AMD announced strong financial results for the third quarter of 2025, showing growth in nearly all areas of its business. While AI is driving a lot of tech spending, AMD is successfully increasing sales of its graphics cards and processors for everyday consumers, in addition to its AI-focused chips. This is positive news as AMD competes with companies like NVIDIA and Intel.

As a researcher tracking AMD’s performance, I’ve been following their impressive growth. In the third quarter, their revenue hit a record $9.2 billion, with a strong gross margin of 52%. This represents a significant jump – a 36% increase compared to the same quarter last year. According to Jean Hu, AMD’s Executive Vice President, this success also resulted in record free cash flow.

AMD reported operating income of $1.3 billion on net revenue of $2 billion, resulting in earnings of $0.75 per share. When excluding certain items to focus on core business performance, AMD’s gross margin was 54% and earnings per share reached $1.20.

I likely would have predicted AMD’s Instinct AI chips would be their biggest revenue driver before the latest earnings report. But it turns out I was wrong.

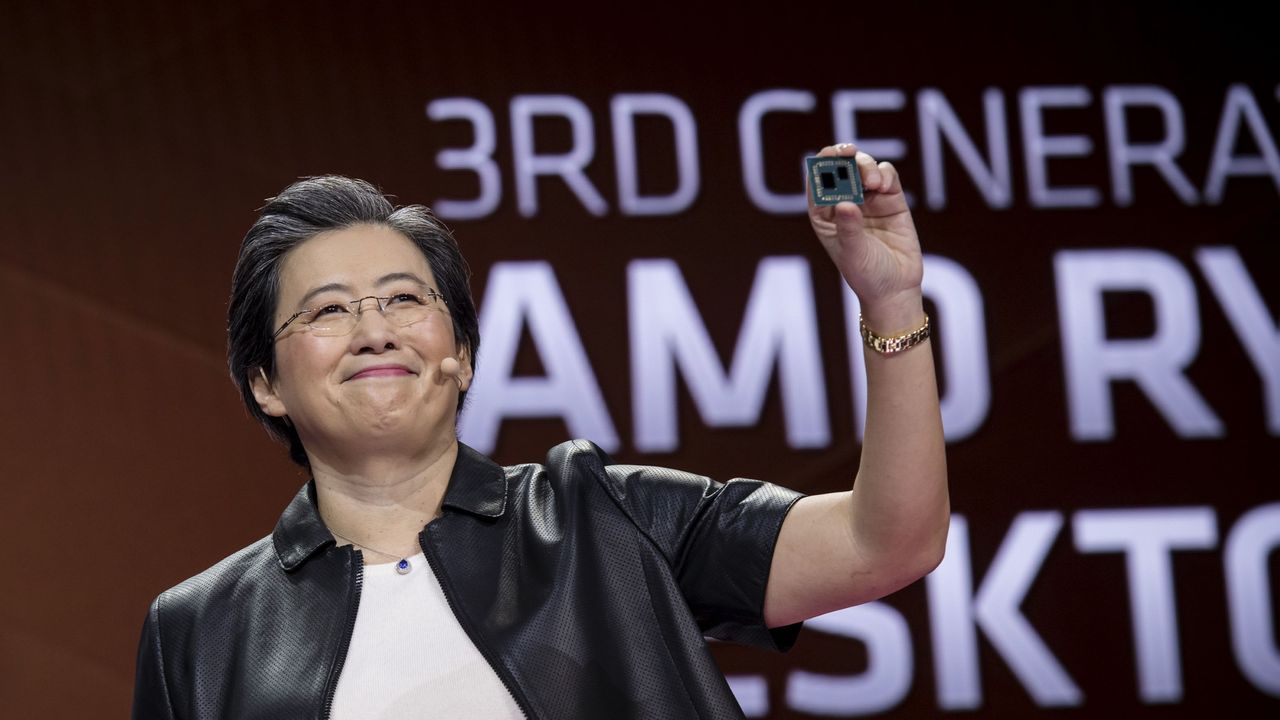

We had a fantastic quarter, achieving record revenue and profits thanks to strong demand for our EPYC and Ryzen processors, as well as our Instinct AI accelerators.

AMD CEO Dr. Lisa Su

AMD reported $4.3 billion in revenue from its data center business, which is a 22% increase compared to the same period last year. This growth was primarily fueled by strong demand for their EPYC processors and Instinct MI350 graphics cards.

As an analyst, I’m really seeing significant growth in our client and gaming segment – it’s far outpacing everything else. We brought in $4 billion in revenue from that segment just in the third quarter, which is a substantial 73% increase year-over-year.

AMD achieved a record $2.8 billion in client revenue, up 46% compared to last year. The company attributes this success to strong sales of its Ryzen consumer processors and a greater variety of products available.

With the release of the powerful AMD Ryzen 7 9800X3D – often hailed as the top CPU for gaming and a significant improvement over the 7800X3D – along with other new X3D models late in 2024, it’s evident that demand for AMD’s popular processors is growing.

While Ryzen processors are popular, AMD’s Radeon graphics cards saw the biggest growth last quarter. Gaming brought in $1.3 billion, more than double the revenue from the same time last year.

AMD has positioned itself on the launch pad … will it take off?

AMD had a strong third quarter in 2025, although consistently achieving these results will be a challenge.

Dr. Lisa Su highlighted a record-breaking third quarter and optimistic projections for the fourth, indicating accelerating growth. This progress is fueled by the increasing demand for our computing products and the rapid expansion of our AI data center business, which is expected to bring substantial revenue and earnings in the coming years.

NVIDIA has become the leading company in the AI hardware market, recently reaching a historic $5 trillion value – a first for any company. Now, its competitor, AMD, is looking to compete for a share of that success.

AMD reports growing excitement around its AI platform, boosted by its recently announced multi-billion dollar partnership with OpenAI. This deal will see OpenAI use 6 gigawatts of AMD’s Instinct AI GPUs to power its future systems, with the first gigawatt expected to be operational in late 2026.

The ongoing disagreements between the US and China are definitely hindering Instinct AI GPU sales in the large and important Chinese market, but AMD has already considered this when making its financial forecasts.

AMD is predicting around $9.6 billion in revenue for the fourth quarter, which is higher than the third quarter. This estimate doesn’t include income from shipments of their MI308 AMD Instinct processors to China.

AMD is experiencing strong growth, and it’s encouraging to see this success isn’t solely dependent on AI. While there are worries about a potential AI bubble and its impact on the stock market, AMD’s core businesses – graphics cards (GPUs) and processors (CPUs) – seem well-positioned to provide stability if that bubble were to burst.

(via PC Gamer)

FAQ

What CPUs did AMD launch in 2025?

In 2025, AMD released several processors, but the Ryzen 9000X3D series really caught attention, as they were designed for serious gamers. The 9800X3D came out in late 2024, and AMD expanded the lineup in March 2025 with the Ryzen 9 9950X3D and 9900X3D.

In January 2025, AMD released new mobile processors with its X3D technology, such as the Ryzen 9 9955HX3D. They also introduced the Ryzen Z2 series of chips, designed for portable gaming devices, at CES 2025.

What GPUs did AMD launch in 2025?

AMD released its new Radeon RX 9000 series graphics cards in March 2025, starting with the high-end RX 9070 XT. The RX 9060 XT followed in early June 2025.

AMD first released the Radeon AI PRO R9700 GPUs to computer manufacturers in July, and then made them available to the general public in October 2025.

Why are AMD’s X3D CPUs so loved by gamers?

AMD has developed a new way to build computer processors by stacking the memory (cache) on top of each other. This speeds up data access and allows for more memory, which significantly improves gaming performance.

Since Intel’s upcoming 2025 desktop processors aren’t expected to perform well beyond basic tasks, AMD’s Ryzen X3D chips have become increasingly popular, especially for demanding applications.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- 10 Movies That Were Secretly Sequels

- The Ascent Developer Will Reveal Its Next Game on December 11th: “Nothing is Off Limits”

2025-11-05 18:42