-

Pepe in profit drops below 400 trillion.

PEPE has declined by over 9% in the last 48 hours.

Pepe [PEPE] was experiencing significant growth a few weeks ago, but it was now losing steam.

URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

Will the euro survive the next Trump move? Find out the latest analysis now!

View Urgent ForecastThe profit from its sales has been dwindling over the past few weeks, and some crucial indicators suggest a sluggish market that might lead to an upcoming revival.

More Pepe goes underwater

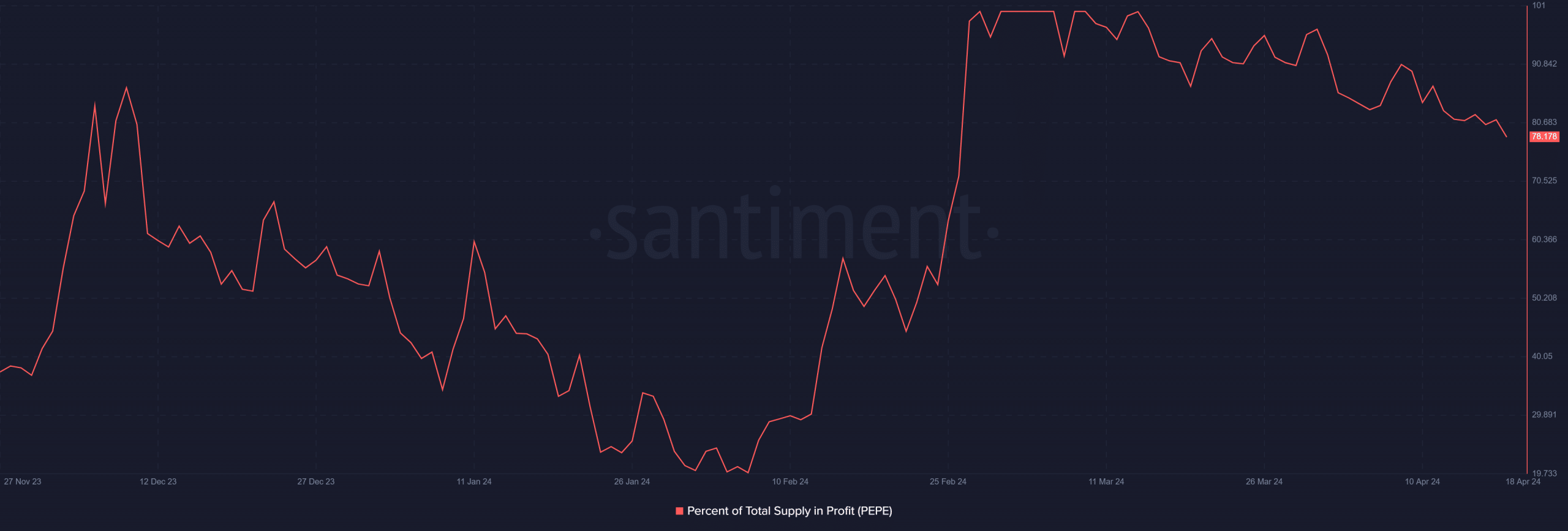

In February, there was a substantial jump in Pepe’s supply generating profits, rising from about 19% to a stunning 100%. This remarkable growth resulted in an increase in the total profitable supply from roughly 84 trillion units to over 420 trillion units.

Starting in March, the supply generating profits dropped significantly, down to approximately 96%, which equates to about 409 trillion dollars.

The downturn continues, causing the amount of PEPE in profit to decrease. Currently, about 78% or around 330 trillion units are in profit.

Enough volume and active addresses for PEPE?

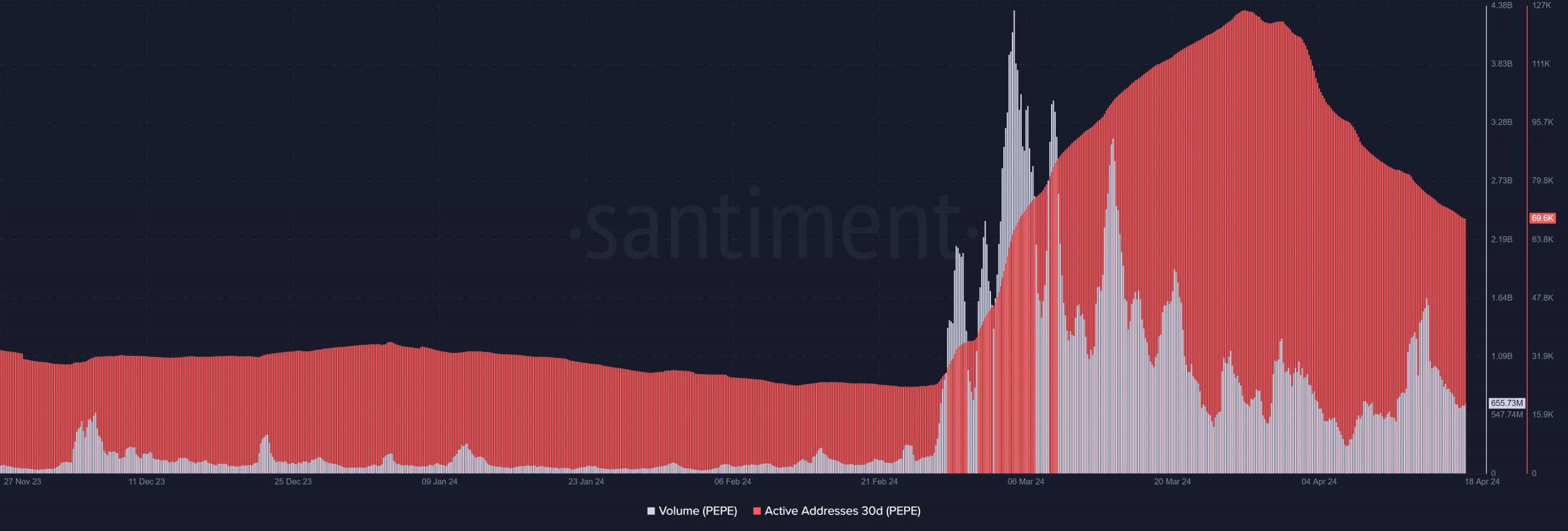

Approximately four weeks ago, there was a noticeable surge in the number of Pepe’s daily active addresses, rising from roughly 24,000 to more than 126,000.

The number stayed above 10,000 until the beginning of April, but then it started to drop.

Starting from early April, there has been a significant decrease in the number of active cryptocurrency addresses, which was around 69,000 when the article was published.

Additionally, Pepe’s volume saw a significant decrease in recent weeks.

Between February 28th and March 15th, the volume reached its highest point and exceeded $1 billion on the 13th and 14th of April. However, the volume has decreased since then.

Currently, the market value is approximately $650 million according to my present research. However, the experts propose that increased action is necessary to boost the price further.

Consequently, the supply in profit is likely to continue dropping, at least for now.

Read Pepe’s [PEPE] Price Prediction 2024-25

PEPE close to flipping support

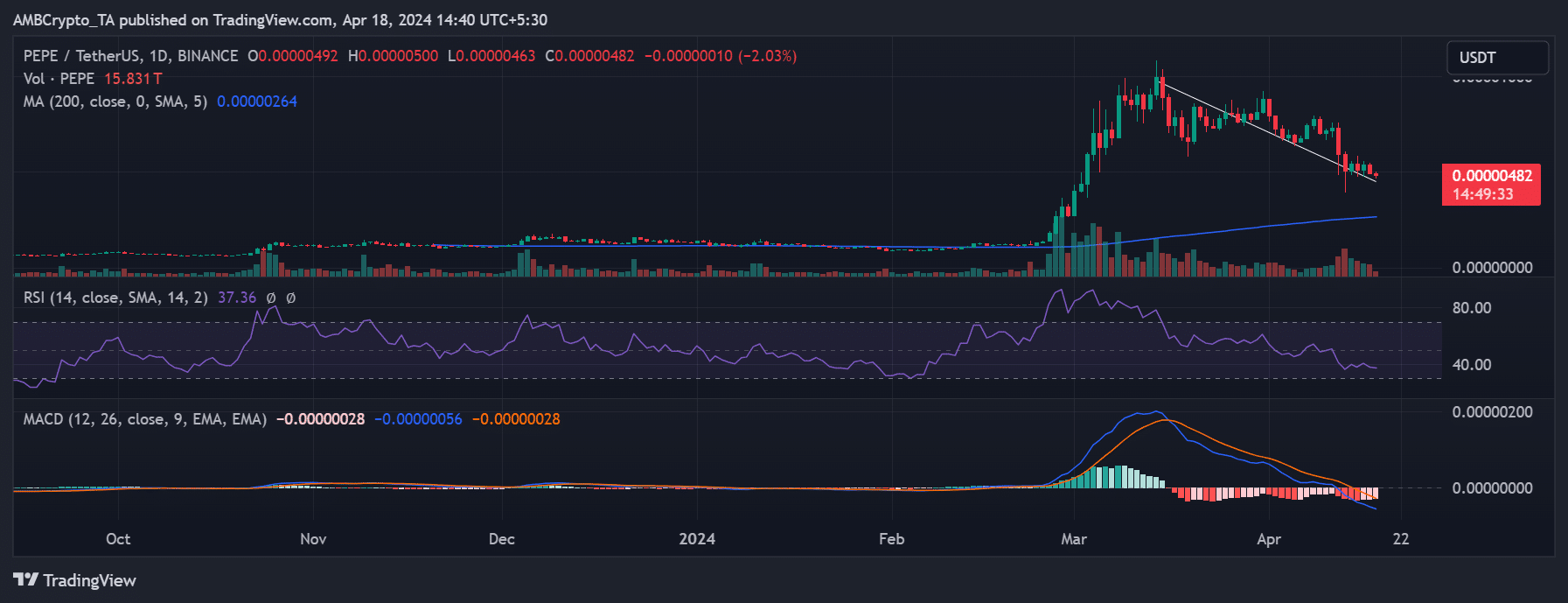

On Pepe’s daily chart, there have been noticeable price drops in the last week. By the close of business on April 17th, the price had fallen more than 8% compared to the beginning of that period.

The graph shows that as the downtrend continues, the trendline now functions as a support level for Pepe, which was priced at approximately $0.0000048 with a decline of over 1.6% when this was written.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-04-18 21:12