- Solana handled more transactions than the next 9 chains combined.

- Solana was the third-highest revenue generator in March.

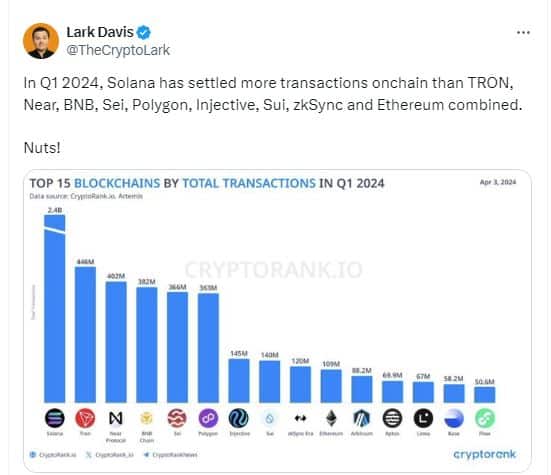

In Q1 2024, Solana (SOL) stood out as the most frequently used blockchain, gaining significant popularity.

A look at Solana’s Q1 achievements

In the first quarter, Solana processed an impressive number of transactions totaling 2.4 billion, as demonstrated in a widely-shared post from prominent crypto influencer Lark Davis. This volume far surpassed the transaction counts of the next nine networks combined.

In the past, Solana has been well-known for having high transaction activity in the Web3 realm. However, the recent surge of memecoin popularity put significant pressure on Solana. In fact, a large number of new coins emerged seemingly overnight, attracting a huge influx of individual investors.

Guessing resulted in a larger volume of transactions, which subsequently generated greater fee income for the network.

According to AMBCrypto’s examination of Token Terminal statistics, Solana generated over $34 million in income during March. This made it the third most profitable platform within the Web3 domain. In comparison to February’s earnings, Solana experienced a nearly sixfold increase.

In addition to an increase in fees, there was a significant jump in the number of users engaging on the network. This figure nearly doubled, rising from 426,000 in February to 932,000 in March.

Solana gets a reality check

In the first quarter, Solana saw a lot of action and was very busy. However, the heavy network usage began to reveal some weaknesses.

Previously, AMBCrypto reported issues with the blockchain experiencing frequent transaction failures. Unfortunately, its developers have yet to find a prompt solution to resolve this problem.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Network congestion caused a lot of fear, uncertainty, and doubt (FUD) among investors, negatively affecting market perception towards Solana’s native coin, SOL. Based on AMBCrypto’s interpretation of Santiment’s statistics, Solana faced more negative discussions than positive ones during the last week.

The pessimism translated into a 7% decline in its price over the week.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-12 06:15