- Helius Labs’ exec raises concerns about big corporations being top Solana validators.

- However, one of Solana’s native validators is amongst the super minority group.

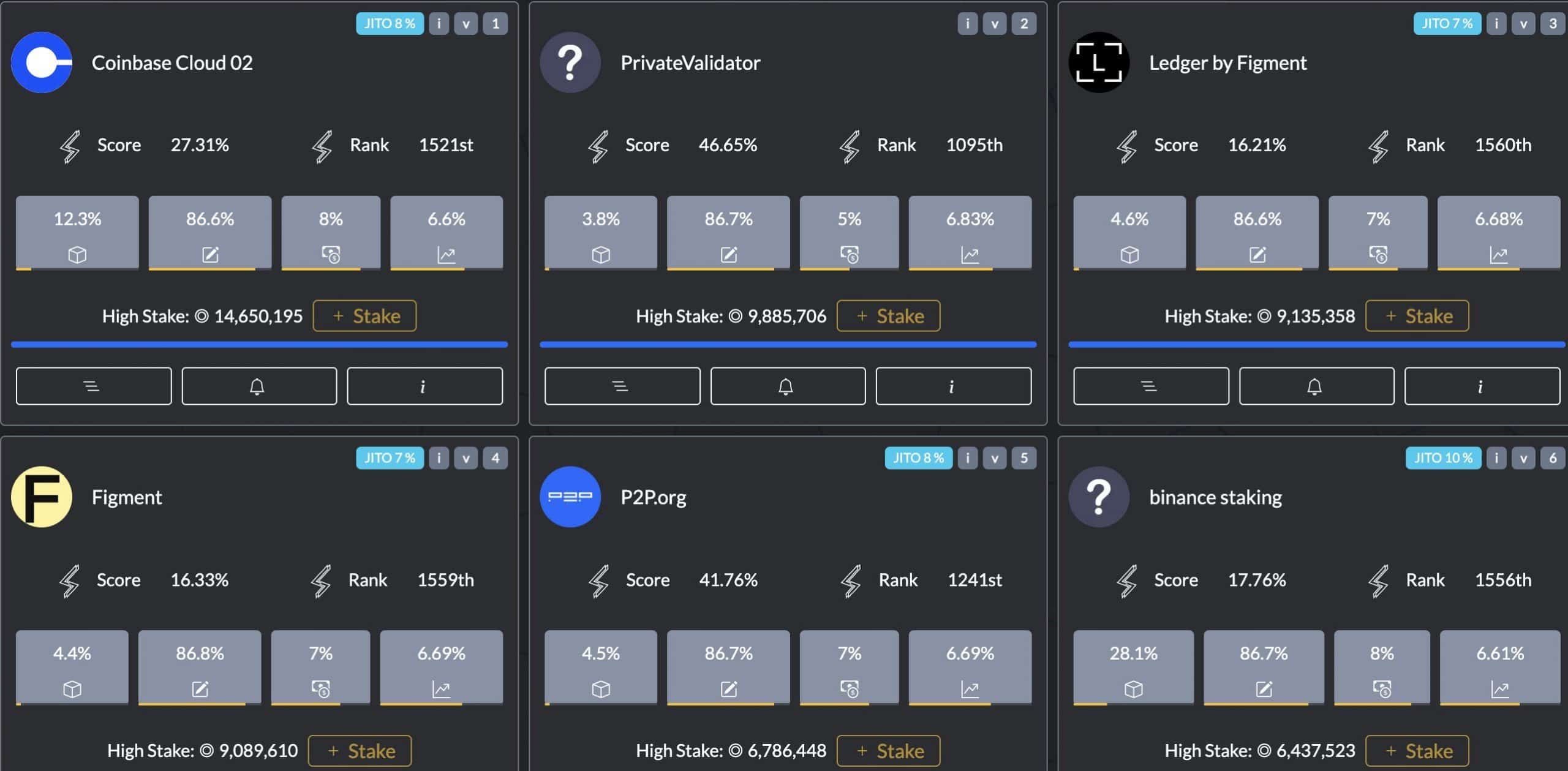

Coinbase and Binance (BNB) are two major players in the Solana (SOL) validator community, collectively managing around one-third (33%) of the staked Solana coins (SOL). With over 1700 validators in total, this represents a significant influence.

Mert Mumtaz, the Co-founder and CEO of Helius Labs (a development platform on the Solana network for cryptocurrency investors), has expressed worries over this prevailing influence.

The Helius Lab executive criticizes the large corporation’s deceitful claims of “trust,” “security,” and exorbitant fees. Instead, they urge people to think about collaborating with Solana’s local teams for a more authentic experience.

“Big businesses often create an illusion of reliability and safety. Let me assure you, Solana’s intricacy calls for a team intimately familiar with its workings to handle uncertainties more effectively than a large corporation.”

The problem with top Solana validators

Based on Mert Mumtaz’s information, the leading six corporations collecting fees for managing Solana validators set the rate at 8%. This represents a significant expense compared to available options, according to Mumtz.

I strongly disprefer the current situation where the leading validators on Solana are large corporations rather than homegrown Solana teams. This needs to be addressed. And these corporations charge up to 8% in commissions. It would be more beneficial for you to stake with native teams as they may offer lower fee structures.

The exec tipped Solana native team validators like Cogent, Laine, and Overlock. He added that,

“Investing in Solana-native teams offers significantly higher returns, making it not only safer but also a smarter choice for your investment in the network.”

It’s worth noting that, based on Solana Beach’s information, Laine (stakewiz.com) is among the top 22 validators, as mentioned by Mumtaz.

In simpler terms, this means that a small group with the ability to collaborate has the power to control and restrict access to the network, posing a significant risk for centralization. However, it appears contradictory to Mumtaz’s goals, particularly concerning security.

In the meantime, SOL reversed its post-network upgrade rally and traded at $133 at press time.

In the longer-term perspective, $130 served as a significant line of defense for buyers. Consequently, a decline beneath this mark might present an opportunity for sellers to gain greater control.

Read More

- DOGS PREDICTION. DOGS cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- STG PREDICTION. STG cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- CLOUD PREDICTION. CLOUD cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

2024-04-16 22:16