-

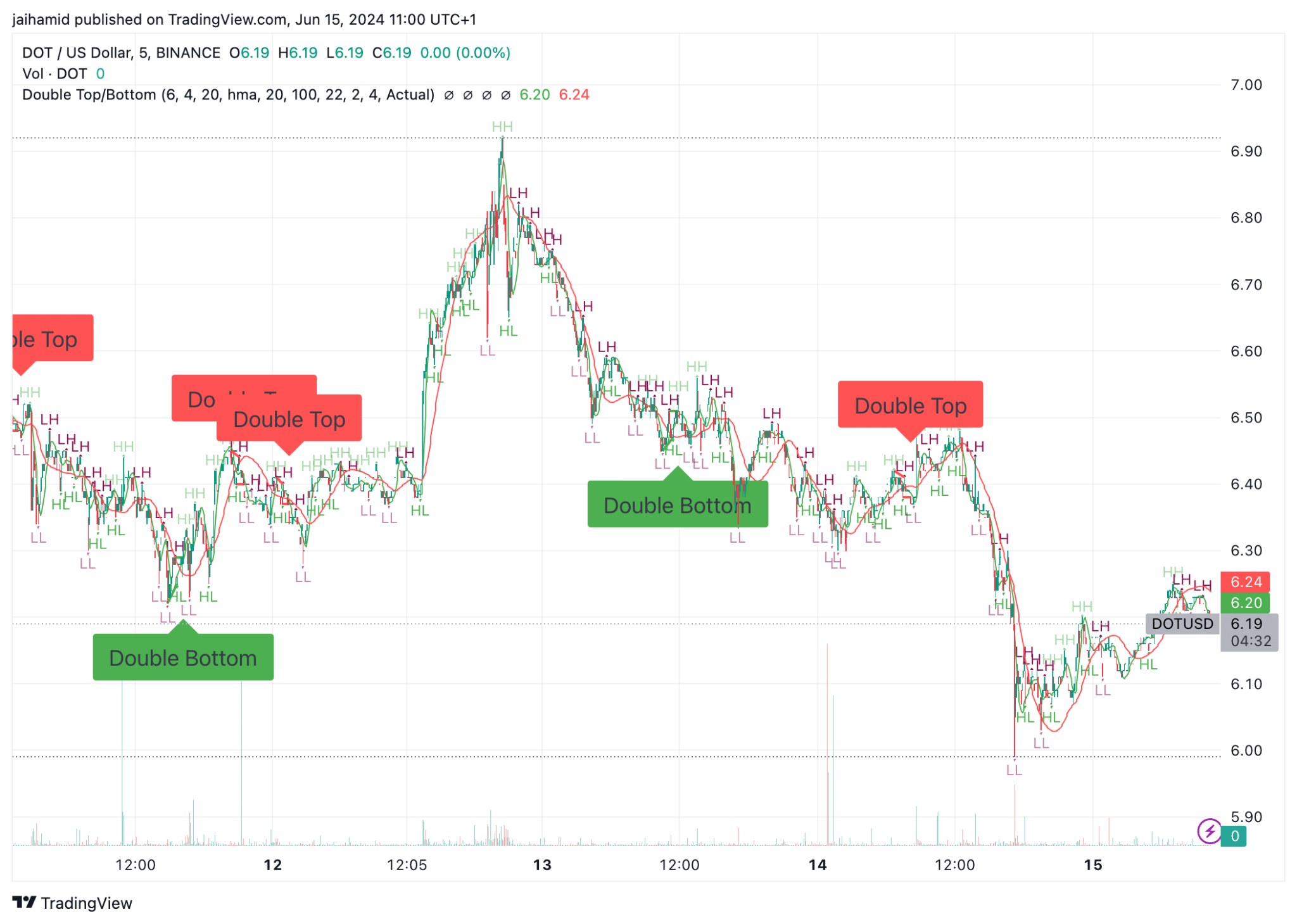

DOT seemed unable to break through the key $7 resistance

Ichimoku Cloud and its alignment with the double-top pattern signaled further declines

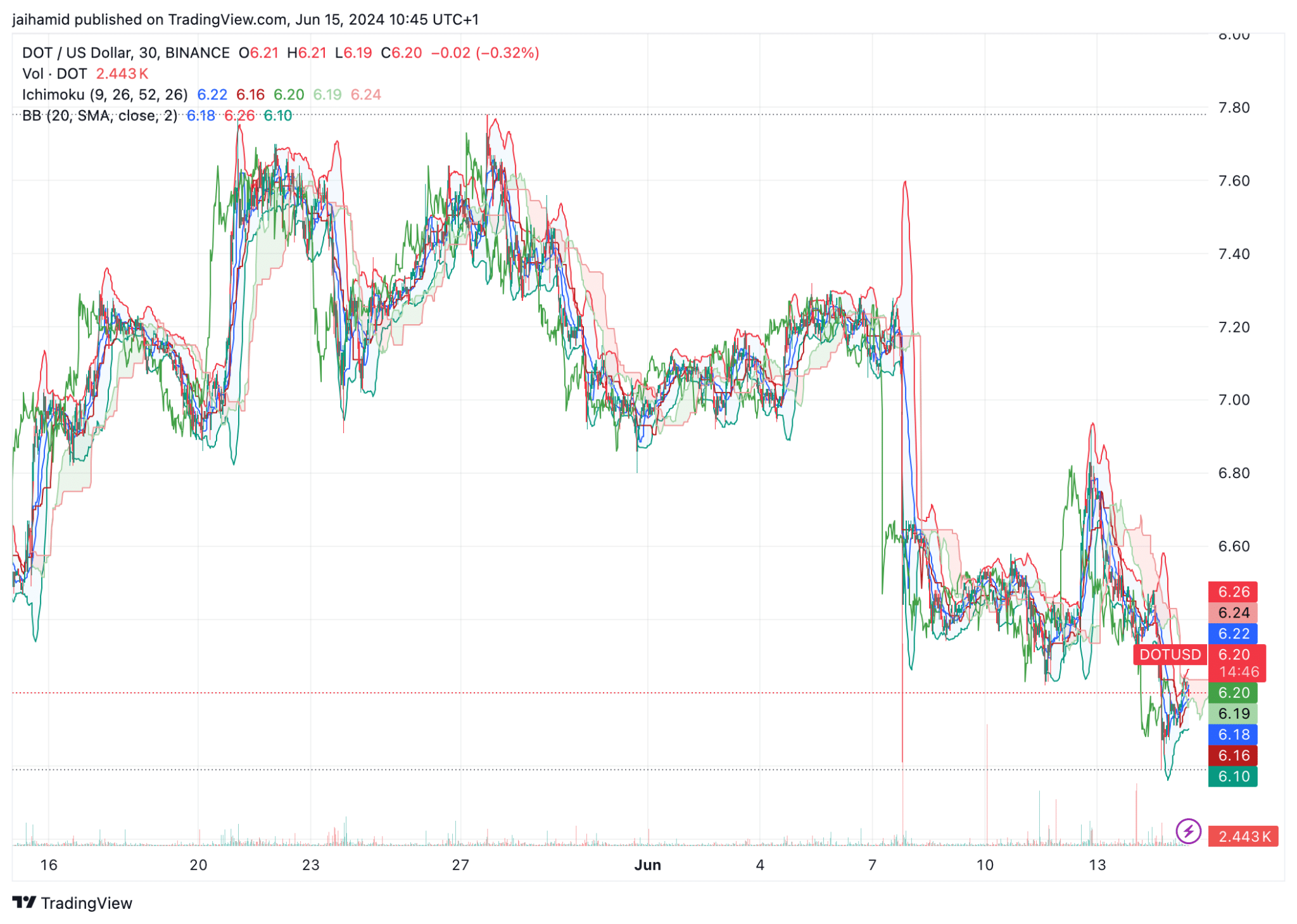

As a researcher, I’ve been closely monitoring Polkadot (DOT) over the past two weeks, and my analysis suggests that the digital asset is facing significant resistance at the key $7 level. Despite several attempts to breach this barrier, DOT has been unable to do so, leading to concerns about further declines.

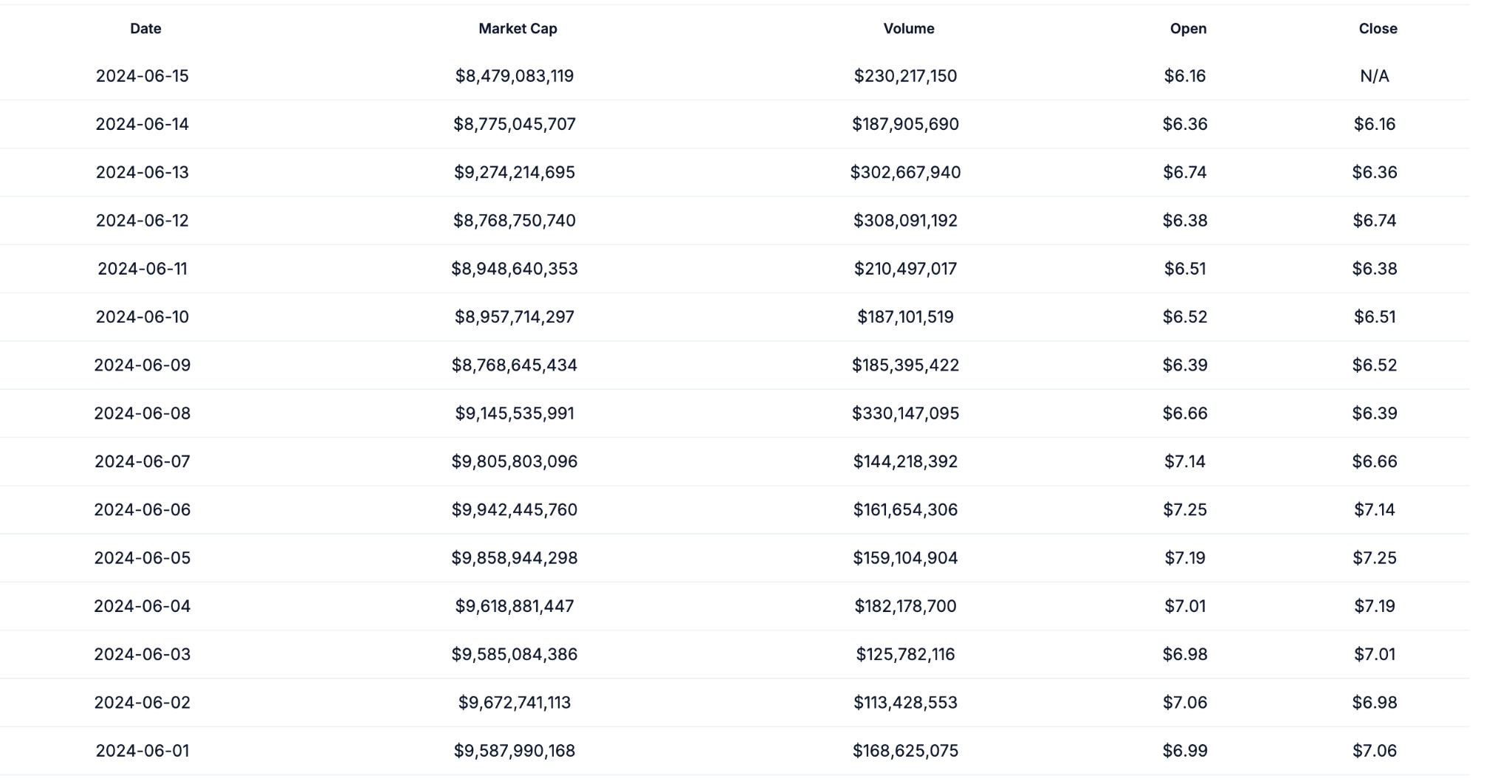

Over the past two weeks, Polkadot (DOT) has experienced significant market pressure from bears, preventing it from surpassing the crucial resistance point of $7. Instead, its price has oscillated between a peak of $7.25 and a trough of $6.16 on the chart.

Despite multiple efforts to surpass its current resistance point, DOT instead retreated to its pricing mark at $6.2 during the reporting period, sparking apprehension among investors regarding potential additional drops.

It’s noteworthy that DOT‘s price fell short of the Ichimoko Cloud level, indicating a potential bearish outlook. Additionally, the conversion line (represented by the blue line) and the baseline (the red line) appeared above the current price, further strengthening the bearish sentiment.

When I penned down these words, DOT‘s price was hovering close to the lower boundary of its Bollinger Bands. This observation implies that DOT might have been undervalued in the short term based on historical market data. If buying interest resurfaces, a brief price recovery or stabilization could ensue.

The moving averages were decreasing and the price was situated beneath them, suggesting potential additional drops.

A crucial area surrounding the $6.20 mark on DOT‘s chart is where price stability is needed. If DOT manages to maintain this level in the short term, it could potentially establish a foundation for an uptrend, especially if it surpasses $6.30. This latter threshold might function as a minor hindrance.

If the price of DOT fails to hold at the $6.20 level, it might result in testing lower support zones. These zones could be around $6.16 or even extend down to $6.00, depending on how strong the bearish trend becomes.

As a researcher studying market trends, I’ve observed an intriguing pattern in the chart under consideration. Specifically, around the $6.60 mark, the price has attempted to breach this level twice but has retreated each time after reaching a peak. This repetitive behavior is known as a double top, and it often serves as a bearish reversal signal. In simpler terms, the failure of the price to sustainably surpass the resistance at $6.60 could be an indication that further declines are on the horizon.

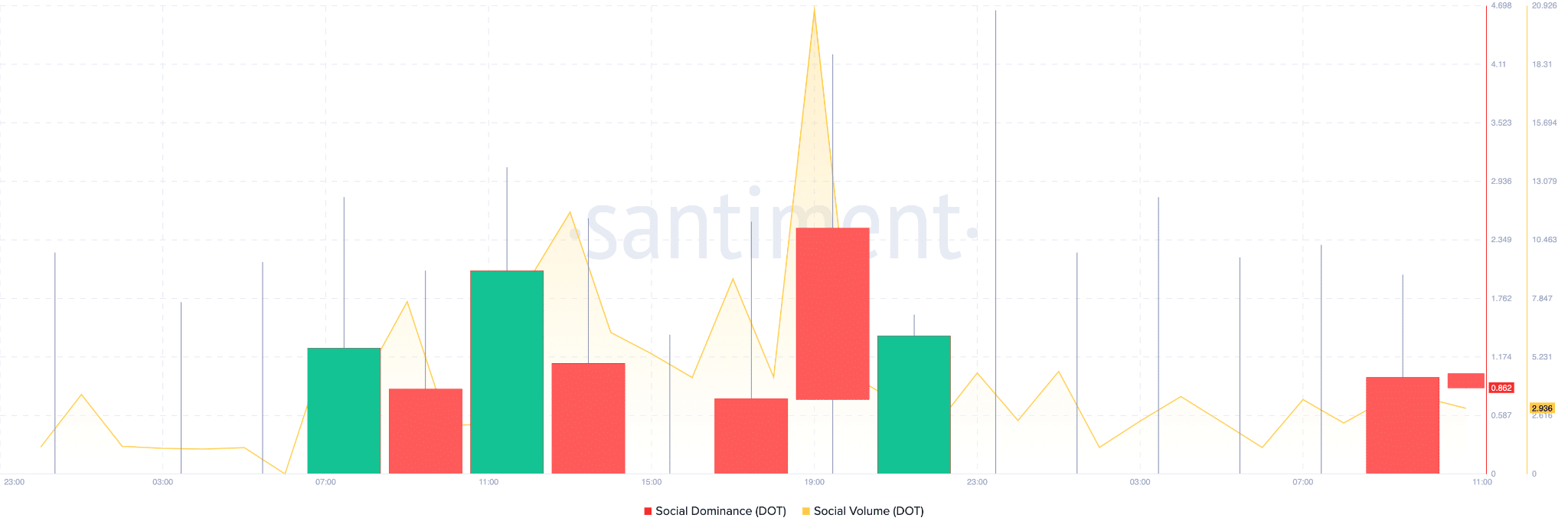

It’s intriguing to note that DOT‘s social media activity and influence have seen only slight increases as per the charts. The coincidence of heightened social media buzz and prolonged social dominance can lead to price instability, with an influx of traders and investors possibly responding to the circulating information.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Kidnapped Boy Found Alive After 7 Years

- Silver Rate Forecast

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Oblivion Remastered – Ring of Namira Quest Guide

2024-06-16 06:15