-

BTC could be nearing its market top per S&P 500 (SPX) correlation.

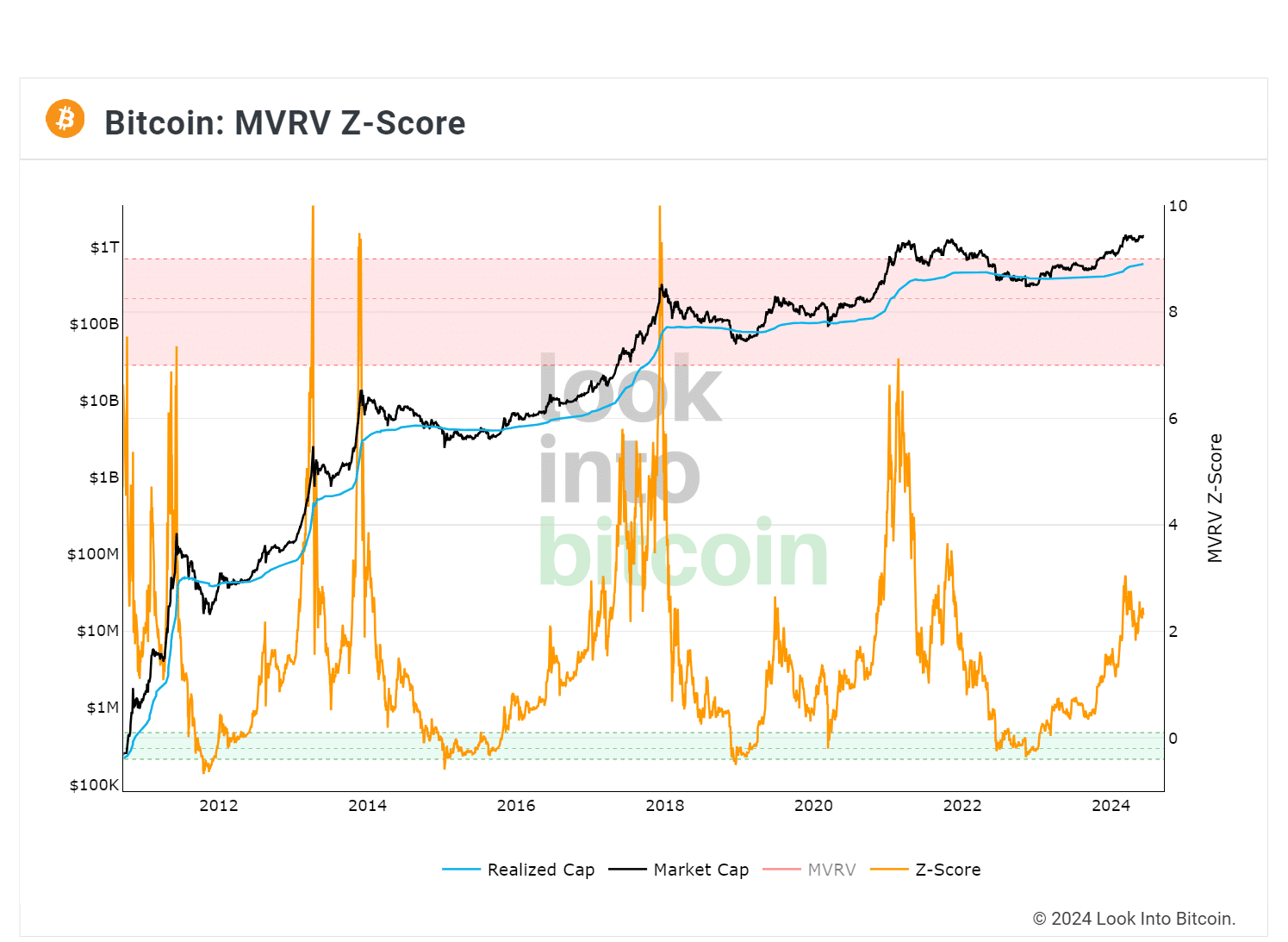

However, the MVRV Z-score indicates that bulls still have extra upside potential.

As an experienced analyst, I find the correlation between Bitcoin (BTC) and the S&P 500 Index (SPX) intriguing. CryptoCon’s analysis suggests that BTC may be nearing its market top based on historical data. However, I remain cautious about drawing definitive conclusions from this correlation alone.

The price of Bitcoin between $60,000 and $71,000 has persisted for three consecutive months now. However, the decreasing likelihood of Federal Reserve interest rate reductions appears to hinder any significant price surge in the short term.

In the midst of the monotonous price consolidation, a financial analyst has made an intriguing observation about Bitcoin (BTC). Based on his analysis using the S&P 500 Index (SPX), crypto expert CryptoCon pointed out that Bitcoin might be nearer to its market peak than many people believe.

Could it be that Bitcoin’s peak prices have been influenced by the stock market all along? The span between every stock market peak and subsequent Bitcoin peak has consistently been 134 weeks. Therefore, based on this pattern, we can anticipate the next target date range to be around the week of July 29th this year. Quite intriguing!

The analyst’s observation reveals that Bitcoin’s (BTC) market peak tends to follow the Stock Price Index (SPX) reaching a market cycle top by a few weeks. Surprisingly, it takes approximately 134 weeks for the SPX to hit its peak from the previous BTC market peak.

According to this correlation and hypothesis, Bitcoin (BTC) may reach its peak price by the end of July 2024. However, it is essential to remember that correlations do not imply causation. In other words, a potential stock market (SPX) peak doesn’t automatically result in a BTC market peak.

However, another user seemed to support the SPX/BTC correlation and stated,

As the S&P 500 index (SPX) increases in worth, investors seek opportunities with greater potential rewards that lie beyond it. This is the manner in which funds move towards Bitcoin and other higher-risk assets.

As a researcher studying the Bitcoin market, I’ve noticed a concerning development based on a recent report by AMBCrypto. The Bitcoin network has shown signs of stagnation, potentially indicating profit-taking behavior among long-term holders (LTHs). This could be a warning sign for investors and traders.

BTC has more room to pump?

As an analyst, I would interpret the MVRV Z-score’s indication of further upside potential before the market peaks as follows: The MVRV Z-score’s positive reading implies that the market values of assets are relatively lower than their realized values. In simpler terms, investors have made more money from selling their assets than their current market prices suggest. This discrepancy could indicate that there is still room for price appreciation before a market top.

From a long-term standpoint, the MVRV Z-score filter helps separate Bitcoin’s price fluctuations due to short-term market volatility from its true undervaluation or overvaluation relative to its ‘fair value.’ Historically, Bitcoin has tended to peak when this metric falls within the pink area (values ranging from 7 to 9).

At this moment, the figure has surpassed the 2-mark slightly. It still holds potential to reach the significant “pink zone” based on past trends.

Despite the pessimistic outlook of some, Bitcoin maximalist and analyst Fred Krueger maintained a positive perspective. He believed that Bitcoin’s value could increase when compared to gold prices and the inflows into gold ETFs.

Bitcoin’s price has nearly doubled since the ETF announcement. However, its market capitalization is only $0.7 trillion compared to gold’s $2.6 trillion. This implies that even without additional inflows, Bitcoin still has room for another price increase of almost double its current level.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- 7 Chilling Horror Films Born from The Twilight Zone’s Dark Legacy

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

2024-06-11 09:11