- LUNC’s social metrics surged, indicating a rise in popularity.

- Its burn rate also spiked in the last few days.

As a seasoned crypto investor with scars from countless market fluctuations etched onto my screen, I find myself intrigued by Terra Classic [LUNC]. Its recent surge in popularity and price is reminiscent of a rollercoaster ride that I’ve been on many times before.

Similar to many other cryptocurrencies, Terra Classic (LUNC) experienced a boost in value with its price climbing by double-digit percentages. Notably, an intriguing turn of events occurred that could potentially drive the token’s price even higher.

Therefore, AMBCrypto checked Terra Classic’s on-chain data to find out what to expect.

Terra Classic is breaking out

According to information from CoinMarketCap, the price of LUNC rose significantly last week due to strong buying activity, with an increase of more than 18%. This upward trend persisted in the past day, causing the token’s worth to climb further by over 6%.

Currently, LUNC is being exchanged at approximately $0.00009981 per coin, and its market value surpasses half a billion dollars ($544 million), placing it as the 130th largest cryptocurrency. This price increase has noticeably affected the token’s social media metrics.

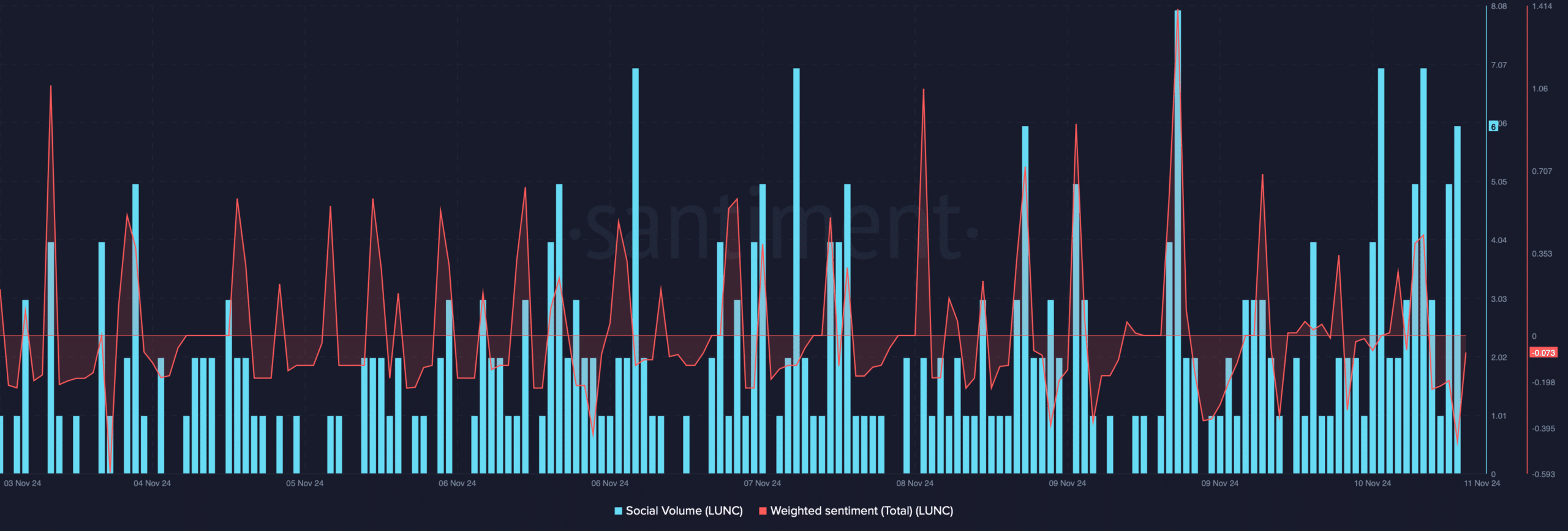

According to our assessment using Santiment’s data, the social activity surrounding LUNC has grown significantly, indicating an uptick in its popularity. Yet, following a steep increase, the sentiment toward Terra Classic (LUNC) has noticeably decreased.

This indicates an increase in pessimistic views towards the asset, potentially leading to a drop in its value.

It was noted by AMBCrypto that the burn rate for LUNC significantly escalated over the past few days, with a particularly notable surge occurring on November 6th.

Typically, an increase in burn rate suggests a deflationary asset. This is because when the burn rate goes up, it reduces the total supply available on the market. As a result, this potential reduction in supply could lead to an increase in the asset’s price over time.

What to expect from LUNC

Later on, we examined additional data sets to gain a clearer perspective on the potential outcomes of LUNC as its burn rate accelerated.

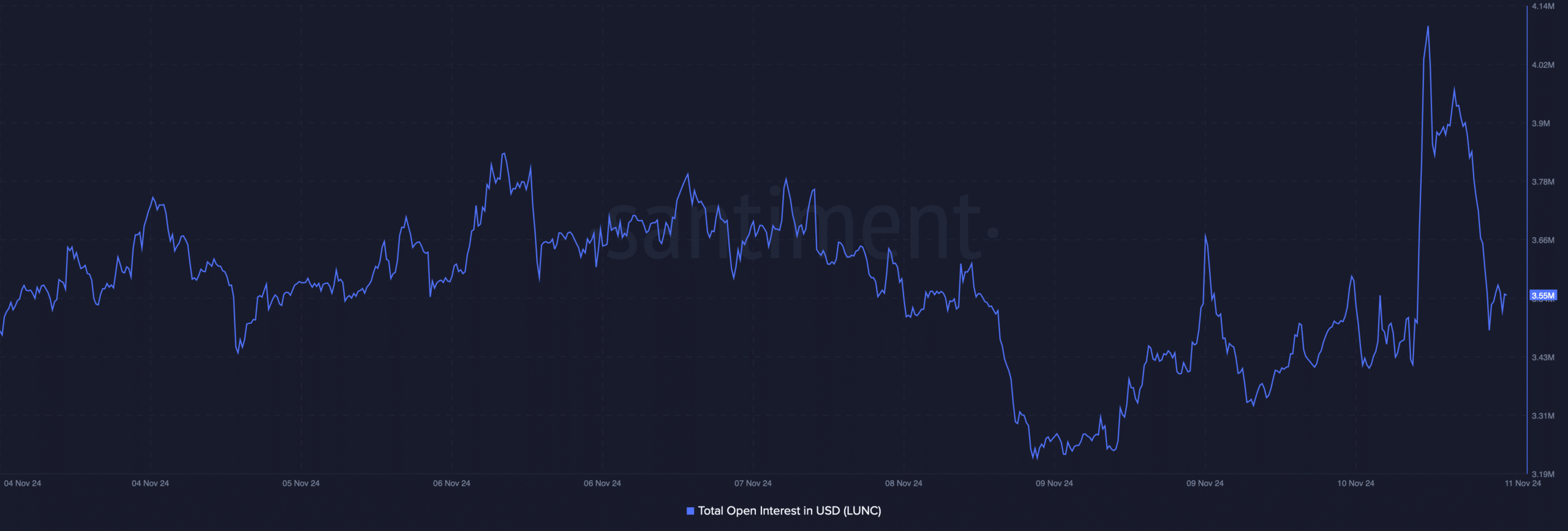

According to AMBCrypto’s interpretation of Santiment’s findings, there was a significant decrease in open positions for LUNC following a substantial increase observed on November 10th.

This meant that the chances of the ongoing price trend changing were high.

Despite some lingering uncertainties, there were still points in Terra Classic’s favor. For example, a review by AMBCrypto using Coinglass data showed that the long/short ratio for Terra Classic had increased.

It appears that there were more buyers (long positions) than sellers (short positions), indicating a potentially positive or bullish outlook for the market.

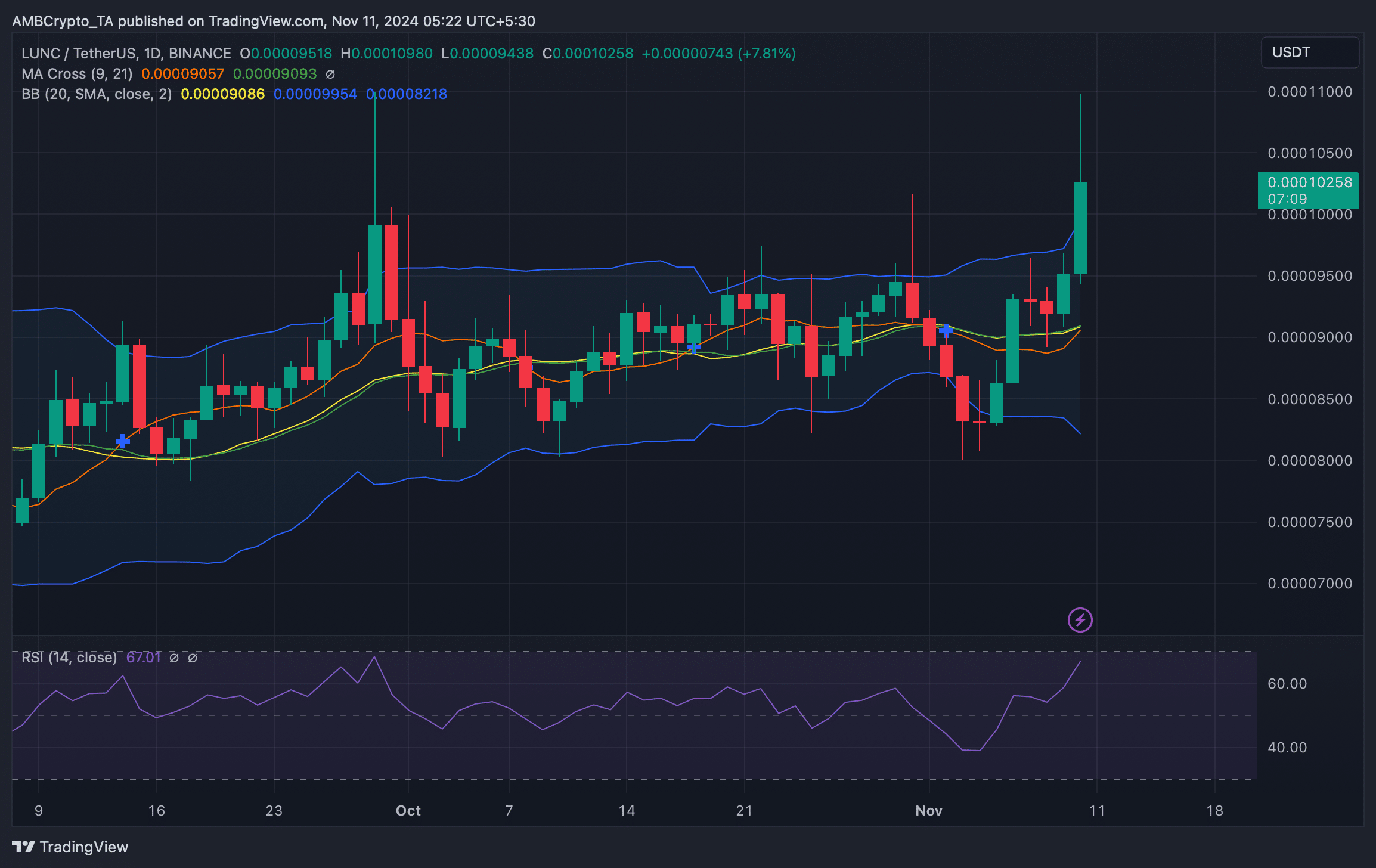

After examining LUNC’s daily graph, we noticed an uptick in the Relative Strength Index (RSI), suggesting increased capital inflows.

Is your portfolio green? Check the LUNC Profit Calculator

Whenever that happens, it suggests a possibility of a continued price rise.

From my perspective as an analyst, when the price of Terra Classic surpassed the upper boundary of the Bollinger Bands, it hinted at a potential for a price adjustment. In other words, while it’s not definitive, there’s certainly a possibility that we might see a correction in its price.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-11-11 08:07