demand for protocols connected to Real-World Assets (RWAs). This surge was largely fueled by the actions of major investors.

Playtime over?

Yet, the data showed that ONDO‘s price had dropped noticeably in the recent past. Following a failed attempt to break through the $1.04 resistance mark on April 4th, the price of ONDO fell by a substantial 25.29%.

In this timeframe, ONDO‘s price surpassed its prior highest prices and lowest prices, leading to the bullish trend for the token coming to an end.

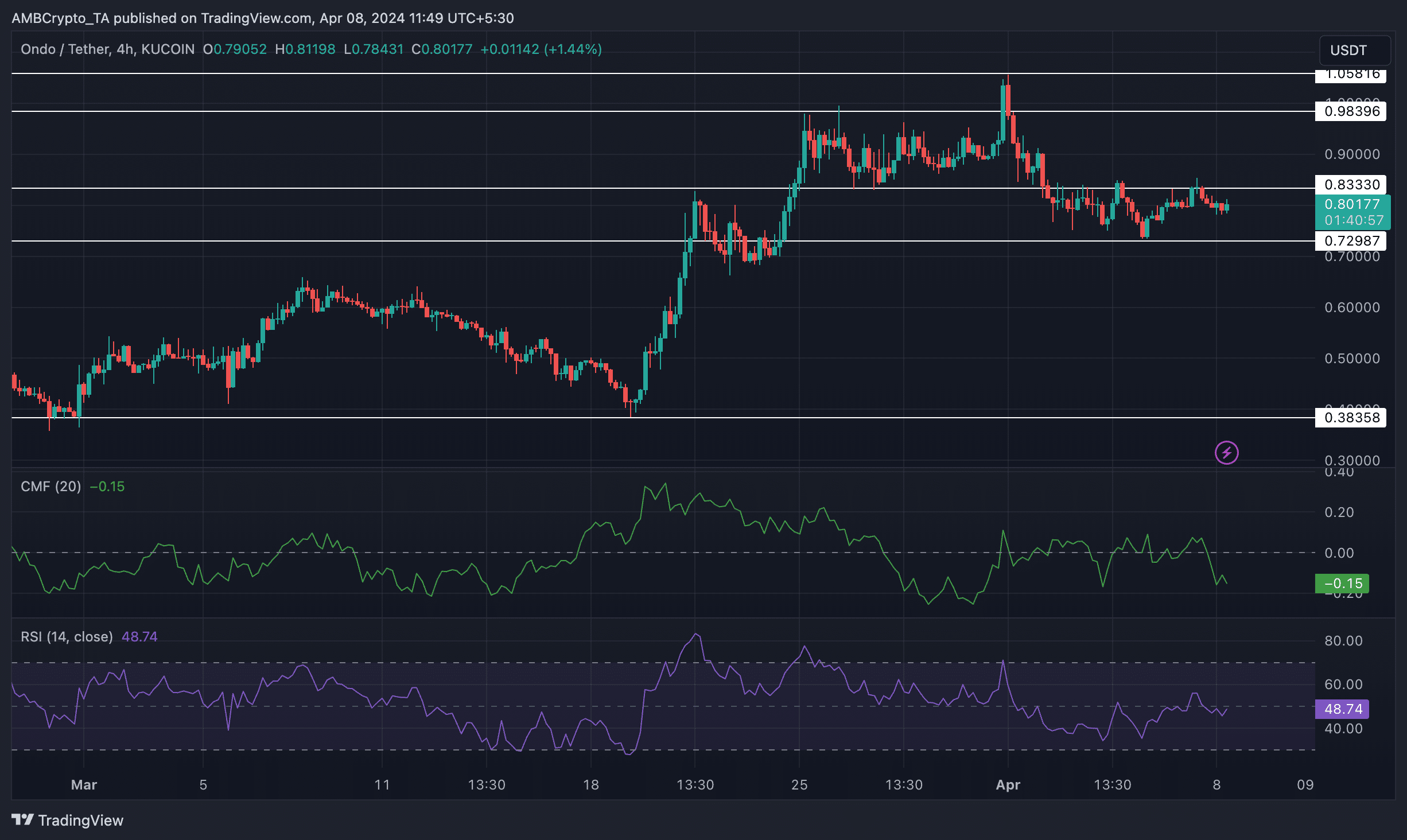

Currently, ONDO is priced 23.32% lower than its peak price of $0.8032 during trading. Additionally, the Chaikin Money Flow (CMF) indicator stands at -0.15. This technical analysis tool signifies that there’s been a noticeable outflow of money from ONDO over the given time frame.

When the cash flow from a security (CF) is less than zero, it signifies that more money is leaving the investment than coming in. In simpler terms, there’s a greater demand to sell this security than to buy it, which can intensify the downward price trend.

Additionally, the token’s RSI reading dropped to 48.83. This indicator represents the rate and magnitude of price fluctuations.

When ONDO‘s value is under 50, it usually means that negative momentum is stronger than positive, implying a significant decrease in the previous bullish trend.

Are whales to blame?

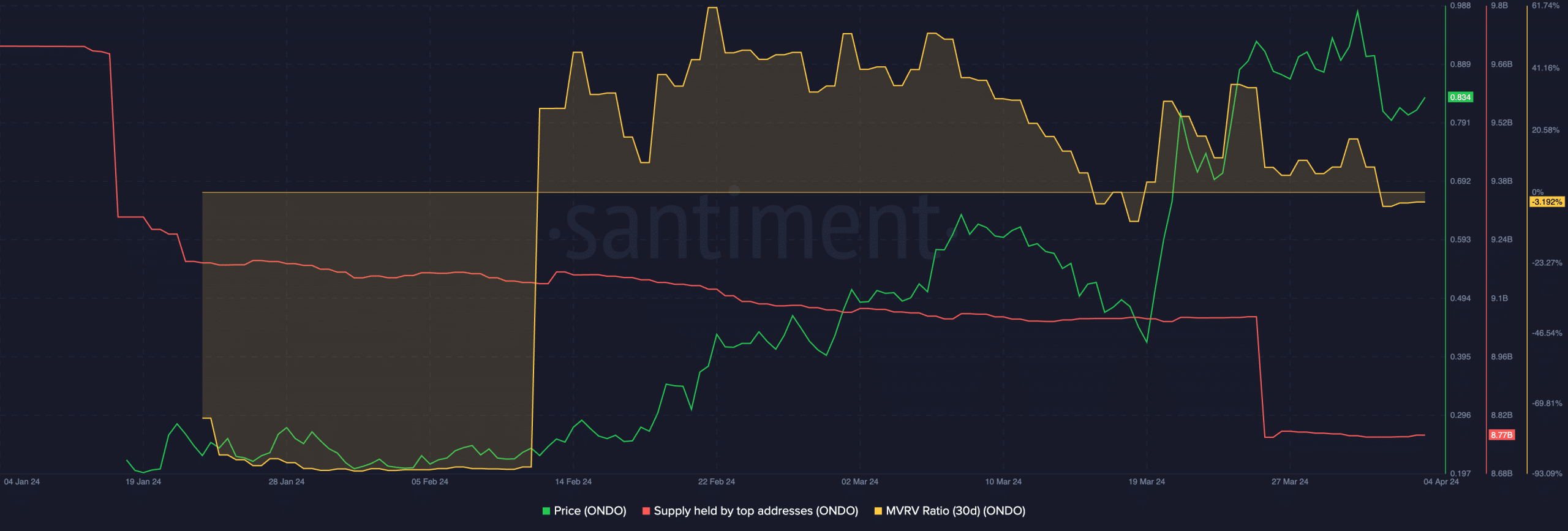

A potential explanation for the drop in ONDO‘s value is that big investors, referred to as “whales,” have been losing enthusiasm for this token. According to AMBCrypto’s examination of Santiment’s statistics, there has been a significant decrease in the amount of ONDO tokens being stored by large holders.

It’s possible that this situation occurred due to several whale investors cashing out their profits, resulting in significant losses for smaller retail investors.

The MVRV ratio for ONDO, which signifies the profitability of its current holders, mirrored the price drop and suggested that a majority of them weren’t making a profit at the moment.

Is your portfolio green? Check the ONDO Profit Calculator

Traders suffered the same unfortunate outcome. In the recent past, more than half a million dollars’ worth of long positions on ONDO were forcedly closed. As a result, there was an increase in the proportion of short positions against ONDO.

The development of ONDO‘s future price will be influenced by the condition and success of its protocol. Over the past few days, the Total Value Locked in the ONDO protocol has been increasing consistently.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-04-09 03:03