-

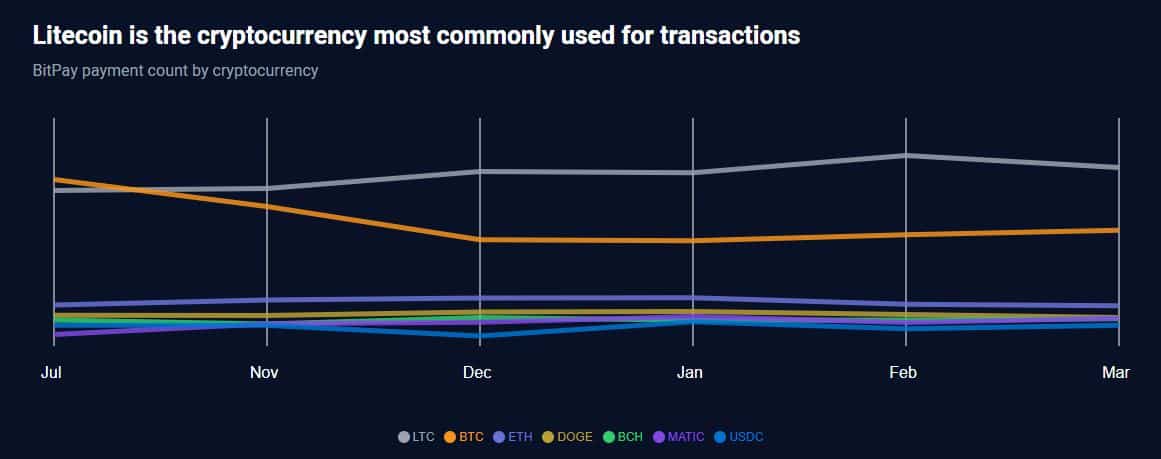

LTC’s share of the global payments was 39% in March, followed by Bitcoin at 25%.

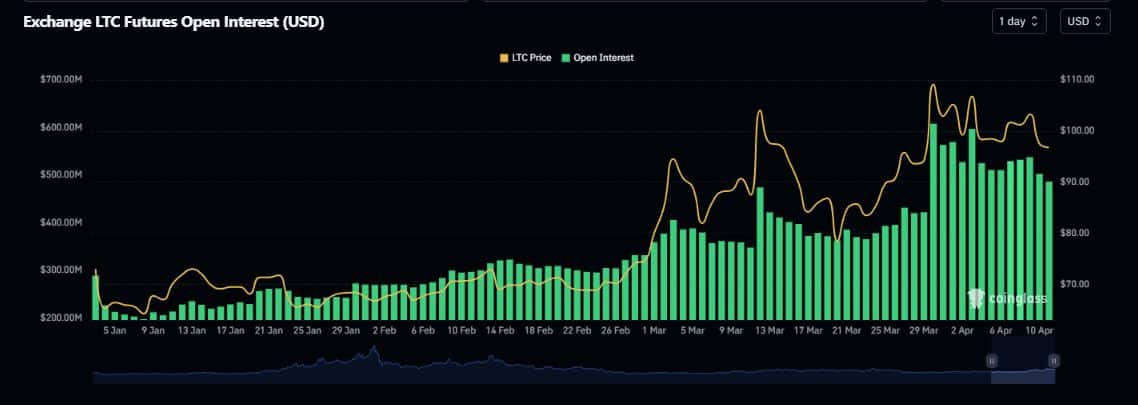

LTC’s growth stagnated in the last month, causing a decline in its Open Interest.

In March, Litecoin (LTC) emerged as the favored digital currency for transactions, surpassing Bitcoin [BTC] and other significant assets.

Litecoin extends winning streak

According to BitPay, the largest cryptocurrency payment processor, Litecoin accounted for 39% of all global crypto payments in March. This is a decrease from the 41% it represented in February.

In March 2024, digital silver once again reigned supreme, maintaining its leading position for the third consecutive month in the charts.

An intriguing observation: The number of transactions on the LTC network surpassed those on Bitcoin and Ethereum together, with the latter two being the most well-known cryptocurrencies presently.

HODLing gains traction too

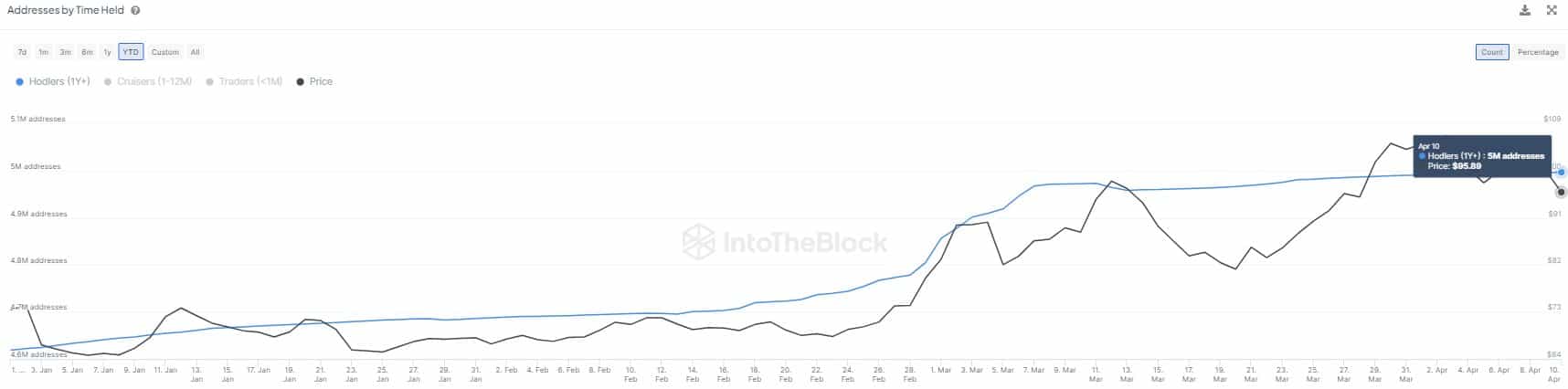

As the use of LTC (Litecoin) as a form of payment became more common, some users chose to hold onto their coins rather than spend them, with the aim of increasing their value over time.

Based on data fromIntoTheBlock, a company specializing in on-chain analysis, over 5 million users now hold Litecoin for at least a year. These individuals are classified as long-term holders.

It’s worth noting that over 62% of all Litecoin addresses holding a balance belonged to the Long-Term Holder (LTH) cohort, indicating a dominant HODLing culture within the network.

LTC remains cold on the price charts

One potential explanation for the extended holding duration is the lackluster gains from the cryptocurrency since its purchase. At present, the coin was priced at $97 on the market, representing a significant decrease of 76% compared to its peak price of $412 in May 2021, as indicated by CoinMarketCap.

Instead, LTC‘s price in the current moment was lower than its value from earlier in 2022. This situation motivated LTC holders to be patient and wait for a price increase.

During the past month, LTC has been trading with minimal price movement, providing limited opportunities for gains or losses for traders.

Based on Coinglass’ data analyzed by AMBCrypto, approximately 13% of the investment in the speculative market has been lost since the beginning of this month.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-04-13 04:07