- RAY has dropped 20% amid increased sell pressure and low demand.

- Will the $5 support trigger a price recovery for the altcoin?

As a seasoned analyst with over two decades of market observation under my belt, I’ve seen bull markets turn bearish and bears become bullish again more times than I care to remember. Currently, Raydium [RAY] finds itself at a critical juncture, teetering on the edge of a possible price recovery or a deeper descent.

In simpler terms, the value of Raydium’s tokens, which is the main venue for trading meme coins on the Solana network, has dropped by more than 20% over the last fortnight.

Currently, RAY has been closely grouped near the $5 mark, yet there’s been a surge in selling pressure primarily from centralized trading platforms. Will the $5 level prove to be strong and hold, or will it succumb under this pressure?

RAY on the edge

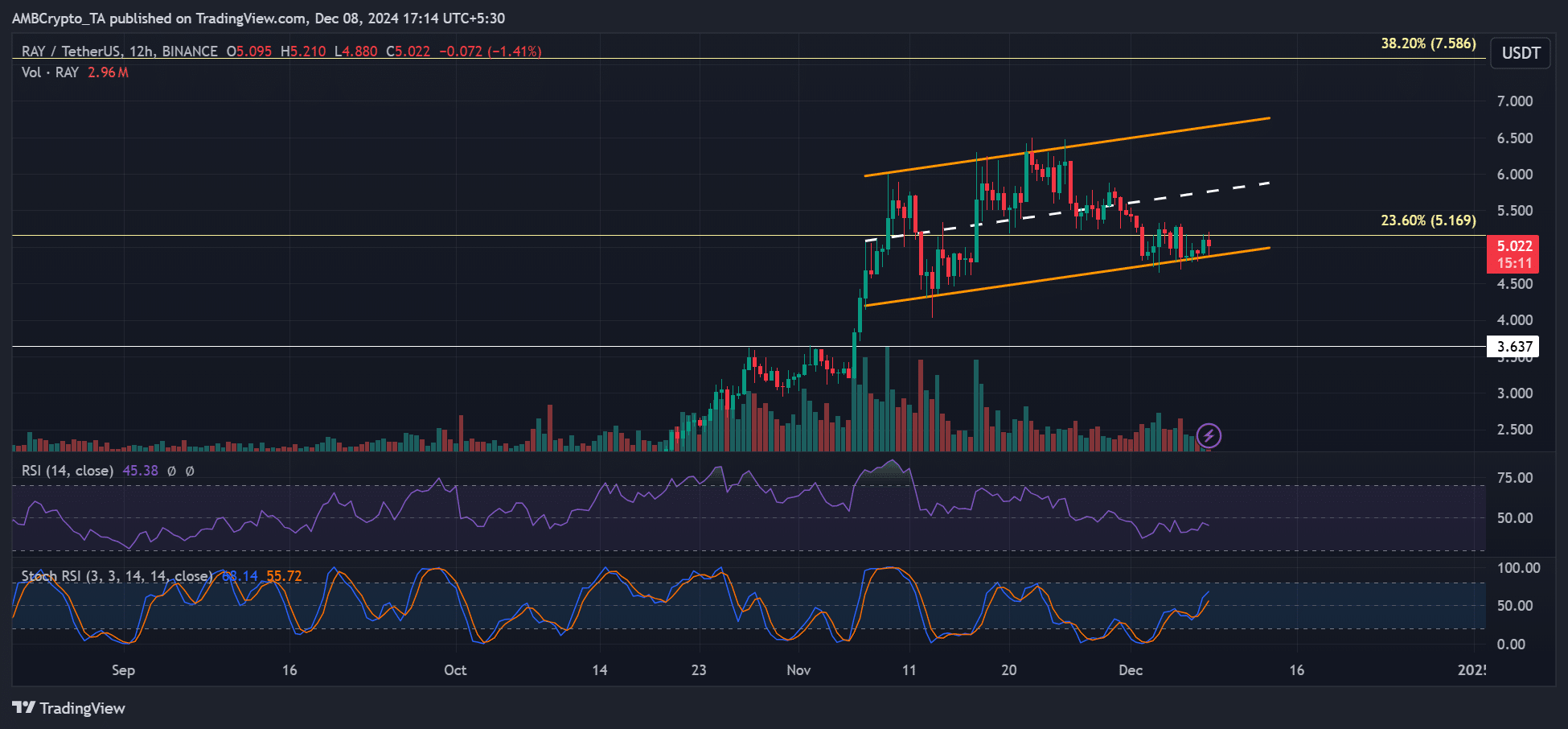

In the middle of November, RAY’s price reached an all-time high of $6.5, following which there was a decrease in buying interest. This was counteracted by an increase in selling pressure, leading to RAY entering a period of price stabilization.

As an analyst, I observed a shift in RAY’s demand dynamics during December. The Relative Strength Index (RSI) dipped below the 50 median level on the 12-hour chart, signaling a decline in demand. This downward trend has made it challenging for the altcoin to break free from its lower range, thus keeping it confined within the boundaries of its channel.

Will the $5 range-low and support break? Yes, if the sell pressure increases in the next few days.

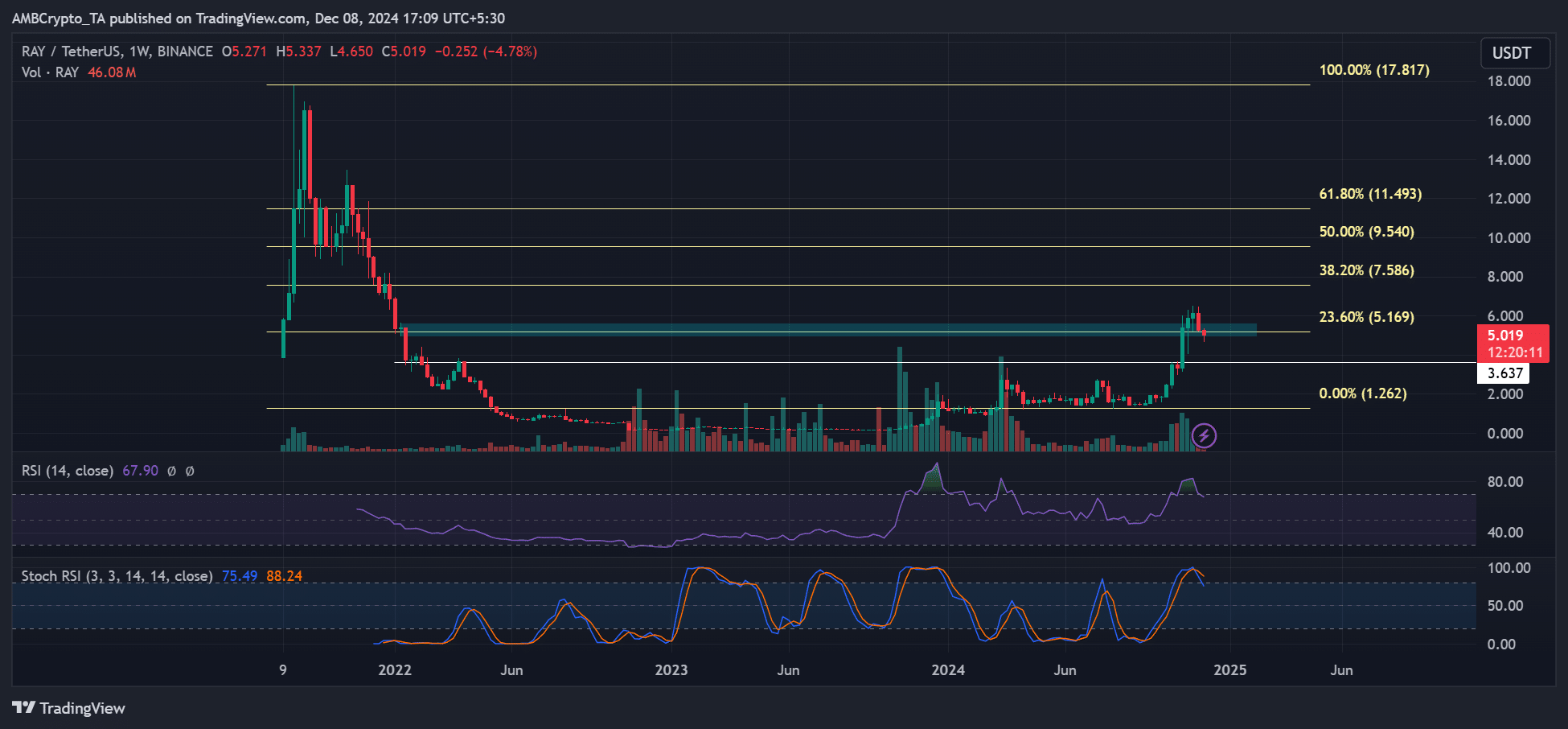

As a researcher, I’ve observed that the $5 mark served as a significant psychological and Fibonacci level, potentially strengthening the bull’s momentum.

If we were to lose this current level, it might cause prices to drop further, thereby shifting the market trend towards bearish. In such a case, $3.6 might function as the potential next line of defense or support for the market.

On the flipside, $7.5 and $9.5 could be reachable if bulls defended the $5 support.

RAY sell pressure

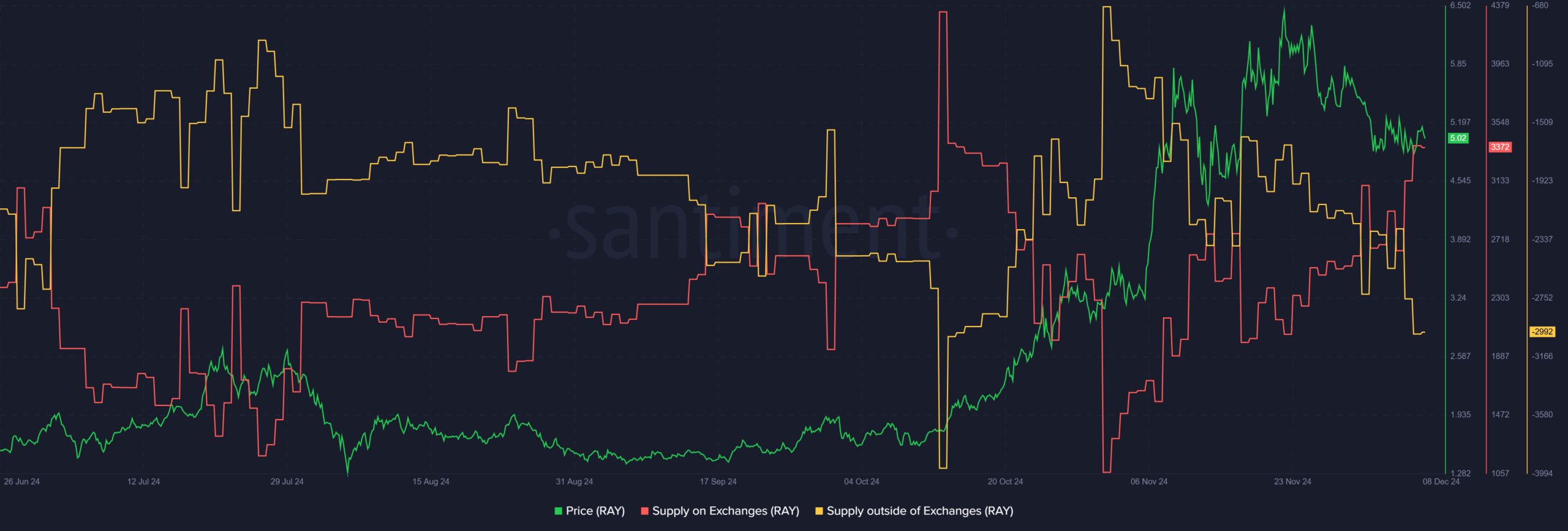

As per Santiment’s data, the supply of tokens on exchanges (represented by the red line) gradually rose throughout November.

During this timeframe, the fresh demand for the altcoin (purchases not made through exchanges, denoted as yellow) decreased, which went against the robust purchasing trend observed in October. This could indicate that short-term investors cashed out their profits in November and December.

The sell-off stalled RAY’s rally at $6.5 and could only reverse it eased.

For those considering investment with a long-term perspective, this sell-off might present an excellent chance. However, it’s not evident yet that RAY traders should make a move based on current indicators.

Read Raydium [RAY] Price Prediction 2024-2025

For swing traders, a weekly candlestick close above $5 could suggest strengthening and a potential buying opportunity. Such a move would increase the odds of RAY soaring to the middle or upper channel target of $7.5.

Read More

- OM/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

2024-12-09 10:15