- Notcoin bears dominated the market as the altcoin fell below its 20 and 50 EMA on its 4-hour chart.

- The altcoin’s Open Interest and long/short ratio reaffirmed bearish sentiment.

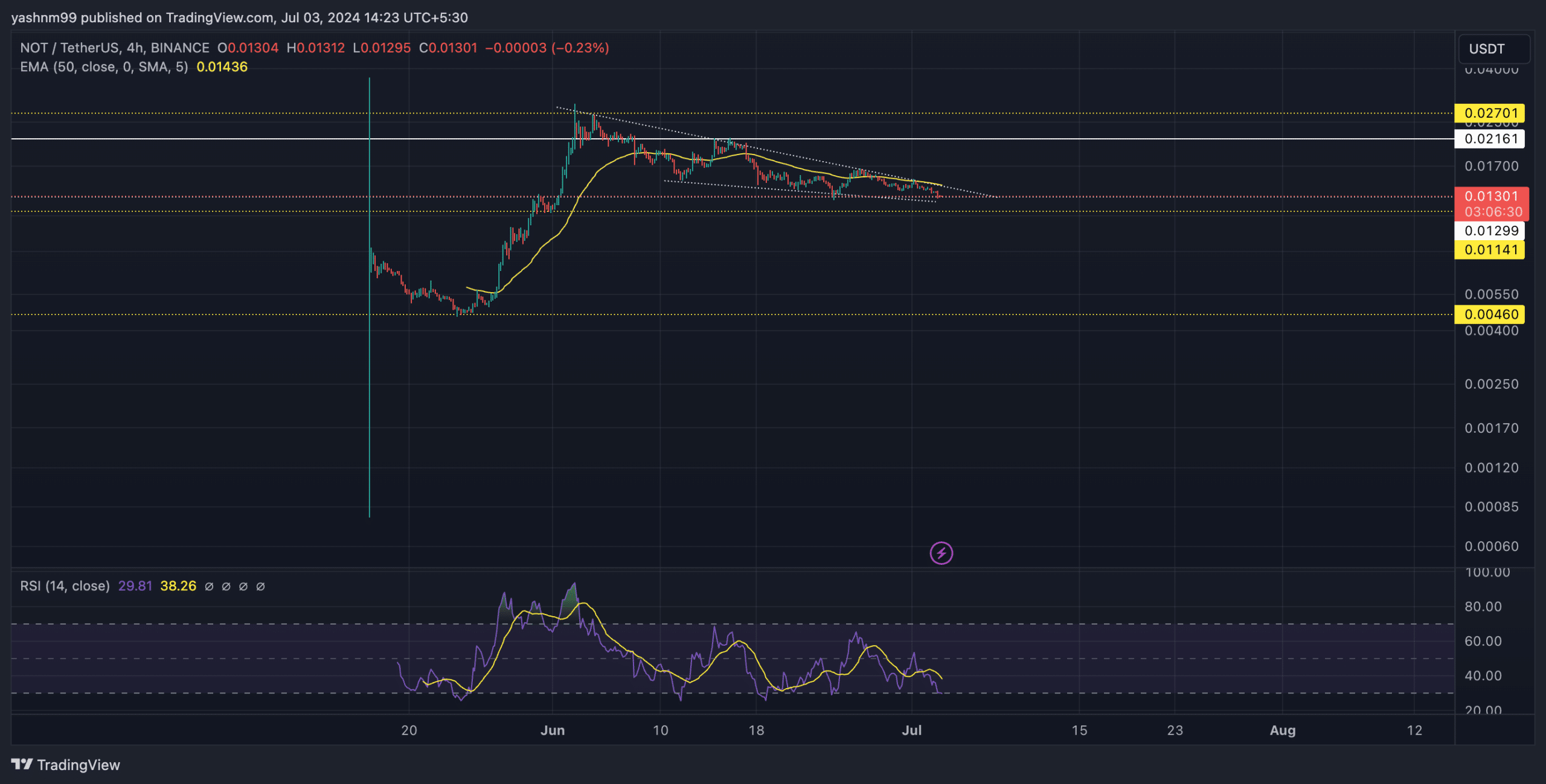

As a seasoned crypto investor with several years of experience under my belt, I’ve seen the market ebb and flow through numerous bull and bear cycles. The recent downturn in Notcoin [NOT] has left me feeling cautious, especially after witnessing its price plummet below its 20 and 50 EMA on the 4-hour chart.

In simpler terms, Notcoin experienced a significant drop in value within the past few hours, dipping below its 20 and 50 moving averages on the chart. This decline was driven by increased selling pressure, causing Notcoin to reverse course from attempting to break through the resistance level of 0.02.

If the purchasers return and defend the $0.129 mark as a floor price, Notcoin might experience a bullish turnaround in the immediate future. Currently, Notcoin’s price hovers around this support level.

Notcoin’s recent reversal formed a falling wedge

As a researcher studying the price movements of NOT, I have observed that following its rebound from the $0.004 support level in May, the altcoin has been on an upward trajectory. This uptrend became particularly notable when NOT surpassed the all-time high (ATH) of 0.029 on June 2, representing a gain of over 470% from its previous bounce.

As an analyst, I’ve observed an impressive surge in Notcoin’s price action, marked by a succession of upward candlesticks indicating a rally. However, this bullish momentum took a turn when Notcoin encountered resistance at the $0.027 level, leading to a prolonged downtrend lasting over a month.

The price trend continued to decline significantly, reaching the $0.11-$0.12 support zone on the chart. The moving averages (20 and 50) on the 4-hour timeframe indicated that the altcoin had dropped below them, suggesting a strong bearish momentum.

During this period, the price trend didn’t follow the typical falling wedge formation on the chart. It’s important to mention that before this pattern emerged, there was a significant upward trend. This preceding uptrend can be indicative of an upcoming bullish reversal.

The appearance of a death cross between the 20-day and 50-day exponential moving averages may hinder an immediate price recovery. It is recommended that investors exercise patience and look for a bullish confirmation through a close above the current falling wedge pattern before considering entering long positions to capitalize on potential uptrends.

If the price reaches a possible peak above its current trend, buyers may have an opportunity to evaluate the $0.02 mark within the next few weeks. Conversely, if there is a prolonged close below the $0.129 mark, NOT‘s near-term outlook could shift toward a downtrend.

Here, the bears would aim to retest the $0.0114 mark.

As a crypto investor, I closely monitor the Relative Strength Index (RSI) to gauge market momentum. When the RSI dips into the bearish zone, falling below its moving average line, it’s a sign of potential selling pressure. However, if there’s a subsequent rebound from this overbought position, it could be an early indication of a bullish reversal trend, adding confidence to my bullish outlook.

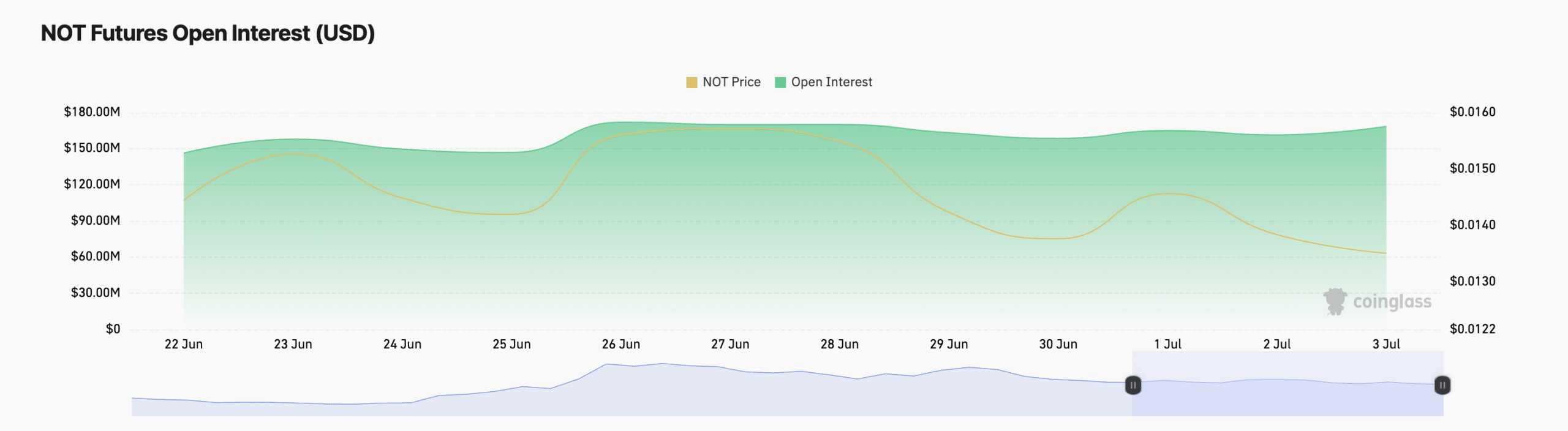

Open Interest declining

The sellers held a more advantageous Open Interest status, as indicated by a approximately 5% decrease in Open Interest for NOT on all exchanges within the previous day.

Realistic or not, here’s NOT’s market cap in BTC’s terms

This decline also coincided with the 24-hour price decrease of nearly 6%.

Additionally, the 24-hour ratio of long to short contracts on Coinglass was approximately 0.88. This implied that there were slightly more short contracts than long contracts held, strengthening the bearish outlook.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION/USD

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP/CAD

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-07-04 01:12