Pray, allow me to impart a most intriguing development: since the revelation of the U.S. Producer Price Index (PPI), the once-steadfast belief in the Federal Reserve’s rate-cutting proclivities has been somewhat… ruffled. 🌬️

September’s Cut: A Certainty No More, Thanks to PPI’s Mischief

The PPI, that mischievous rogue, has delivered a report hotter than a summer’s day in Bath, casting a shadow of doubt upon the equation. Though traders still cling to their hopes of a rate cut on the 17th of September, 2025, the CME Fedwatch data reveals a most unwelcome truth: it is no longer the assured affair it once appeared. 🕵️♀️

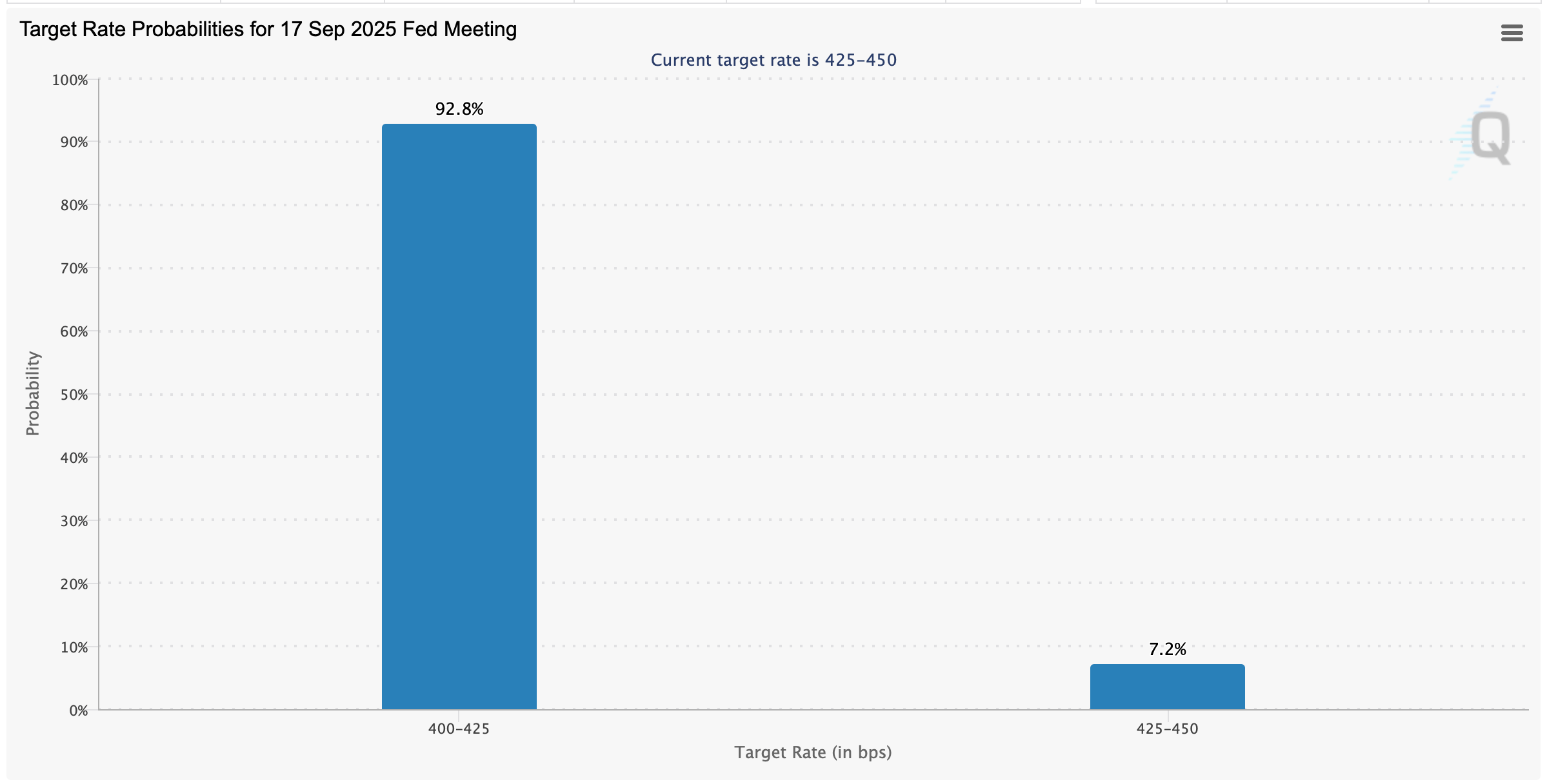

Fedwatch, that ever-watchful sentinel, now places a 92.8% probability upon the target range descending to 4.00%-4.25%, a modest decline from its current perch of 4.25%-4.50%. Before PPI’s dramatic entrance, this probability stood above 96%, as firm as a Darcy at a ball. Yet, 7.2% of traders now anticipate the Fed to remain steadfast, unmoved by the clamor. In essence, the market leans toward a cut, yet a whisper of doubt has crept into the parlors of finance. 🧐

Kalshi traders, those astute observers, are nearly unanimous in their conviction that the Fed funds rate shall remain above 3% in September, maintaining odds of 97% or higher for every level up to 3.75%. Yet, at 4%, their confidence wavers ever so slightly, though still assigning a 96% chance. Beyond 4.25%, the odds plummet to 21%, a clear indication that a cut is anticipated, albeit with a touch of trepidation. This, too, shifted with the inflation report’s grand reveal. 🧮

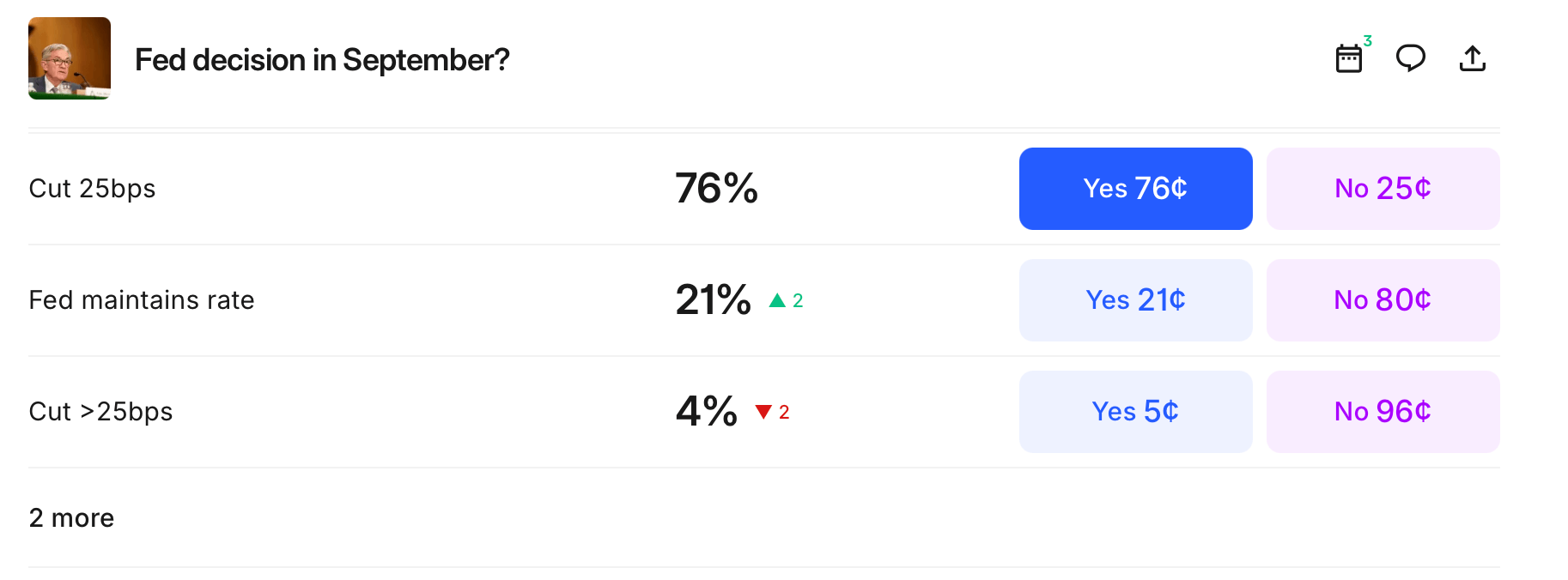

In another market, the Kalshi traders favor a modest cut at September’s meeting, with 76% wagering on a 25-basis-point (bps) trim. The odds of the Fed holding steady have risen to 21%, while a mere 4% envision a larger cut as plausible. In short, the market’s purse is firmly on a small but significant reduction, with grander moves deemed as likely as Mr. Collins proposing to Elizabeth Bennet. 💼

Polymarket traders, too, are firmly behind a quarter-point cut, assigning it a 72% chance, despite a minor dip in their usual aplomb. A 50-basis-point cut lingers at a mere 5%, while the odds of no change have ascended to 23%. A hike, you say? Virtually no one entertains such a notion, with a 25+ basis-point increase at a paltry 1%. The moral of this tale: markets expect a trim, but nothing beyond 25 bps shall do. ✂️

Yet, let us not forget that the odds on both Kalshi and Polymarket were once far more robust. These shifting probabilities reflect a market grappling with fresh inflation signals, recalibrating expectations with the alacrity of a Bennet sister at a dance. While confidence in a modest September cut remains high, the cracks in the consensus hint at a more cautious outlook. Traders, ever vigilant, brace for surprises, knowing full well that one unexpected datum could upend the entire rate-cut narrative in the blink of an eye. 🌀

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Goat 2 Release Date Estimate, News & Updates

- Felicia Day reveals The Guild movie update, as musical version lands in London

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 10 Movies That Were Secretly Sequels

- Best Thanos Comics (September 2025)

2025-08-15 19:52