The fight for control of Paramount and Warner Bros. Discovery is reaching a critical point, and Warner Bros. Discovery is making it clear: potential buyers need to make a move quickly or risk losing out.

Warner Bros. Discovery is moving up the date for a shareholder vote on Netflix’s $72 billion deal to buy its Warner Bros. studio and HBO Max, according to The New York Post. This gives Paramount Skydance, headed by David Ellison and supported by RedBird Capital, much less time to make a better offer.

Inside WBD, patience is reportedly wearing thin.

“Time to put up or shut up,” is how one source close to the company summarized the situation.

WBD’s Netflix Vote Changes the Entire Playing Field

Warner Bros. Discovery updated a filing with the Securities and Exchange Commission on Monday, suggesting that regulators will likely approve a shareholder vote soon. If the vote is approved, it’s expected to happen later this month or in early March.

That procedural step dramatically raises the pressure on Paramount Skydance.

According to a Warner Bros. Discovery executive who spoke with The New York Post, the company has roughly two weeks to submit another offer – which would be their eighth – given the current situation.

This vote isn’t about choosing between Netflix and Paramount. It’s a simple yes or no on whether shareholders accept Netflix’s offer to buy the company.

The executive clarified that the vote on the proxy will essentially decide whether Netflix is allowed to acquire Warner Bros. Discovery. It won’t be a decision between Paramount and Netflix unless a new offer from Paramount emerges.

That distinction matters — a lot.

Why Paramount’s Current Offer Isn’t Enough

As a movie buff, I’ve been following the potential Warner Bros. Discovery deal closely. Right now, Paramount and Skydance are offering around $78 billion for the company – that works out to about $30 a share. Honestly, looking at the numbers, that seems better than the all-cash offer Netflix put on the table, which was $27.75 a share.

But WBD’s board sees it differently.

Netflix is offering a straightforward, certain, and quick deal. Paramount’s offer, however, depends on selling off other assets – specifically Warner Bros. Discovery’s cable channels like CNN, TNT, and Discovery – to make up the difference in price. The future value of those channels is uncertain.

According to a Warner Bros. Discovery insider, if a better offer doesn’t emerge, Netflix is likely to acquire the company, as shareholders would be unwilling to turn down a firm offer of $27.75 per share.

In other words, certainty beats theoretical upside.

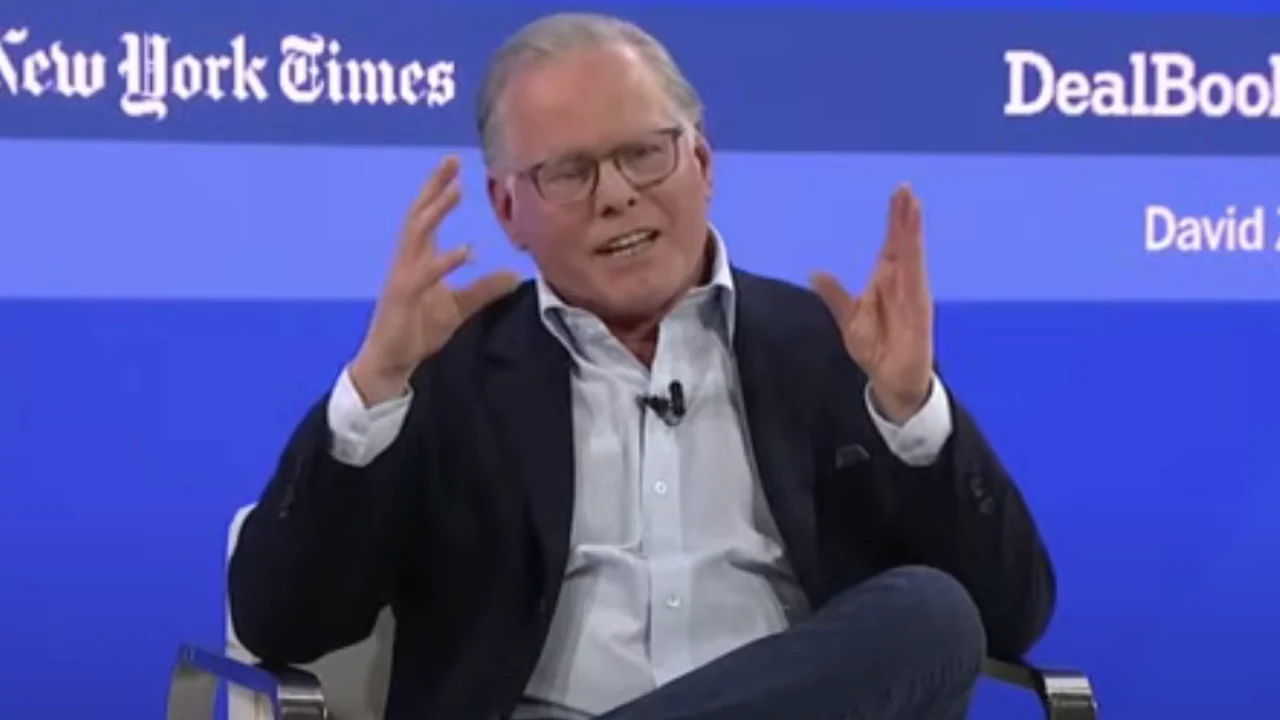

Zaslav Drives a Harder Bargain

David Zaslav, the CEO of Warner Bros. Discovery, is apparently seeking a more favorable agreement from Paramount, possibly an additional $4 per share. This is on top of already agreeing to pay a $2.8 billion penalty to Netflix if the deal falls through.

Zaslav is also demanding something else: personal financial backing from Larry Ellison.

According to sources at the Post, David Zaslav is asking Larry Ellison to personally guarantee a large amount of debt – potentially tens of billions of dollars – to help fund the acquisition. This is similar to the $40 billion guarantee Ellison already provided to support his son’s offer.

That demand comes at an awkward moment.

Larry Ellison’s wealth, though still incredibly large, has reportedly dropped almost $200 billion recently because of how Oracle’s stock has been performing. Although Paramount and Skydance say this hasn’t impacted their talks, people familiar with the situation think it’s a key reason why the deal is moving slowly.

Regulatory Scrutiny Still Looms Large

Meanwhile, Netflix’s deal is far from rubber-stamped.

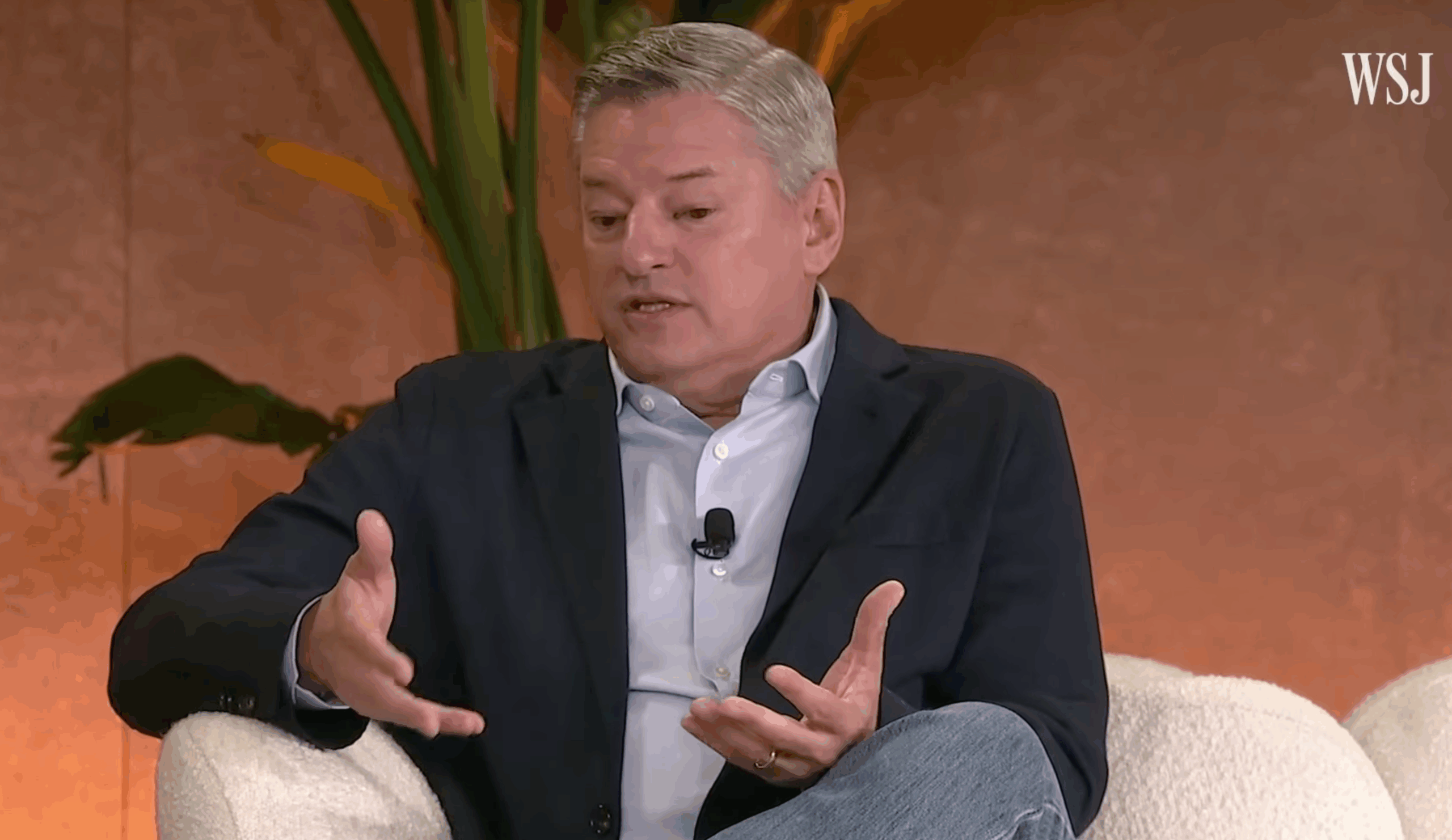

The planned merger of Netflix, the leading streaming service, with HBO Max, currently the third-largest, is raising concerns about fair competition in the U.S., U.K., and European Union. Netflix leaders are now in discussions with regulators and will be answering questions at a Senate hearing led by Senator Mike Lee.

Lee has already flagged the deal as raising “a lot of antitrust red flags.”

Netflix’s Ted Sarandos and a representative from Warner Bros. Discovery are both scheduled to give testimony.

Despite potential hurdles, Warner Bros. Discovery seems certain they’ll get regulatory approval, so they’re pushing Paramount to act now rather than delay.

Paramount WBD: Final Countdown

The long and complicated situation between Paramount and Warner Bros. Discovery has been unfolding publicly for months, filled with rumors, competing deals, and strategic financial maneuvering. However, a recent update to official filings has completely shifted the landscape.

If Paramount Skydance is serious about acquiring Warner Bros. Discovery, it needs to demonstrate its commitment with concrete financial offers and solid assurances, without any more ambiguity.

If not, investors might simply take their money from Netflix and invest elsewhere. Recent comments from people within Warner Bros. Discovery suggest this is becoming increasingly probable.

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Resident Evil Requiem cast: Full list of voice actors

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- Best Shazam Comics (Updated: September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- PS5, PS4’s Vengeance Edition Helps Shin Megami Tensei 5 Reach 2 Million Sales

- American Dad Drops First Look at 2026 Return to Fox: Watch the Trailer

2026-02-03 16:58