- Bitcoin posted strong fees post-halving.

BTC remained in a bear trend despite an over 1.7% increase.

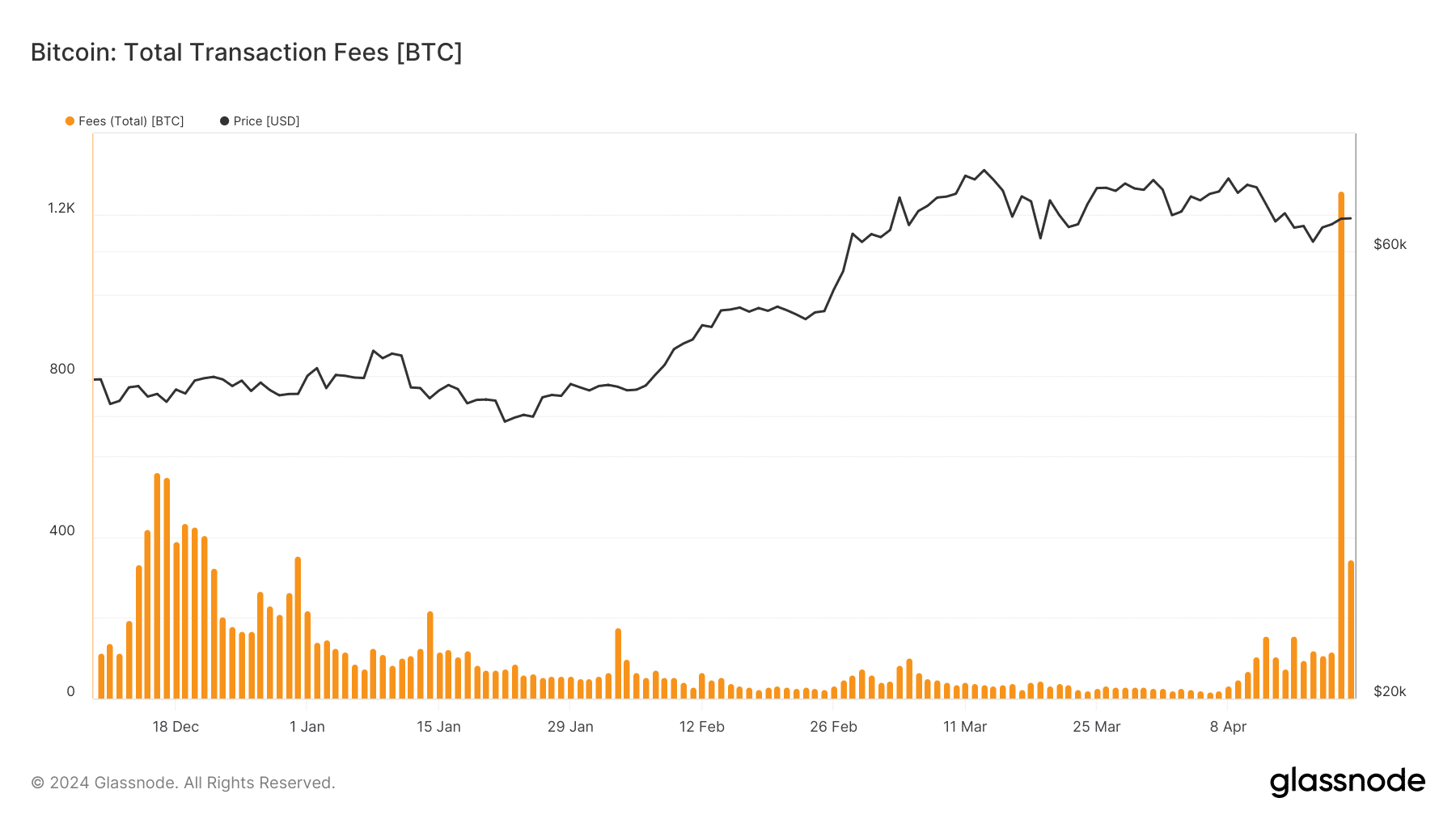

The Bitcoin (BTC) halving, which was expected to reduce miner fees, has taken place. Surprisingly, fees reached an all-time high following the halving. But signs point to this being a short-term phenomenon.

Bitcoin records highest average transaction fee

On the morning of April 20th, the Bitcoin halving occurred. Surprisingly, though, by the close of that day, transaction fees had reached an unprecedented peak instead of decreasing as predicted following the halving event.

According to Glassnode’s findings, fees reached a peak of 1,257 BTC or approximately $81 million on the 20th of April.

The daily fee reached an all-time high this day, representing a substantial hike for the platform and its miners.

On April 20th, a closer look at the typical transaction costs on the network revealed an uptick to around $128.

Additionally, according to the fee chart on Crypto Fees, Bitcoin had the most expensive fees during the last week. The typical fee amounted to approximately $20.2 million, which was significantly higher than Ethereum‘s [ETH] lowest average of around $5 million.

At the moment of composing this text, the daily fees had decreased. As reported by Glassnode, they fell to a level of 344 BTC, which is approximately equal to 22.3 million US dollars.

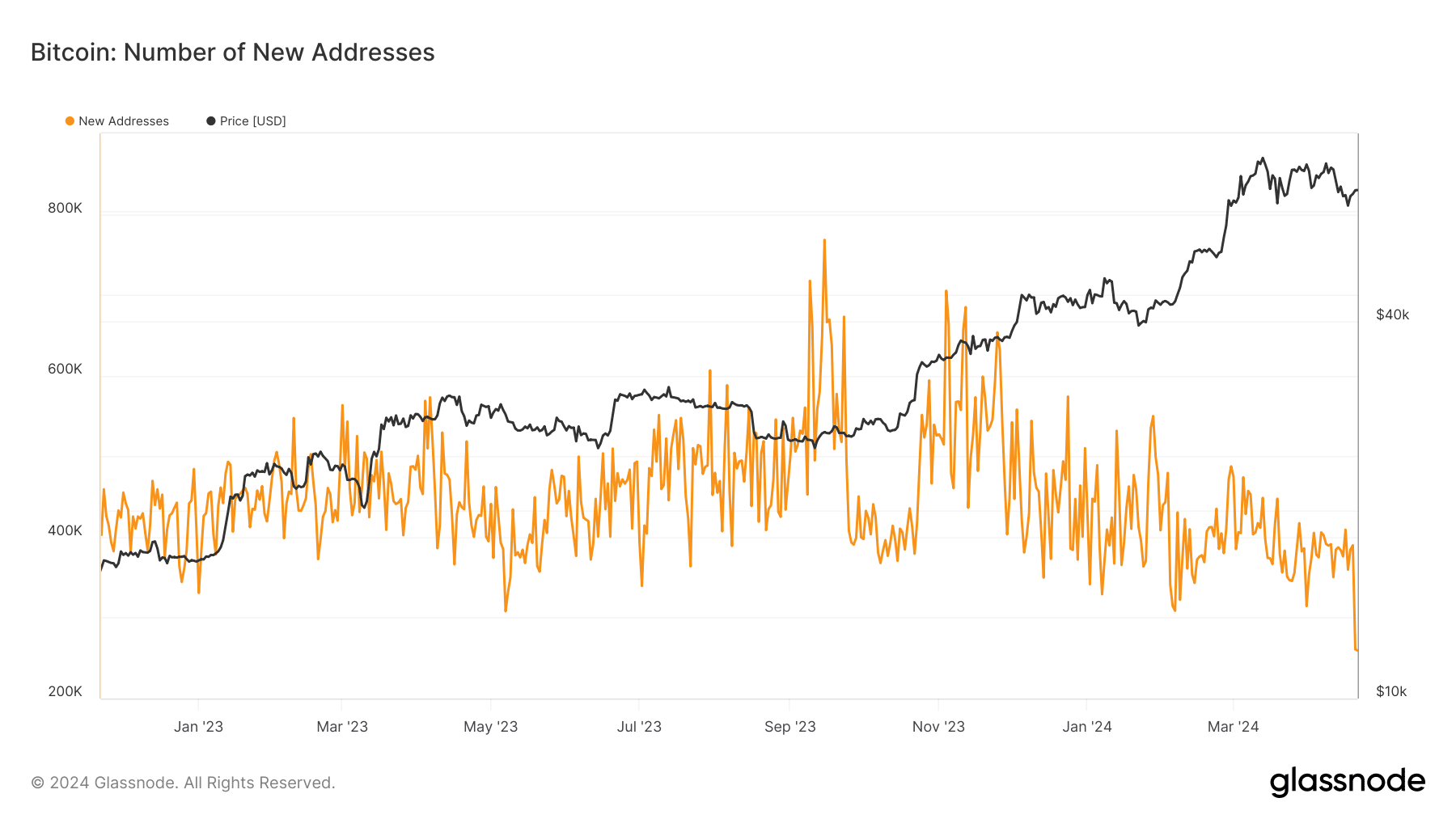

This substantial fluctuation in fees coincided with a decrease in the number of daily new users.

Bitcoin addresses fall to lowest in over a year

As fees soared to new heights, the count of fresh Bitcoin account registrations headed in the reverse direction.

According to AMBCrypto’s examination of Glassnode data, there has been a significant reduction in new addresses being created. Currently, the figure is approximately 259,431, which is lower than the 300-400,000 range observed just a few days ago.

An influx of new users might have been predicted to cause a spike in fees, but instead, it was the development at Runestone that possibly contributed to the increase. Afterward, the decrease in fees lent credence to this theory.

A rise in fees and an influx of new users can signal higher levels of usage for Bitcoin, which could have a positive effect on its market price.

BTC goes back to $66,000

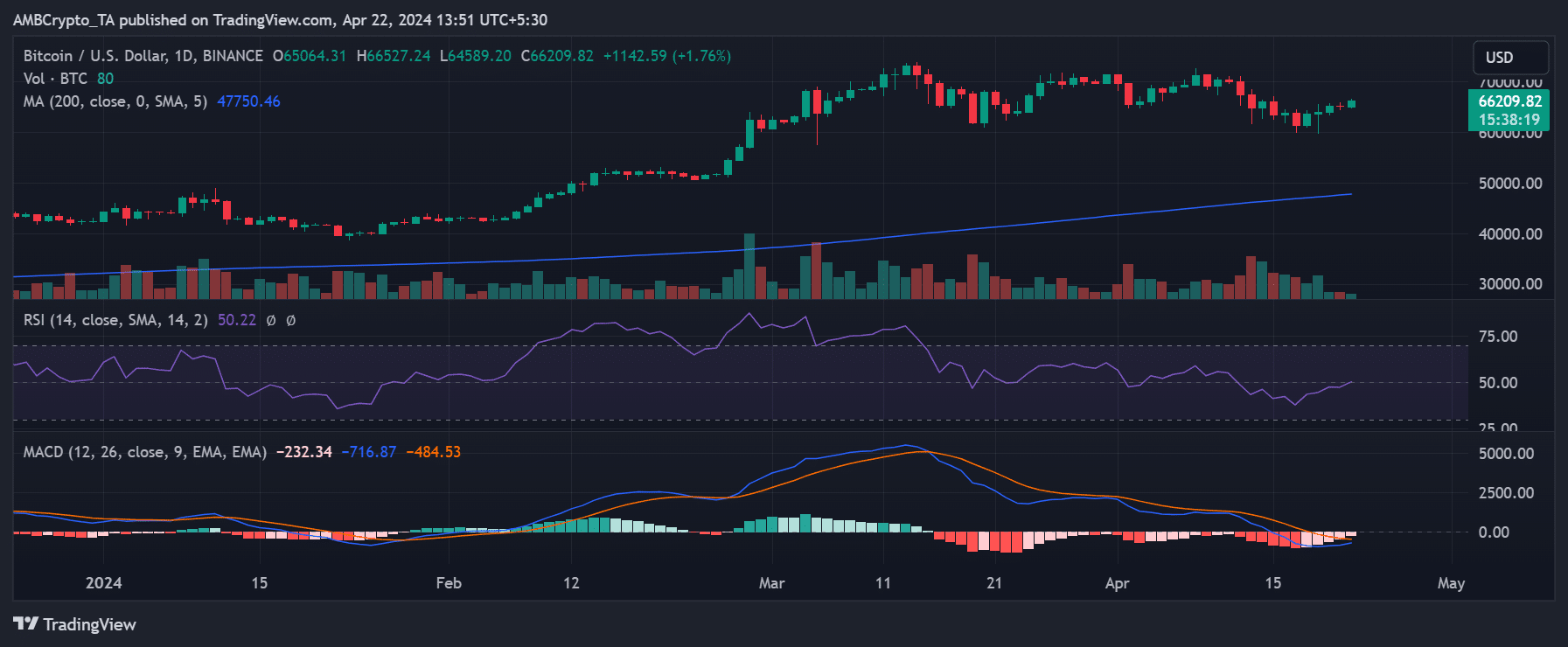

On April 21st, Bitcoin went through a small decrease in value, which was followed by a swift recovery, as shown in its chart representing daily prices.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the current moment, according to AMBCrypto’s analysis, Bitcoin was valued around $66,200 – representing a 1.7% price rise.

Although the rally wasn’t over, it hadn’t turned completely bullish yet. The bearish trend was still present, and surpassing that price level would indicate a switch to an uptrend.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-22 16:07