- Raydium showed a series of bullish signals in the 4-hour time frame chart.

- RAY’s inflows were positive in the last 24 hours, suggesting a slight return of bulls.

As a seasoned crypto investor with a knack for spotting promising opportunities, I find myself intrigued by the current state of Raydium [RAY]. The bullish signals it’s showing are hard to ignore, especially the breakout from a bullish pennant pattern in the 4-hour time frame chart. This is reminiscent of the stock market’s “bull by the horns” move, only this time, we’re talking about RAY.

🌪️ Storm Brewing: EUR/USD Forecast Turns Chaotic Under Trump!

Discover why the next days could be critical for forex traders!

View Urgent ForecastAt the time of publication, Raydium [RAY] was priced at $5.57 – marking a significant 23% rise over the past 24 hours as reported by CoinMarketCap. Notably, the trading volume also saw a substantial boost by 94%, reaching approximately $356 million.

RAY has surged by over 190% since its previous key milestone in the trend, hinting that it could potentially replicate the same pattern.

On the 4-hour chart, RAY exhibited a sequence of optimistic indicators, most notably the burst through a bullish pennant formation. This implies a possible prolongation of the upward trend.

A bullish pennant pattern, where prices temporarily level off after a steep increase and then surge higher due to increased demand, signifies robust buying activity.

According to current market trends, potential resistance points for a possible price increase can be found around $6.40 and $7.60. These levels correspond roughly to a price surge of approximately 35% to 50% from the initial breakout point.

These metrics point out…

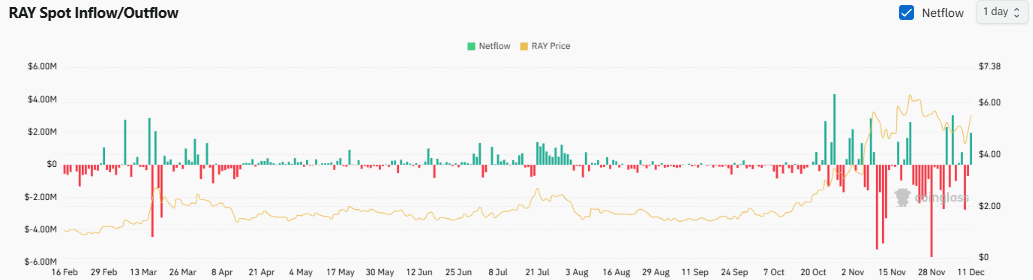

RAY’s Inflow/Outflow pattern exhibits considerable change, featuring notable surges in inflow that are particularly evident in the latest period. These increases in inflow are linked to price fluctuations observed within RAY.

Increased net inflows indicate a surge in buying activity, possibly signaling optimism or a bullish attitude among investors.

While inflow spikes may contribute to a possible 35% growth, they also introduce potential market volatility, as demonstrated by swift reversals back to outflows.

Maintaining a consistent upward trend in purchasing activity often signals that a market rally could persist further, even when the OI-Weighted Funding Rate stands at -0.0319%. In other words, this rate indicates that short sellers are compensating long holders.

Over the past day, the overall increase in funds flowing in indicates a potential rise in prices (bullish trend). Yet, it’s crucial to keep monitoring the inflows and outflows over time to verify if this trend leads to significant long-term price changes.

RAY’s DEX Volume

In October, Raydium outpaced Uniswap in terms of decentralized exchange (DEX) volume, recording a staggering $90.5 billion contrasted with Uniswap’s $45.3 billion for the same period.

In November, RAY managed an impressive sum of $124.6 billion, surpassing Uniswap’s $51.1 billion by more than double. This aligns with the predicted 35% increase, but keep in mind that this figure could still fluctuate.

Read Raydium [RAY] Price Prediction 2024-2025

The substantial increase in transactions on Raydium, mainly due to memecoins accounting for approximately two-thirds of its November transaction activity, suggests that it has recently gained prominence within the cryptocurrency market.

The “Pump Fun” event significantly boosted Raydium’s monthly income by more than $100 million, demonstrating robust financial health and high levels of user interaction on the platform.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Silver Rate Forecast

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Avowed Update 1.3 Brings Huge Changes and Community Features!

2024-12-12 05:11