In the world of crypto, where fortunes are made, lost, and occasionally celebrated with a spirited dance, a new trend has emerged from the digital mist: restaking. Imagine taking your existing staked ETH, giving it a nice little pat, and then using it to secure *more* stuff. Yes, it’s basically crypto’s version of spreading peanut butter on toast, then spreading it on more toast, and hoping everyone appreciates the extra layers of breakfast-like complexity.

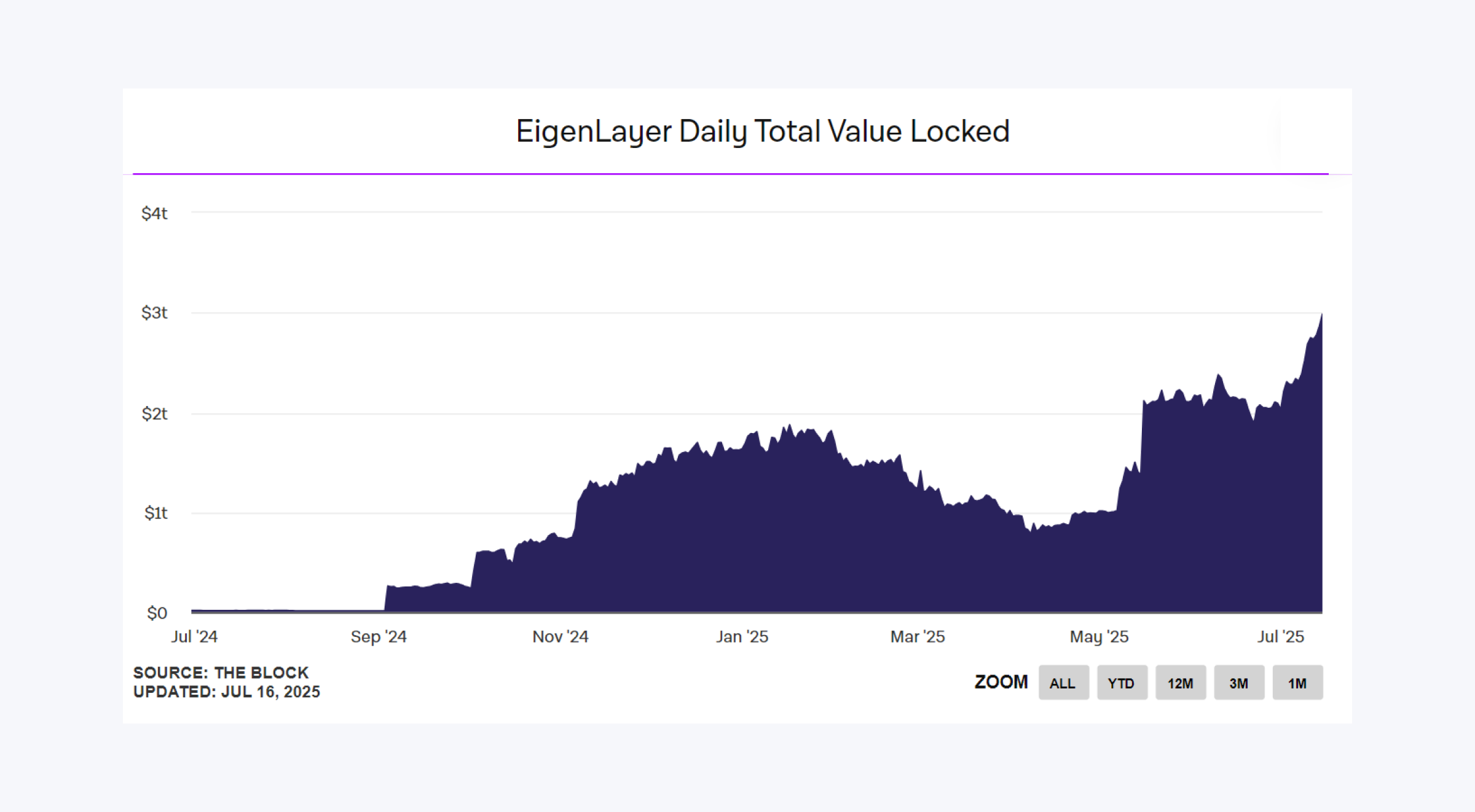

As of June 2025, over $15 billion worth of ETH-because apparently, nobody likes to be left out of shiny new schemes-has been cheekily restaked through a slick purple protocol called EigenLayer. This is like using your old car to start a taxi business, then turning around and using those taxis to run a pizza delivery. It sounds clever until you realise you might be delivering pizzas in a fire truck. 🍕🔥

People are eyeing this with the same spark of greed that once fueled the yield farming craze, just with fancier words and more complicated diagrams. The big question: is this the dawn of a new, sustainable crypto security model or just yet another bubble waiting to pop with a loud bang?

Key Takeaways (Because You Might Be Wandering):

- Restaking is what you get when you decide your ETH, already earning its keep, should do even more work for you.

- This secures new crypto networks-think of it as handing out security patrols to extra guards-while traditional yield farming is basically a sheepdog chasing after liquidity.

- EigenLayer is the Big Brother of this scene, monopolising the restaking playground for now.

- It’s a high-stakes poker game-only for those who know exactly what they’re risking (and have a stronger stomach than most).

What Is Staking? (Spoiler: It’s Not Just a Fancy Term)

Picture Proof-of-Stake (PoS) as the yuppie cousin to the old Proof-of-Work mining: less energy, less fuss, more fancy wallets. Since Ethereum’s “Merge” in 2022, validators have replaced miners as the new security guards, staking their ETH as collateral-it’s basically depositing your savings at a bank that promises not to run off with your money.

If they behave, they earn a modest slice of the network’s transaction cake-around 3-4% in the latest episode of “Crypto The More You Know.” If they act badly, well, their ETH gets slashed-like a bad haircut, but with more capital involved-and everyone pays the price.

Earn Yields / Make It Rain

Validators, in their infinite patience, earn passive income-think of it as crypto’s version of getting slightly richer for babysitting your own coins. As of 2025, that’s around 3-4% APR. Who needs a job, right?

The Liquid Solution (Because Nobody Likes to Wait)

The problem with traditional staking? Locked assets make for unhappy wallets. Enter Liquid Staking Tokens (LSTs)-like stETH or rETH-that let you hold a tradable claim on your locked-up ETH. It’s like having a financial cake and eating it too, while still being able to trade the crumbs.

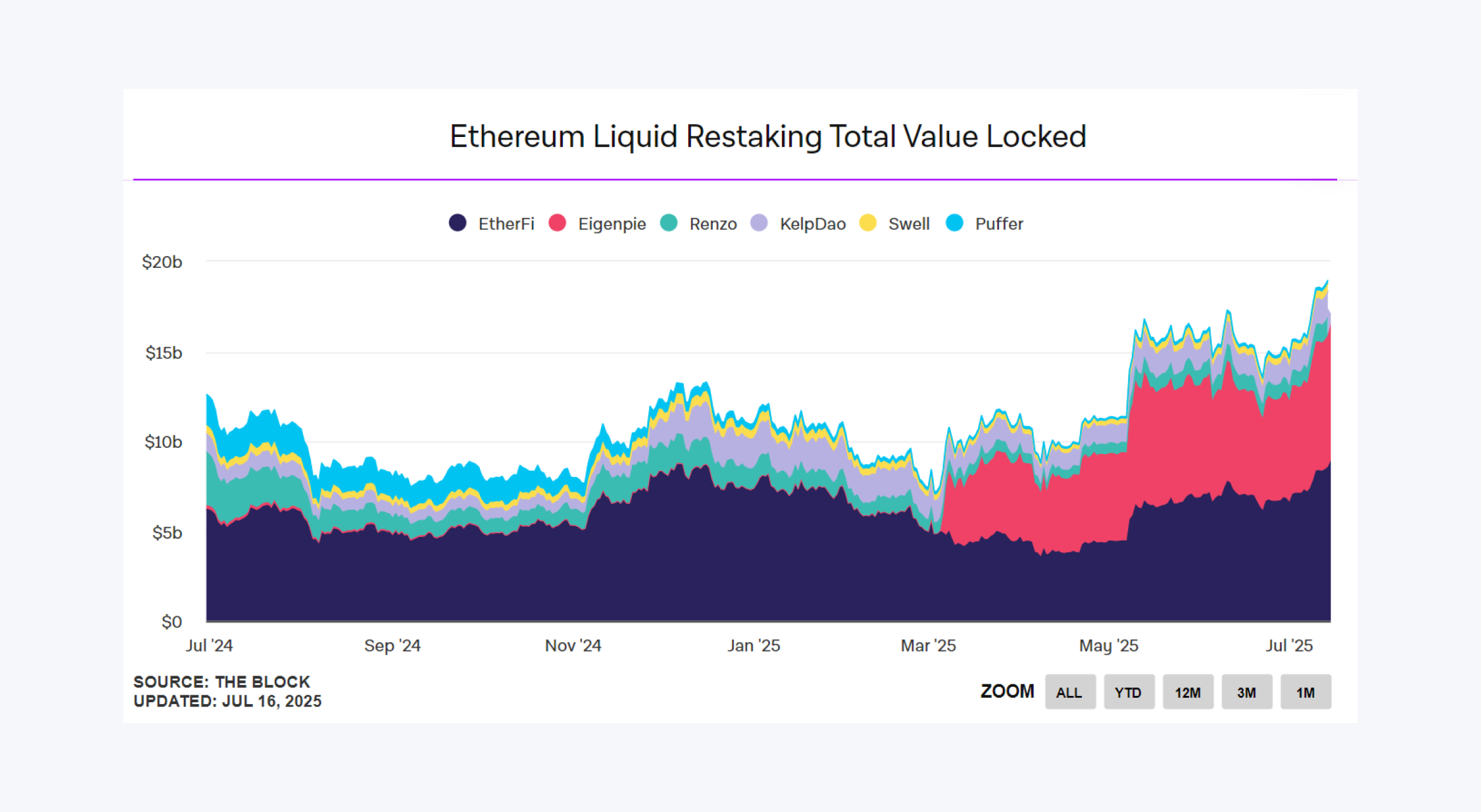

This innovation is so popular, it’s now the backbone of billions of dollars in crypto assets-a real pillar of the economy, or at least a very expensive Lego set.

What Is Restaking? (No, Not Just Repeating)

Restaking is when your already-staked ETH pulls a double shift. It’s like giving your loyalty to more than one mafia boss-except instead of mafia, it’s crypto protocols all vying for your funds, promising rewards in return (and some headaches).

EigenLayer: The Kingpin of Restaking

Enter EigenLayer-basically the monopoly board of restaking. By mid-2025, over 5 million ETH (that’s more than $15 billion at current prices) have been restaked here, because everyone loves a good ol’ trust fall with the blockchain.

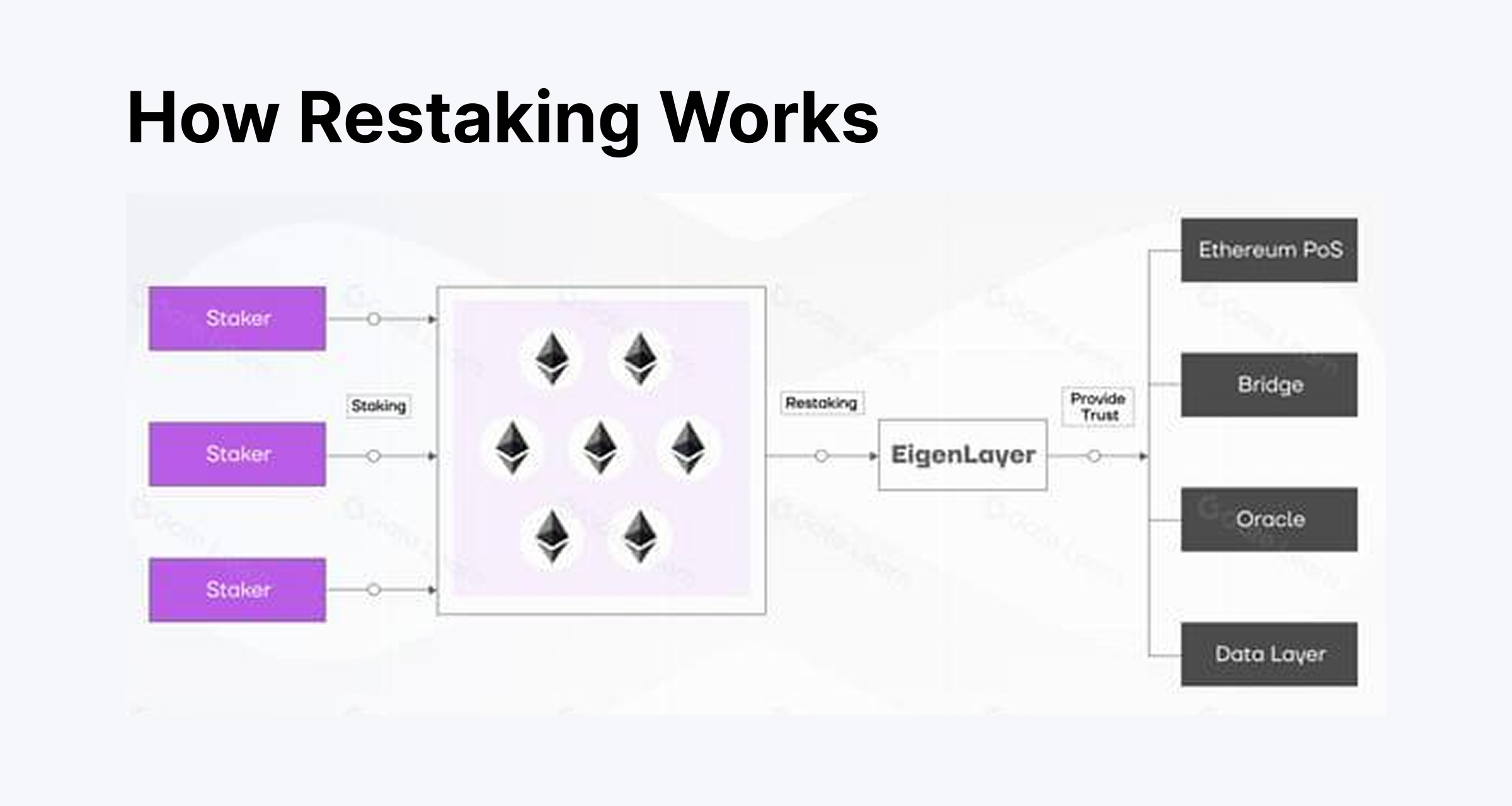

This clever trick allows new protocols to rent security – so they skip building their own army of validators and just lease the security blanket from Ethereum’s giant pile of staked ETH. Talk about outsourcing security-economically, of course.

What Are Actively Validated Services? (AVSs-Not Just an Acronym)

These are the fancy infrastructures like cross-chain bridges, data tunnels, and oracle services-basically the bones of the crypto skeleton-and they’re all desperately looking for security. Restakers get paid for this security, turning their ETH into a passive income machine that’s better than just sitting around.

Eigenlayer has transformed trust into a marketplace, where Ethereum stakers lease out security, making the crypto ecosystem a little more complicated-and a lot more interesting.

How Do You Get In? (No, It’s Not a Secret Society, Mostly)

You’ve got two options: be a hero with technical skills or be a simple mortal with liquid assets.

Heroic Method: The Solo Staker

Run your own validator node-because who doesn’t love managing a 24/7 server in their garage for the glory of staking? The catch: it costs over $110,000 worth of ETH and requires a PhD in Blockchain Maintenance. You’ll feel very powerful. Just don’t forget to feed your node, or it might misbehave.

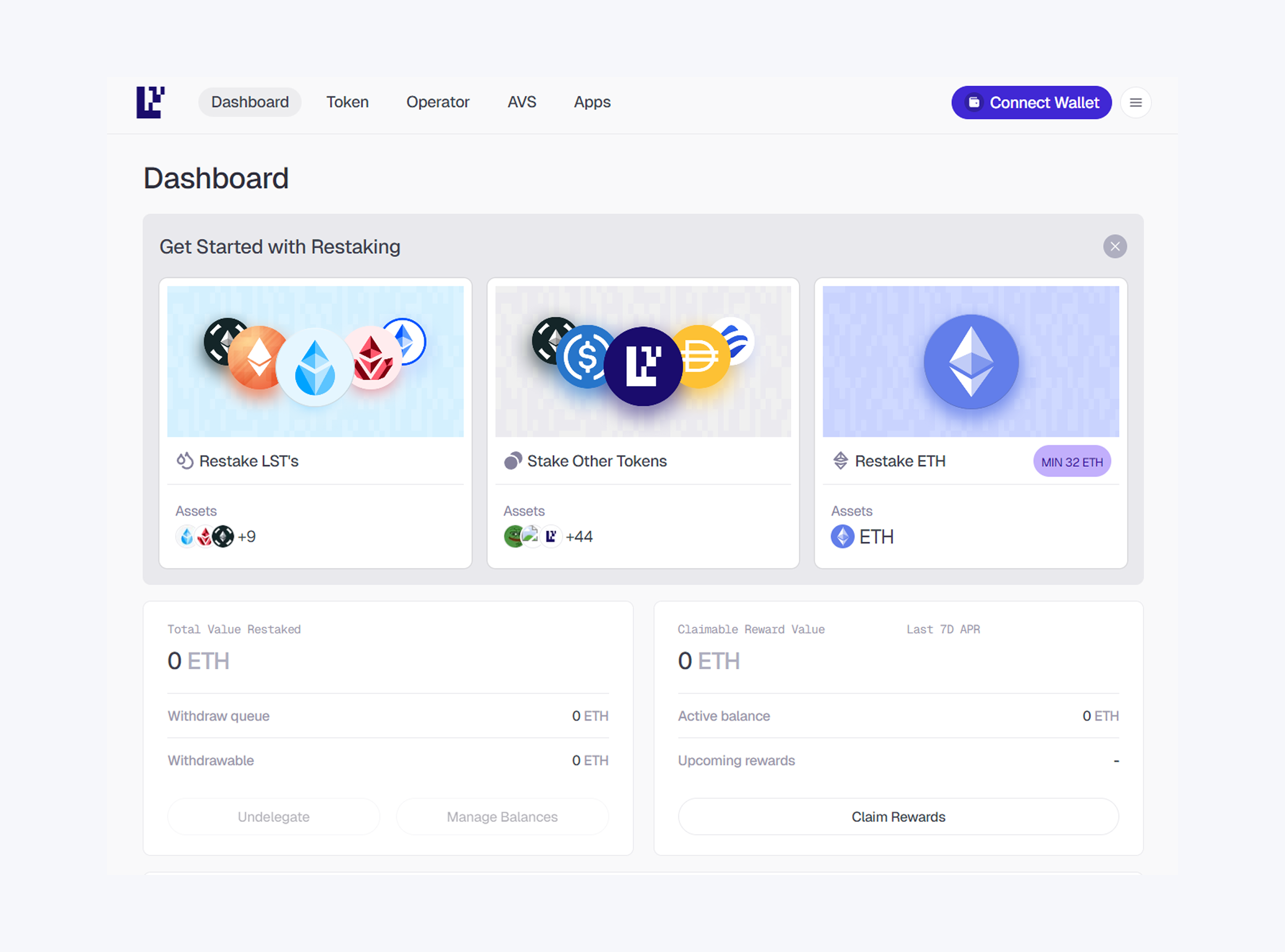

The Lazy Route: Liquid Restaking

This is the popular choice. Use platforms like Ether.fi or Puffer Finance-think of them as your crypto Uber drivers-who handle the backend chaos. You start by staking your ETH, getting a fancy token like stETH or rETH, then deposit it into their protocols to get a shiny new token like eETH, which is just more tokens pretending to be better than other tokens.

- Step 1: Stake your ETH and get a nice receipt (LST).

- Step 2: Pump that LST into a liquid restaking protocol.

- Step 3: Get a new LRT that’s tradable, usable, and surprisingly, still earning rewards.

Now your restaked assets are working overtime, accumulating layered rewards without you lifting a finger-well, unless you want to double-click on DeFi stuff.

What’s All the Fuss About? (Apart from the Money?)

The hype is fueled by the promise of earning multiple layers of yield for nearly doing nothing. The real magic trick is future tokens-airdrops on steroids-that could make early crypto investors cry tears of joy-or regret.

The Two Layers of “Real” Yield

In theory, you get paid from the basic ETH staking and the fees from the services secured with your ETH. Think of it as combining a royalty check with a bonus-sweet, but not guaranteed.

The Big Buzz: Future Airdrops

The real excitement is about points-like hotel loyalty cards but for crypto. Accumulate enough, and you stand a good chance of getting a golden ticket (tokens!) during future surprise airdrops. Everyone’s gambling on these points turning into something shiny-like loot in a treasure hunt.

Restaking vs Yield Farming: The Epic Face-Off

Both promising mountains of gold, but let’s face it, they’re more different than cats and dogs-except both can scratch your eyes out if you’re not careful.

The Service

- Yield Farming: You’re the market maker-adding liquidity to pools, betting on (and sometimes against) other traders.

- Restaking: You’re the security guard-guarding multiple protocols with your ETH, hoping they don’t all get hacked on the same day.

The Yield

- Yield Farming: Rewards come from protocol inflation and crowd enthusiasm-the “look! A new token!” effect.

- Restaking: Real profits are from fees and, if you’re lucky, from those mysterious future airdrops everyone’s whispering about.

The Risks

- Yield Farming: Impermanent loss, rug pulls, and protocol bugs-oh my!

- Restaking: Slashing-think of it as your ETH losing its head if the validator misbehaves-and the scary possibility that one bad actor could take down the whole system like a crypto version of a domino rally.

The Perilous Path Ahead

Restaking isn’t for the faint-hearted; it’s a rollercoaster with a few more twists than Brussels sprout-shaped smart contracts. Slashing, centralisation, bugs-these are your ride’s unexpected drops. If you’re not a whale or a wizard, maybe stick to less thrilling ways to lose your money?

Final Word

Restaking is like a turbocharged trust fall-impressive but potentially catastrophic if you don’t know what you’re doing. It’s a high-risk, high-reward game that’s turning heads and wallets-often in the same direction.

Frequently Asked Questions (Because Curiosity Killed the FOMO)

What *exactly* is restaking?

It’s when your already-staked ETH gets a second (or third) job securing other protocols, for which you get paid in coins, points, or the hope of future riches.

How is it different from normal staking?

Normal staking only secures one network, like a loyal knight. Restaking is more like a superhero with multiple superpowers-more risk, more reward, more chaos.

What are these “restaking points”?

Scores that protocols hand out-think badges-hoping they’ll someday be worth enough to buy you a yacht (or just some more tokens).

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- These Are the 10 Best Stephen King Movies of All Time

- Best Controller Settings for ARC Raiders

- Silent Hill 2 Leaks for Xbox Ahead of Official Reveal

- Meet the cast of Mighty Nein: Every Critical Role character explained

- USD JPY PREDICTION

2025-08-05 12:34