- PEPE could still be discounted now that this is its first major rally, especially based on Dogecoin’s past performance

- HODLers have been accumulating , but whales still contributed to sell pressure

As a seasoned analyst with over two decades of experience observing the dynamic world of cryptocurrencies, I find myself intrigued by the enigma that is PEPE. Having witnessed Dogecoin’s meteoric rise and subsequent consolidation phases, I can’t help but draw parallels between the two memecoins.

In my humble opinion, while PEPE has indeed shown remarkable growth, it may still have untapped potential in this bull market. The recent bounce back at key Fibonacci levels and the significant decrease in its current price compared to the December ATH are strong indicators of a coin that might still be discounted.

However, I must stress that investors should approach PEPE with caution. Whales continue to exert pressure on the sell side, which could limit bullish momentum in the short term. Yet, the resurgence in HODLers and cruisers, coupled with a decline in short-term traders, suggests a renewed optimism among PEPE enthusiasts.

In essence, PEPE could be a coin worth considering for those looking to capitalize on the memecoin segment’s potential growth. But remember, investing in cryptocurrencies is like dancing on a volcano – it’s exciting, but don’t forget to watch out for lava!

As a researcher delving into the world of cryptocurrencies, I often ponder whether it’s wise to include PEPE in my investment portfolio or if its potential upside has already been realized by 2025. This is a question that crosses the minds of many crypto investors yearning for memecoin diversification.

Indeed, PEPE has already soared an incredible 4300% from its all-time lows to its peak in December. This impressive growth seems to indicate that there could be a relatively small unrealized potential for further growth during the upcoming phase of the bull market.

Nevertheless, it’s possible that this isn’t true when considering the significant advancements made by Dogecoin, the reigning meme coin in its initial major bull market surge.

As someone who has been closely following the cryptocurrency market for several years now, I have seen many coins skyrocket in value only to eventually plummet just as quickly. However, I must admit that Dogecoin’s (DOGE) performance between 2020 and 2021 was nothing short of astonishing. With gains of over 13,000%, it set a new standard for meme-based coins like Pepe (PEPE).

Based on this past success, I believe that PEPE could potentially have an even higher ceiling from its current price level. However, as with any investment in the cryptocurrency market, it’s essential to approach it with caution and a healthy dose of skepticism.

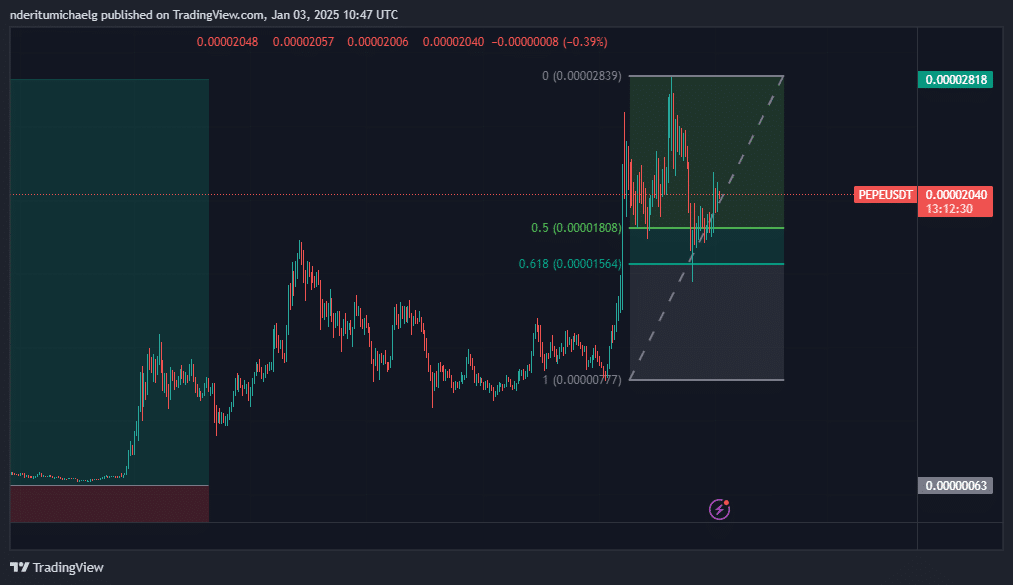

Recently, I noticed that PEPE bounced back at a critical Fibonacci level (0.5 and 0.618 from November low to December peak) on its charts. This could be an indication that the coin is poised for further growth in the short term. That being said, it’s important to remember that past performance does not guarantee future results, and the cryptocurrency market can be highly volatile.

Overall, I would encourage anyone considering investing in PEPE or any other cryptocurrency to do their due diligence, research the underlying technology and team behind the coin, and make informed decisions based on their own risk tolerance and investment goals.

Currently, as I’m typing this, PEPE appears to be around 27% below its December peak, priced at approximately $0.00002028.

Are investors still interested in PEPE?

Despite facing selling pressure in December, it’s noteworthy that the memecoin maintained a substantial portion of the profits made in November. This suggests that many investors remain hopeful regarding its potential growth by 2025.

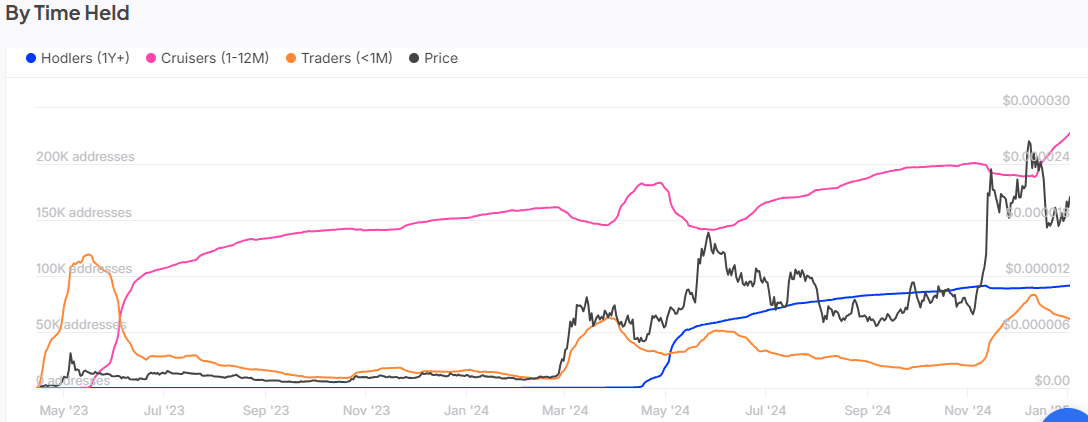

Initially, the number of long-term HODLers (those who hold cryptocurrency for a long time) peaked at around 91,210 addresses before mid-November. However, there was a noticeable drop in these numbers in December, suggesting that many HODLers may have cashed out their profits.

Nevertheless, the number has grown again, reaching a total of 91,490 HODLer addresses as of January 3, 2025.

Since December 12th, there has been a substantial increase in the number of swing traders (cruisers). This rise indicates a significant accumulation as the price dropped. On December 12th, there were 188,650 addresses for these traders, but by January 3rd, that number had grown to 225,950. It’s possible that this increase played a significant role in the recent rise of the price levels.

In the meantime, there was a decrease in the number of short-term traders, from approximately 82,060 addresses on December 10th to about 61,450 addresses currently – This suggests a move towards shorter trading durations compared to longer ones.

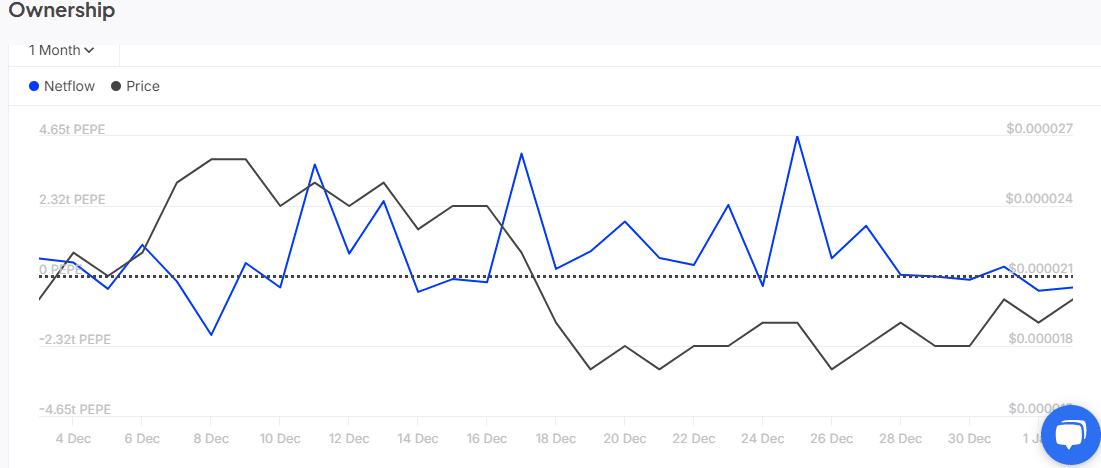

Currently, although these findings might appear favorable, it’s important to remember that whales are primarily concentrating on immediate gains. This is evident when considering the massive outflow of holdings, which amounted to $377.4 billion in PEPE on January 2nd – a clear indication that these large investors have been offloading their assets.

The sell pressure from whales may limit PEPE bulls in the short term.

Although it’s important to note that the memecoin could potentially rise more in the upcoming months, it depends on whether large investors (whales) and institutions show interest in it.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Silver Rate Forecast

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2025-01-04 00:08