-

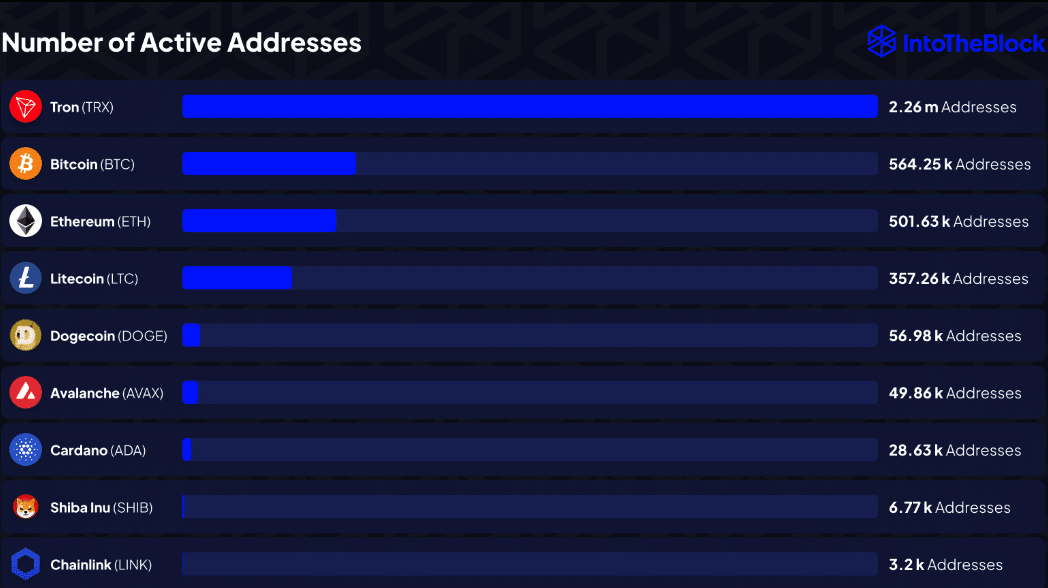

The difference in active addresses showed that transactions were higher with LTC.

ADA and LTC might target a rise to $0.79 and $95.37 in the mid-term.

As an experienced analyst, I have closely observed the cryptocurrency market and have come to notice some interesting trends between Cardano (ADA) and Litecoin (LTC). Based on recent data, it appears that Litecoin outperforms Cardano in terms of network activity.

The market capitalization of Cardano‘s ADA cryptocurrency is approximately $10 billion more than that of Litecoin‘s LTC. However, in terms of network activity, Cardano falls significantly short of Litecoin.

Based on IntoTheBlock’s report, there were approximately 357,260 active Litecoin addresses on May 31st. In contrast, the number of active Cardano addresses was relatively low, with only around 28,630.

It’s Litecoin over Cardano this time

Unique wallets represented by active addresses are the count of distinct entities engaged in confirmed transactions on a blockchain. It’s crucial to mention that each address is only considered once, regardless of the frequency of transactions conducted within a given timeframe.

The gap in activity indicates that Litecoin saw approximately 12 times more action than Cardano during that period. Although this isn’t always the case, heightened activity may serve as a precursor to price increases for a cryptocurrency.

At the moment of publication, Litecoin (LTC) was priced at $84.52, marking a 1.53% rise in value over the past 24 hours. In contrast, Cardano (ADA) stayed around $0.45 during this period, suggesting a flat trend for the token.

As a crypto investor, I’ve been keeping an eye on the price difference between Litecoin (LTC) and Cardano (ADA). I was curious to know if there had been any significant developments in the Litecoin project that might have caused this gap. After conducting some research through AMBCrypto, I haven’t found any major updates or announcements that would explain the current price disparity. Consequently, it appears that the market is valuing LTC higher than ADA at present.

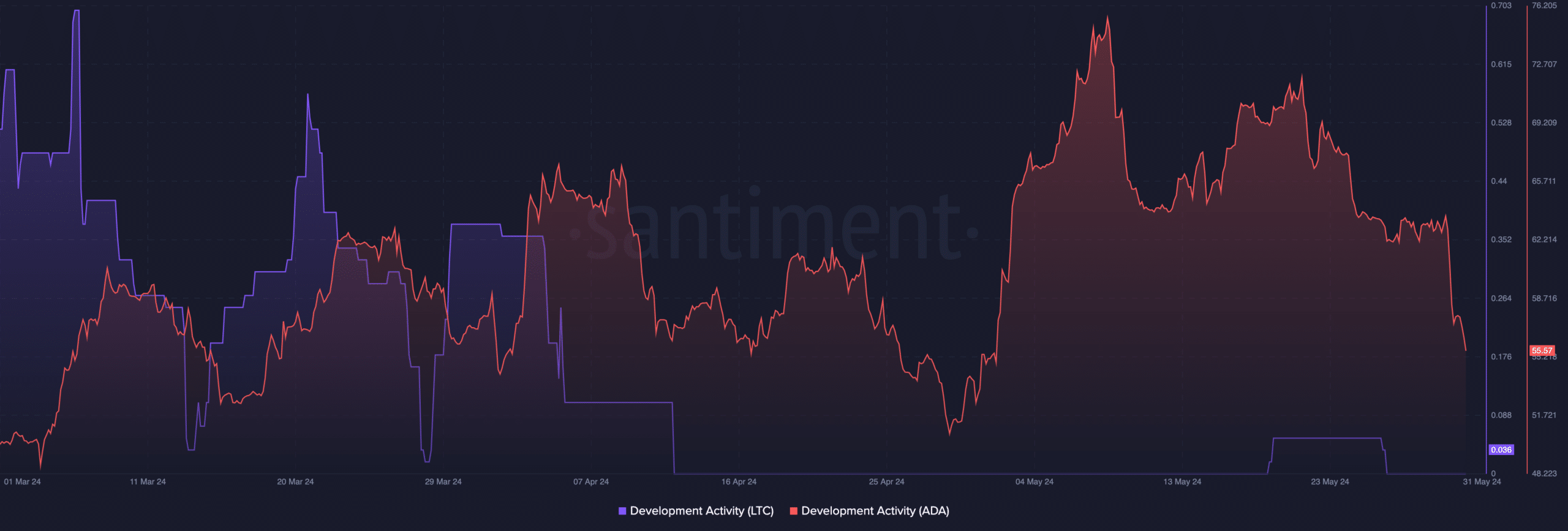

To determine if Litecoin surpassed Cardano across the board, let’s explore one aspect: development activity. In this specific domain, Cardano showed remarkable consistency.

At present, according to Santiment’s latest data, the development activity for the project has decreased to a level of 55.57. This figure signifies the level of dedication developers have towards maintaining the optimal performance of the blockchain.

In simpler terms, the number of code commits to Cardano’s network was decreasing, suggesting a decline in its overall health. Contrastingly, Litecoin saw no such trend with its active addresses.

ADA and LTC show promise

As of the current moment, the number of ongoing developments on the Litecoin network amounts to 0.036. In contrast, the publicly accessible repositories on GitHub for Cardano are quite substantial compared to Litecoin’s nearly insignificant presence.

As a researcher studying the relationship between various cryptocurrency metrics and their impact on prices, I’ve come to the observation that the margin between ADA and LTC does not typically influence their respective price trends. Consequently, a larger margin for ADA over LTC does not automatically guarantee better performance from the former.

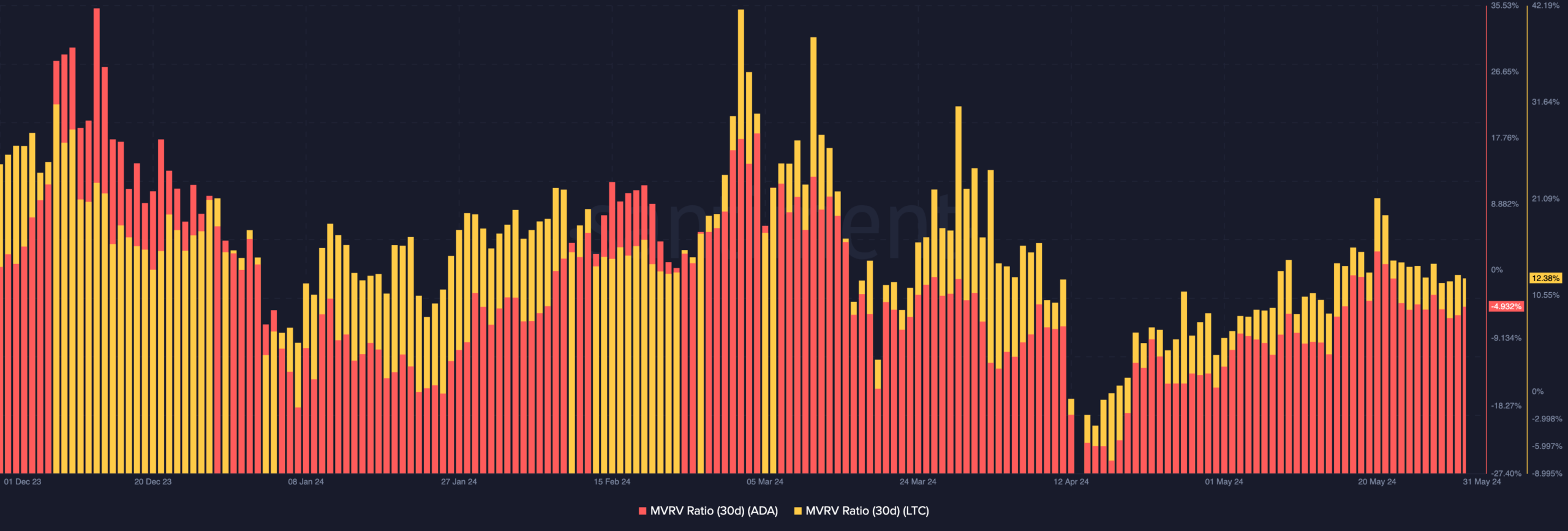

Regarding the price, AMBCrypto calculated the Market Value to Realized Value (MVRV) ratio to evaluate the profitability and value of a particular cryptocurrency.

As a Cardano investor, I’d observe that the 30-day MVRV ratio for our beloved cryptocurrency currently stands at a negative 4.932% at present market prices. This figure indicates that many ADA holders have been incurring unrealized losses over the past month.

In contrast, LTC‘s case stood out with a ratio of 12.38%, indicating a profitable position for an average LTC investor over the previous 30-day period.

Realistic or not, here’s LTC’s market cap in ADA terms

When it comes to valuation, both cryptocurrencies could be termed undervalued.

Should the market exhibit extreme bullishness once again, Cardano could potentially reach a price of $0.79. Likewise, Litecoin may have the potential to surge and touch $95.37 under such market conditions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-01 08:07