Japan’s rising bond yields are sending shockwaves through global markets, stretching the yen carry trade, and adding more pressure on Bitcoin and other crypto assets.

Ah, Japan. Always up to something, aren’t they? This time, it’s their sharp bond yield surge that has turned heads across the globe. And not in the way you’d like to see it-unless you’re a fan of market chaos. Over the past week, traders in every market imaginable have been clutching their pearls, debating liquidity risks and wondering whether they should sell everything and move to a remote island. Spoiler alert: That might not help.

The rise in bond yields came at a particularly unfortunate time for digital assets, which are already wobbling like a toddler on roller skates after seeing a sharp drop in flows into major crypto investment products.

Japan’s Yield Shock: A Harbinger of Market Madness?

Who saw this coming? Japan’s surprise move caught global investors off guard when their long-dated government bond yields shot up to levels not seen since-well, ever. We’re talking about a 40-year yield jumping to 3.697%, a 20-year yield at 2.80%, and a 30-year yield making a casual stroll to 3.334%. Even the 10-year yield managed to climb by 70 basis points in the last year. That’s like a bad credit score trying to get better-only in reverse.

The rise in yields followed Tokyo’s announcement of a stimulus package, worth a cool 17 trillion yen-roughly 110 billion dollars. Normally, we’d expect bond markets to respond to fiscal stimulus by lowering yields, but nope, traders decided to send them higher. Why? Because they’ve got doubts about Japan’s ability to handle its 250% GDP debt and its ever-growing interest payments. Who can blame them? The government’s debt load is practically crushing them like a giant elephant sitting on a sandwich.

Clearly, many investors were expecting a little more gentle behavior from the bond market. Instead, they got a spike that had analysts clutching their calculators and mumbling about the unthinkable: higher yields.

The Yen Carry Trade: Breaking the Bank, One Loan at a Time

Now, let’s talk about the yen carry trade. For decades, investors have borrowed in yen, which is as cheap as a cup of instant noodles, and used those funds to chase higher returns in other markets. Well, it’s no longer a cozy little strategy.

The recent rise in yields has forced the yen carry trade to rethink its life choices. Rising yields mean higher funding costs and, even worse, currency risks for anyone caught holding yen loans. Plus, if Japan’s yields go up, the yen usually strengthens, meaning that anyone overseas who borrowed in yen to invest elsewhere is looking at a nasty surprise when they try to repay.

Some analysts predict that the yen could strengthen by 4-8% over the next six months, which sounds great-unless you’re an overseas borrower scrambling to pay back those loans. This is all part of a market supporting a monstrous 20 trillion-dollar position. If funding becomes too expensive, many of these positions could unravel faster than a cheap sweater in a washing machine. You know what that means: forced selling, and lots of it, which will likely spill over into stocks, bonds, and currencies. Fun times, right?

Crypto’s Dilemma: Can Bitcoin Survive the Storm?

So, what’s all this got to do with crypto? Well, if Japan’s rising bond yields continue their upward march, they’ll start drawing capital back into the land of the rising sun, away from global markets. This is especially true when domestic yields rise. Investors tend to reduce foreign exposure and return those funds to Japan like a cat returning to its comfy bed.

This means less support for markets around the world, especially U.S. Treasuries, equity ETFs, and emerging market securities, all of which will feel the squeeze first. And let’s not forget, crypto could be next on the chopping block.

As liquidity tightens, investors often gravitate towards safer assets. In other words, get ready for a round of asset evacuations, as analysts draw comparisons to previous periods when global liquidity withdrawals led to massive price dumps across risk assets-like crypto. Yikes.

Related Reading: Japan Is Reportedly Considering A Tighter Crackdown On Crypto DATs

Bitcoin’s Struggle: Will It Weather the Storm?

If Japan’s bond yields continue to rise, domestic bonds might just look a lot more appealing than foreign assets. After all, who wants to hold a risky Bitcoin when you can invest in a nice, stable bond yielding 3.7%?

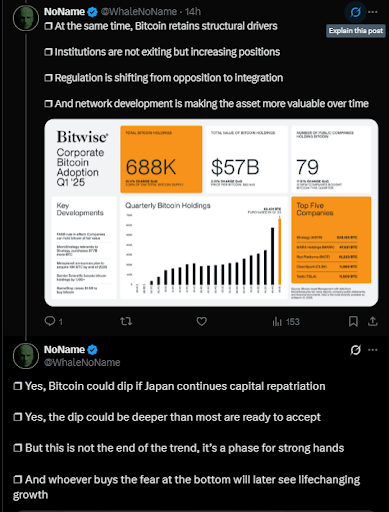

At the moment, Bitcoin is already seeing fewer inflows into major ETFs, and institutional buyers are becoming more like the kids who say, “Maybe next time.” Higher yields generally support a stronger dollar, and we all know the dollar tends to weigh down on global assets-especially Bitcoin. We’ve seen this happen before, during 2015, 2018, and 2022, when liquidity tightened and risk assets, including Bitcoin, took a dive.

Bitcoin might have been a good bet in the past, but with cash fleeing risk markets, Bitcoin’s suffering, not because people are no longer interested, but because all that money is being pulled out. In fact, during past periods of tightening liquidity, Bitcoin has experienced its fair share of pain.

And if there’s a massive unwind of yen-funded positions? Well, you can expect a wave of selling across the board. Crypto assets are usually the first to react, and Bitcoin might find itself in the line of fire once again if things continue to head south.

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Build a Waterfall in Enshrouded

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Get the Bloodfeather Set in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- Battlefield 6 Players Found a Secret Room in the Shooting Range, Prompting a Handful of Theories

- Frieren Season 2 Drops First Look at Episode 1 Ahead of Crunchyroll Premiere

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

2025-11-19 22:08