- Litecoin can breakout if altcoin season kicks in and institutional buyers add to their bags.

- Litecoin’s hashrate soared to new historic highs, but will short-term price enjoy some bullish relief?

As an analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear runs, and I must say that Litecoin’s current trajectory is intriguing. The surge in institutional buying, despite market headwinds, is a clear sign of growing interest. Grayscale’s recent accumulation of LTC to an all-time high suggests that even the whales are not immune to its charm.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastDespite Litecoin [LTC] not having Exchange-Traded Funds (ETFs) like its larger counterparts, it hasn’t deterred institutional interest.

One of the prominent institutional investors in the cryptocurrency market, known as Grayscale, is expanding its holdings by accumulating more Litecoin (LTC).

It appears that recent information shows Grayscale continues to amass Litecoin, even amidst unfavorable market conditions. Interestingly, these institutional investors chose not to reduce their holdings when the market took a dip at the beginning of August.

Over the past four weeks, it accumulated more Litecoins, and the total increased from 1.75 million LTC to 1.85 million LTC – a new record for Grayscale’s Litecoin holdings.

0.024% of all existing Litecoins are held by Grayscale, suggesting that large investors like whales and institutions remain keen on the cryptocurrency, even though this may not seem significant at first glance.

A little over a month back, it was announced that Fidelity, a financial institution managing more than twelve trillion dollars in assets, initiated the provision of Litecoin exposure for their clients.

These developments may attract more interest from retail traders.

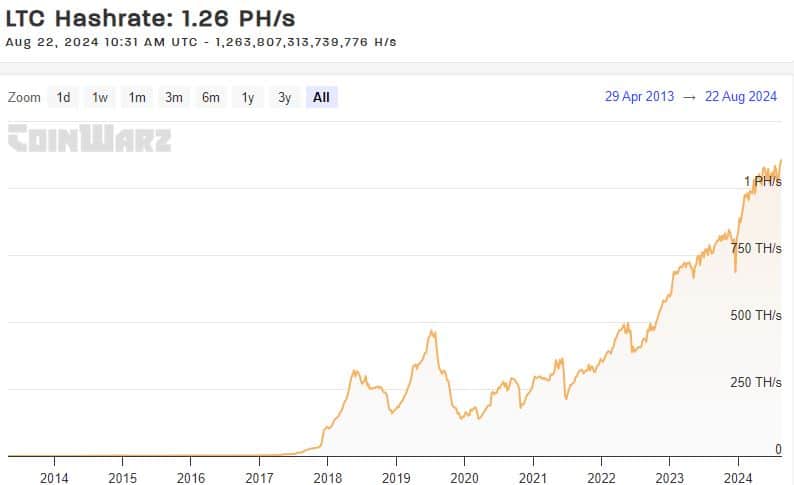

Litecoin hashrate soars to new ATH

Additionally, Litecoin’s growth extends beyond just price. A significant aspect is its hashrate, which has consistently risen over time. Recently, it reached an unprecedented peak of 1.29 Petahashes per second (PH/S) within the last day.

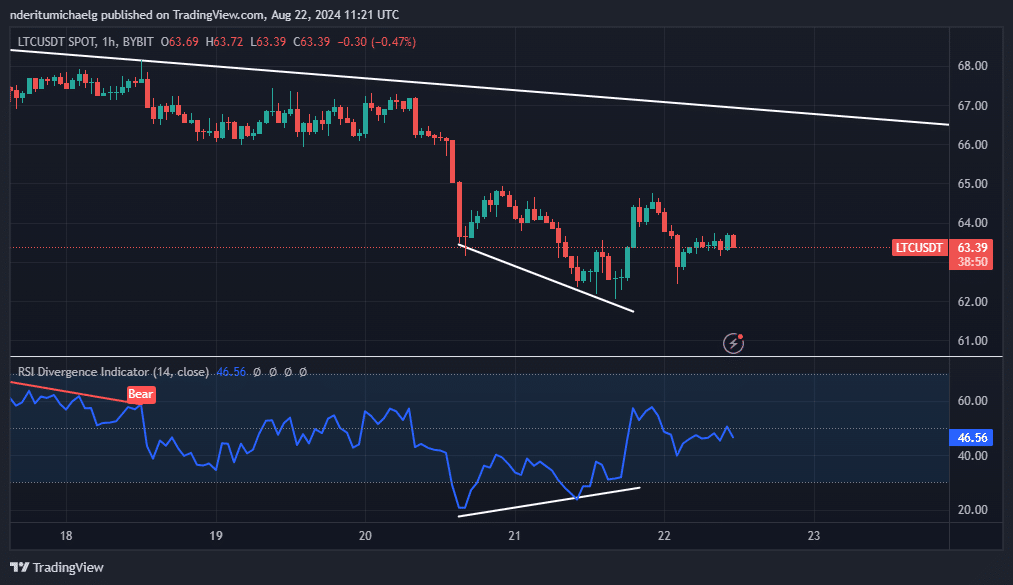

Over the past five days, Litecoin has shown a downward trend, retreating from a long-term resistance level. Yet, there are signs that it could be gearing up for an uptrend, potentially signaling a bullish recovery.

Its 1-hour chart recently formed a bullish divergence pattern with the RSI.

A bullish divergence indicates a potential reversal for Litecoin (LTC), which may lead us back towards testing the $66 price range again. This is one possible scenario.

It traded at $63.32 at press time, which was close to a previously tested support level.

Looking at a broader perspective, particularly on daily charts, suggests a strong likelihood of a breakout occurring. This is due to Litecoin’s formation of a wedge pattern, with both support and resistance levels exerting pressure to push it towards either a breakout or breakdown point.

current market conditions seem to be leaning towards a positive trend as institutions are actively buying up stocks. Yet, it’s important to note that this increased demand does not automatically mean a bullish outcome will occur.

Recently, the financial markets have shown a high degree of volatility, and they are presently teetering on the brink as they assess the health of the worldwide economy. Such circumstances might affect the movement of funds over the next several months.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gold Rate Forecast

- OM PREDICTION. OM cryptocurrency

- 25+ Ways to Earn Free Crypto

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

2024-08-23 01:11