- Smart contracts deployed on the Avalanche network declined significantly over the last few weeks.

- Activity and DEX volumes on the network also fell, however, TVL remained high.

Over the past few weeks, AVAX, or Avalanche, has remained relatively stable without showing significant reaction to market fluctuations. Yet, behind the scenes, the Avalanche network itself has encountered some difficulties.

Problems for Avalanche

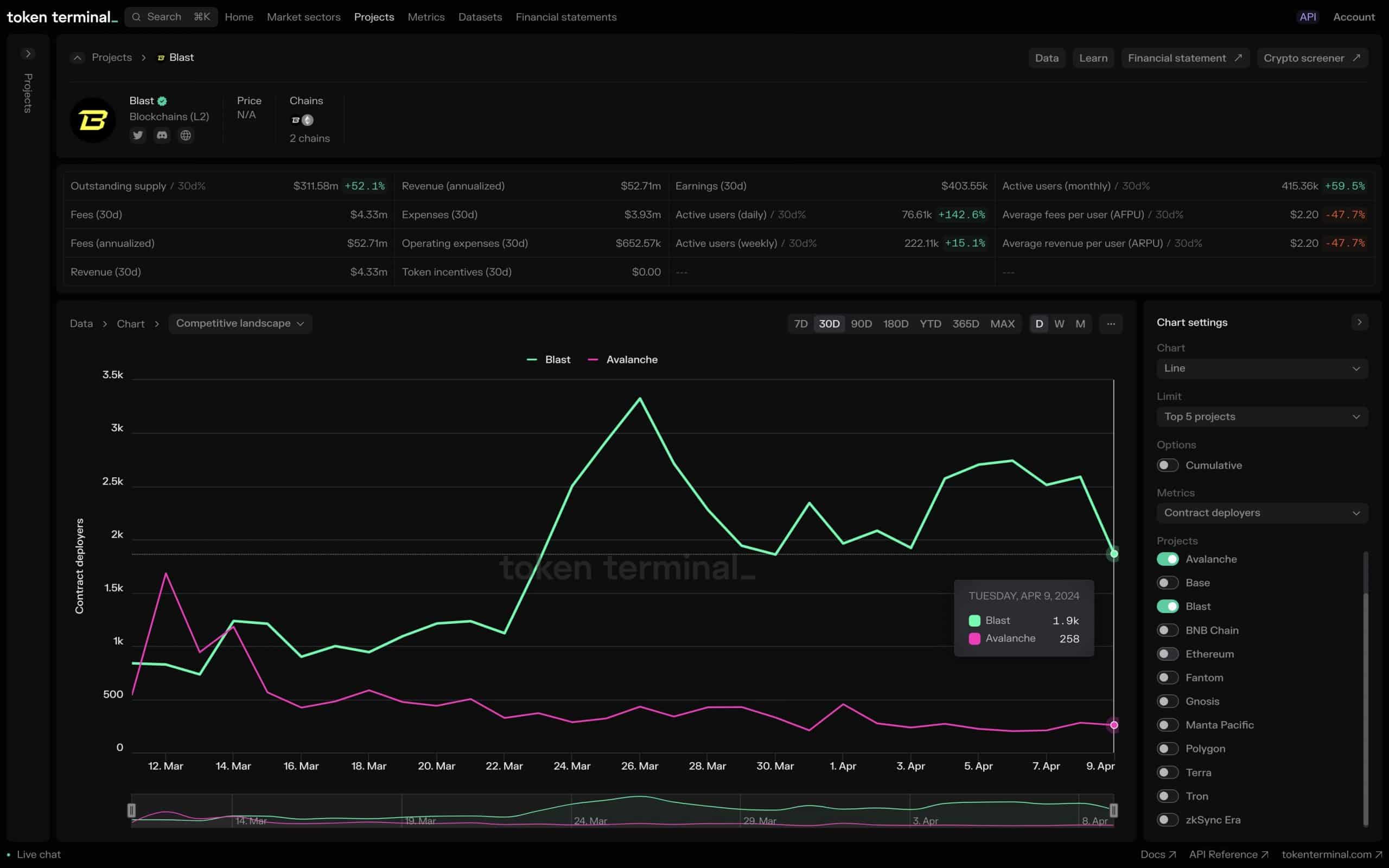

Based on recent figures from Token Terminal, there’s been a substantial drop in the number of individuals deploying smart contracts on Avalanche. This decrease might indicate a potential slowdown in the network’s innovative pace.

With fewer new projects, Avalanche may have a harder time keeping up with the fast-paced development in the blockchain sector. This slowdown could also indicate deeper problems within the platform.

It’s possible that developers aren’t deeply involved in the Avalanche network or aren’t getting sufficient backing. Regardless of the reason, this situation might undermine developers’ faith in Avalanche, which is essential for a blockchain platform to thrive.

If Avalanche doesn’t tackle these possible challenges, it may lose steam and trail behind other competitors.

Looking at the DeFi space

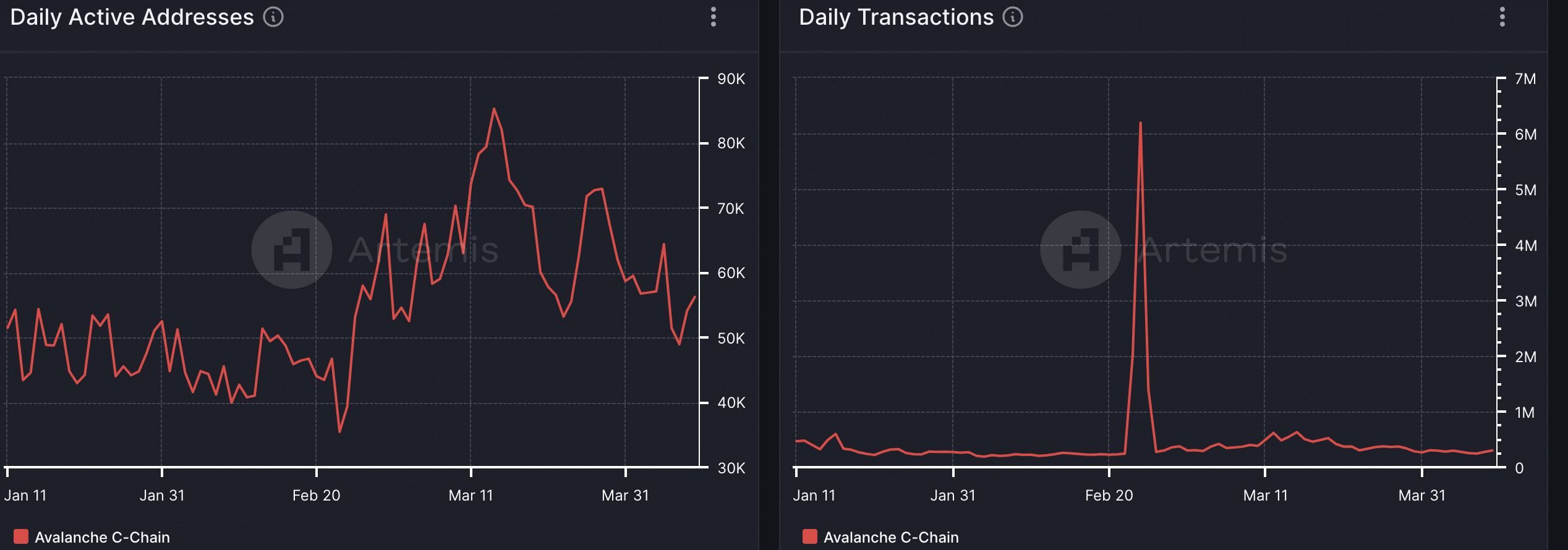

In the world of Decentralized Finance (DeFi) on Avalanche, there was an observable increase in the amount of cryptocurrencies held in deposits. This expansion underscores growing investor interest. However, other indicators presented cause for concern.

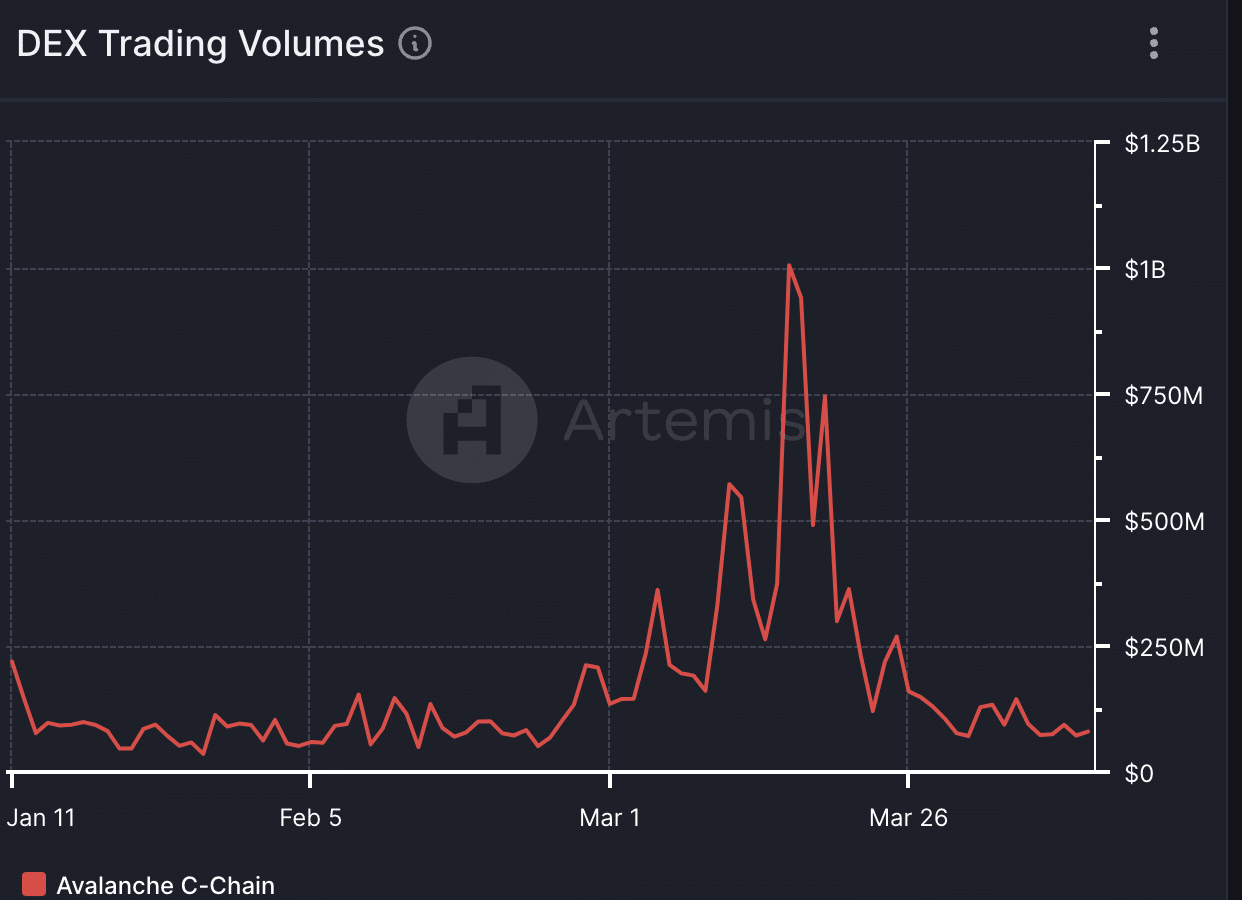

The number of transactions and trading volume decreased noticeably on Avalanche’s Decentralized Exchanges, indicating a drop in network activity. This reduction in activity could be a sign of decreasing user interest and reduced overall utilization of the network.

The discrepancy between increasing total value locked (TVL) and decreasing user activity is quite concerning. It questions the longevity of the ongoing TVL expansion.

If the TVL (Total Value Locked) in a system doesn’t result in an equivalent surge in new users and network engagement, it may just be current users securing greater worth. Consequently, this situation could foster a stationary environment with restricted prospects for expansion.

In addition, the decrease in Decentralized Exchange (DEX) trading volume could be a warning sign for decreased market activity, an essential feature of any blockchain project.

Realistic or not, here’s AVAX market cap in BTC’s terms

New users may be deterred from joining the Avalanche ecosystem due to this factor, limiting its expansion and acceptance.

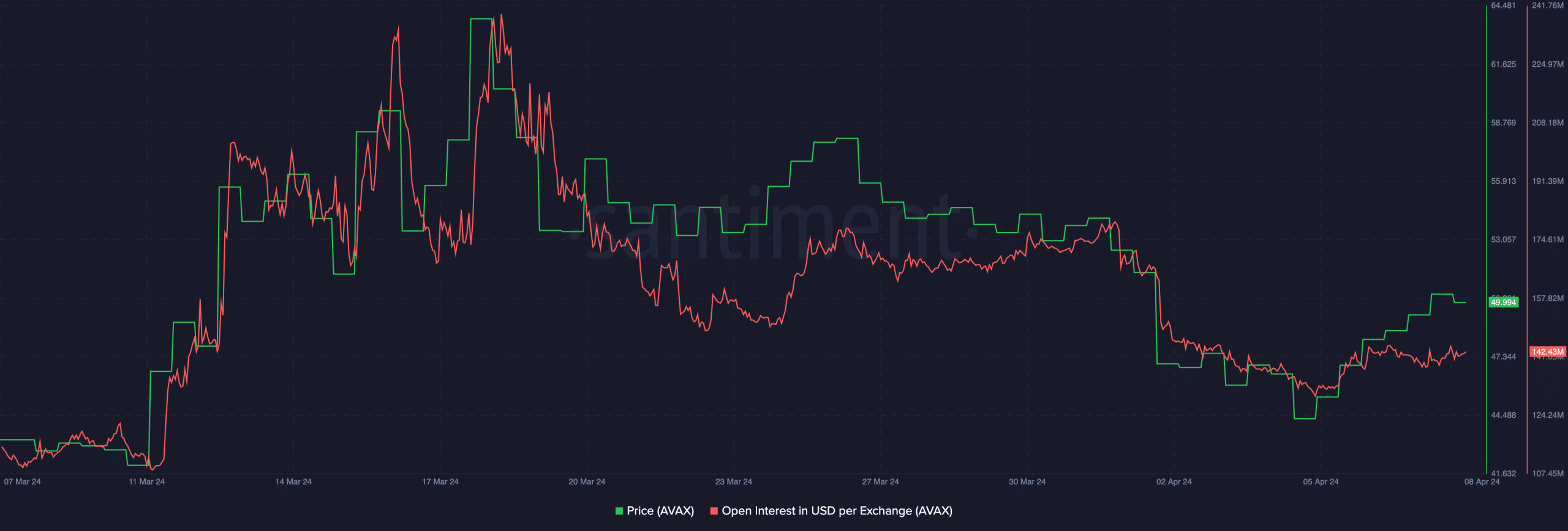

Currently, AVAX is priced at $46.73 on the press date. Within the past 24 hours, its price dropped by 0.81%. Furthermore, there was a noticeable decrease in Open Interest for AVAX, indicating that fewer traders are currently engaging with the token.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- THETA PREDICTION. THETA cryptocurrency

- Crypto week ahead: Will Bitcoin, Ethereum hit new highs?

2024-04-12 05:11