- Binance Coin retested a key support level at $593

- Metrics seemed to point to a potential price surge on the charts

As an experienced analyst, I believe that Binance Coin (BNB) is currently at a pivotal point in its market cycle. Based on the charts, the altcoin retested a key support level at $593 after a potential price surge that saw it hit all-time highs. The metrics suggest that bullish momentum may return to BNB’s market soon.

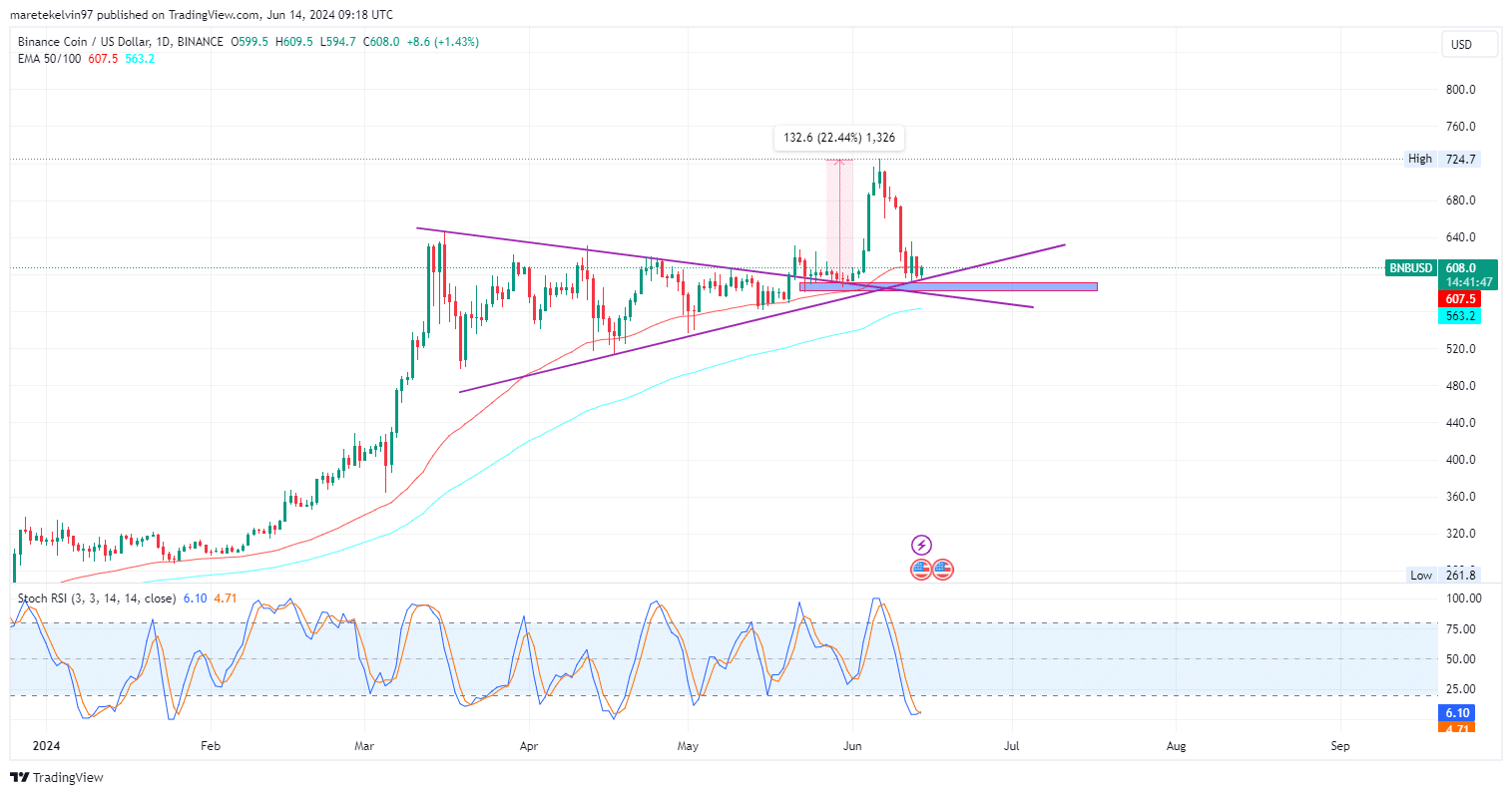

The price of Binance Coin (BNB) had been confined within a symmetrical triangle pattern since March 31. After breaking out of this triangle on May 24, BNB soared by an impressive 22.44%, reaching its peak. However, following this surge, the price retreated and approached the significant support level of $593. This pullback raises questions about when the bullish trend for Binance Coin may resume.

At the time of writing, the crypto was valued at over $608, down almost 15% from its latest ATH.

The market value of Binance Coin (BNB) was almost at its all-time high of approximately $90 billion, but its price chart showed that the 50-day and 100-day exponential moving averages hovered near the $607.5 and $563.2 support levels respectively.

Taking a closer look at the altcoin’s charts is advisable with a note of caution. While Binance Coin (BNB) hovers above its support levels, the altcoin’s technical indicators could provide valuable insights. For example, the Stochastic RSI, which stands at 6.10, suggests that BNB might be oversold and could experience a price reversal before any notable price increases.

Will whale activity, social volume accelerate the surge?

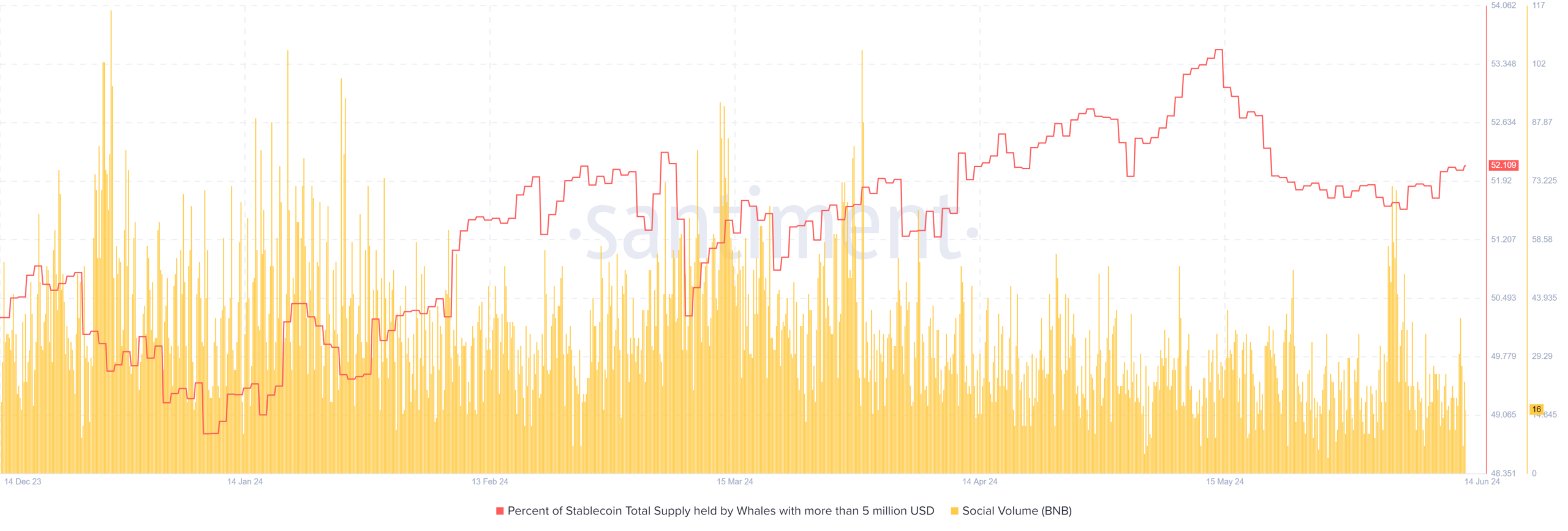

Based on AMBCrypto’s analysis using Santiment, there’s a rising trend in the proportion of stablecoins owned by wealthy investors with over $5 million in their holdings. This signifies that these significant investors are preparing for a possible upcoming bull market.

An alternate expression could be: Furthermore, social buzz around BNB noticeably increased in tandem with growing market attention.

In simpler terms, the connection between an increase in social media chatter and price fluctuations in the market underscores its optimistic outlook. An elevated volume of mentions often foreshadows substantial price changes, be they favorable or unfavorable.

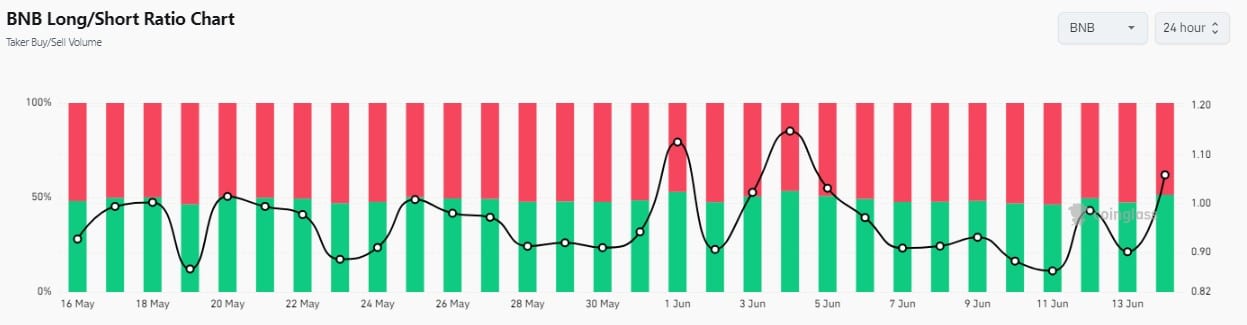

As a crypto investor, I closely follow the market trends and recent analysis by AMBCrypto caught my attention. They delved deeper into the long/short ratio data from Coinglass, revealing some intriguing findings. Lately, this metric has shown several bullish spikes. This means that the number of long positions (betting on a price increase) is outpacing the short positions (betting on a price decrease). These trends suggest optimism among investors, indicating potential for further upward momentum in the market.

The price of Binance Coin is currently significant. With mounting bullish sentiment, fueled by rising social media chatter and increasing whale transactions, there’s a strong possibility that Binance Coin could soon experience a substantial price increase.

If BNB gathers sufficient downward pressure and finishes its trading below the resistance area, a potential price decline could follow.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- EPCOT Ceiling Collapses Over Soarin’ Queue After Recent Sewage Leak

- Heartstopper Season 4 Renewal Uncertain, But Creator Remains Optimistic

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- Daredevil: Born Again’s Shocking Release Schedule Revealed!

- BNB PREDICTION. BNB cryptocurrency

- Gene Hackman and Wife Betsy Arakawa’s Shocking Causes of Death Revealed

- The White Lotus Season 3: Shocking Twists and a Fourth Season Confirmed!

- Microsoft Stands Firm on Gulf of Mexico Name Amid Mapping Controversy

2024-06-15 07:03